Homeowners Today Have Options To Avoid Foreclosure

Even with the latest data coming in, the experts agree there’s no chance of a large-scale foreclosure crisis like the one we saw back in 2008.

Why There Won’t Be a Recession That Tanks the Housing Market

There’s been a lot of recession talk over the past couple of years.

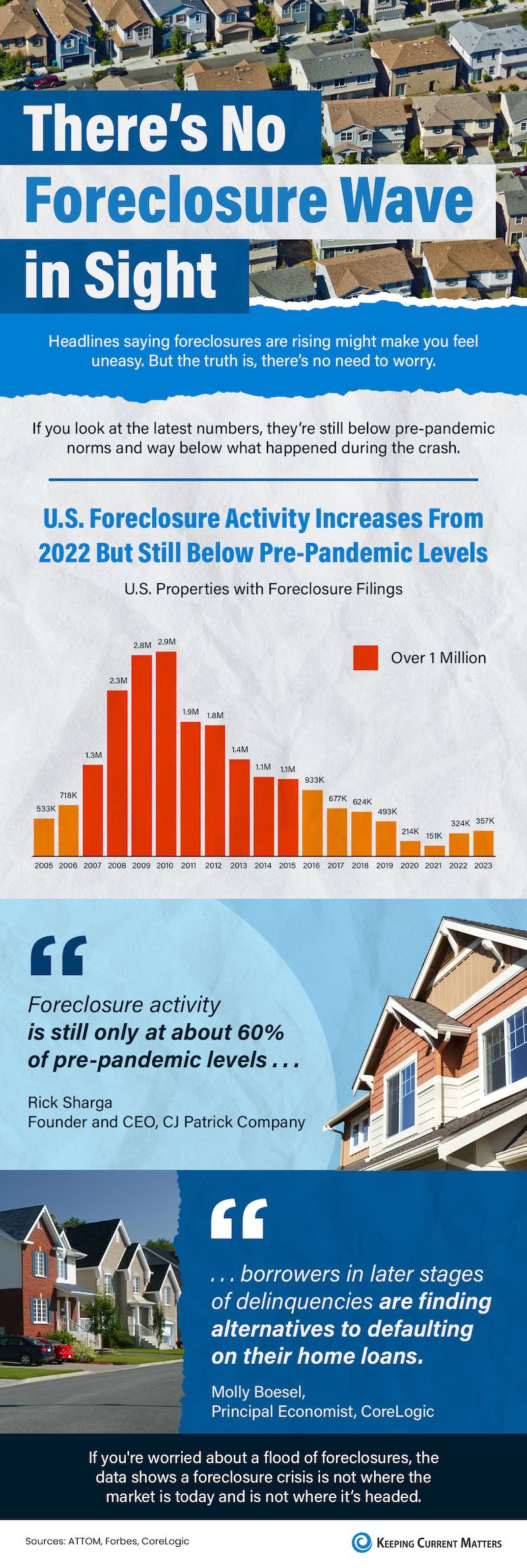

There’s No Foreclosure Wave in Sight [INFOGRAPHIC]

Foreclosure Activity Is Still Lower than the Norm

Have you seen headlines talking about the increase in foreclosures in today’s housing market?

Foreclosures and Bankruptcies Won’t Crash the Housing Market

If you've been following the news recently, you might have seen articles about an increase in foreclosures and bankruptcies.

Why Today’s Housing Inventory Shows a Crash Isn’t on the Horizon

You might remember the housing crash in 2008, even if you didn't own a home at the time.

Don’t Expect a Wave of Foreclosures [INFOGRAPHIC]

Don’t Expect a Flood of Foreclosures

The rising cost of just about everything from groceries to gas right now is leading to speculation that more people won’t be able to afford their mortgage payments.

Four Ways You Can Use Your Home Equity

If you’re a homeowner, odds are your equity has grown significantly over the last few years.

Foreclosure Numbers Today Aren’t Like 2008

If you've been keeping up with the news lately, you've probably come across headlines talking about the increase in foreclosures in today’s housing market.

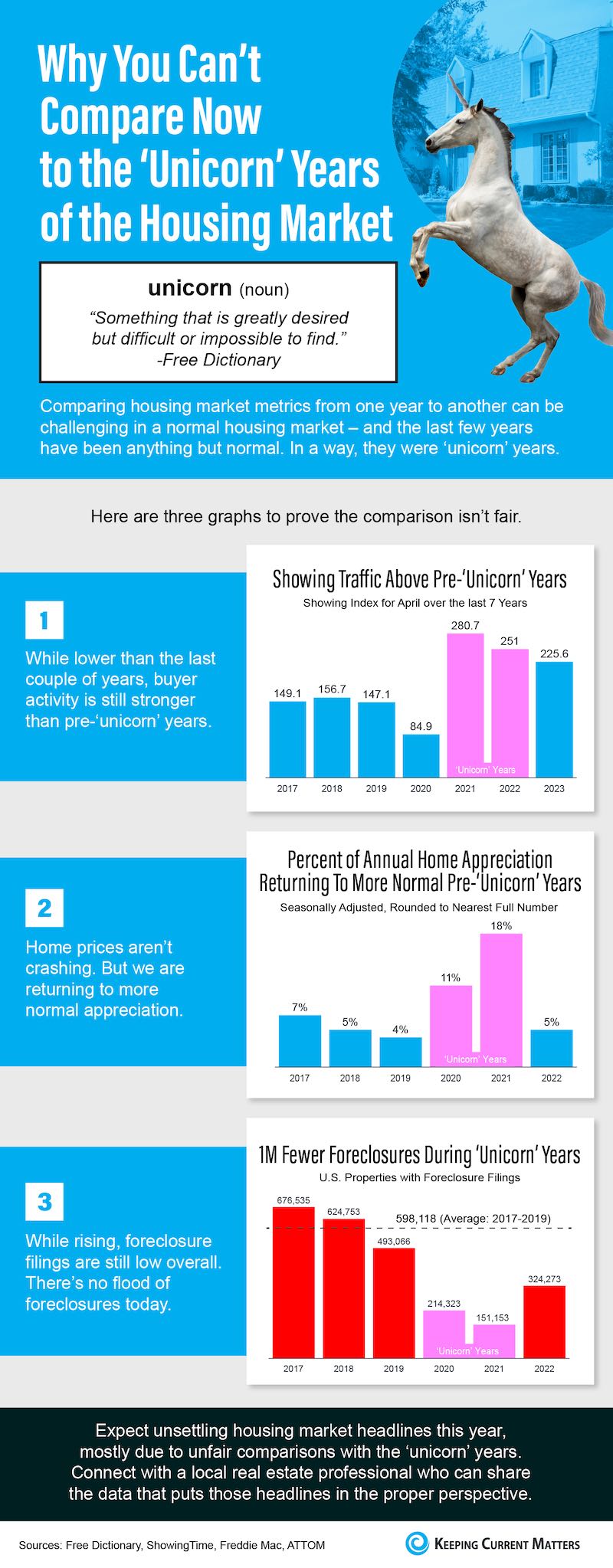

Why You Can’t Compare Now to the ‘Unicorn’ Years of the Housing Market [INFOGRAPHIC]

Today’s Real Estate Market: The ‘Unicorns’ Have Galloped Off

Comparing real estate metrics from one year to another can be challenging in a normal housing market.

Why Today’s Housing Market Is Not About To Crash

There’s been some concern lately that the housing market is headed for a crash.

Why Today's Foreclosure Numbers Are Nothing Like 2008

You’ve likely seen headlines about the number of foreclosures climbing in today’s housing market.

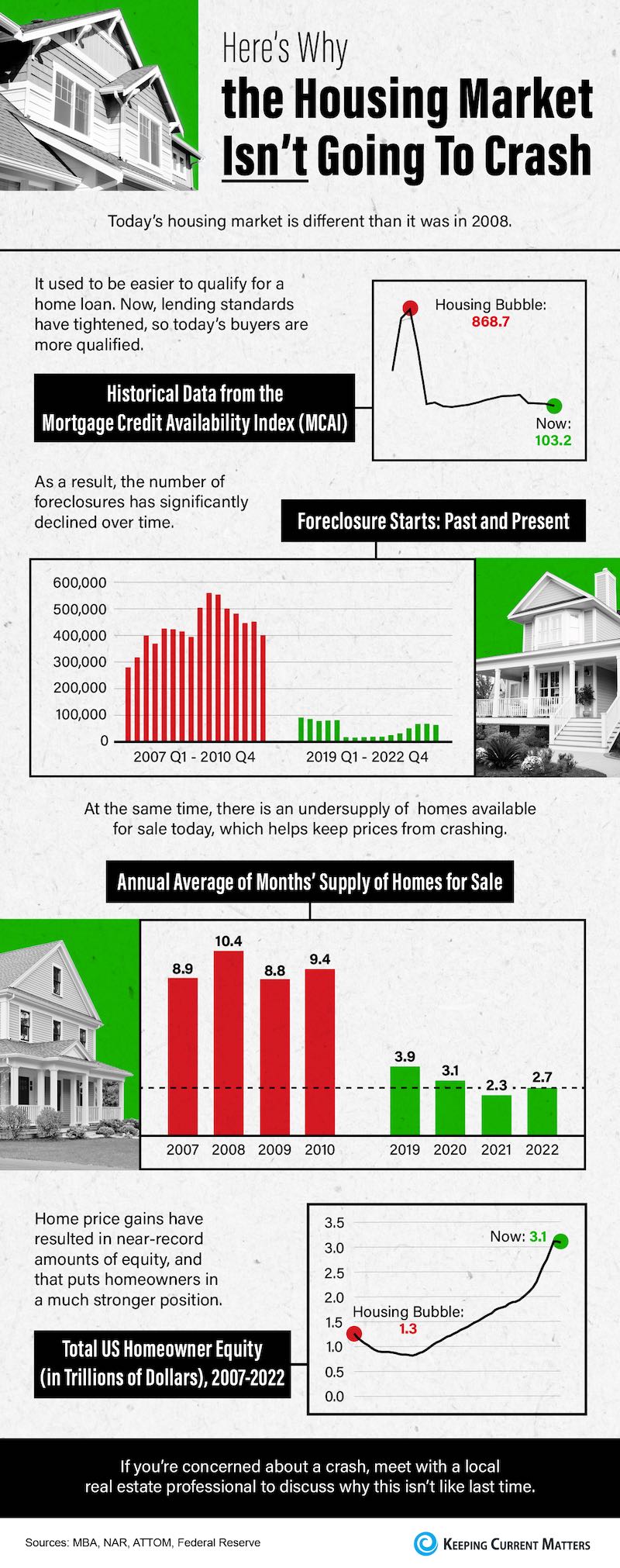

Here’s Why the Housing Market Isn’t Going To Crash [INFOGRAPHIC]

Why Today’s Housing Market Isn’t Headed for a Crash

67% of Americans say a housing market crash is imminent in the next three years. With all the talk in the media lately about shifts in the housing market, it makes sense why so many people feel this way. But there’s good news. Current data shows today’s market is nothing like it was before the housing crash in 2008.

Why You Shouldn’t Fear Today’s Foreclosure Headlines

If you’ve seen recent headlines about foreclosures surging in the housing market, you’re certainly not alone. There’s no doubt, the stories in the media can be pretty confusing right now. They may even make you think twice about buying a home for fear that prices could crash. The reality is, the data shows a foreclosure crisis is not where the market is headed, and understanding what that really means is mission critical if you want to know the truth about what’s happening today. Here’s a deeper look.

Today’s Housing Market Is Nothing Like 15 Years Ago

There’s no doubt today’s housing market is very different than the frenzied one from the past couple of years. In the second half of 2022, there was a dramatic shift in real estate, and it caused many people to make comparisons to the 2008 housing crisis. While there may be a few similarities, when looking at key variables now compared to the last housing cycle, there are significant differences.

Why There Won’t Be a Flood of Foreclosures Coming to the Housing Market

With the rapid shift that’s happened in the housing market this year, some people are raising concerns that we’re destined for a repeat of the crash we saw in 2008. But in truth, there are many key differences between what’s happening today and the bubble in the early 2000s.

Home Equity: A Source of Strength for Homeowners Today

Experts agree there’s no chance of a large-scale foreclosure crisis like we saw back in 2008, and that’s good news for the housing market. As Mark Fleming, Chief Economist at First American, says:

3 Graphs Showing Why Today’s Housing Market Isn’t Like 2008

With all the headlines and talk in the media about the shift in the housing market, you might be thinking this is a housing bubble. It’s only natural for those thoughts to creep in that make you think it could be a repeat of what took place in 2008. But the good news is, there’s concrete data to show why this is nothing like the last time.

Why the Forbearance Program Changed the Housing Market

When the pandemic hit in 2020, many experts thought the housing market would crash. They feared job loss and economic uncertainty would lead to a wave of foreclosures similar to when the housing bubble burst over a decade ago. Thankfully, the forbearance program changed that. It provided much-needed relief for homeowners so a foreclosure crisis wouldn’t happen again. Here’s why forbearance worked.

3 Graphs To Show This Isn’t a Housing Bubble

With all the headlines and buzz in the media, some consumers believe the market is in a housing bubble. As the housing market shifts, you may be wondering what’ll happen next. It’s only natural for concerns to creep in that it could be a repeat of what took place in 2008. The good news is, there’s concrete data to show why this is nothing like the last time.

What You Actually Need To Know About the Number of Foreclosures in Today’s Housing Market

While you may have seen recent stories about the volume of foreclosures today, context is important. During the pandemic, many homeowners were able to pause their mortgage payments using the forbearance program. The goal was to help homeowners financially during the uncertainty created by the health crisis.

Why This Housing Market Is Not a Bubble Ready To Pop

Homeownership has become a major element in achieving the American Dream. A recent report from the National Association of Realtors (NAR) finds that over 86% of buyers agree homeownership is still the American Dream.