Is It Getting More Affordable To Buy a Home?

Over the past year or so, a lot of people have been talking about how tough it is to buy a home.

Is It Better To Rent Than Buy a Home Right Now?

You may have seen reports in the news recently saying it’s more affordable to rent right now than it is to buy a home.

Ways To Use Your Tax Refund If You Want To Buy a Home

Have you been saving up to buy a home this year?

Builders Are Building Smaller Homes

There’s no arguing it, affordability is still tight.

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

You may have heard headlines in the news lately about agents in the real estate industry and discussions about their commissions.

Don’t Let Your Student Loans Delay Your Homeownership Plans

If you have student loans and want to buy a home, you might have questions about how your debt affects your plans.

Top 5 Reasons To Hire an Agent When Buying a Home [INFOGRAPHIC]

Newly Built Homes Could Be a Game Changer This Spring

Buying a home this spring?

Is It Easier To Find a Home To Buy Now?

One of the biggest hurdles buyers have faced over the past few years has been a lack of homes available for sale.

Single Women Are Embracing Homeownership

In today's housing market, more and more single women are becoming homeowners.

What Every Homebuyer Should Know About Closing Costs

Before making the decision to buy a home, it's important to plan for all the costs you’ll be responsible for.

3 Helpful Tips for First-Time Homebuyers [INFOGRAPHIC]

What Are Experts Saying About the Spring Housing Market?

If you’re planning to move soon, you might be wondering if there'll be more homes to choose from, where prices and mortgage rates are headed, and how to navigate today’s market.

Does It Make Sense To Buy a Home Right Now?

Thinking about buying a home?

4 Tips To Make Your Strongest Offer on a Home

Are you thinking about buying a home soon?

Your Home Is a Powerful Investment

Going into 2023, there was a lot of talk about a possible recession that would cause the housing market to crash.

What Mortgage Rate Do You Need To Move?

If you’ve been thinking about buying a home, mortgage rates are probably top of mind for you.

Finding Your Perfect Home in a Fixer Upper

If you’re trying to buy a home and are having a hard time finding one you can afford, it may be time to consider a fixer-upper.

The Benefits of Downsizing When You Retire

If you’re taking a look at your expenses as you retire, saving money where you can has a lot of appeal.

What To Know About Credit Scores Before Buying a Home

If you want to buy a home, you should know your credit score is a critical piece of the puzzle when it comes to qualifying for a mortgage.

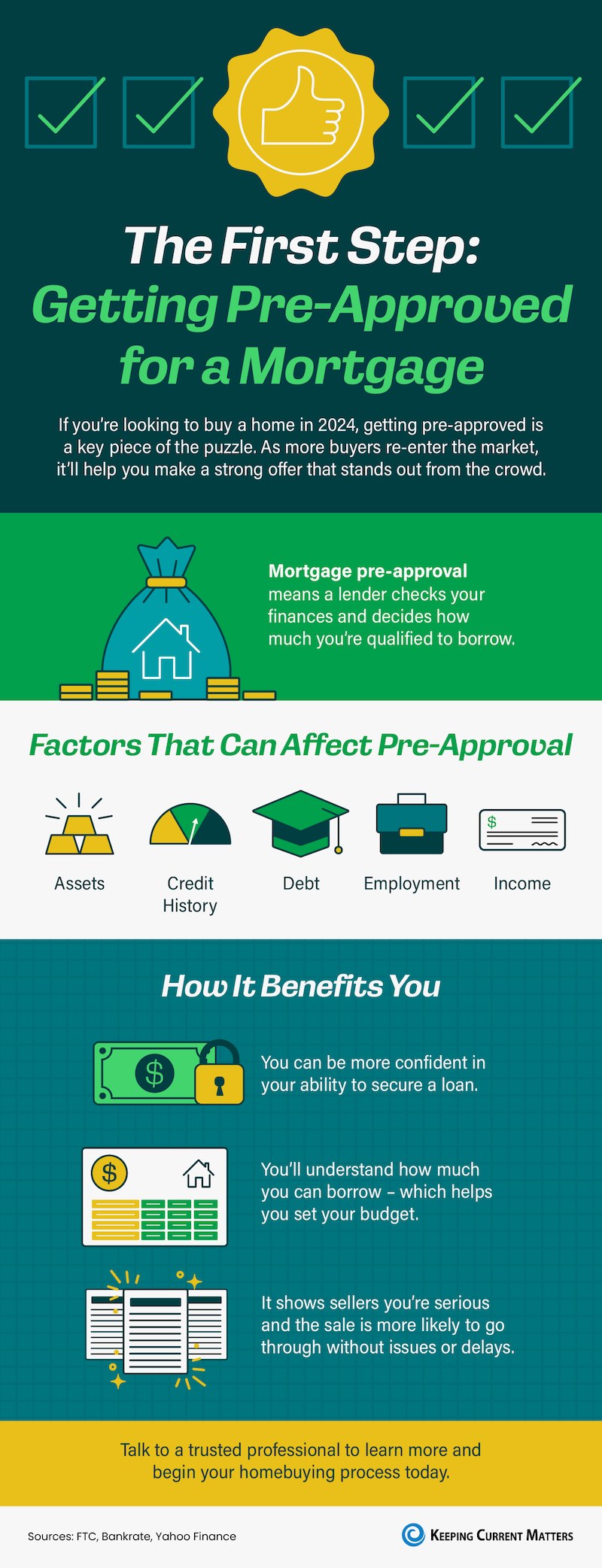

The First Step: Getting Pre-Approved for a Mortgage [INFOGRAPHIC]

Why You Want an Agent’s Advice for Your Move

No matter how you slice it, buying or selling a home is a big decision.

The Truth About Down Payments

If you’re planning to buy your first home, saving up for all the costs involved can feel daunting, especially when it comes to the down payment.

Strategic Tips for Buying Your First Home

Buying your first home is a big, exciting step and a major milestone that has the power to improve your life.