Here Comes the Housing Inventory!!

Almost every real estate conversation revolves around the continuous rise in house values over the last four years. Some have even mentioned a concern about another possible bubble forming. However, the recent increase in prices can be attributed to a very simple principle: supply and demand.

US Housing Market Swings in Favor of Homeownership

According to the latest Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index, homeownership is a better way to produce greater wealth, on average, than renting. The results from the first quarter index showed that “16 of the 23 metropolitan markets investigated moved in the direction of buy territory.”

Harvard: 5 Reasons Why Owning A Home Makes Sense Financially

We have reported many times that the American Dream of homeownership is alive and well. The personal reasons to own a home differ for each buyer, but there are many basic similarities.

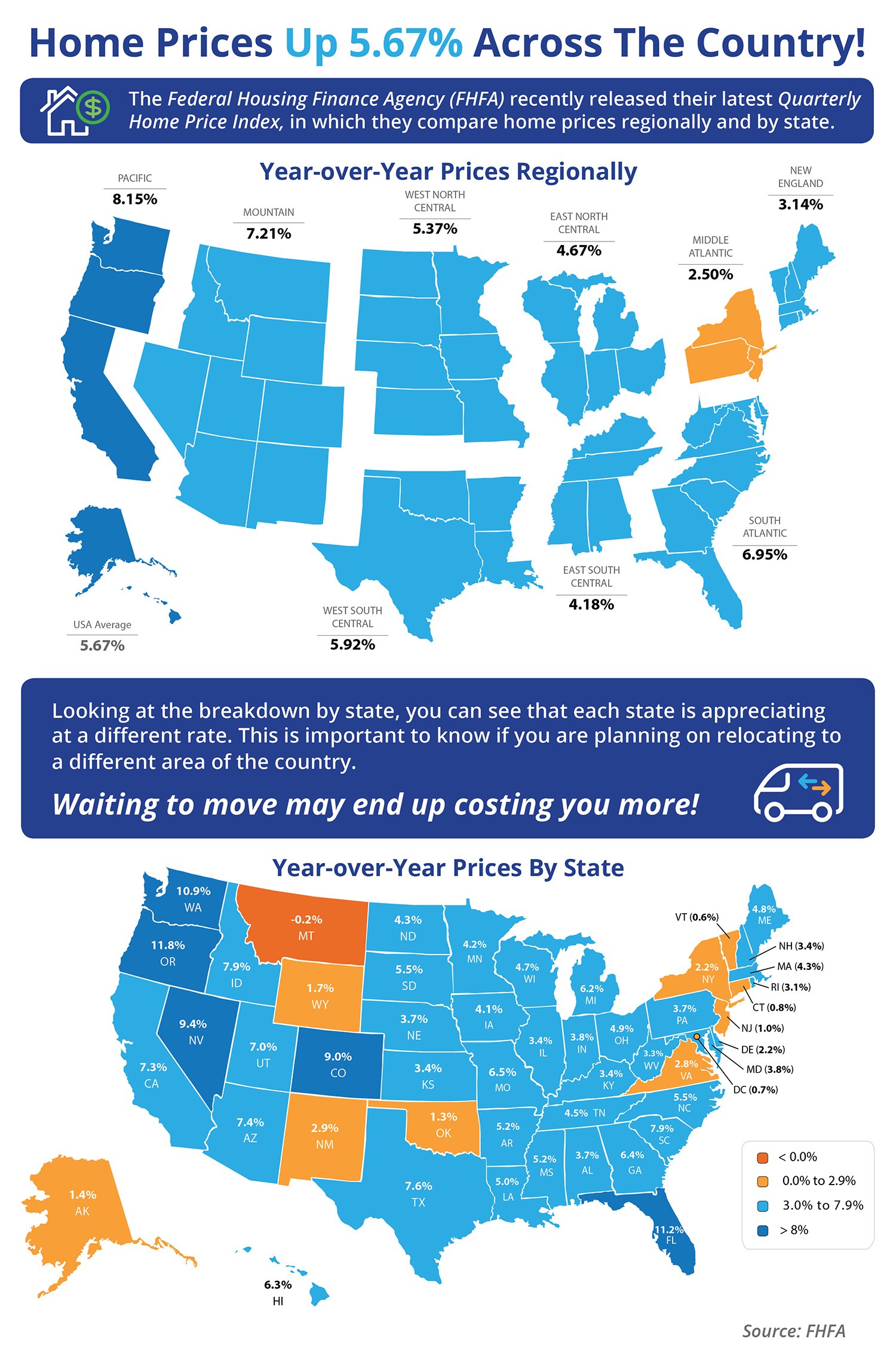

Home Prices Up 5.67% Across The Country! [INFOGRAPHIC]

Some Highlights:

- Across the country, home prices are up by 5.67%.

- Each state is appreciating at a different rate, however, which is important to realize if you plan on relocating to a different state.

- Regionally, prices have appreciated year-over-year by as high as 8.15%.

Serious About Home Buying? Get Pre-Approved

In many markets across the country, the amount of buyers searching for their dream home greatly outnumbers the amount of homes for sale. This has led to a competitive marketplace where buyers often need to stand out. One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search.

Single Women Make Up 2nd Largest Home Buying Group

According to the National Association of Realtors’ (NAR) 2015 Profile of Home Buyers and Sellers, single women made up 18% of all first-time homebuyers last year, second only to married couples who made up 54% of total buyers.

Is Your First Home Within Your Grasp Now?

There are many people sitting on the sidelines trying to decide if they should purchase a home or sign a rental lease. Some might wonder if it makes sense to purchase a house before they are married and have a family. Others may think they are too young. And still others might think their current income would never enable them to qualify for a mortgage.

5 Reasons To Hire A Real Estate Pro

Whether you are buying or selling a home, it can be quite an adventurous journey. You need an experienced Real Estate Professional to lead you to your ultimate goal. In this world of instant gratification and internet searches, many sellers think that they can For Sale by Owner or FSBO.

June is National Homeownership Month! [INFOGRAPHIC]

Some Highlights:

- Paying rent is not a good investment, but owning is a great way to start building family wealth.

- Not only does homeownership allow you to provide your children with great education, but you can also decide whether or not your child grows up with a pet.

- Owning a home provides you with tax benefits while also providing you with more living space to move around in.

Wall Street Journal: Housing Recovery Picks Up Steam

Yesterday, we ran a post quoting major housing experts on the increasing strength of the U.S. housing market. We were pleasantly surprised that, on the same day, the Wall Street Journal decided to run a front page story titled, “Housing Recovery Picks Up Steam” (article available to WSJ subscribers).

A Possible Housing Meltdown? These Experts Respectfully Disagree

We want to let you know that “rumors of a new market meltdown” are not based on any reputable data. As proof, we offer you the comments of the following experts who have a totally different view on the current housing market.

How Does Housing Help Build Family Wealth?

As the economy continues to improve, more and more Americans are seeing their personal financial situations also improving. Instead of just getting by, many are now beginning to save and find other ways to build their net worth. One way to dramatically increase their family wealth is through the acquisition of real estate.

New & Existing Home Sales Climb [INFOGRAPHIC]

![New & Existing Home Sales Climb [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2016/05/20160527-EHS-APR-STM.jpg)

Some Highlights:

- Both New Home Sales and Existing Home Sales are up month-over-month and year-over-year.

- Inventory remains low which continues to drive home prices up as demand continues to exceed the 4.7-month inventory.

- The median price of new homes is up 12% from March 2016, while the median price of existing homes is up 6.3% from April 2015.

Where Are Home Values Headed Over the Next 5 Years?

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

When Is It A Good Time To Rent? Definitely NOT NOW!

People often ask whether or not now is a good time to buy a home. No one ever asks when a good time to rent is. However, we want to make certain that everyone understands that today is NOT a good time to rent.

Renting vs. Buying: What Does it Really Cost? [INFOGRAPHIC]

![Renting vs. Buying: What Does it Really Cost? [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2016/05/Rent-vs.-Buy-STM.jpg)

Some Highlights:

- The percentage of income needed to afford a median priced home is almost half the percentage of income needed to afford median rent.

- Buying costs are significantly less than renting costs.

- The percentage of income needed to afford a median priced home is less than the historic norm.

The Presidential Election and Its Impact on Housing

Every four years people question what effect the Presidential election might have on the national housing market. Let’s take a look at what is currently taking place. The New York Times ran an article earlier this week where they explained:

Housing Market Snapshot [INFOGRAPHIC]

![Housing Market Snapshot [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2016/05/Housing-Market-Update-STM.jpg)

Some Highlights:

- Home sales are up 1.5% year-over-year and 5.1% month-over-month.

- Demand is still much higher than the available housing inventory which declined 2.2% from March 2015.

- This is the 49th consecutive month with year-over-year price gains.

Mortgage Rates Remain at Historic Lows

The latest report from Freddie Mac shows that the 30-year fixed-rate mortgage averaged 3.61% last week, slightly down from the week before (3.66%), and nearly 20 points lower than a year ago (3.80%).

4 Reasons to Move Up to Your Dream Home This Spring

Spring is in full force; the summer months are right around the corner. If you are debating moving up to your dream home, here are four great reasons to consider listing your current home and moving up to your dream home now, instead of waiting.

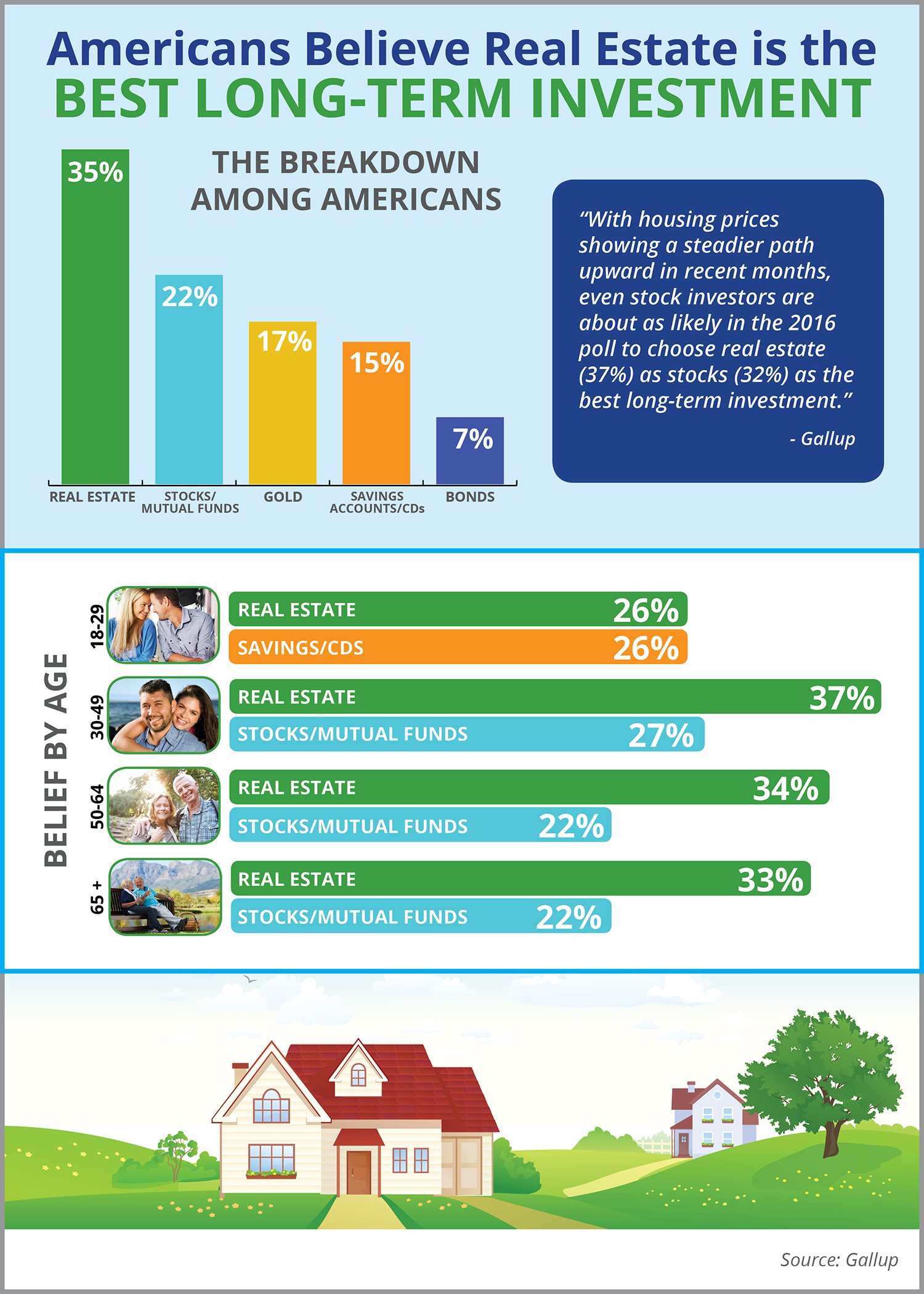

Americans Believe Real Estate is the Best Long-Term Investment [INFOGRAPHIC]

Some Highlights:

- Real estate outranks stocks/mutual funds, gold, savings accounts/CDs, and bonds as the best long-term investment among Americans.

- Real estate is ranked as the best long-term investment among all age groups.

- Millennials rank both real estate and savings/CDs at 26% when it comes to the best long-term investment.

Warren Buffett: There is No Housing Bubble

With home prices expected to appreciate by over 5% this year, some are beginning to worry about a new housing bubble forming. Warren Buffet addressed this issue last week in an article by Fortune Magazine. He simply explained:

Americans Rank Real Estate #1 Long Term Investment

The Gallup organization recently released a survey in which Americans were asked to rank what they considered to be the “best long term investment.” Real estate ranked number one, with 35% of those surveyed saying it was a better long term investment than stocks & mutual funds, gold, savings accounts or bonds.

Billionaire: Buy a Home… And if You Can, Buy a Second Home!

Three years ago, John Paulson gave a keynote address at the CNBC/Institutional Investor Conference. In his speech, he told those in attendance that he believes housing will continue its strong recovery for the next 4 to 7 years, saying that:

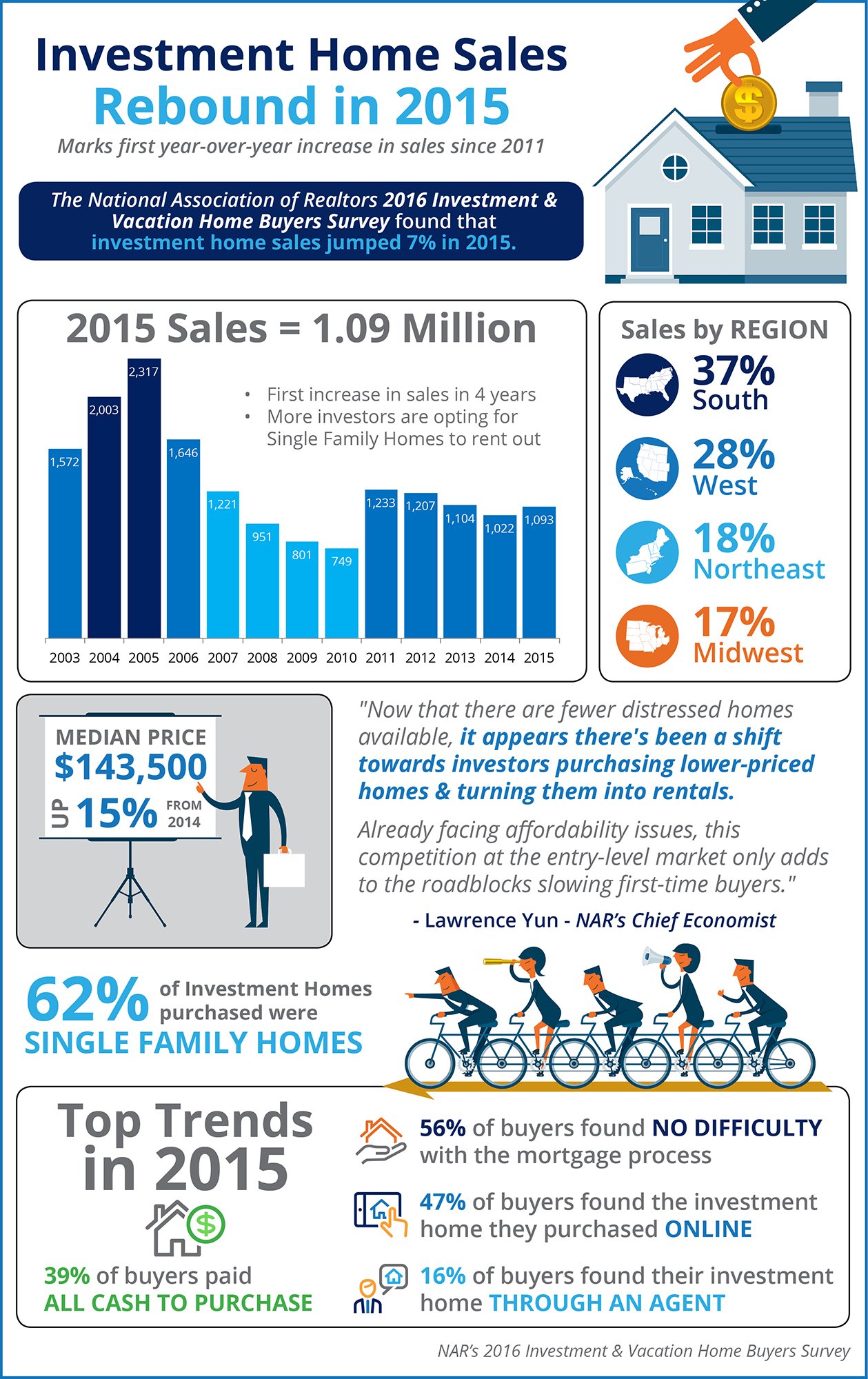

Investment Home Sales Rebound in 2015 [INFOGRAPHIC]

Some Highlights:

- 2015 marks the first year-over-year increase in investment home sales since 2011.

- 62% of all investment homes purchased were single family homes.

- The South saw the highest percentage of investment home sales (39%) with the West coming in second (28%).