Is It Better To Rent Than Buy a Home Right Now?

You may have seen reports in the news recently saying it’s more affordable to rent right now than it is to buy a home.

Why So Many People Fall in Love with Homeownership

Chances are at some point in your life you’ve heard the phrase, home is where the heart is.

Home Prices Forecast To Climb over the Next 5 Years [INFOGRAPHIC]

The Dramatic Impact of Homeownership on Net Worth

If you're trying to decide whether to rent or buy a home this year, here's a powerful insight that could give you the clarity and confidence you need to make your decision.

How To Turn Homeownership into a Side Hustle

Does the rising cost of just about everything these days make your dream of owning your own home feel less within reach?

Why Homeowners Are Thankful They Own

Countless people have set out on the exciting journey of homeownership.

Homeowner Net Worth Has Skyrocketed

If you’re weighing your options to decide whether it makes more sense to rent or buy a home today, here’s one key data point that could help you feel more confident in making your decision.

How Buying a Multi-Generational Home Helps with Affordability Today

In today's world of rising housing costs, many buyers are looking for ways to still be able to buy a home.

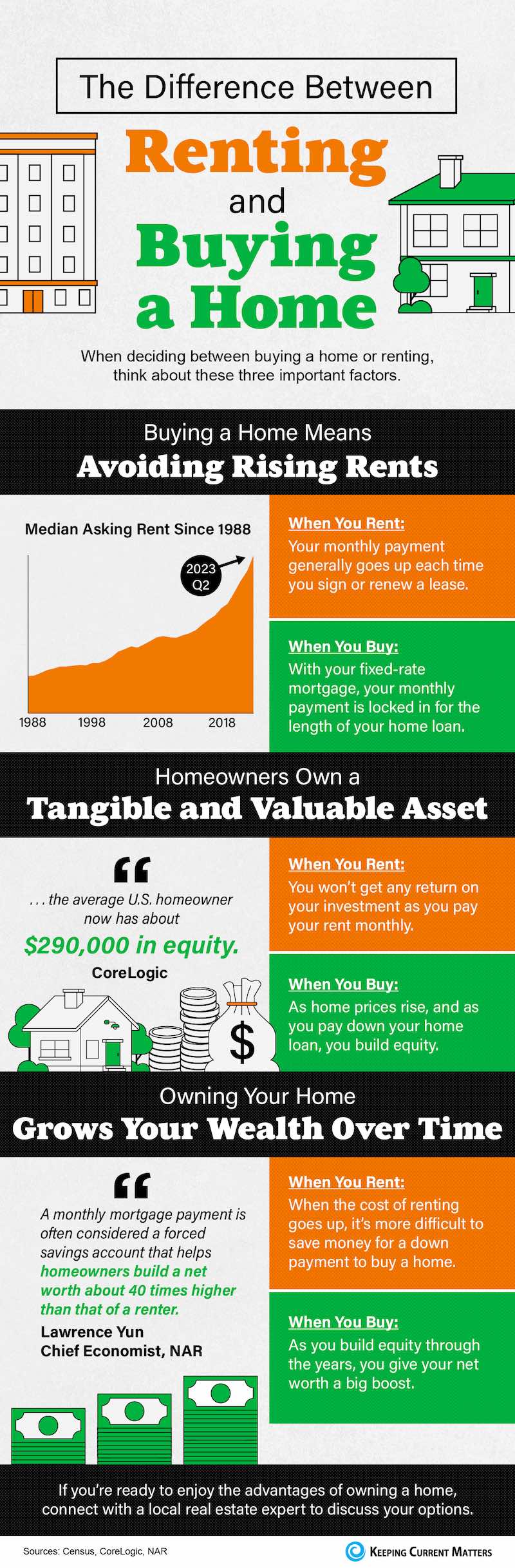

The Difference Between Renting and Buying a Home [INFOGRAPHIC]

Growing Your Net Worth with Homeownership

Take a moment to imagine where you want to be in a few years.

Should Baby Boomers Buy or Rent After Selling Their Houses?

Are you a baby boomer who’s lived in your current house for a long time and you’re ready for a change?

Owning Your Home Helps You Build Wealth

You may have heard some people say it’s better to rent than buy a home right now.

Why Homeownership Wins in the Long Run

Today’s higher mortgage rates, inflationary pressures, and concerns about a potential recession have some people questioning: should I still buy a home this year?

Homeownership Helps Protect You from Inflation [INFOGRAPHIC]

Owning a Home Helps Protect Against Inflation

You’re probably feeling the impact of high inflation every day as prices have gone up on groceries, gas, and more.

Why Buying a Home Makes More Sense Than Renting Today

Wondering if you should continue renting or if you should buy a home this year?

Reasons To Consider Condos in Your Home Search

Are you having trouble finding a home that fits your needs and your budget?

What’s Ahead for Home Prices in 2023

Over the past year, home prices have been a widely debated topic.

Buying a Home May Make More Sense Than Renting [INFOGRAPHIC]

Avoid the Rental Trap in 2023

If you’re a renter, you likely face an important decision every year: renew your current lease, start a new one, or buy a home. This year is no different. But before you dive too deeply into your options, it helps to understand the true costs of renting moving forward.

Homeownership Is an Investment in Your Future

There are many people thinking about buying a home, but with everything affecting the economy, some are wondering if it’s a smart decision to buy now or if it makes more sense to wait it out. As Bob Broeksmit, President and CEO of the Mortgage Bankers Association (MBA), explains:

Should You Still Buy a Home with the Latest News About Inflation?

While the Federal Reserve is working hard to bring down inflation, the latest data shows the inflation rate is still high, remaining around 8%. This news impacted the stock market and added fuel to the fire for conversations about a recession.

The Emotional and Non-financial Benefits of Homeownership

With higher mortgage rates, you might be wondering if now's the best time to buy a home. While the financial aspects are important to consider, there are also powerful non-financial reasons it may make sense to make a move. Here are just a few of the benefits that come with homeownership.

Why Buying a Home May Make More Sense Than Renting [INFOGRAPHIC]

![Why Buying a Home May Make More Sense Than Renting [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/09/20220930-MEM.png)

Some Highlights

- If you’re trying to decide whether to rent or buy a home, consider the advantages homeownership offers.

- Buying a home can help you escape the cycle of rising rents, it’s a powerful wealth-building tool, and it’s typically considered a good hedge against inflation.

- If you’re ready to take advantage of the benefits of homeownership, let’s connect to explore your options.

The U.S. Homeownership Rate Is Growing

The desire to own a home is still strong today. In fact, according to the Census, the U.S. homeownership rate is on the rise. To illustrate the increase, the graph below shows the homeownership rate over the last year: