Want More Listings? Here’s the 3-Step Conversation You Need to Have

In real estate, there’s no silver bullet to close more deals. Driving results in your business requires work. That means having more conversations, staying in touch with your prospects, amping up your online presence, and building a brand as the local expert.

But the reality is, you won’t find success in any of these avenues if you don’t know what’s going on in the market — and how to have the right conversations with your leads.

And if there’s one topic you should be talking about right now, it’s equity.

You want to help homeowners feel confident about selling in 2025. A powerful way to do that is by talking to them about how much equity they’ve built, how they can use it to make their next move, then sealing the deal by showing them real numbers they can really wrap their heads around. Ready to get more prospects off the fence and win more business this year?

Here’s everything you need to know about homeowner equity and a three-step action plan that uses this data to unlock more listings this year.

1. Homeowners Have Record Amounts of Equity

Over the past few years, we’ve seen home prices rise significantly, which helped homeowners grow their wealth. In fact, people currently have near-record amounts of equity. The problem is, many homeowners know they have equity and that it’s valuable, but they don’t understand the real numbers or how they can use it to their benefit.

According to a recent report from ICE Mortgage Monitors, the average homeowner with a mortgage now has $318,000 of equity in their home, of which $207,000 is tappable. A report from CoreLogic also notes that the average U.S. homeowner gained approximately $5,700 in equity in just a one-year period as of the third quarter of 2024.

So, if you have clients sitting on the sidelines thinking prices are high, rates are high, and they can’t make a move right now, helping them understand the assets they have in their home — and how to use it to their advantage — is a game changer.

That’s why step one in your action plan is to read and share this KCM blog about equity. The blog dives deeper into the most current data and insights about equity, so you know exactly how to answer your clients’ biggest questions. Plus, it’s a great educational piece that will prime them for step two of your action plan.

2. Why Have Homeowners Gained So Much Equity?

From 1985-2008, the average homeowner moved every 5-6 years. Today, homeowners are staying put for closer to 9-10 years. The longer people stay in their homes, the more of their mortgage they pay off. And as prices rise, as they usually do, homeowners gain equity with regular price appreciation.

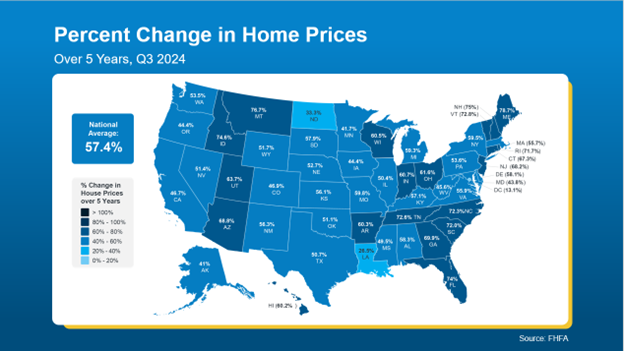

Data from the FHFA shows that over the past five years, the average home price increased nearly 60%. Since 1991, home prices have risen by a staggering 320%. Of course this varies by area, but nationally, it translates to a massive boost in equity.

Since you’ve already shared a blog about equity with your sphere, many of them are probably wondering how much equity they have in their home. Which opens the door for — you guessed it — step two of your action plan: Following up with a personalized text message.

This is a great way to connect with your tenured clients and get a conversation going. Then, you can layer in your market knowledge and expertise and back it all up with real numbers.

Kick things off by sending this simple text:

“I wouldn’t be a great agent if I didn’t ask: Would you be interested in an estimate on your equity and what your home is worth in today’s market.”

(Note: Always be sure to follow current TCPA/Do Not Call regulations and any local or federal restrictions for contacting consumers. Offer an opt-out option in your communication.)

3. How Homeowners Benefit from Record Equity

People know they have equity, and they want to move, but they don’t know how to tap into it to make that happen. Here’s where you come in.

Let them know that the equity they’ve built can be used for a down payment for their next home or maybe allow them to put in an all-cash offer if they’re downsizing or moving to a less expensive area. Homeowners can also use their equity to open up cash flow for retirement, a valuable home improvement, or to start a business.

The key is knowing how to have this conversation and putting numbers to what you’re saying. That’s what moves the needle and shifts people’s mindset from why would I move to why wouldn’t I move.

So, it only makes sense that step three in your action plan is showing your prospects the real numbers. Once you have a conversation going, provide a personalized Professional Equity Assessment Report. This custom evaluation allows them to see the big picture and better understand their purchasing power. Real numbers speak volumes, and when they see how the dollars and cents add up, they’ll stop worrying about today’s mortgage rates and start realizing the potential they have to leverage the equity in their home. It’s also much more professional than using your calculator to crunch the numbers in front of a client.

Remember, online calculators aren’t as accurate as you and your expertise; you understand what’s happening in the local area better than anyone else. Plus, you can export the PEAR as a PowerPoint, an email template, or however you think it will resonate with your client best.

Bottom Line

Equity can truly change lives. But many homeowners don’t know how much equity they actually have, much less how to use it to reach their goals.

So, use this three-step action plan to connect with your leads and explain how equity can unlock new possibilities and shape their financial path forward.

While you’re helping someone understand the life-changing opportunity of using their equity to downsize, move, or tap into a cash flow, you’ll also open up the listing for your business. It’s a win-win.

Download the KCM Professional Equity Assessment Report today to get a conversation about equity started and win more listings.