The 3 Biggest Questions Every Agent Needs to be Able to Answer This Fall

When the going gets tough and the market starts shifting, buyers, sellers and even agents tend to have one response: to fight or to flight.

But the real estate market is in a constant state of shifts and changes. Some of them are bigger or more impactful than others, but the truth remains the same: from pandemics to recessions, we can never predict what’s going to happen.

You do, however, have control over how you manage your business through it and how you communicate what’s happening and why it’s happening to your clients.

Because no matter what is going on in the world, one thing will forever remain the same: people will always need a place to call home.

So, before you hit the panic button, you need to cut through the noise and get your clients the answers they need to the biggest questions in real estate right now.

Will mortgage rates keep rising?

One of the biggest factors of the housing market cooldown we’re seeing is the swift rise in mortgage rates. And as that volatility continues, many people are asking “are mortgage rates going to keep rising?” Being able to answer this question for both buyers and sellers is mission-critical right now.

But to answer this question, you have to first understand the why behind the reason mortgage rates have doubled since the beginning of the year: inflation.

In an effort to ease inflation, the Federal Reserve is taking steps to try to tame inflation by slowing the economy, and those decisions are having an impact on mortgage rates. And until that’s under control, we may continue to see them stay high or rise even higher.

The best thing you can do for your clients right now is to give them all the facts. Because if they’re waiting for mortgage rates to drop…it may be a while.

However, despite the challenges rising mortgage rates bring, there is still opportunity in the market, especially as we move into the fall and winter months.

“There is no doubt that the increasing mortgage rate will make homebuying even more challenging, . . . buyers may still find opportunities, as these changes coincide with the time of the year when buyers have historically found the best market conditions to obtain more bargaining power,” said Jiayi Xiu, economist for realtor.com.

So long as you can explain what’s happening and why it’s happening with mortgage rates, you can help anyone navigate this rising rate environment and be the market expert they need.

What’s going to happen with home prices?

After years of record breaking price appreciation in the country, we’ve been seeing a very different scenario play out in the last few months.

In order to truly understand why this is happening, this quote from Dave Ramsey explains it all:

“The root issue of what drives house prices almost always is supply and demand.”

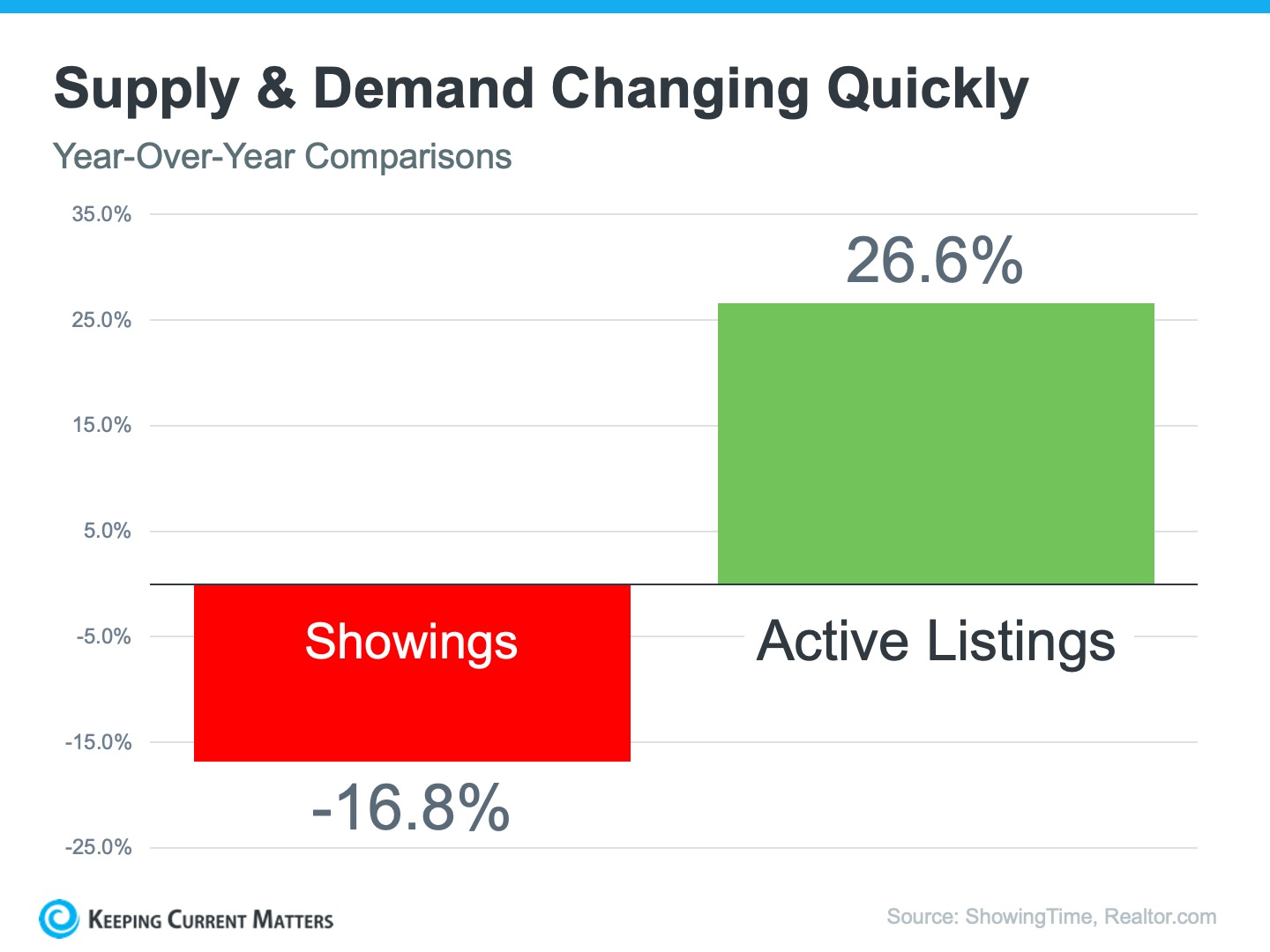

And when you take a look at the graph below, you’ll see why we have seen such a large slowdown in home price appreciation in the last few months.

The best way we can explain this to consumers is that we’re at an inflection point.

The swift rise in mortgage rates and lingering inflation has changed the playing field in the housing market. So, as the pace of sales slows, the more active listings there are.

But that doesn’t mean we’re going to see national depreciation in home values.

Overall, experts are projecting continued price appreciation in most markets, averaging about 1.8% in 2023. However, there are some overheated areas where experts are projecting slight depreciation, but certainly not enough to call it a crash.

The best thing you can do right now is to look at national data, look at your local market data, and combine it all to form what’s really going to make you stand out from other agents: a relevant market opinion.

Remember, headlines do more to terrify than clarify. So, it’s always important to make sure that you’re not only staying on top of the latest housing insights from the most trusted and credible sources but that you’re also able to understand them so you can tell your clients the whole story of what’s happening.

And if you want a full breakdown (plus script and slides) of the latest 2023 home price forecast, check out the Monthly Market Report.

Should I buy a home right now?

So, with all the uncertainty surrounding mortgage rates and home prices, the ultimate question comes down to this: should you buy a home right now?

Despite the volatility we’re seeing in today’s housing market, it’s important to remind our clients of the many financial and non-financial benefits of homeownership.

Yes, affordability is a challenge right now. It’s true that it costs more to buy a home today than it did last year, but the same is also true for renting. This means, either way, you’re going to be paying more. The difference is, with homeownership, you’re also gaining equity which will help grow your net worth.

One of the best ways to explain this is that homeownership truly wins over time. It’s a long-game.

And so when someone’s asking, “should I buy a home right now?,” you can explain to them that they can either put all of that money over time into rent and not get a return or play the long game, invest it in homeownership and benefit from their investment.

Bottom Line

We can’t control what’s going to happen with mortgage rates or price appreciation, but we can control what we prioritize. That way, in times of uncertainty, you see these factors less as stop signs and more as opportunities for growth and change.

Remember this: the key to success in any market is staying educated, acclimating to the current climate and making sure you’re keeping the most important thing the most important thing: helping your clients buy and sell homes.

And the best way to do that this fall is to put out the right information that helps buyers and sellers make the right decisions.

That’s why we’ve assembled the most important slides so you can easily help answer the biggest questions in the market right now. Download them free today.