What most housing market news gets wrong

Let’s get one thing clear.

Context in content is always important.

But when it comes to the housing market, especially the one we’ve seen the last few years, it’s even more crucial. Why?

Because the market trends in recent years are anything but normal. So, when you’re answering questions or dodging objections, context matters even more.

Let’s break down an example.

This is a recent headline a major news outlet published:

We’re all guilty of seeing headlines and jumping to conclusions. We’re especially guilty of not diving in and reading the entire article to understand the full context of how that statement came to be.

But words like “price drop” are alarming when it comes to the housing market. They give the impression that home prices will fall, possibly significantly, this year. Opinions are formed, conclusions are made, and misinformation is spread.

However, this headline couldn’t be further from the truth.

That’s where context comes in.

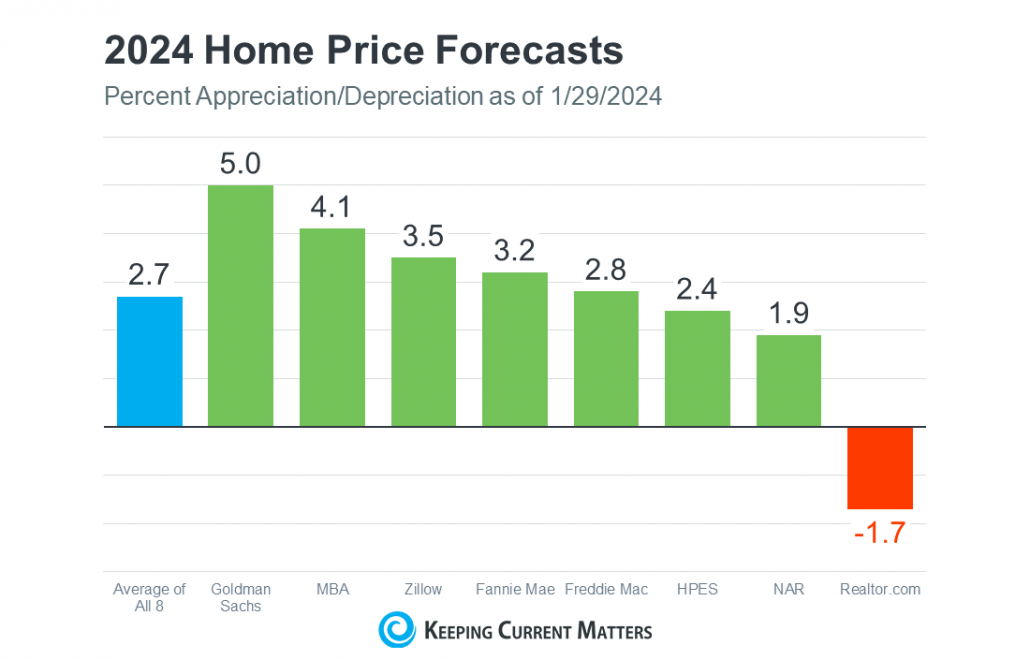

If you look at the visual below, you see that some of the most respectable organizations in the real estate industry are calling for steady and sustained appreciation in 2024.

They’re also calling for this trend to continue over the next five years, on average, nationally.

Let’s add some more context.

This article was based on the input of analysts from one financial institution. It’s understandable how someone could see this headline and think “these people know what they’re talking about” and form an opinion around that.

But again, it’s the facts and circumstances that matter most. That’s what context is.

According to the Bureau of Labor Statistics, there were 291,880 financial and investment analysts employed in the U.S. as of May 2021, the last time this data was updated.

That means this article was was based on the opinion of a handful of analysts from only one institution…out of over 290,000 that currently hold that job title.

What’s better to gather an educated, unbiased opinion? The projection of one institution or the average of five of some of the reputable ones in the industry? It’s kind of a no brainer.

The more insights or data you have at your fingertips, the better you’re able to form a relevant, market opinion of your own.

To further drive the point home, let’s add one last layer of context. Look at this graph:

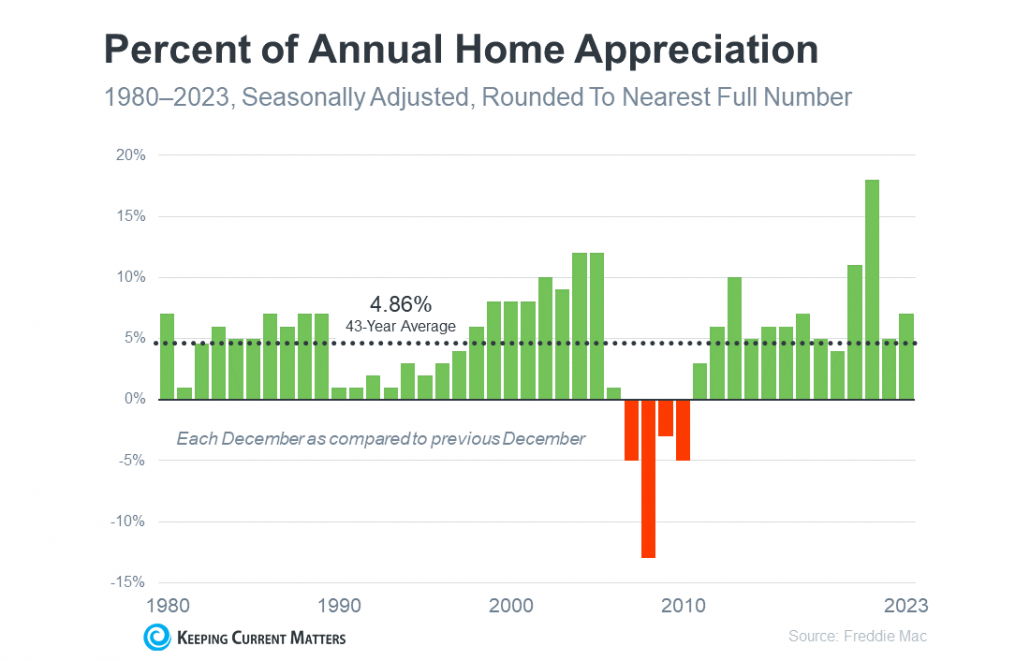

What do you notice? The average home price appreciation rate per year since 1980 is 4.86% according to this data from Freddie Mac.

The last two years, we saw appreciation slightly above that. In fact, if you look at that visual, you’ll see that most years hover around that 5% mark. That’s what experts would say is a normal, sustainable home price appreciation rate.

This year’s current projection, as noted in the first graph, is slightly below that – and also expected to rise as the year goes on. But it is not a “home price drop.” Just a slower, steadier rate of appreciation.

Bottom Line

When we see certain headlines, it’s almost impossible not to have a strong reaction. That’s half the reason they get so many clicks. They spark emotion and incite curiosity.

The way you rise above it and create content that matters is with context.

If you do that, authenticity and credibility follow.

And to help you, we’ve put together scripts for two of the most confusing topics in housing right now: home prices and mortgage rates.

These scripts will help you put the context in your content and help you have educated conversations with your sphere based on insights and data from the industry’s top experts. Download them for free today.