- Representaran a cerca de 3.4 millones de hogares en U.S.A

- Ocuparan más de 2 millones de unidades multifamiliares y más de 1.2 millones de casas unifamiliares

- Representaran más de 900 mil propietarios de casa”

The Research Institute for Housing America también proyecto “que de 2010 a 2020 los inmigrantes van a contar por más de un tercio del crecimiento de los propietarios de casa y más de una cuarta parte del crecimiento de los hogares que alquilan.”

La necesidad de continuar con la investigación

En la edición de este mes de Housing Insights por Fannie Mae, Ellos mencionan como fuente The American Community Survey al afirmar que, hubo 18.8 millones de inmigrantes inquilinos en el país en 2012. Fannie Mae continúa diciendo que estos números representan "una gran reserva en la demanda de futuros propietarios de casas potenciales.” Ellos concluyeron con esto:

“el estudio continuo de cómo estos y futuros inmigrantes avanzan en hacerse propietarios de casa a medida que ellos residen por largo tiempo en los Estados Unidos, puede proporcionar información valiosa a las perspectivas futuras para el mercado de la vivienda en este país.”

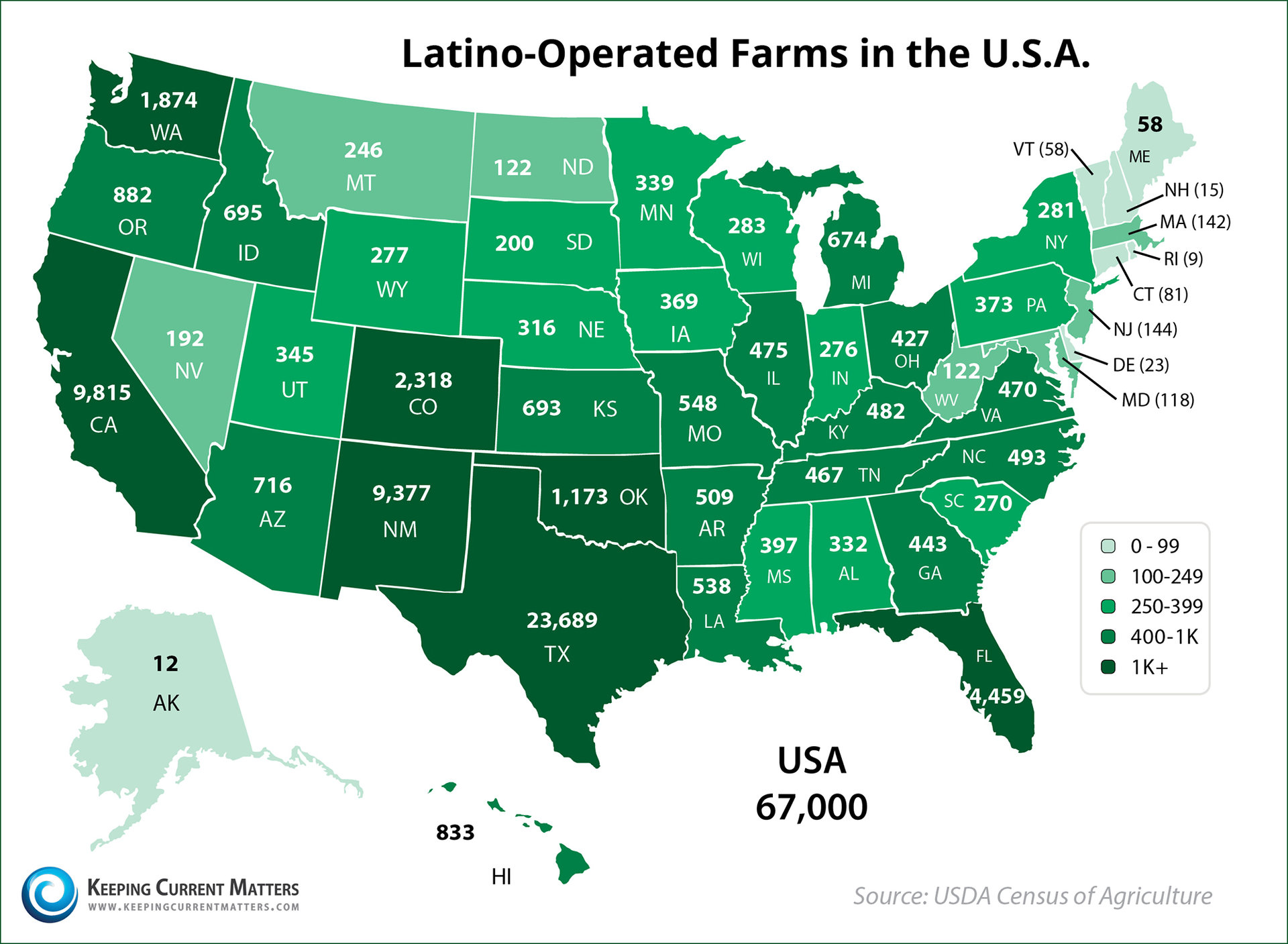

Una mirada más local al impacto

Para quienes buscan datos locales, un estudio realizado por AS/COA en alianza con a New American Economy, ofrece un mapa interactivo que demuestra “el cambio neto de la población inmigrante en el país desde 2000 a 2010 y el efecto correspondiente en el valor de las propiedades.”

En conclusión

Si nos fijamos en las conclusiones de múltiples fuentes, podemos ver que ellos están de acuerdo que los inmigrantes revitalizaran vecindarios menos deseables y apoyaran el mercado de la vivienda.

Cada grupo está buscando mayores oportunidades económicas al igual que los inmigrantes en décadas pasadas que vinieron a los Estados Unidos. La pregunta es: ¿Estamos preparados para ayudarles a ellos con sus necesidades en bienes raíces?

[assets] => Array ( ) [can_share] => no [categories] => Array ( [0] => stdClass Object ( [category_type] => standard [children] => [created_at] => 2019-06-03T18:18:43Z [id] => 5 [name] => Para los compradores [parent] => [parent_id] => [published_at] => 2019-06-03T18:18:43Z [slug] => buyers [status] => public [translations] => stdClass Object ( ) [updated_at] => 2019-06-03T18:18:43Z ) ) [content_type] => blog [contents] =>Hoy estamos alegres de tener a Jeymy González, La VP de KCM en español, como nuestra bloguera invitada. Jeymy ha experimentado personalmente los desafíos que los hispanos pueden enfrentar durante el proceso de bienes raíces y trabaja para ayudar esta comunidad con orientación y educación. ¡Disfruten! – El equipo de KCM

Hay muchos temas candentes ahora y definitivamente inmigración es uno de ellos. Sea que estén de acuerdo o en desacuerdo con lo que está pasando en este momento, la historia de inmigración comenzando alrededor de 1600 nos muestra que los Estados Unidos ha sido siempre un país que recibe a los inmigrantes. Varias organizaciones han realizado investigaciones sobre el impacto que pueden tener los inmigrantes en la demanda de la vivienda, veamos algunos de esos resultados:

La investigación hecha por The National Association of Home Builders (NAHB por sus siglas en ingles) en 2012 dice:

“Asumiendo que la inmigración neta de 1.2 millones (el extremo bajo de la proyección del Censo para 2010) persista por 10 años, este modelo estima que después de 10 años los nuevos inmigrantes van a:

- Representaran a cerca de 3.4 millones de hogares en U.S.A

- Ocuparan más de 2 millones de unidades multifamiliares y más de 1.2 millones de casas unifamiliares

- Representaran más de 900 mil propietarios de casa”

The Research Institute for Housing America también proyecto “que de 2010 a 2020 los inmigrantes van a contar por más de un tercio del crecimiento de los propietarios de casa y más de una cuarta parte del crecimiento de los hogares que alquilan.”

La necesidad de continuar con la investigación

En la edición de este mes de Housing Insights por Fannie Mae, Ellos mencionan como fuente The American Community Survey al afirmar que, hubo 18.8 millones de inmigrantes inquilinos en el país en 2012. Fannie Mae continúa diciendo que estos números representan "una gran reserva en la demanda de futuros propietarios de casas potenciales.” Ellos concluyeron con esto:

“el estudio continuo de cómo estos y futuros inmigrantes avanzan en hacerse propietarios de casa a medida que ellos residen por largo tiempo en los Estados Unidos, puede proporcionar información valiosa a las perspectivas futuras para el mercado de la vivienda en este país.”

Una mirada más local al impacto

Para quienes buscan datos locales, un estudio realizado por AS/COA en alianza con a New American Economy, ofrece un mapa interactivo que demuestra “el cambio neto de la población inmigrante en el país desde 2000 a 2010 y el efecto correspondiente en el valor de las propiedades.”

En conclusión

Si nos fijamos en las conclusiones de múltiples fuentes, podemos ver que ellos están de acuerdo que los inmigrantes revitalizaran vecindarios menos deseables y apoyaran el mercado de la vivienda.

Cada grupo está buscando mayores oportunidades económicas al igual que los inmigrantes en décadas pasadas que vinieron a los Estados Unidos. La pregunta es: ¿Estamos preparados para ayudarles a ellos con sus necesidades en bienes raíces?

[created_at] => 2014-08-28T06:00:05Z [description] => Hoy estamos alegres de tener a Jeymy González, La VP de KCM en español, como nuestra bloguera invitada. Jeymy ha experimentado personalmente los desafíos que los hispanos pueden enfrentar durante el proceso de bienes raíces y trabaja para ayudar es... [expired_at] => [featured_image] => https:/// [id] => 117 [published_at] => 2014-08-28T10:00:05Z [related] => Array ( ) [slug] => immigration-its-impact-on-the-housing-market [status] => published [tags] => Array ( ) [title] => Inmigración & su impacto en el mercado de la vivienda [updated_at] => 2015-11-18T14:25:43Z [url] => /es/2014/08/28/immigration-its-impact-on-the-housing-market/ )

En los últimos seis años, el ser propietario de vivienda ha perdido algo de su encanto como una inversión financiera. Al sufrir los propietarios de vivienda a través de la crisis de la vivienda, más y más han empezado a cuestionar si ser propietario de una casa es realmente una buena manera de construir patrimonio. Un

En los últimos seis años, el ser propietario de vivienda ha perdido algo de su encanto como una inversión financiera. Al sufrir los propietarios de vivienda a través de la crisis de la vivienda, más y más han empezado a cuestionar si ser propietario de una casa es realmente una buena manera de construir patrimonio. Un

Every day we are pleasantly surprised with the research coming forward regarding the Millennial generation. Whether it was

Every day we are pleasantly surprised with the research coming forward regarding the Millennial generation. Whether it was  It's probably only natural for real estate agents to assume that most boomers or retirees bent on moving to a new city to enjoy their golden years will be on the trail to Florida, Arizona, or some other state blessed with warmth and plenty of sunshine. And those states are probably the ones best situated to offer plenty of age-in-place benefits, right?

Nope.

When a boomer or senior who's open-minded about where they wish to move and retire searches Google for the best cities to age in place or best cities to retire, they finds some spots that are a bit out of the norm, but quite intriguing nonetheless.

Places like Sioux Falls, SD; Provo, UT; Iowa City, IA; Bismarck, ND; Columbia, MO; Omaha, NE; Madison, WI; and Boston, MA top the list.

As adults 55+ begin to contemplate their future and plan for a possible move, they are hearing more and more about the importance of preparing to age-in-place. They already know they hope to live in their own home, independently, for as long as possible. And the cities listed above – plus many other non-traditional retirement options – are receiving plenty of attention as go-to spots for their aging-in-place benefits in the form of quality healthcare, accessible transportation, government initiatives in building the city as senior-friendly, and a number of other indexes.

The Milken Institute, a non-partisan think tank, compiled a list in 2012 of the 259 Best Cities to Age Successfully. Another ranking is due later this summer of 2014. It divided the rankings into "Large Metros" and 'Small Metros," with Provo, Utah topping the Large City list and Sioux Falls the Small City rankings.

Others in the Top 10 of Large Cities to Age Successfully include Pittsburgh, Toledo, Des Moines, Salt Lake City, and Washington D.C.

Others in the Top 10 of Small Cities to Age Successfully include Rochester, MN, Ann Arbor, MI, Missoula, MT, Durham-Chapel Hill, NC, and Gainesville, FL.

See the entire list here and learn more about the Milken Institute's approach to promoting aging-in-place awareness:

It's probably only natural for real estate agents to assume that most boomers or retirees bent on moving to a new city to enjoy their golden years will be on the trail to Florida, Arizona, or some other state blessed with warmth and plenty of sunshine. And those states are probably the ones best situated to offer plenty of age-in-place benefits, right?

Nope.

When a boomer or senior who's open-minded about where they wish to move and retire searches Google for the best cities to age in place or best cities to retire, they finds some spots that are a bit out of the norm, but quite intriguing nonetheless.

Places like Sioux Falls, SD; Provo, UT; Iowa City, IA; Bismarck, ND; Columbia, MO; Omaha, NE; Madison, WI; and Boston, MA top the list.

As adults 55+ begin to contemplate their future and plan for a possible move, they are hearing more and more about the importance of preparing to age-in-place. They already know they hope to live in their own home, independently, for as long as possible. And the cities listed above – plus many other non-traditional retirement options – are receiving plenty of attention as go-to spots for their aging-in-place benefits in the form of quality healthcare, accessible transportation, government initiatives in building the city as senior-friendly, and a number of other indexes.

The Milken Institute, a non-partisan think tank, compiled a list in 2012 of the 259 Best Cities to Age Successfully. Another ranking is due later this summer of 2014. It divided the rankings into "Large Metros" and 'Small Metros," with Provo, Utah topping the Large City list and Sioux Falls the Small City rankings.

Others in the Top 10 of Large Cities to Age Successfully include Pittsburgh, Toledo, Des Moines, Salt Lake City, and Washington D.C.

Others in the Top 10 of Small Cities to Age Successfully include Rochester, MN, Ann Arbor, MI, Missoula, MT, Durham-Chapel Hill, NC, and Gainesville, FL.

See the entire list here and learn more about the Milken Institute's approach to promoting aging-in-place awareness:  I have been a subscriber to the Wall Street Journal (WSJ) for as long as I can remember. In my opinion, it is the single greatest source of financial information and insights available. I don’t always agree with their analysis but I always respect their position.

However, in an article this past weekend,

I have been a subscriber to the Wall Street Journal (WSJ) for as long as I can remember. In my opinion, it is the single greatest source of financial information and insights available. I don’t always agree with their analysis but I always respect their position.

However, in an article this past weekend,  We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family is ready, willing and able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy.

We are not the only ones that think owning has massive benefits or that now is a sensational time to plunge into owning your own home. Here are a few others:

We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family is ready, willing and able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy.

We are not the only ones that think owning has massive benefits or that now is a sensational time to plunge into owning your own home. Here are a few others:

The American desire to own a second home as a vacation home is alive and well!

The American desire to own a second home as a vacation home is alive and well! Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A

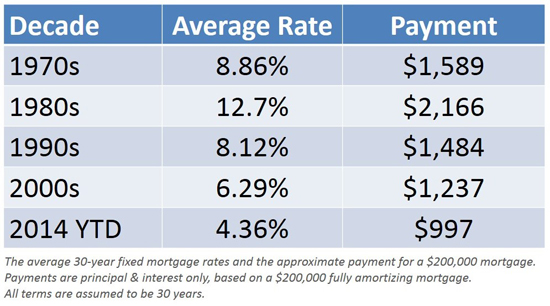

Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A  "One thing seems certain: we aren't likely to see average 30-year fixed mortgage rates return to the historic lows experienced in 2012."

- Freddie Mac, March 24, 2014

There are those that hope that 30-year mortgage interest rates will head back under 4%. Obviously, for any prospective home purchaser that would be great news. However, there is probably a greater chance that interest rates will return to the greater than 6% rate of the last decade before they would return to the less than 3.5% rate of 2012.

Freddie Mac, in one of four original posts on their

"One thing seems certain: we aren't likely to see average 30-year fixed mortgage rates return to the historic lows experienced in 2012."

- Freddie Mac, March 24, 2014

There are those that hope that 30-year mortgage interest rates will head back under 4%. Obviously, for any prospective home purchaser that would be great news. However, there is probably a greater chance that interest rates will return to the greater than 6% rate of the last decade before they would return to the less than 3.5% rate of 2012.

Freddie Mac, in one of four original posts on their