stdClass Object

(

[agents_bottom_line] => (English)  If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when it comes to purchasing real estate. That is actually far from reality.

After all 12,575 houses sold yesterday, 12,575 will sell today and 12,575 will sell tomorrow. 12,575!

That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. According to the report, annualized sales now stand at 4.59 million. Divide that number by 365 (days in a year) and we can see that, on average, over 12,500 homes sell every day.

If you are considering whether or not to put your house up for sale, don't let the headlines scare you. There are purchasers in the market and they are buying - to the tune of 12,575 homes a day.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => Para los vendedores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)

If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when it comes to purchasing real estate. That is actually far from reality.

After all 12,575 houses sold yesterday, 12,575 will sell today and 12,575 will sell tomorrow. 12,575!

That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. According to the report, annualized sales now stand at 4.59 million. Divide that number by 365 (days in a year) and we can see that, on average, over 12,500 homes sell every day.

If you are considering whether or not to put your house up for sale, don't let the headlines scare you. There are purchasers in the market and they are buying - to the tune of 12,575 homes a day.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => Para los vendedores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)  If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when it comes to purchasing real estate. That is actually far from reality.

After all 12,575 houses sold yesterday, 12,575 will sell today and 12,575 will sell tomorrow. 12,575!

That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. According to the report, annualized sales now stand at 4.59 million. Divide that number by 365 (days in a year) and we can see that, on average, over 12,500 homes sell every day.

If you are considering whether or not to put your house up for sale, don't let the headlines scare you. There are purchasers in the market and they are buying - to the tune of 12,575 homes a day.

[created_at] => 2014-04-23T07:00:53Z

[description] => (English) If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when ...

[expired_at] =>

[featured_image] => https:///

[id] => 26

[published_at] => 2014-04-23T07:00:53Z

[related] => Array

(

)

[slug] => 12575-houses-sold-yesterday

[status] => published

[tags] => Array

(

)

[title] => (English) 12,575 Houses Sold Yesterday!

[updated_at] => 2014-06-12T20:46:29Z

[url] => /es/2014/04/23/12575-houses-sold-yesterday/

)

If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when it comes to purchasing real estate. That is actually far from reality.

After all 12,575 houses sold yesterday, 12,575 will sell today and 12,575 will sell tomorrow. 12,575!

That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. According to the report, annualized sales now stand at 4.59 million. Divide that number by 365 (days in a year) and we can see that, on average, over 12,500 homes sell every day.

If you are considering whether or not to put your house up for sale, don't let the headlines scare you. There are purchasers in the market and they are buying - to the tune of 12,575 homes a day.

[created_at] => 2014-04-23T07:00:53Z

[description] => (English) If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when ...

[expired_at] =>

[featured_image] => https:///

[id] => 26

[published_at] => 2014-04-23T07:00:53Z

[related] => Array

(

)

[slug] => 12575-houses-sold-yesterday

[status] => published

[tags] => Array

(

)

[title] => (English) 12,575 Houses Sold Yesterday!

[updated_at] => 2014-06-12T20:46:29Z

[url] => /es/2014/04/23/12575-houses-sold-yesterday/

)

(English) 12,575 Houses Sold Yesterday!

(English) If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when ...

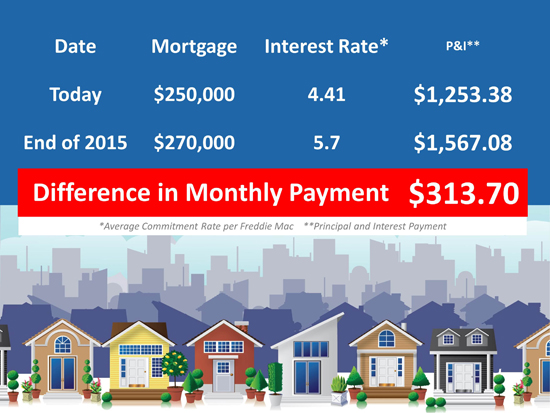

There is a great opportunity that exists now for Millennials who are willing and able to purchase a home NOW... Here are a couple other ways to look at the cost of waiting.

Let’s say you're 30 and your dream house costs $250,000 today, at 4.41% your monthly Mortgage Payment with Interest would be $1,253.38.

But you’re busy, you like your apartment, moving is such a hassle...You decide to wait till the end of next year to buy and all of a sudden, you’re 31, that same house is $270,000, at 5.7%. Your new payment per month is $1,567.08.

There is a great opportunity that exists now for Millennials who are willing and able to purchase a home NOW... Here are a couple other ways to look at the cost of waiting.

Let’s say you're 30 and your dream house costs $250,000 today, at 4.41% your monthly Mortgage Payment with Interest would be $1,253.38.

But you’re busy, you like your apartment, moving is such a hassle...You decide to wait till the end of next year to buy and all of a sudden, you’re 31, that same house is $270,000, at 5.7%. Your new payment per month is $1,567.08.

We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family is ready, willing and able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy.

We are not the only ones that think owning has massive benefits or that now is a sensational time to plunge into owning your own home. Here are a few others:

We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family is ready, willing and able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy.

We are not the only ones that think owning has massive benefits or that now is a sensational time to plunge into owning your own home. Here are a few others:

We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first time or repeat buyer, you must not be concerned about price but instead about the ‘long term cost’ of the home. Let us explain.

Recently, we

We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first time or repeat buyer, you must not be concerned about price but instead about the ‘long term cost’ of the home. Let us explain.

Recently, we

Millennials have become an important topic of discussion for media outlets and blogs throughout the Country. While some argue that my generation is blossoming later than our predecessors, optimists such as myself believe that with our rebounding economy will help Millennials finally arrive in the economic arena that allows them the growth potential generations before us were afforded.

While I truly believe Millennials are positioned to become an important force in the new economy, the widening economic policy that minimizes retirement accounts and creates underemployment of Millennials threatens what is now America’s largest demographic.

Millennials have become an important topic of discussion for media outlets and blogs throughout the Country. While some argue that my generation is blossoming later than our predecessors, optimists such as myself believe that with our rebounding economy will help Millennials finally arrive in the economic arena that allows them the growth potential generations before us were afforded.

While I truly believe Millennials are positioned to become an important force in the new economy, the widening economic policy that minimizes retirement accounts and creates underemployment of Millennials threatens what is now America’s largest demographic.

Nielsen recently released their report “

Nielsen recently released their report “ A recent

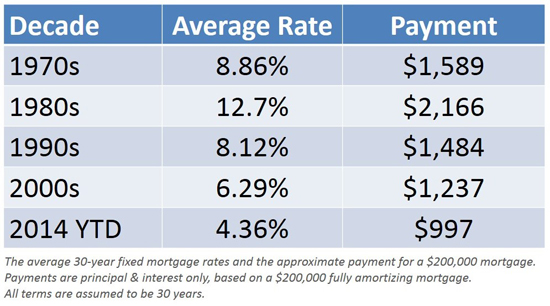

A recent  "One thing seems certain: we aren't likely to see average 30-year fixed mortgage rates return to the historic lows experienced in 2012."

- Freddie Mac, March 24, 2014

There are those that hope that 30-year mortgage interest rates will head back under 4%. Obviously, for any prospective home purchaser that would be great news. However, there is probably a greater chance that interest rates will return to the greater than 6% rate of the last decade before they would return to the less than 3.5% rate of 2012.

Freddie Mac, in one of four original posts on their

"One thing seems certain: we aren't likely to see average 30-year fixed mortgage rates return to the historic lows experienced in 2012."

- Freddie Mac, March 24, 2014

There are those that hope that 30-year mortgage interest rates will head back under 4%. Obviously, for any prospective home purchaser that would be great news. However, there is probably a greater chance that interest rates will return to the greater than 6% rate of the last decade before they would return to the less than 3.5% rate of 2012.

Freddie Mac, in one of four original posts on their

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. This year he released a new paper on homeownership -

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. This year he released a new paper on homeownership -  Several government agencies are reviewing data to determine what will be the minimum down payment required under the new Qualified Residential Mortgage (QRM) guidelines scheduled to be revealed in the next few months. In the original

Several government agencies are reviewing data to determine what will be the minimum down payment required under the new Qualified Residential Mortgage (QRM) guidelines scheduled to be revealed in the next few months. In the original  Several government agencies are reviewing data to determine what will be the minimum down payment required under the new Qualified Residential Mortgage (QRM) guidelines scheduled to be revealed in the next few months. In the original

Several government agencies are reviewing data to determine what will be the minimum down payment required under the new Qualified Residential Mortgage (QRM) guidelines scheduled to be revealed in the next few months. In the original