stdClass Object

(

[agents_bottom_line] => Let's team up so you have someone who can keep you in the loop on everything that might impact your move, like how many homes are up for sale right now.

[assets] => Array

(

)

[banner_image] =>

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2024-04-10T16:06:50Z

[id] => 320

[name] => Inventory

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:19:06Z

[slug] => inventory

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Inventario

)

)

[updated_at] => 2024-04-10T16:19:06Z

)

)

[content_type] => blog

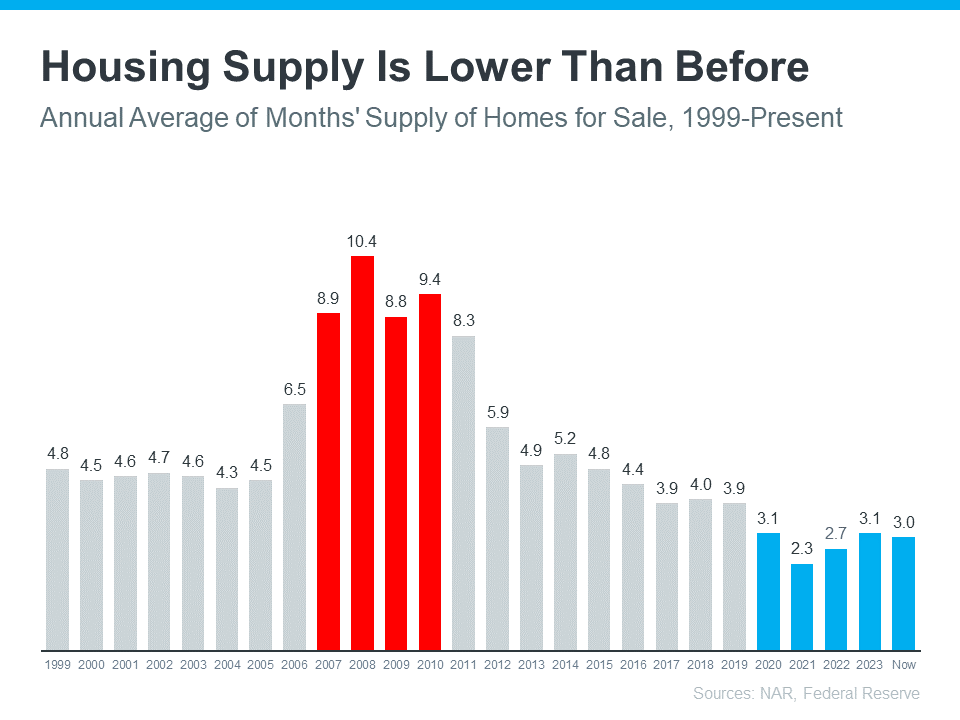

[contents] => There’s no denying the last couple of years have been tough for anyone trying to buy a home because there haven’t been enough houses to go around. But things are starting to look up.

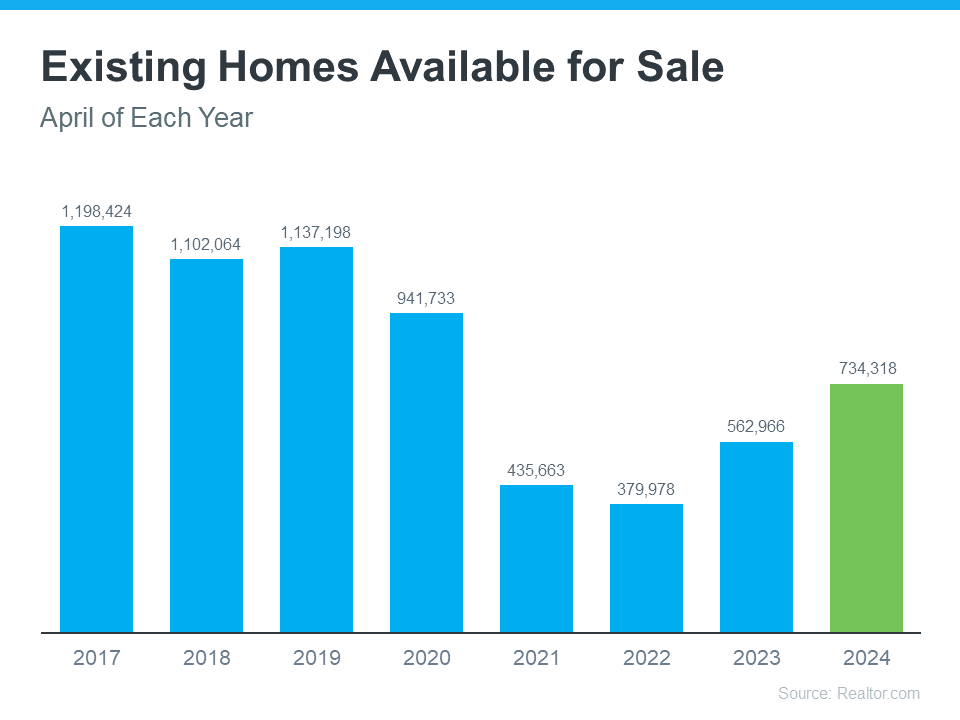

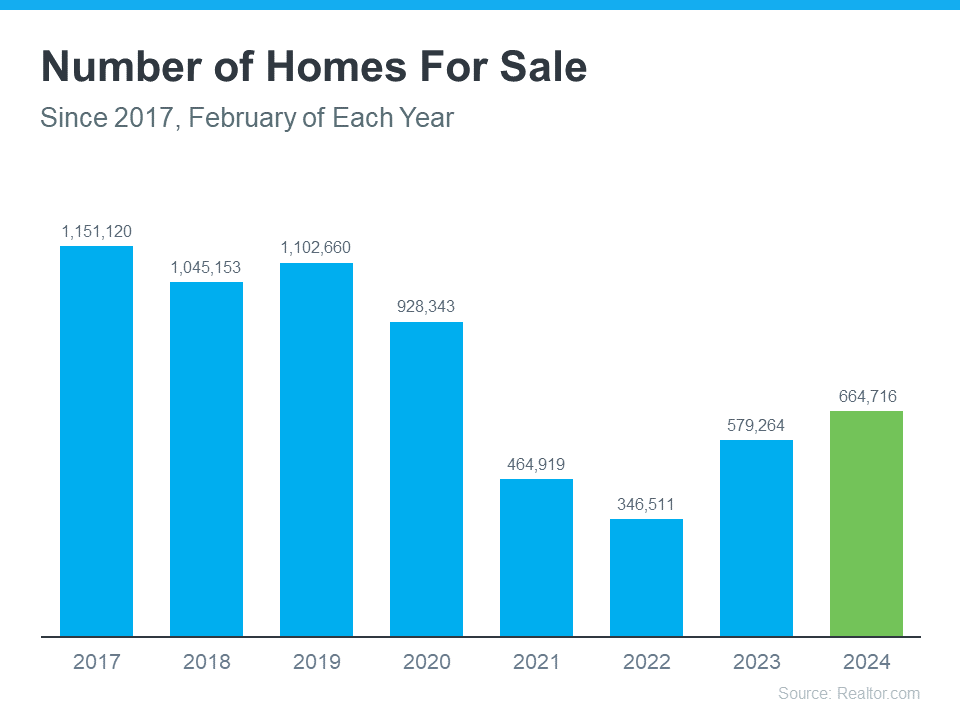

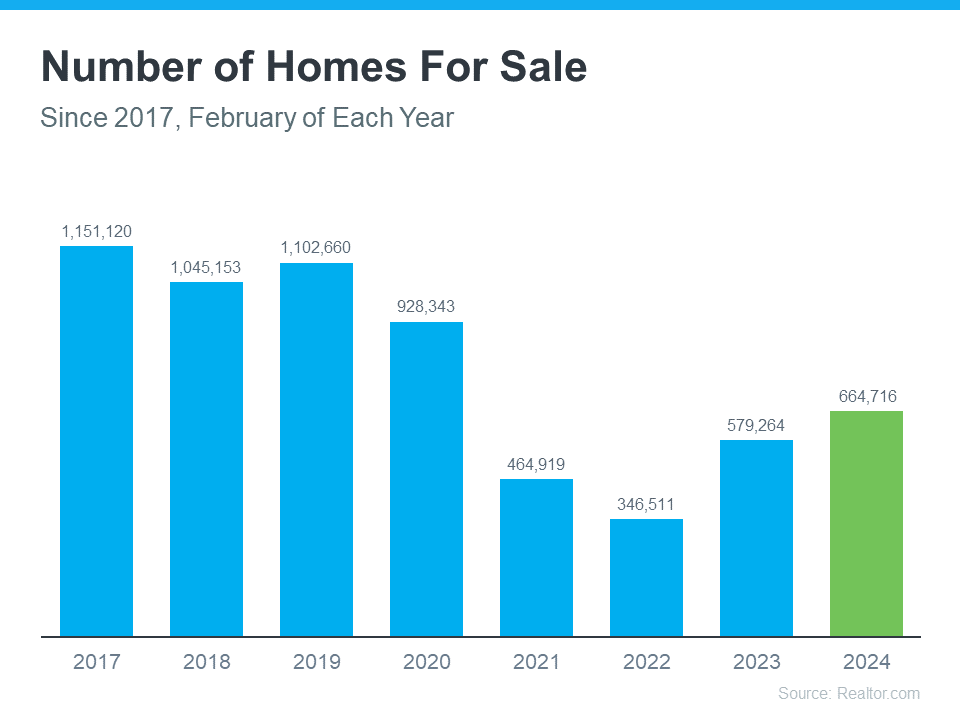

There are more homes up for grabs this year. The graph below uses the latest data from Realtor.com to show in April 2024 there were more homes for sale than there were over the last few years (2021-2023):

As Realtor.com explains:

“There were 30.4% more homes actively for sale on a typical day in April compared with the same time in 2023, marking the sixth consecutive month of annual inventory growth.”

But does this growing inventory make house hunting easier? Yes and no.

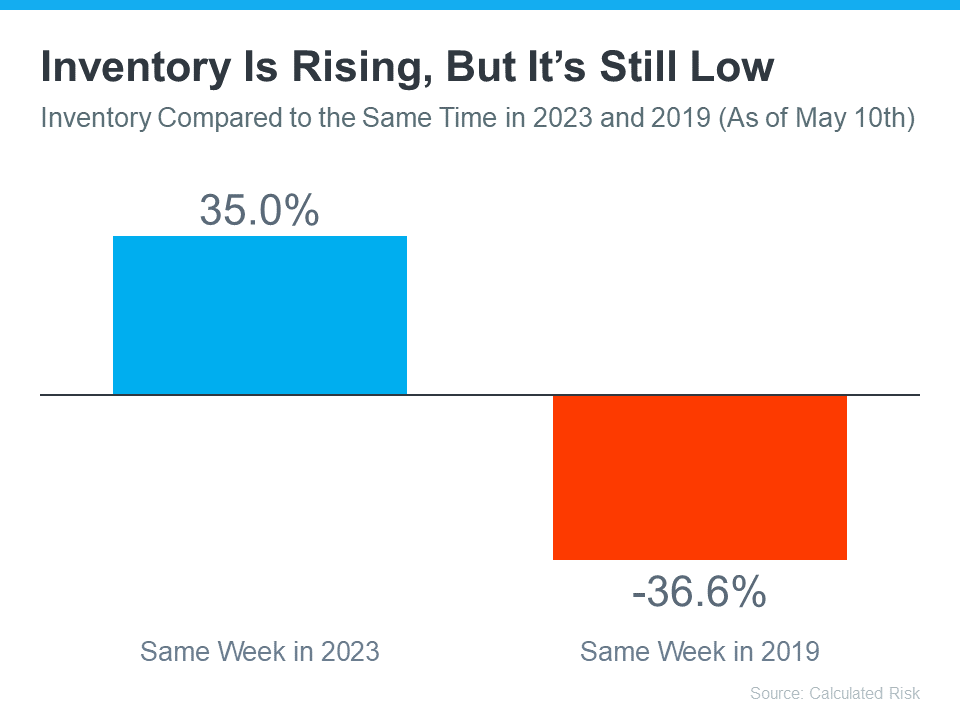

Using the latest weekly data from Calculated Risk, the graph below shows, that even with the growth lately, there are still way fewer homes for sale than there were in the last normal year in the housing market:

What Does This Mean for You?

If you’ve been looking to buy but put your plans on hold because you just couldn’t find what you were searching for, you might see more options now than you did over the past few years – but don't expect a huge selection.

To check out your growing options, it's a good idea to work with a local real estate agent you trust. Real estate is all about location. And an agent can help you get the scoop on the homes available in the area you're interested in. Bankrate explains:

“In today’s homebuying market, it’s more important than ever to find a real estate agent who really knows your local area — down to your specific neighborhood — and can help you successfully navigate its unique quirks.”

[created_at] => 2024-05-15T14:15:45Z

[description] => There’s no denying the last couple of years have been tough for anyone trying to buy a home because there haven’t been enough houses to go around.

[expired_at] =>

[featured_image] => https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240515/20240516-The-Number-of-Homes-for-Sale-Is-Increasing.png

[id] => 52370

[kcm_ig_caption] => There’s no denying the last couple of years have been tough for anyone trying to buy a home because there haven’t been enough houses to go around. But things are starting to look up.

There are more homes up for grabs this year.

As Realtor.com explains: “There were 30.4% more homes actively for sale on a typical day in April compared with the same time in 2023, marking the sixth consecutive month of annual inventory growth.”

What Does This Mean for You?

If you’ve been looking to buy but put your plans on hold because you just couldn’t find what you were searching for, you might see more options now than you did over the past few years – but don't expect a huge selection.

To check out your growing options, it's a good idea to work with a local real estate agent you trust. Real estate is all about location. And an agent can help you get the scoop on the homes available in the area you're interested in. Bankrate explains: “In today’s homebuying market, it’s more important than ever to find a real estate agent who really knows your local area — down to your specific neighborhood — and can help you successfully navigate its unique quirks.”

Let's team up so you have someone who can keep you in the loop on everything that might impact your move, like how many homes are up for sale right now.

[kcm_ig_hashtags] => housingmarket,househunting,keepingcurrentmatters

[kcm_ig_quote] => The number of homes for sale is increasing.

[public_bottom_line] => Team up with a local real estate agent who can keep you in the loop on everything that might impact your move, like how many homes are up for sale right now.

[published_at] => 2024-05-16T10:30:00Z

[related] => Array

(

)

[slug] => the-number-of-homes-for-sale-is-increasing

[status] => published

[tags] => Array

(

)

[title] => The Number of Homes for Sale Is Increasing

[updated_at] => 2024-05-16T10:30:59Z

[url] => /2024/05/16/the-number-of-homes-for-sale-is-increasing/

)

The Number of Homes for Sale Is Increasing

There’s no denying the last couple of years have been tough for anyone trying to buy a home because there haven’t been enough houses to go around.