stdClass Object

(

[agents_bottom_line] => Buying a home is a big, important decision that represents the heart of the American Dream. If you want to accomplish your goal, let’s connect to start the process today.

[assets] => Array

(

)

[banner_image] =>

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 11

[name] => First-Time Buyers

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T15:59:33Z

[slug] => first-time-buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Compradores de vivienda por primera vez

)

)

[updated_at] => 2024-04-10T15:59:33Z

)

)

[content_type] => blog

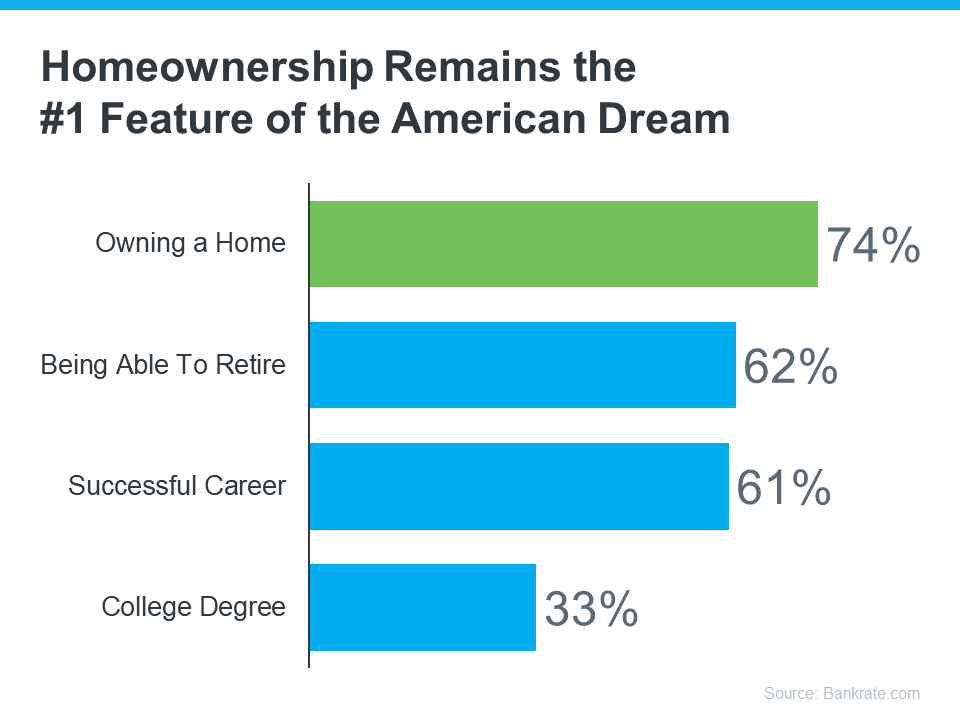

[contents] => Everyone has their own idea of the American Dream, and it's different for each person. But, in a recent survey by Bankrate, people were asked about the achievements they believe represent the American Dream the most. The answers show that owning a home still claims the #1 spot for many Americans today (see graph below):

In fact, according to the graph, owning a home is more important to people than retiring, having a successful career, or even getting a college degree. But is the dream of homeownership still alive for younger generations?

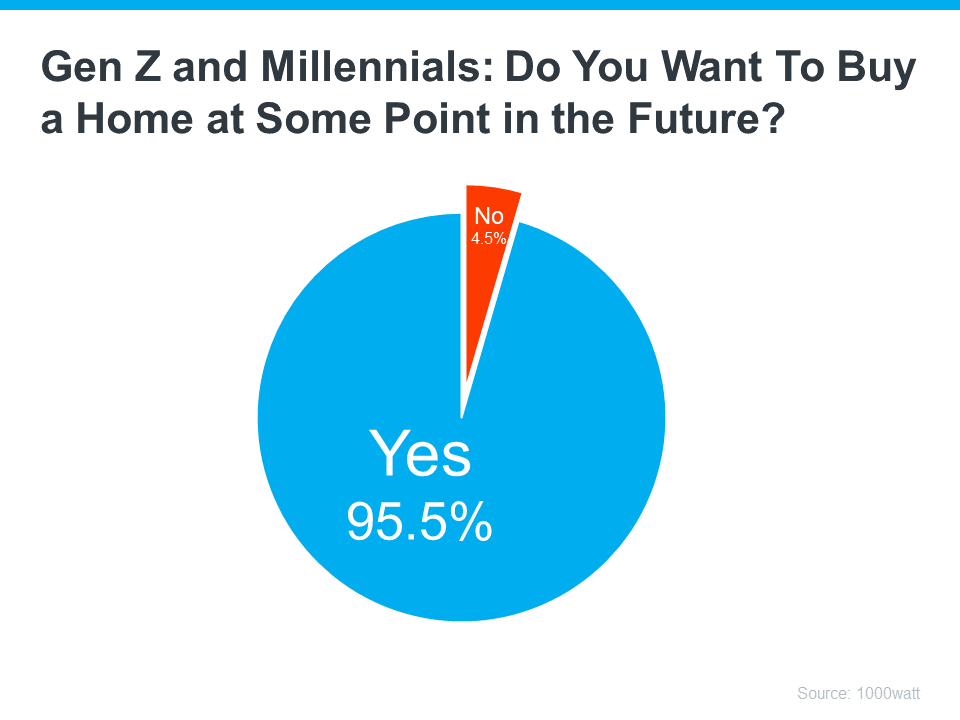

A recent survey by 1000watt dives into how the two generations many people believed would be the renter generations (Gen Z and millennials) feel about homeownership. Specifically, it asks if they want to buy a home in the future. The resounding answer is yes (see graph below):

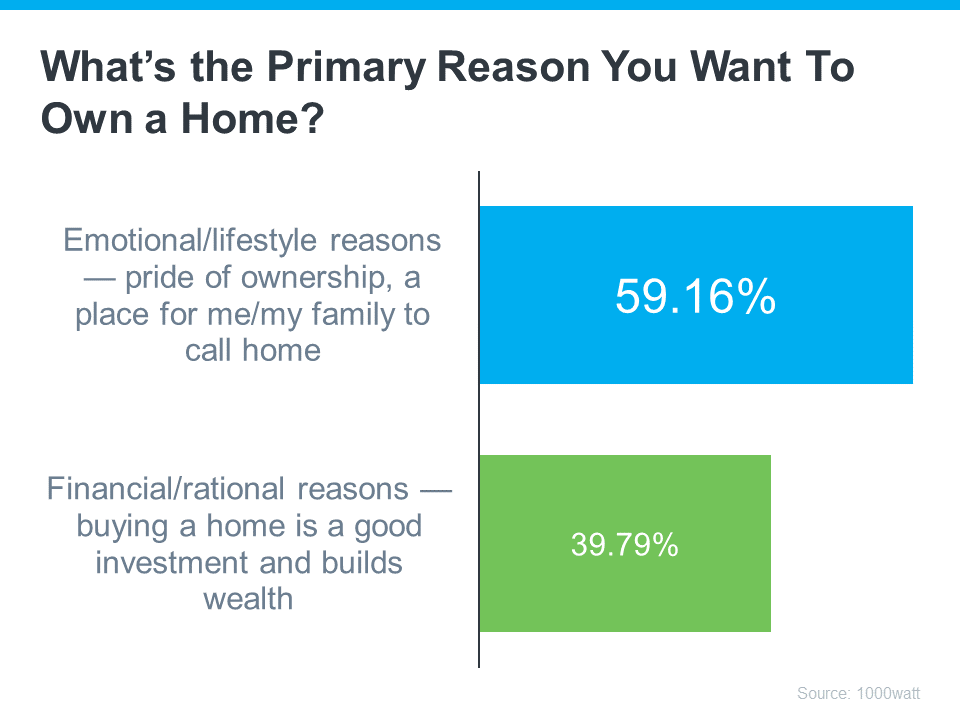

While there are plenty of reasons why someone might prefer homeownership to renting, the same 1000watt survey shows, that for 63% of Gen Z and millennials, it’s that your place doesn’t feel like “home” unless you own it – maybe you feel the same way.

That emotional draw is further emphasized when you look at the reasons why Gen Z and millennials want to become homeowners. For all the financial benefits homeownership provides, in most cases it’s about the lifestyle or emotional benefits (see graph below):

What Does This Mean for You?

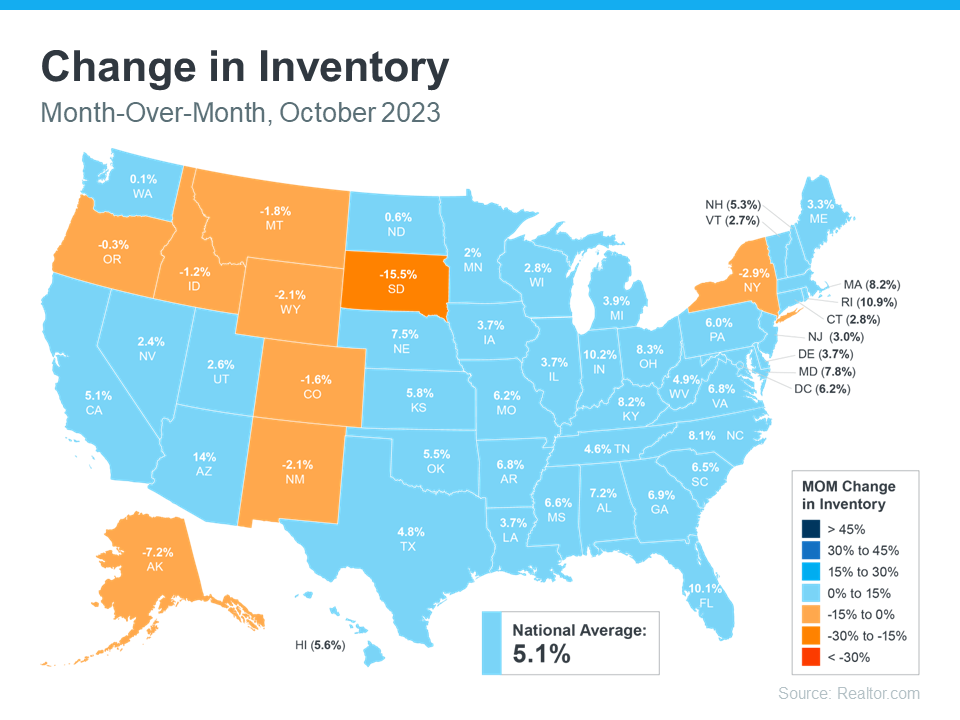

If you’re a part of Gen Z or are a millennial and you’re ready, willing, and able to buy a home, you’ll want a great real estate agent by your side. Their experience and expertise in the local housing market will help you overcome today’s high mortgage rates, low inventory, and rising home prices to find your first home and turn your dream into a reality.

Working with a local real estate agent to find your dream home is the key to unlocking the American Dream.

[created_at] => 2023-11-27T20:45:47Z

[description] => Everyone has their own idea of the American Dream, and it's different for each person.

[expired_at] =>

[featured_image] => https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20231127/20231130-Is-Owning-a-Home-Still-the-American-Dream-for-Younger-buyers.png

[id] => 34961

[kcm_ig_caption] => Everyone has their own idea of the American Dream, and it's different for each person. But, in a recent survey by Bankrate, people were asked about the achievements they believe represent the American Dream the most. The answers show that owning a home still claims the #1 spot for many Americans today.

A recent survey by 1000watt asks if they (Gen Z and millennials) want to buy a home in the future. The resounding answer is yes.

While there are plenty of reasons why someone might prefer homeownership to renting, the same 1000watt survey shows, that for 63% of Gen Z and millennials, it’s that your place doesn’t feel like “home” unless you own it – maybe you feel the same way.

That emotional draw is further emphasized when you look at the reasons why Gen Z and millennials want to become homeowners. For all the financial benefits homeownership provides, in most cases it’s about the lifestyle or emotional benefits.

What Does This Mean for You?

If you’re a part of Gen Z or are a millennial and you’re ready, willing, and able to buy a home, you’ll want a great real estate agent by your side. Their experience and expertise in the local housing market will help you overcome today’s high mortgage rates, low inventory, and rising home prices to find your first home and turn your dream into a reality.

Working with a local real estate agent to find your dream home is the key to unlocking the American Dream.

Buying a home is a big, important decision that represents the heart of the American Dream. If you want to accomplish your goal, DM me to start the process today.

[kcm_ig_hashtags] => firsttimehomebuyer,opportunity,housingmarket,househunting,makememove,homegoals,houseshopping,housegoals,investmentproperty,emptynest,downsizing,locationlocationlocation,newlisting,homeforsale,renovated,starterhome,dreamhome,curbappeal,keepingcurrentmatters

[kcm_ig_quote] => Is owning a home still the American dream for younger buyers?

[public_bottom_line] => Buying a home is a big, important decision that represents the heart of the American Dream. If you want to accomplish your goal, begin by talking to a local real estate expert to start the process today.

[published_at] => 2023-11-30T16:00:00Z

[related] => Array

(

)

[slug] => is-owning-a-home-still-the-american-dream-for-younger-buyers

[status] => published

[tags] => Array

(

[0] => content-hub

)

[title] => Is Owning a Home Still the American Dream for Younger Buyers?

[updated_at] => 2023-12-12T16:30:44Z

[url] => /2023/11/30/is-owning-a-home-still-the-american-dream-for-younger-buyers/

)

Is Owning a Home Still the American Dream for Younger Buyers?

Everyone has their own idea of the American Dream, and it's different for each person.