The Biggest Questions Clients Are Asking This Holiday Season (And FREE Slides to Answer Them)

‘Tis the season for friendly gatherings, and you know what that means. Everyone and their aunt Susan are going to be asking you questions about the real estate market.

The fact of the matter is, there’s a lot of speculation about what’s happening in housing right now, and everyone’s got an opinion on it.

It’s your job to be prepared for that inevitable table talk so you can show (and tell) your sphere the latest expert insights. That way when you’re at a New Years’ shindig and someone asks a question, you don’t drop the ball during the ball drop.

So, sit back, sip some hot chocolate, get the answers to the top questions you’ll need to answer this holiday season (plus free slides).

Is the Housing Market Going to Crash?

Rumors of a “housing crash” have been murmured for years. But is there actually meat behind those murmurs or are they just clickbait?

The truth is, while most news outlets feed off the doom and gloom of housing crash headlines, you can feed them a different story: the facts.

Yes, the escalation of home price appreciation leaves many to wonder if this is a bubble that’s going to burst. But the truth is, the housing market looks very different from the infamous events that led to 2008.

For instance:

- Rising home appreciation is a direct result of low supply and high buyer demand

- Mortgage lending standards are much tighter than they were in 2008

- Homeowners are using their equity much more responsibly today

Rest assured, your holiday guests can be confident that it is very much still a good time to buy or sell a home. And if they’re searching for proof with their figgy pudding, these slides will help show them the truth behind those headlines.

Will There be a Wave of Foreclosures as Forbearance Ends?

There’s no sugarcoating it. The pandemic was hard on a lot of Americans, leaving many jobless and without a choice but to put their mortgages in forbearance.

And as forbearance comes to a close, many are wondering: is a wave of foreclosures on the horizon?

The answer you can tell your clients is a sound “no.”

Here’s why according to experts:

- There are far fewer homeowners in trouble this time

- Most of the mortgages in forbearance have enough equity to sell, rather than foreclose, on their homes

- The current low inventory market can absorb listings – it needs them

Today, the probable number of foreclosures coming out of the forbearance program is nowhere near the number of foreclosures that impacted the housing crash.

To give some perspective, according to the Wall Street Journal:

“Between 2006 and 2014, about 9.3 million households went through foreclosure, gave up their home to a lender or sold in a distressed sale.” This time, we’re talking about just a few hundred thousand mortgages potentially in that situation, thanks to the forbearance plan.

Is the Real Estate Market Going to Last?

As the saying goes: what goes up must come down, right?

In the last year and a half, we’ve seen what could be the hottest real estate market of our lifetime. But we can all agree, or hope, that the factors leading up to that market won’t be repeating themselves anytime soon.

While mortgage rates are projected to rise and home prices continue to appreciate (although at a slower pace next year), we’re still seeing strong buyer demand. Plus, a recent study shows the majority of active sellers are planning to list their homes this winter.

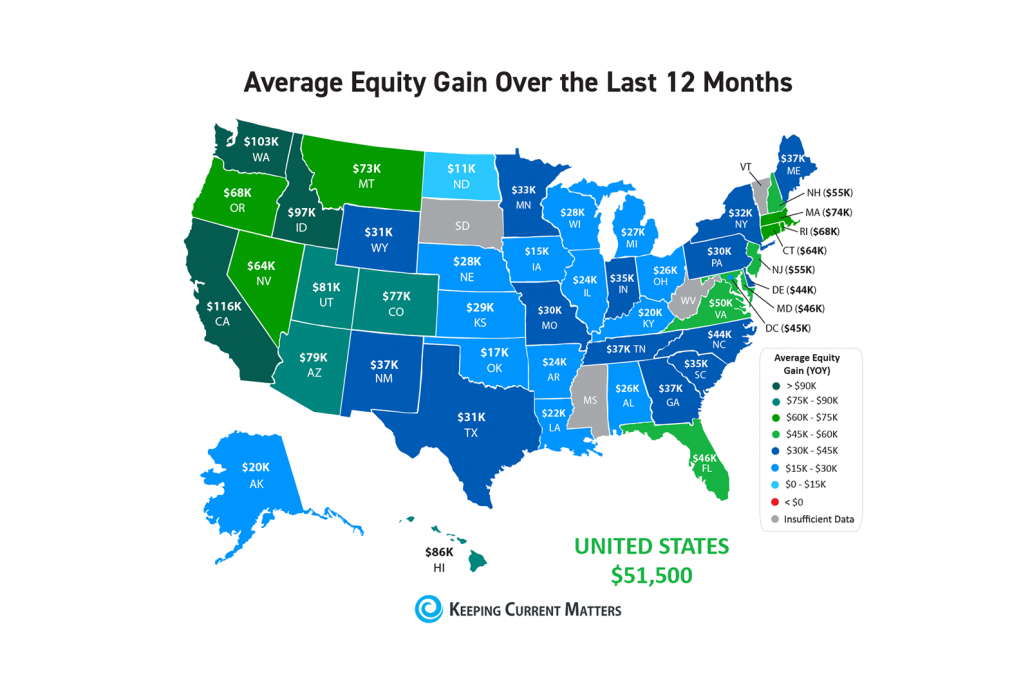

Much of this motivation to sell stems from homeowners earning record-breaking amounts of equity over the past year at the same time homeownership needs have changed drastically as we moved through the health crisis.

All of these signs point to a real estate market that won’t be cooling off anytime soon.

What we can expect to see is more choices for buyers as inventory rises. Looking for back-up? Get our latest graphs and charts so you can not only tell, but show, your sphere what top experts project.

With Prices so High, Are Homes Still Affordable?

Home values appreciated by almost 20% nationwide over the past year. Let that sink in a minute.

And with mortgage rates on the rise, many people are wondering: is it still affordable to buy a home?

The answer is: yes.

Let’s breakdown why:

- Despite escalating prices, homes are still more affordable than they were at anytime leading up to the housing crisis

- Rental prices are on the rise, making homeownership a more affordable option in many markets

- Inventory is expected to rise, taking the edge off of the supply and demand issue that led to the price growth we saw over the last year

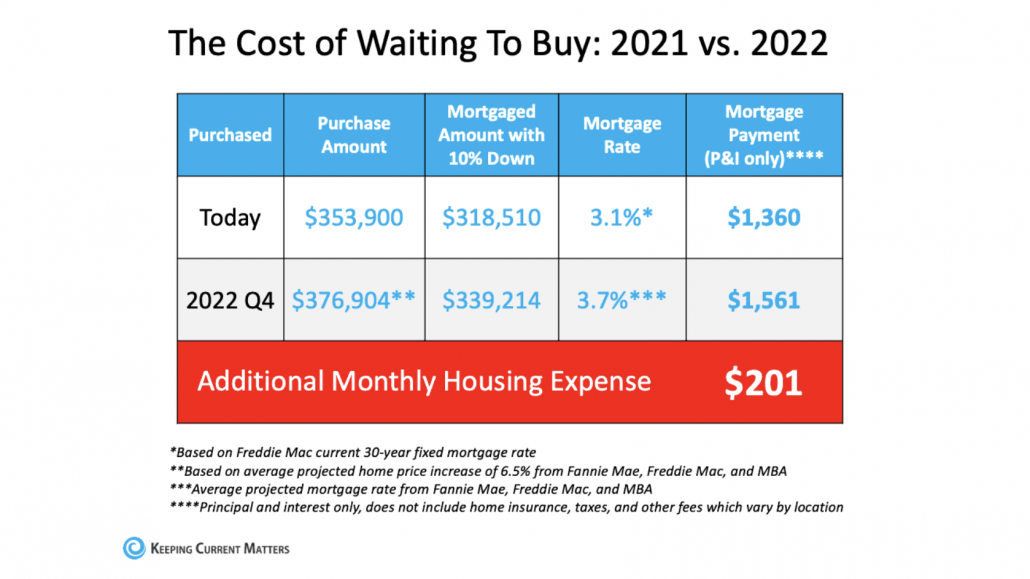

While the days of sub-3% mortgage rates may be fading away, buyers can remain confident in today’s affordability. However, be sure to tell them to not wait too long. As mortgage rates rise and home prices continue to appreciate, waiting to make a move will mean only one thing: it will cost more to buy a home.

What Will Happen with the 2022 Market?

If we’ve learned anything over the past couple of years, it’s that we can’t predict the future.

We can, however, project it based on what the experts are saying.

With industry experts anticipating more inventory, higher mortgage rates, and continued price appreciation in the New Year, there’s plenty of incentive for buyers and sellers to make a move sooner than later this year.

Looking for more information to back up your answers? Check out our full 2022 housing market forecast.

Bottom Line

As friends, family and loved ones gather this holiday season for the first time in years, we can begin to see life return to a state of normalcy we weren’t sure we’d ever get back to.

And when you’re the real estate agent in your family or friends group, you can expect to get a question or ten about the market.

In order to stay the housing market expert in your circle, you need to be able to provide relevant and educated responses that are backed by facts.

At the end of it all, what may seem like small talk at a holiday party could mean a big return come the new year.

But you’ll need more than just answers to prove you’re the market expert. These top slides cover all the questions and will help back up your advice with data and facts.

Download them to your phone so you have them ready the next time an uncle, cousin, friend, neighbor, or random party guest asks one of these questions.