These Are the Top Visuals to Share to Boost Client Confidence

There’s no doubt that today’s economic uncertainty is leaving many wondering: what will happen with real estate in 2023?

The truth is: while the housing market may look different than the frenzy we saw in previous years, that market wasn’t sustainable and we’re slowly just returning back to what a “normal” market looks like.

The question is: do your clients know that?

With media painting a certain picture, many may be thinking the worst, putting their real estate plans on hold or worse, panicking that we’re going to see a housing collapse.

That’s why these are the 5 slides that every real estate agent needs to share right now.

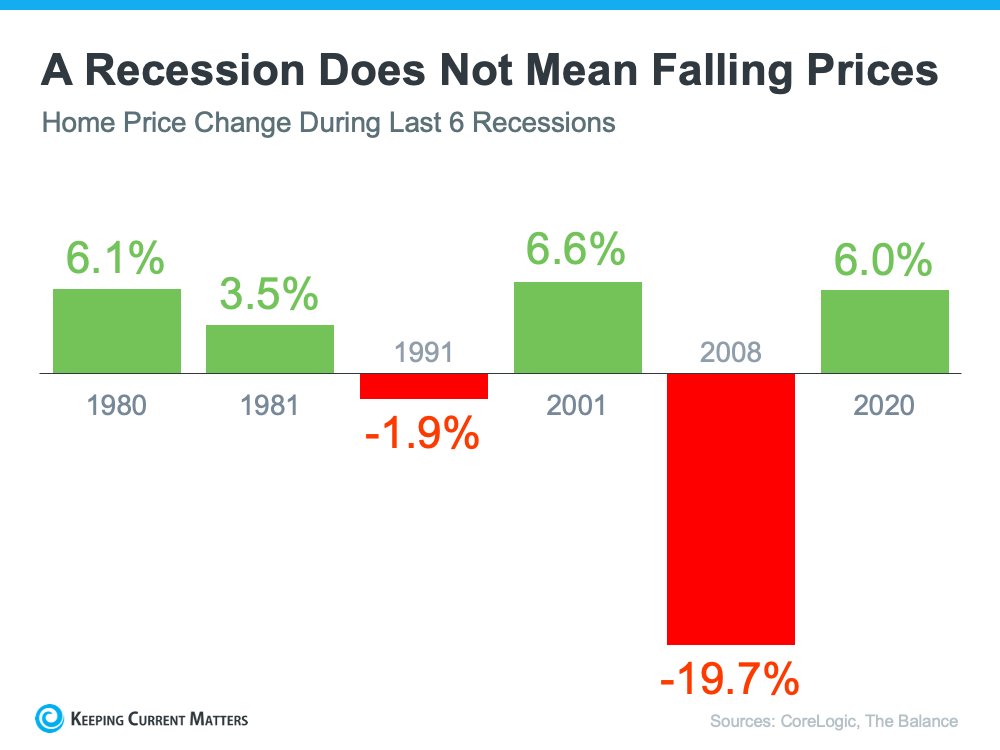

A Recession Doesn’t Mean Home Prices Will Fall

We all remember what happened in 2008, and unfortunately for many of your clients, the words “recession” and “housing bubble” immediately bring back memories of the crash.

However, there are big differences between today’s market and the ones leading up to the crash.

Here are the reasons today is nothing like the last time.

Before the Great Recession, the housing market had:

- Loose lending standards

- An oversupply of homes

- Overtapped equity

Today’s market looks the opposite with:

- Stricter lending practices

- An undersupply of homes

- More equity

In fact, in four out of the last six recessions home prices still appreciated.

Sharing visuals like the one below helps show the most important thing everyone needs to know: a recession does not equal a housing crisis.

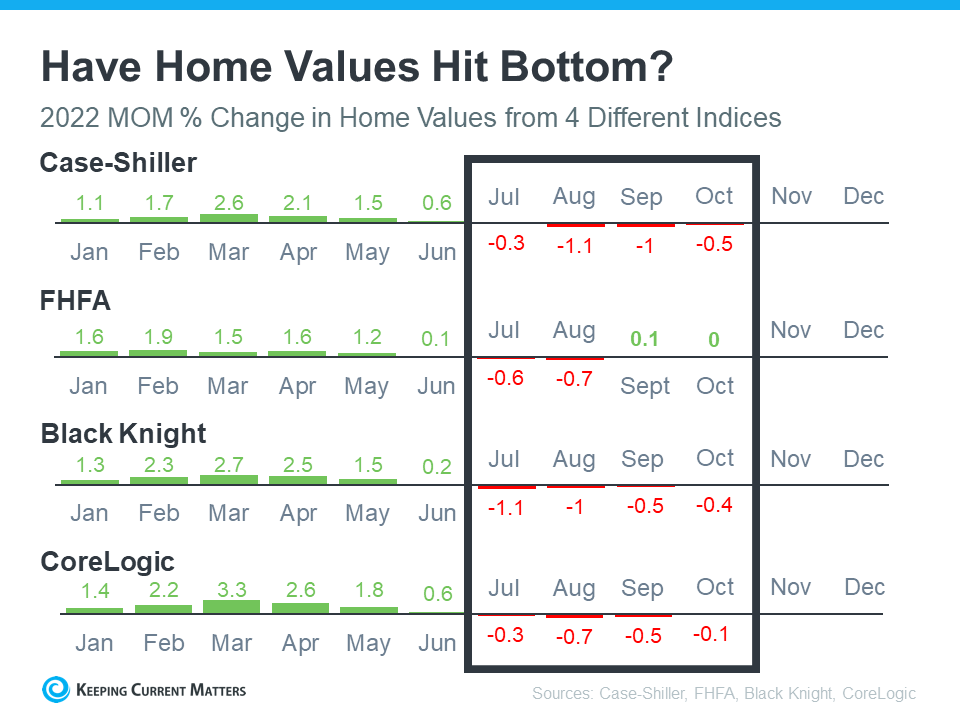

Price Appreciation is Moderating – But Perspective Matters

Home prices month-over-month have depreciated for the past four months on record, but there’s a strong case to be made that the worst may be behind us.

Expert forecasters aren’t calling for a free fall in prices. In fact, if you look at the latest data, there’s a case to be made that the biggest portion of month-over-month price depreciation nationally may already be behind us – and even those numbers weren’t significant declines on the national level.

Instead of how far will they drop, the question becomes: have home values hit bottom?

Looking at the data below, we can see this month-over-month change. It may not confirm that depreciation is behind us, but it does confirm prices aren’t in a free fall and may be an early signal that the worst is already behind us.

Showing both buyers and sellers this slide should help clear up any confusion about home prices plummeting any time soon.

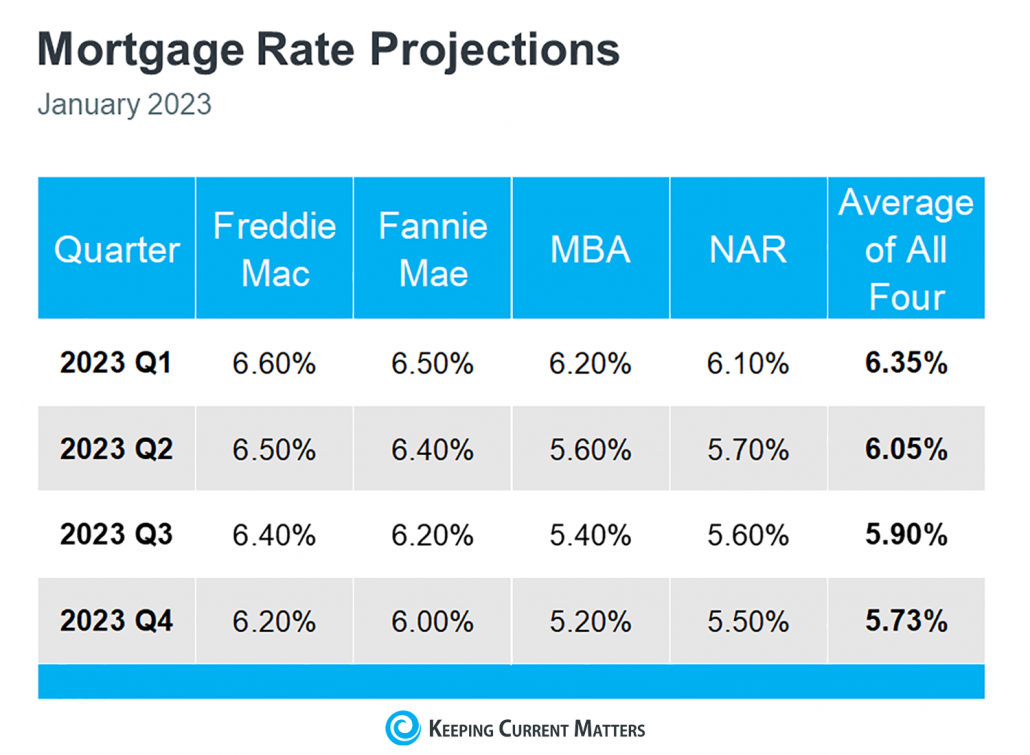

Experts Believe Mortgage Rates Have Peaked

As the saying goes, trying to time the housing market perfectly is a bit like playing the lottery.

While we can never truly foresee what’s going to happen, we can keep our spheres up-to-date on the latest insights, especially in a shifting market.

And the truth is, with the current unpredictability of mortgage rates and experts predicting continued home price appreciation, making a move this winter may be the better financial decision.

As the graph below shows, even at a more typical pace of appreciation, buyers still stand to make significant equity gains as their home grows in value. Making sure your clients know what’s at stake if they delay their plans may be just the thing that helps move them off the fence.

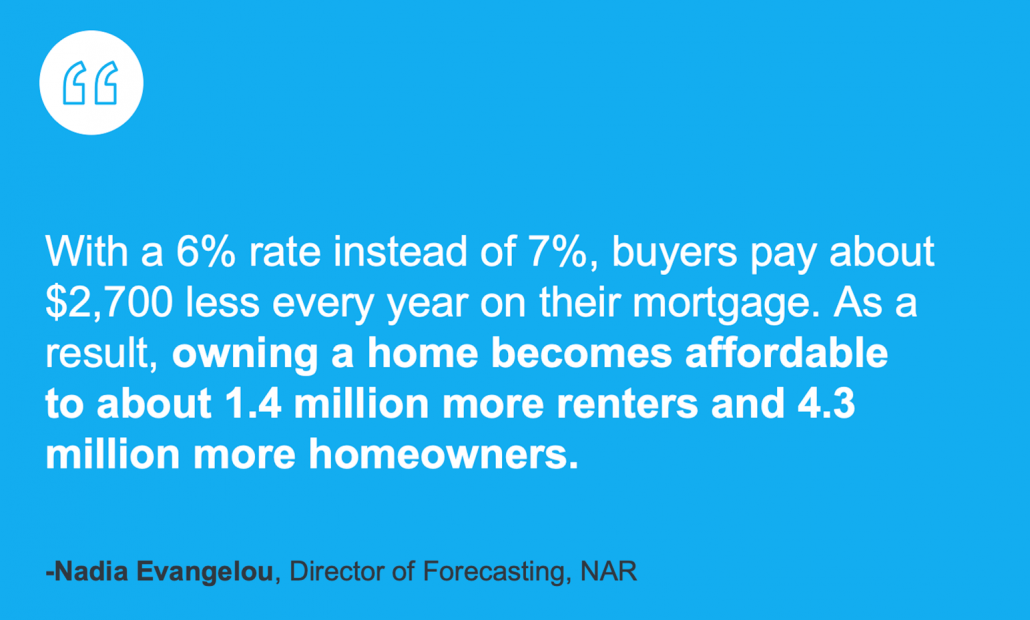

Affordability is Improving

It’s probably one of the biggest questions you’re getting right now: should I buy a home right now?

No doubt, one of the biggest catalysts impacting the slowdown in the housing market was the rapid rise in mortgage rates. By more than doubling in a 12-month period, many Americans were forced to put their buying or selling plans on hold because of affordability.

The good news: affordability is improving as inflation eases and rates slowly go down.

Any drop in mortgage rates helps boost purchasing power by bringing down your expected monthly mortgage payment. This means the lower mortgage rates experts forecast this year could be just what clients need to reignite their homebuying goals.

We Won’t See a Wave of Foreclosures

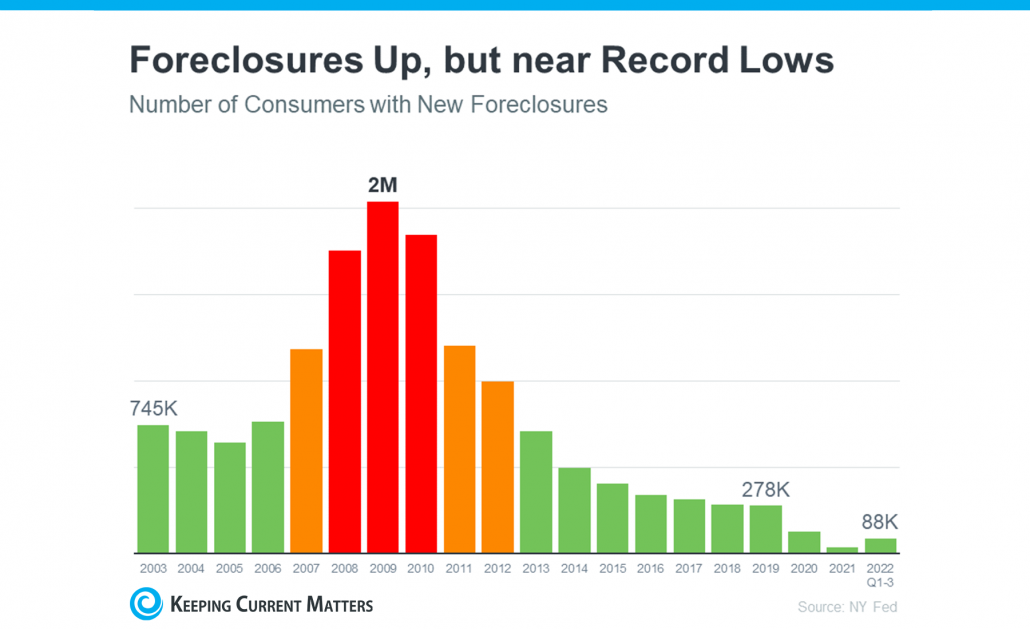

Another big topic swirling around the rumor mill is that foreclosures are on the rise.

According to the Year-End 2022 U.S. Foreclosure Market Report from ATTOM, foreclosure filings are up 115% from 2021, but down 34% from 2019. As media headlines grab onto this 115% increase, it’s more important than ever to put that percentage into context.

Here’s why:

- There was a foreclosure moratorium during the pandemic

- There aren’t as many homeowners at-risk due to stricter lending standards in the last 15 years

- Moat homeowners have more than enough equity to sell their homes, rather than foreclose

When it comes to really explaining this to your clients, this quote says it all.

“The bottom line is there will be an increase in foreclosures over the next year (from record low levels), but there will not be a huge wave of distressed sales as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.”

If your clients had any doubts about a possible housing crash, this should help clear up their confusion and shed light on the fact that the market is a lot stronger than what clickbait-y headlines might imply.

Bottom Line

With information coming from all sides, it’s important to continue to step up and be the real estate expert your friends, family and clients rely on.

While the real estate market continues to shift, there is still a lot of speculation about what the future holds. In order to create confidence in your communities and calm fears among clients, you need to continue to share the right information the right way.

In other words, it’s time to spread the word (and the visuals) to make sure your sphere is always in-the-know on the latest insights.

These graphs are a great starting point, but it’s going to take persistence to get the message out there. Be sure to download the visuals you need this winter so you have everything you need to be the educated agent right now and set yourself up for success in the coming months.