4 Biggest Questions Agents Need to Answer Right Now

When the going gets tough and the market faces challenges, buyers, sellers, and even agents tend to have one response: to fight or to flight.

But the real estate market is in a constant state of shifts and changes. Some of them are bigger or more impactful than others, but the truth remains the same: from pandemics to recessions, we can never predict what’s going to happen.

You do, however, have control over how you manage your business through it and how you communicate what’s happening and why it’s happening to your clients.

Because no matter what is going on in the world, one thing will forever remain the same: people will always need a place to call home.

Most importantly, you need to cut through the noise and get your clients the answers they need to the biggest questions in real estate right now.

Are prices going to crash?

Even though we’re no longer seeing the buyer frenzy that drove home values up during the pandemic, prices have been relatively flat at the national level. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), doesn’t expect that to change:

“Home prices will be steady in most parts of the country with a minor change in the national median home price.”

You might think sellers would have to lower prices to attract buyers in today’s market, and that’s part of why some may have been waiting for prices to come crashing down. But there’s another factor at play – low inventory. And according to Yun, that’s limiting just how low prices will go:

“We simply don’t have enough inventory. Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely.”

So while a lot of people expected prices would crash this year, thanks to low inventory, that isn’t happening. Why? There simply aren’t enough homes for sale.

Should I rent or should I buy a home?

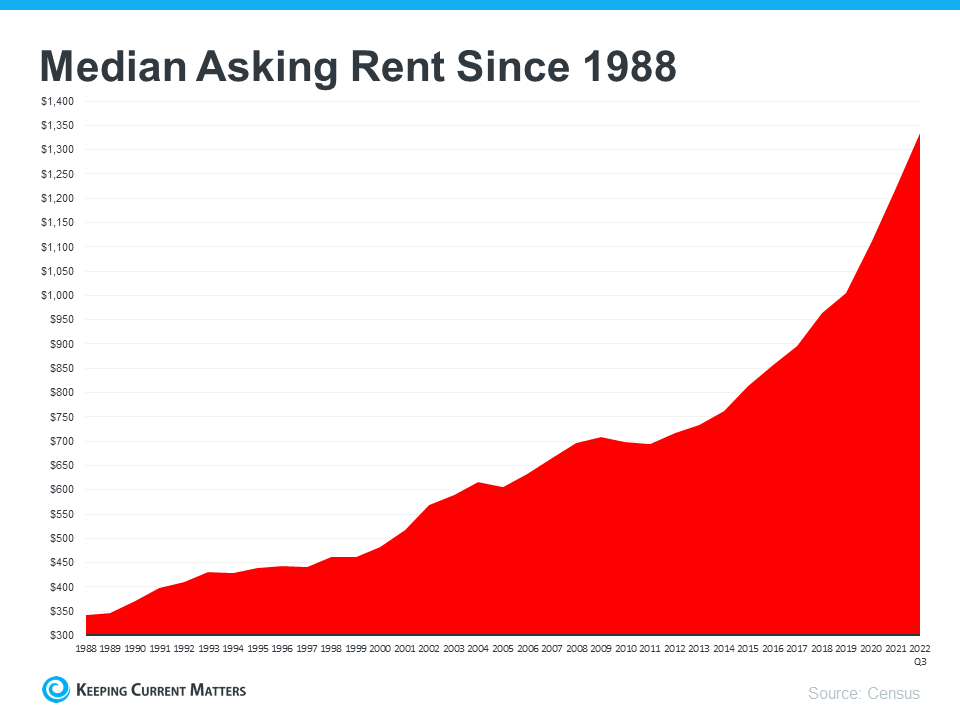

Many potential homebuyers are torn between buying a home or continuing to rent. However, historically we’ve seen rent trend up over time. According to data from the Census, rents have been climbing pretty steadily since 1988.

And, data from the latest rental report from Realtor.com shows rents continue to grow today, even though it’s at a slower pace than we saw at the height of the pandemic:

“In March 2023, the U.S. rental market experienced single-digit growth for the eighth month in a row . . . The median asking rent was $1,732, up by $15 from last month and down by $32 from the peak but is still $354 (25.7%) higher than the same time in 2019 (pre-pandemic).”

With rents much higher now than they were in more normal, pre-pandemic years, owning a home may be a better option, especially if the long-term trend of rents increasing each year continues. In contrast, homeowners with a fixed-rate mortgage can lock in a monthly mortgage payment for the duration of their loan (typically 15-30 years).

So, as rents rise in many parts of the country, it may make more financial sense or some buyers to continue to pursue homeownership than hitting the pause button on their search.

Is it still a good time to sell?

With all the uncertainty surrounding the economy right now, many homeowners are on the fence about whether it’s a good time to sell. But there’s one big factor playing to their advantage in today’s housing market: inventory.

The less inventory there is on the market when you sell, the less competition sellers are likely to face from other listings.

That means a house will get more attention from the buyers looking for a home this spring. And since there are significantly more buyers in the market than there are homes for sale, you could even receive more than one offer on your house. Recent data found that multiple offers are also on the rise again.

Will there be a flood of foreclosures?

You’ve likely seen headlines about the number of foreclosures climbing in today’s housing market. That may leave you with a few questions, especially for your clients thinking about buying a house. Understanding what they really mean is mission-critical if you want to know the truth about what’s happening today.

According to a recent report from ATTOM, a property data provider, foreclosure filings are up 6% compared to the previous quarter and 22% since one year ago. As media headlines call attention to this increase, reporting on just the number could actually generate worry and may even make someone think twice about buying a home for fear that prices could crash. The reality is, while foreclosures are climbing, it’s clear activity now is nothing like it was during the housing crisis.

That’s also largely because buyers today are more qualified and less likely to default on their loans. So, while foreclosures may be higher than they have been in the last couple of years, foreclosures are still far below the record-high number that was reported when the housing market crashed.

Bottom Line

We can’t control what’s going to happen with mortgage rates or the economy, but we can control what we prioritize. That way, in times of uncertainty, you see these factors less as stop signs and more as opportunities for growth and change.

Remember this: the key to success in any market is staying educated, acclimating to the current climate, and making sure you’re keeping the most important thing the most important thing: helping your clients buy and sell homes.

And the best way to do that right now is to put out the right information that helps buyers and sellers make the right decisions.

That’s why we’ve assembled the most important slides so you can easily help answer the biggest questions in the market right now. Download them free today.