Homeownership's Impact on Net Worth

Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A study by the Federal Reserve formally answered this question.

Some of the findings revealed in their report:

- The average American family has a net worth of $77,300

- Of that net worth, 61.4% ($47,500) of it is in home equity

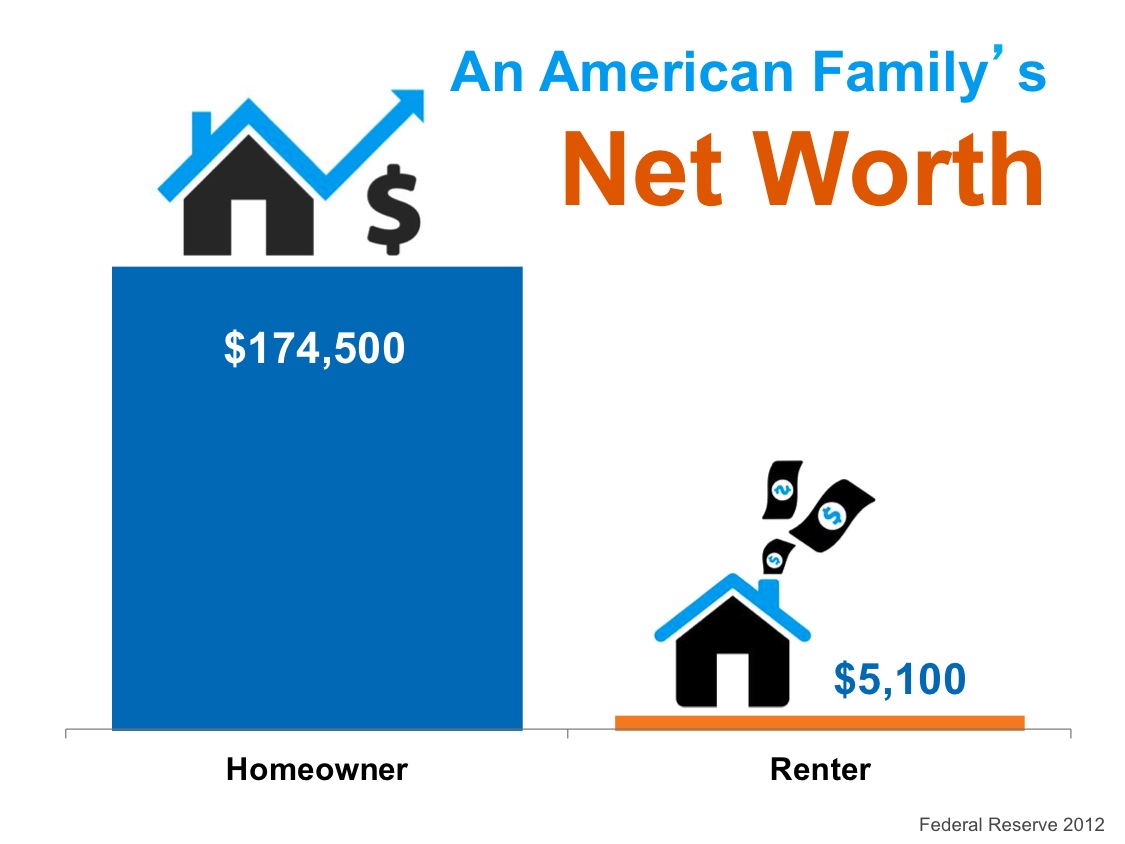

- A homeowner’s net worth is over thirty times greater than that of a renter

- The average homeowner has a net worth of $174,500 while the average net worth of a renter is $5,100

Bottom Line

The Fed study found that homeownership is still a great way for a family to build wealth in America.

|

Members: Sign in now to set up your Personalized Posts & start sharing today!

Not a Member Yet? Click Here to learn more about KCM’s newest feature, Personalized Posts. |