How the Economy Impacts Mortgage Rates

As someone who’s thinking about buying or selling a home, you’re probably paying close attention to mortgage rates – and wondering what's ahead.

/by

KCM CREW

A Newly Built Home May Actually Be More Budget-Friendly

If you’re in the market to buy a home, there’s some exciting news for you.

/by

KCM CREW

How Affordability and Remote Work Are Changing Where People Live

There’s an interesting trend happening in the housing market.

/by

KCM CREW

Unlocking Homebuyer Opportunities in 2024

There’s no arguing this past year has been difficult for homebuyers.

/by

KCM CREW

How To Determine if You’re Ready To Buy a Home

If you’re trying to decide if you’re ready to buy a home, there’s probably a lot on your mind.

/by

KCM CREW

The Price of Perfection: Don’t Wait for the Perfect Home

In life, patience is a virtue – but in the world of homebuying, waiting too long in hopes of finding the perfect home actually isn't wise.

/by

KCM CREW

Homeownership: The Heart of the American Dream

Everyone’s vision for the future is personal and unique.

/by

KCM CREW

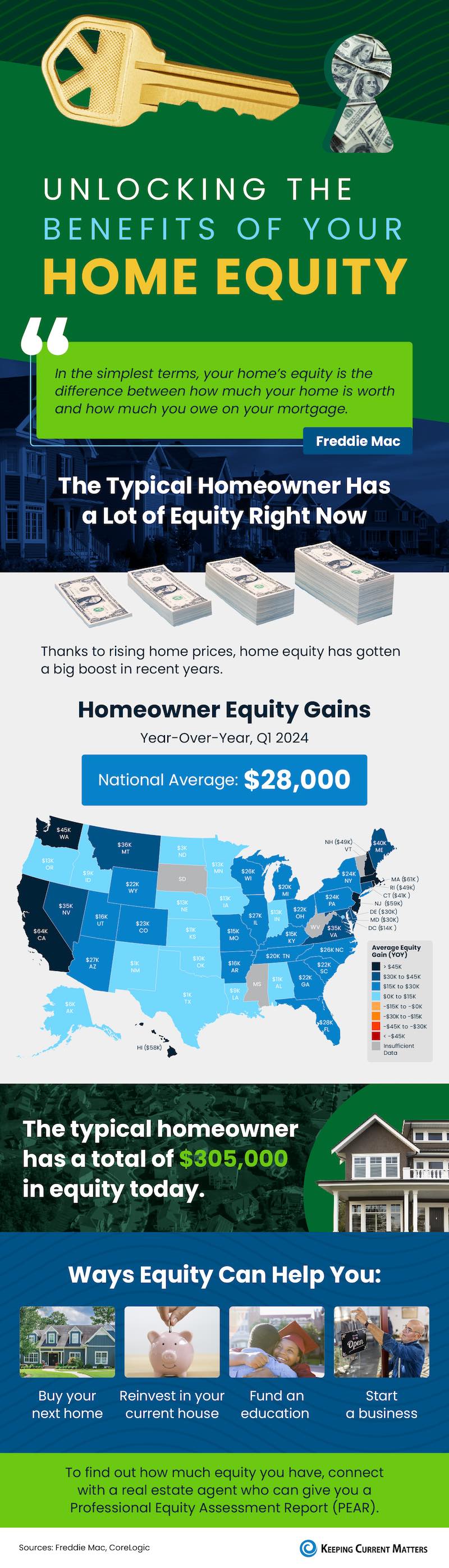

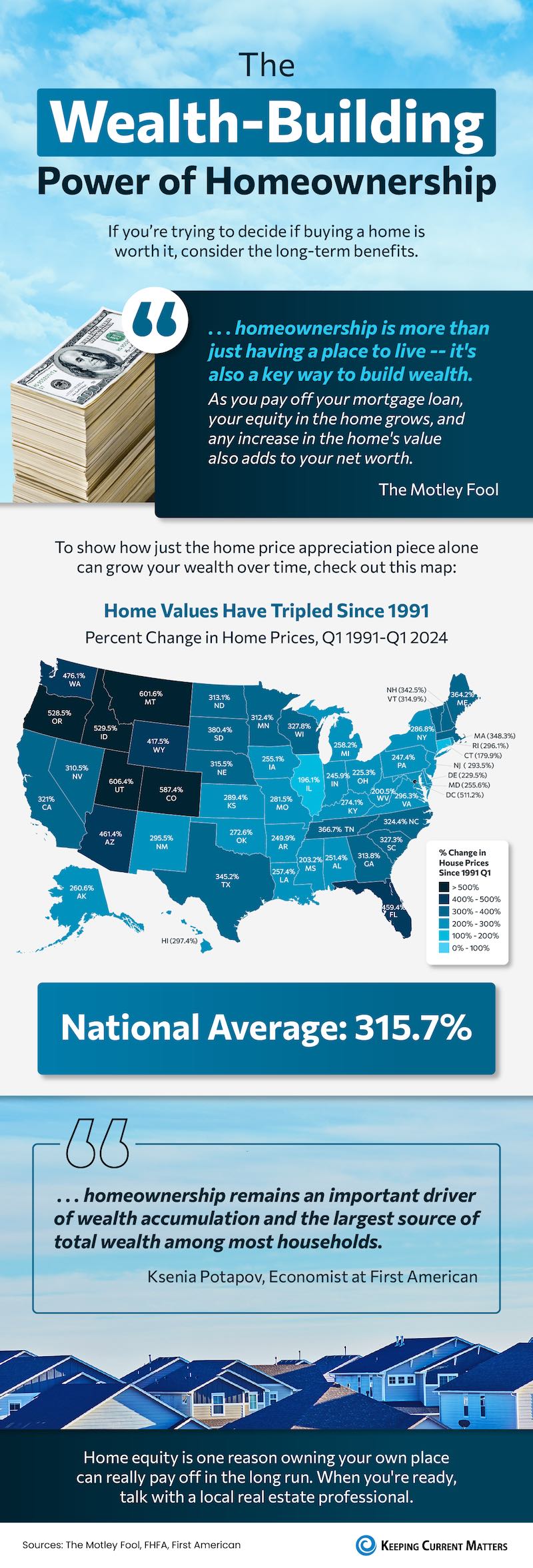

Real Estate Still Holds the Title of Best Long-Term Investment

With all the headlines circulating about home prices and mortgage rates, you may be asking yourself if it still makes sense to buy a home right now, or if it’s better to keep renting.

/by

KCM CREW

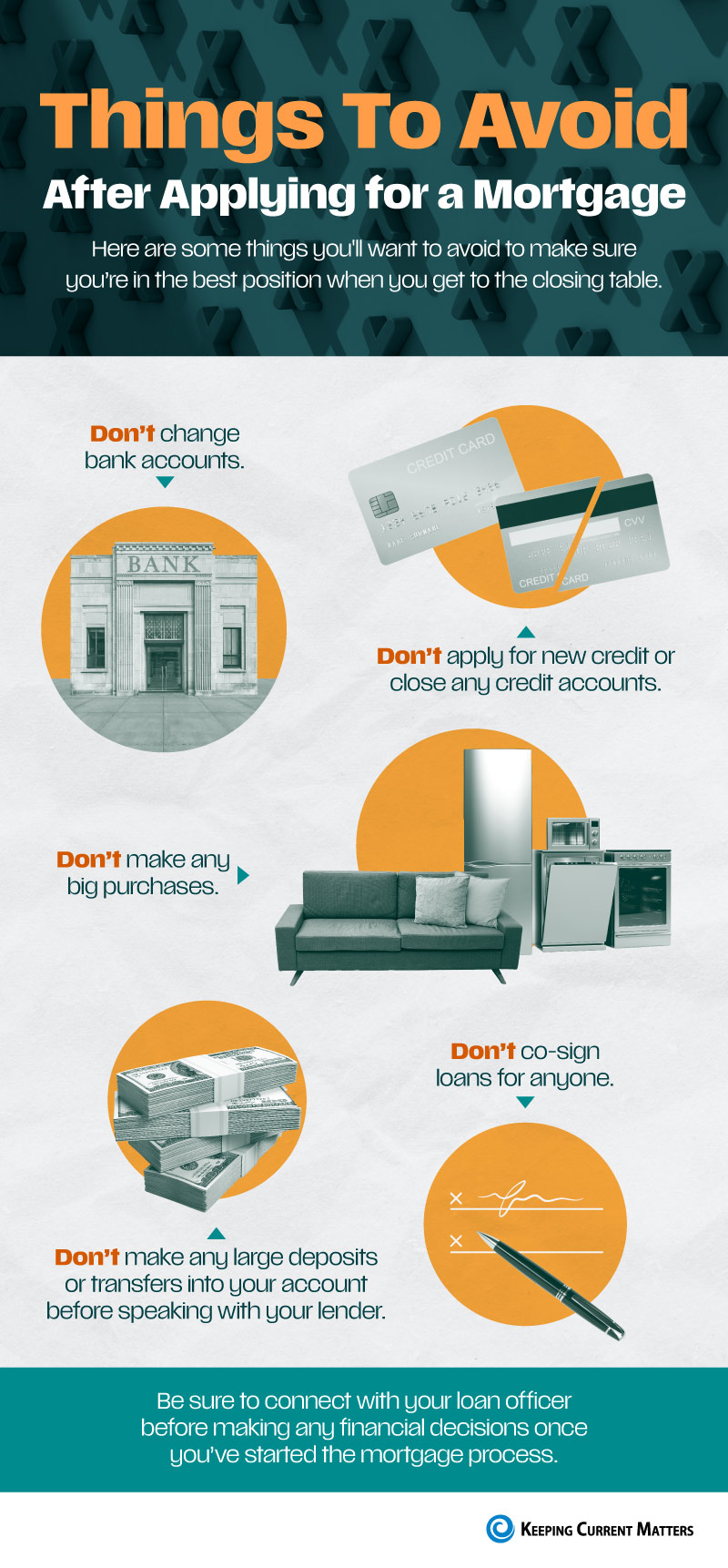

The Difference Between an Inspection and an Appraisal

When you decide to buy your first home, you may come across a number of terms and conditions you’re not familiar with.

/by

KCM CREW

Focus on Time in the Market, Not Timing the Market

Should you buy a home now or should you wait?

/by

KCM CREW

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales.

/by

KCM CREW

Why a Vacation Home Is the Ultimate Summer Upgrade

Summer is officially here and that means it’s the perfect time to start planning where you want to vacation and unwind this season.

/by

KCM CREW

What You Need To Know About Today’s Down Payment Programs

There's no denying it's gotten more challenging to buy a home, especially with today's mortgage rates and home price appreciation.

/by

KCM CREW

Do Elections Impact the Housing Market?

The 2024 Presidential election is just months away.

/by

KCM CREW

Homebuilders Aren’t Overbuilding, They’re Catching Up

You may have heard that there are more brand-new homes available right now than the norm.

/by

KCM CREW

Home Prices Aren’t Declining, But Headlines Might Make You Think They Are

If you’ve seen the news lately about home sellers slashing prices, it’s a great example of how headlines do more to terrify than clarify.

/by

KCM CREW

Savings Strategies Every First-Time Homebuyer Needs To Know

If homeownership is on your goal sheet for your future, you’re probably working on your savings.

/by

KCM CREW

The Sweet Spot for Buying Luxury Homes

If you’ve been looking for a home at the high-end of your market, but haven’t found the right one, you may have put your search on hold.

/by

KCM CREW

What To Expect if You Buy or Sell a Home This June

June is a busy month in the housing market because a lot of people buy and sell this time of year.

/by

KCM CREW

More Than a House: The Emotional Benefits of Homeownership

With all the headlines and talk about housing affordability, it can be tempting to get lost in the financial side of buying a home.

/by

KCM CREW