Freddie Mac’s New 3% Down Program

Today, Freddie Mac is scheduled to start buying mortgages with down payments of only three percent – the first time down payments have been this low on Freddie Mac loans in nearly five years. The program is called Freddie Mac Home Possible AdvantageSM.

In a recent Executive Perspectives, Dave Lowman EVP, Single-Family Business Freddie Mac, explained the potential impact this program will have on the housing market:

“There’s a new reason Realtors and lenders may expect more qualified borrowers at the closing table during this spring’s home buying season. In addition to low mortgage rates and rising job growth, the down payment hurdle is starting to shrink for creditworthy borrowers, including first-time homebuyers.”

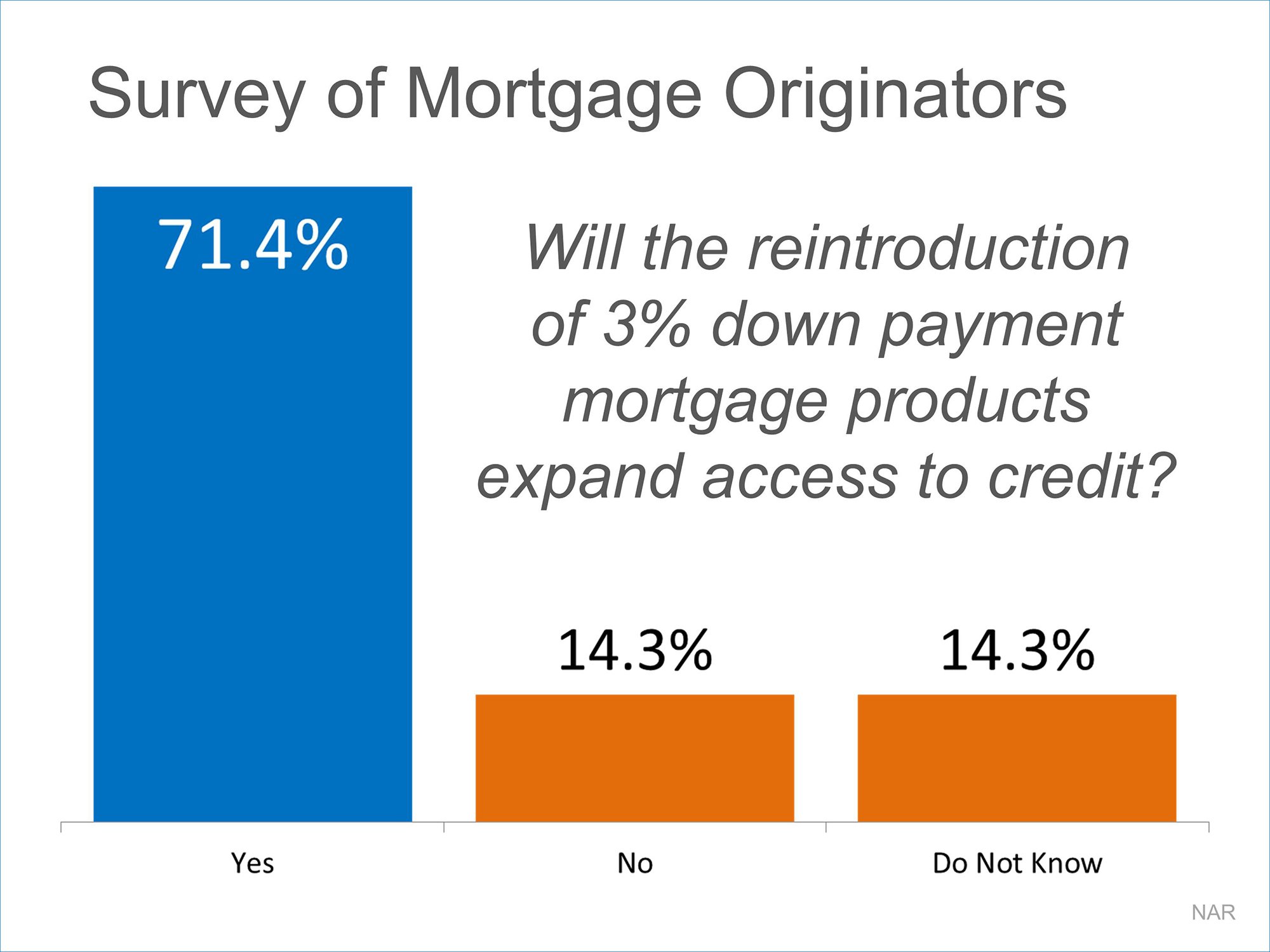

And the mortgage industry agrees with Mr. Lowman. In a recent survey of mortgage originators by the National Association of Realtors (NAR), it was revealed that most loan officers believe the move to a lower down payment will increase access to mortgage credit. Here are that survey’s findings:

Bottom Line

Many potential buyers are “ready and willing” to buy a home but have been afraid they may not be “able” because of a lack of adequate savings for a down payment. Check with a local real estate or mortgage professional to understand what the new rules may mean to you.

|

Members: Sign in now to set up your Personalized Posts & start sharing today!

Not a Member Yet? Click Here to learn more about KCM’s newest feature, Personalized Posts. |