5 Reasons You Shouldn’t For Sale By Owner

In today's market, with homes selling quickly and prices rising some homeowners might consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons this might not be a good idea for th...

![Buyer Demand Exceeds Buyer Demand [INFOGRAPHIC] | Simplifying The Market](http://www.simplifyingthemarket.com/wp-content/uploads/2015/05/EHS-APRIL-STM.jpg)

![Buyer Demand Exceeds Buyer Demand [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2015/05/EHS-APRIL-STM.jpg)

Recently, Freddie Mac published a blog post titled

Recently, Freddie Mac published a blog post titled  Recently, Freddie Mac published a blog post titled

Recently, Freddie Mac published a blog post titled  In a

In a  In a

In a  Though the real estate market has improved, we still have one item holding it back from a full recovery – a robust supply of homes for sale. Demand has

Though the real estate market has improved, we still have one item holding it back from a full recovery – a robust supply of homes for sale. Demand has  Everyone knows the

Everyone knows the

Everyone knows the

Everyone knows the

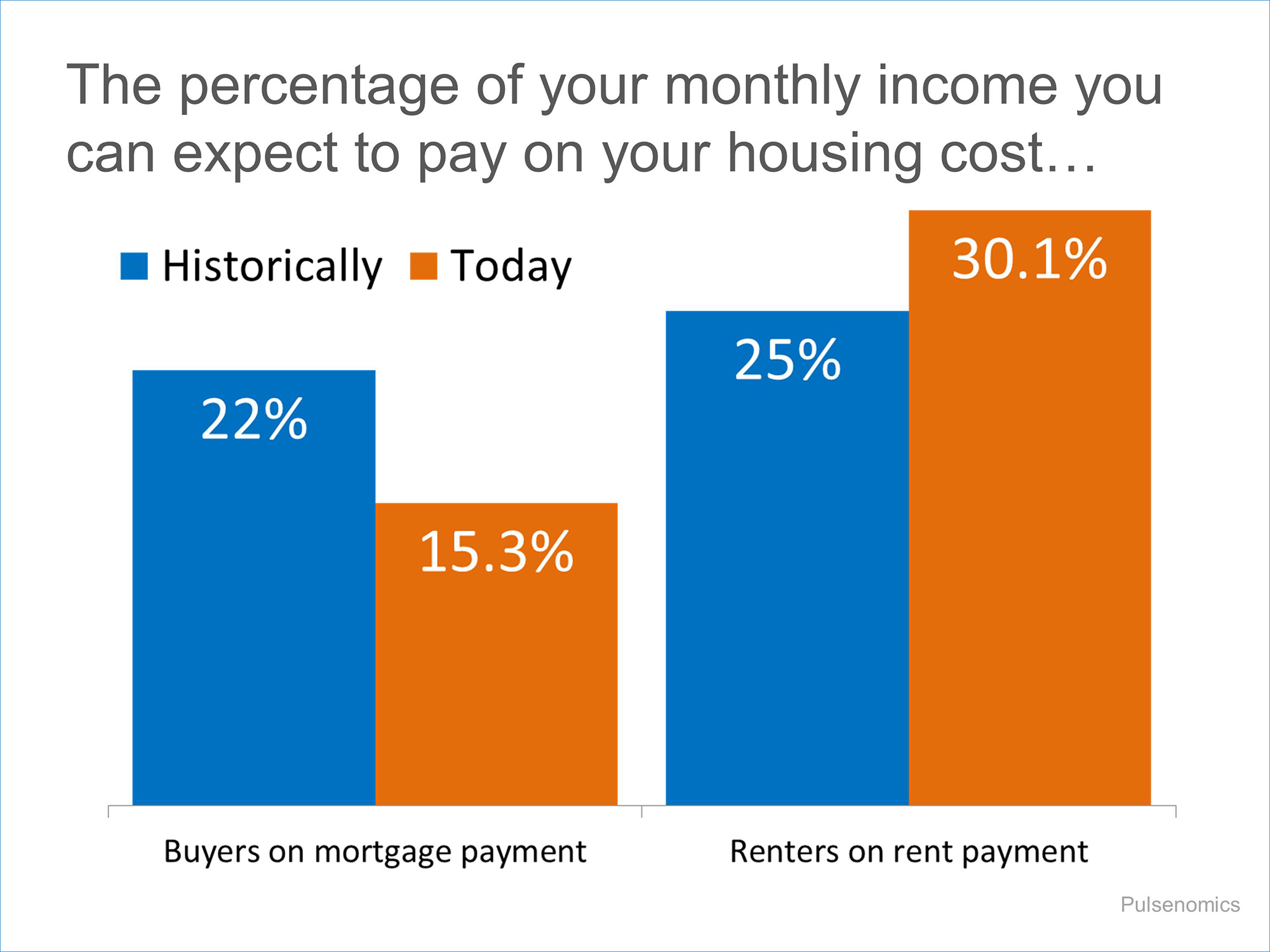

If you are debating purchasing a home right now, you are surely getting a lot of advice. Though your friends and family will have your best interest at heart, they may not be fully aware of your needs and what is currently happening in real estate. Let’s look at whether or not now is actually a good time for you to buy a home.

There are 3 questions you should ask before purchasing in today’s market:

If you are debating purchasing a home right now, you are surely getting a lot of advice. Though your friends and family will have your best interest at heart, they may not be fully aware of your needs and what is currently happening in real estate. Let’s look at whether or not now is actually a good time for you to buy a home.

There are 3 questions you should ask before purchasing in today’s market:

![How Quickly Are Homes Selling In Your State? [INFOGRAPHIC] | Simplifying The Market](http://www.simplifyingthemarket.com/wp-content/uploads/2015/04/Days-on-the-Market-STM.jpg)

![How Quickly Are Homes Selling In Your State? [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2015/04/Days-on-the-Market-STM.jpg)

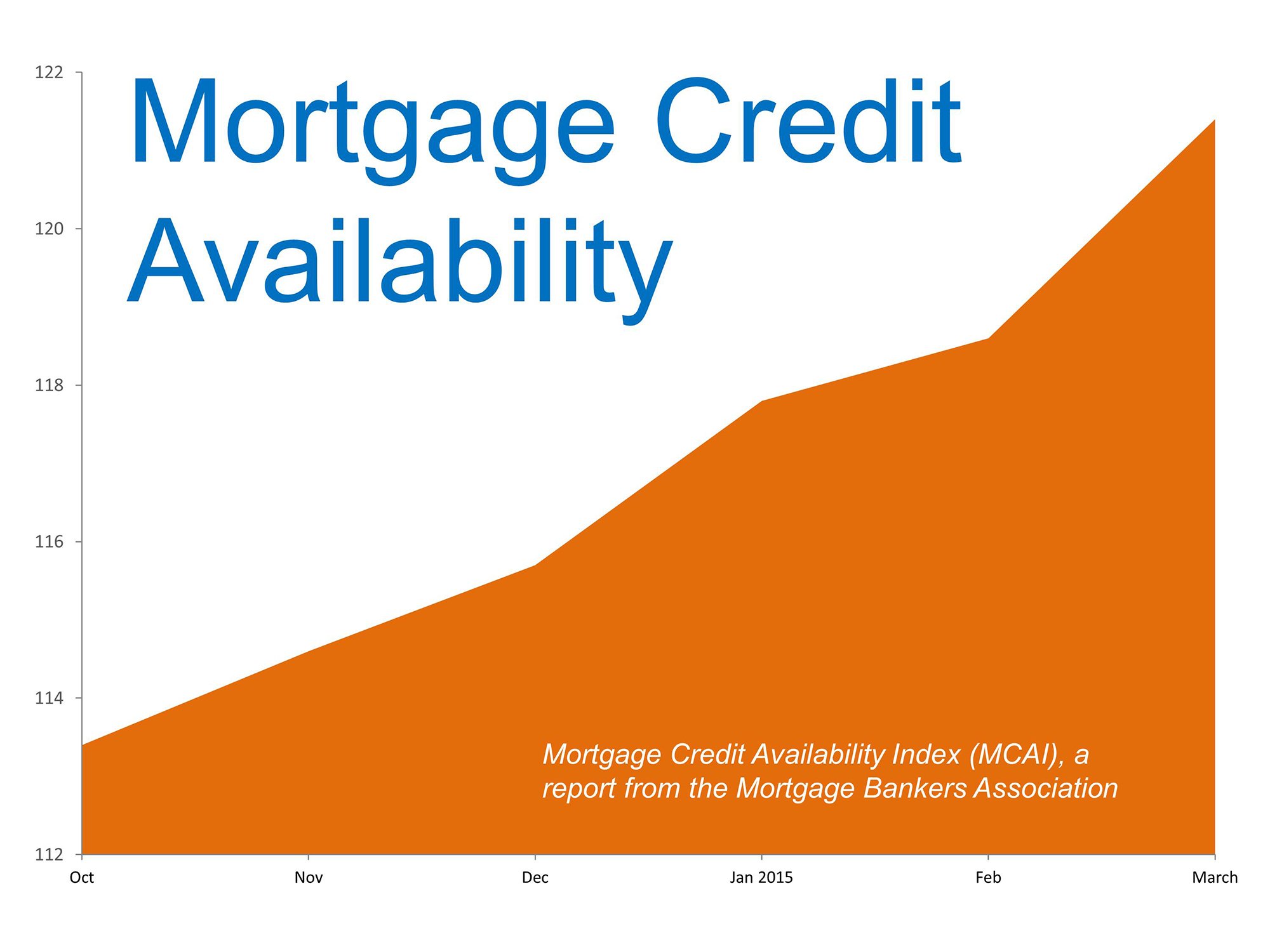

There has been a lot of discussion about how difficult it is to get a home mortgage in this market. There is no doubt that the process is not as easy as it was eight to ten years ago and that’s probably good news. However, it does appear that availability to mortgage money is increasing with each passing day.

The Mortgage Bankers’ Association publishes the

There has been a lot of discussion about how difficult it is to get a home mortgage in this market. There is no doubt that the process is not as easy as it was eight to ten years ago and that’s probably good news. However, it does appear that availability to mortgage money is increasing with each passing day.

The Mortgage Bankers’ Association publishes the

According to Nationwide’s recently unveiled, Health of Housing Market (HoHM)

According to Nationwide’s recently unveiled, Health of Housing Market (HoHM) ![The Difference A Year Can Make [INFOGRAPHIC] | Simplifying The Market](http://www.simplifyingthemarket.com/wp-content/uploads/2015/04/Calendar-Blue.jpg)

![The Difference A Year Can Make [INFOGRAPHIC] | Simplifying The Market](http://www.simplifyingthemarket.com/wp-content/uploads/2015/04/Payment-Difference-STM.jpg)

![The Difference A Year Can Make [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2015/04/Calendar-Blue.jpg)

![The Difference A Year Can Make [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2015/04/Payment-Difference-STM.jpg)

In today’s market, where demand is outpacing supply in many regions of the country, pricing a house is one of the biggest challenges real estate professionals face. Sellers often want to price their home higher than recommended, and many agents go along with the idea to keep their clients happy. However, the best agents realize that telling the homeowner the truth is more important than getting the seller to like them.

In today’s market, where demand is outpacing supply in many regions of the country, pricing a house is one of the biggest challenges real estate professionals face. Sellers often want to price their home higher than recommended, and many agents go along with the idea to keep their clients happy. However, the best agents realize that telling the homeowner the truth is more important than getting the seller to like them.

In today’s market, where demand is outpacing supply in many regions of the country, pricing a house is one of the biggest challenges real estate professionals face. Sellers often want to price their home higher than recommended, and many agents go along with the idea to keep their clients happy. However, the best agents realize that telling the homeowner the truth is more important than getting the seller to like them.

In today’s market, where demand is outpacing supply in many regions of the country, pricing a house is one of the biggest challenges real estate professionals face. Sellers often want to price their home higher than recommended, and many agents go along with the idea to keep their clients happy. However, the best agents realize that telling the homeowner the truth is more important than getting the seller to like them.