Two Great Reasons to Buy not Rent

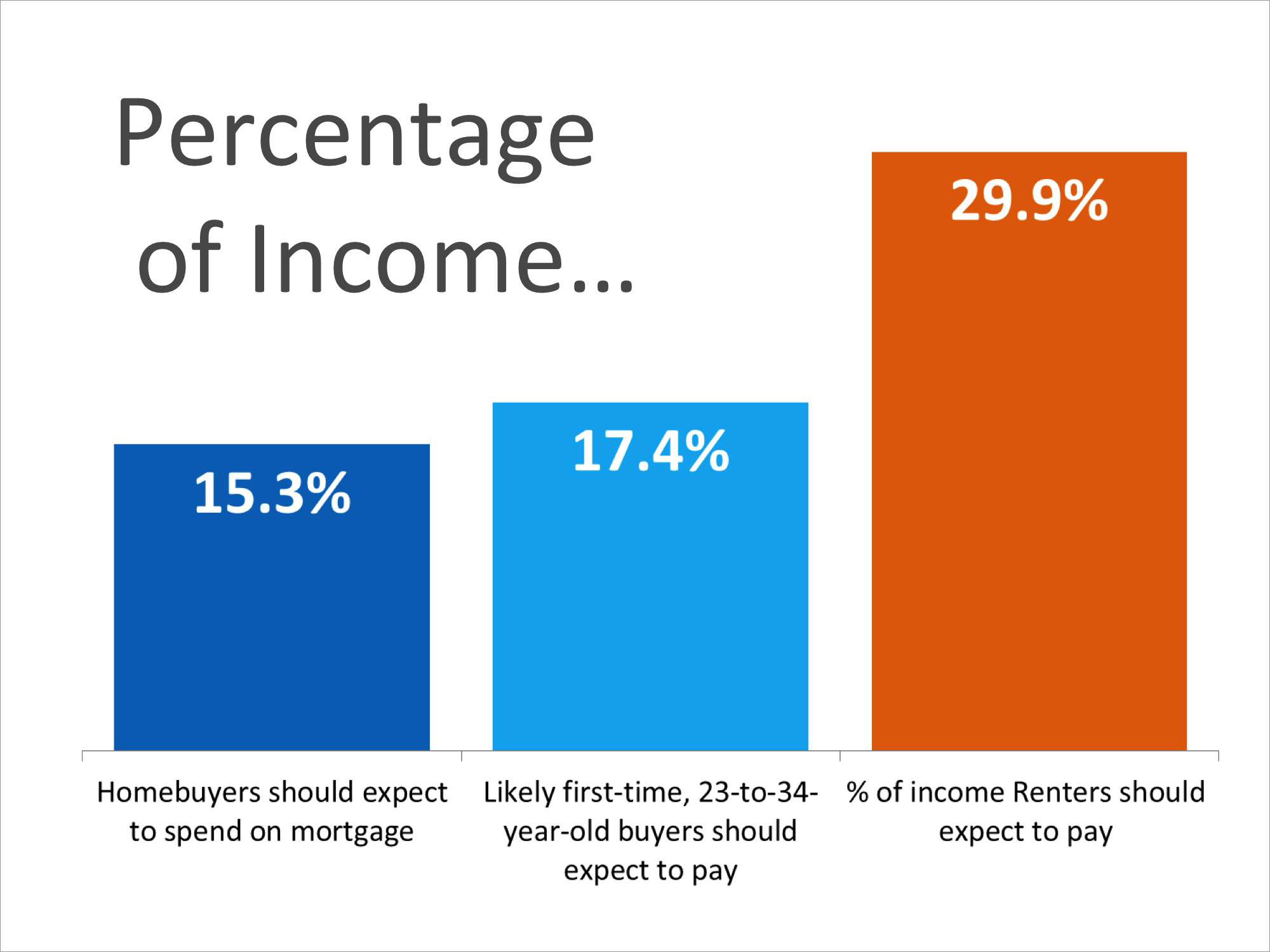

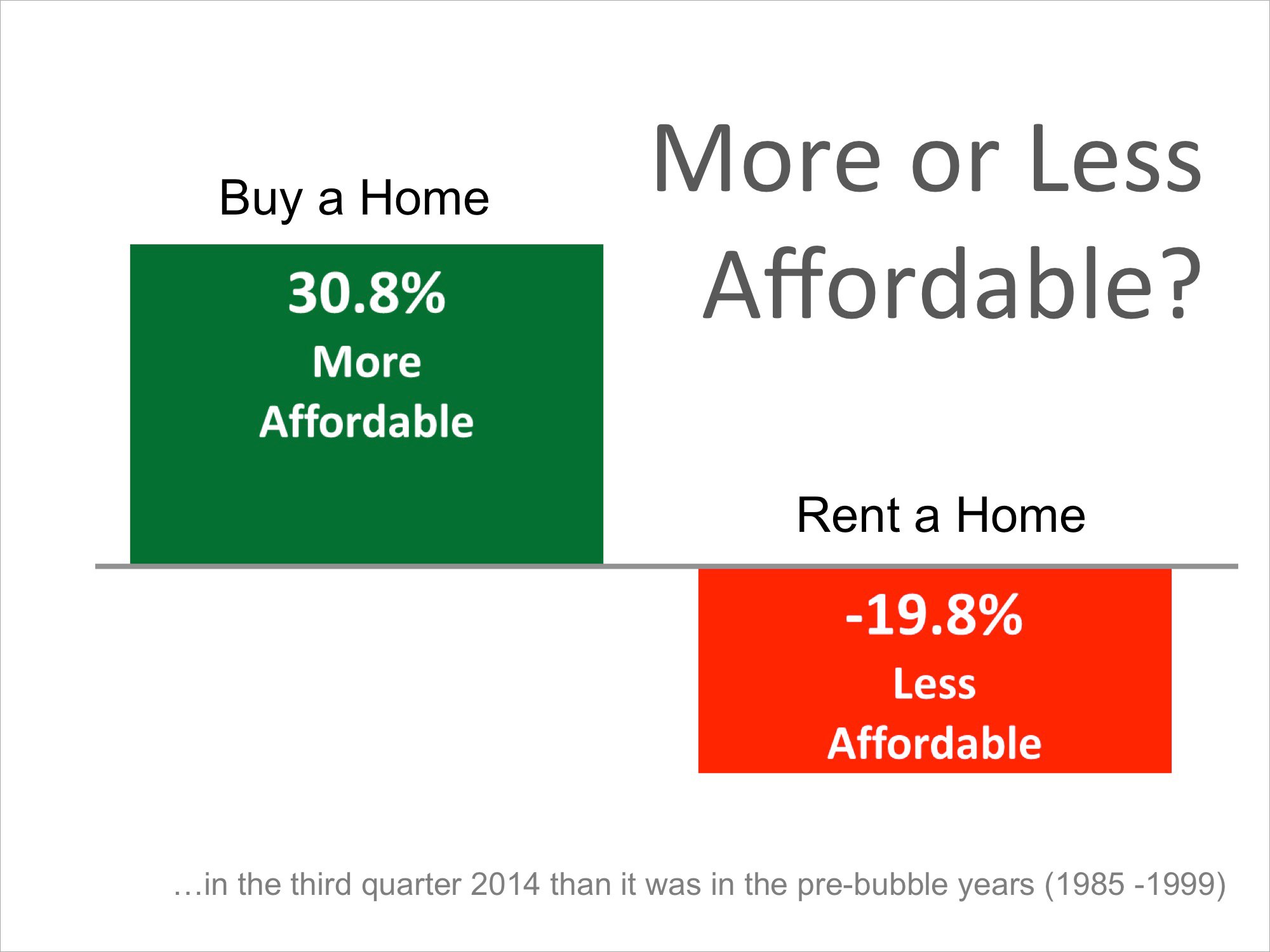

There are many young people debating whether they should renew the lease on their apartment or sign a contract to purchase their first home. Based on a recent study, here are two reasons buying a home might make more sense:

|

Members: Sign in now to set up your Personalized Posts & start sharing today!

Not a Member Yet? Click Here to learn more about KCM’s newest feature, Personalized Posts. |