Don’t Wait! Move Up To Your Dream Home Now!

Now that the housing market has stabilized, more and more homeowners are considering moving up to the home they have always dreamed of. Prices are still below those of a few years ago and interest rates have stayed near historic lows.

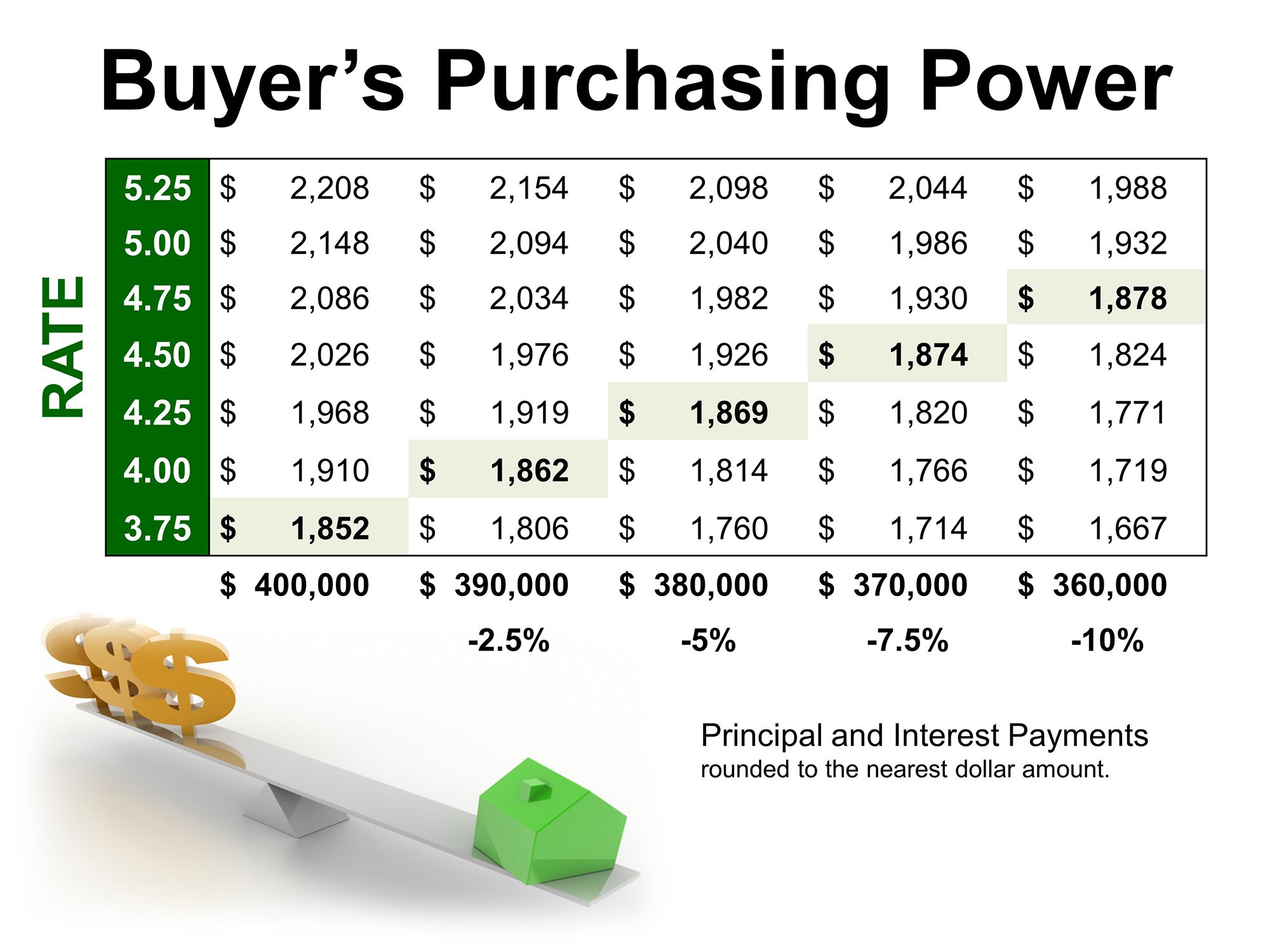

Sellers should realize that waiting to make the move when mortgage rates are projected to increase probably doesn’t make sense. As rates increase, the price of the house you can afford will decrease if you plan to stay within a certain budget for your monthly housing costs.

Here is a chart detailing this point:

According to Freddie Mac, the current 30-year fixed rate is currently around 3.75%. With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5% (in this example, by $10,000).

Freddie Mac predicts that mortgage rates will be closer to 4.7% by this time next year.

Act now to get the most house for your hard-earned money.

|

Members: Sign in now to set up your Personalized Posts & start sharing today!

Not a Member Yet? Click Here to learn more about KCM’s newest feature, Personalized Posts. |