3 Crucial Questions Most Home Buyers Don’t Know the Answer To...DO YOU?

Whether you are considering the purchase of your first home or trading up to the home your family frequently fantasizes about, there are three crucial questions you must know the answer to:

-

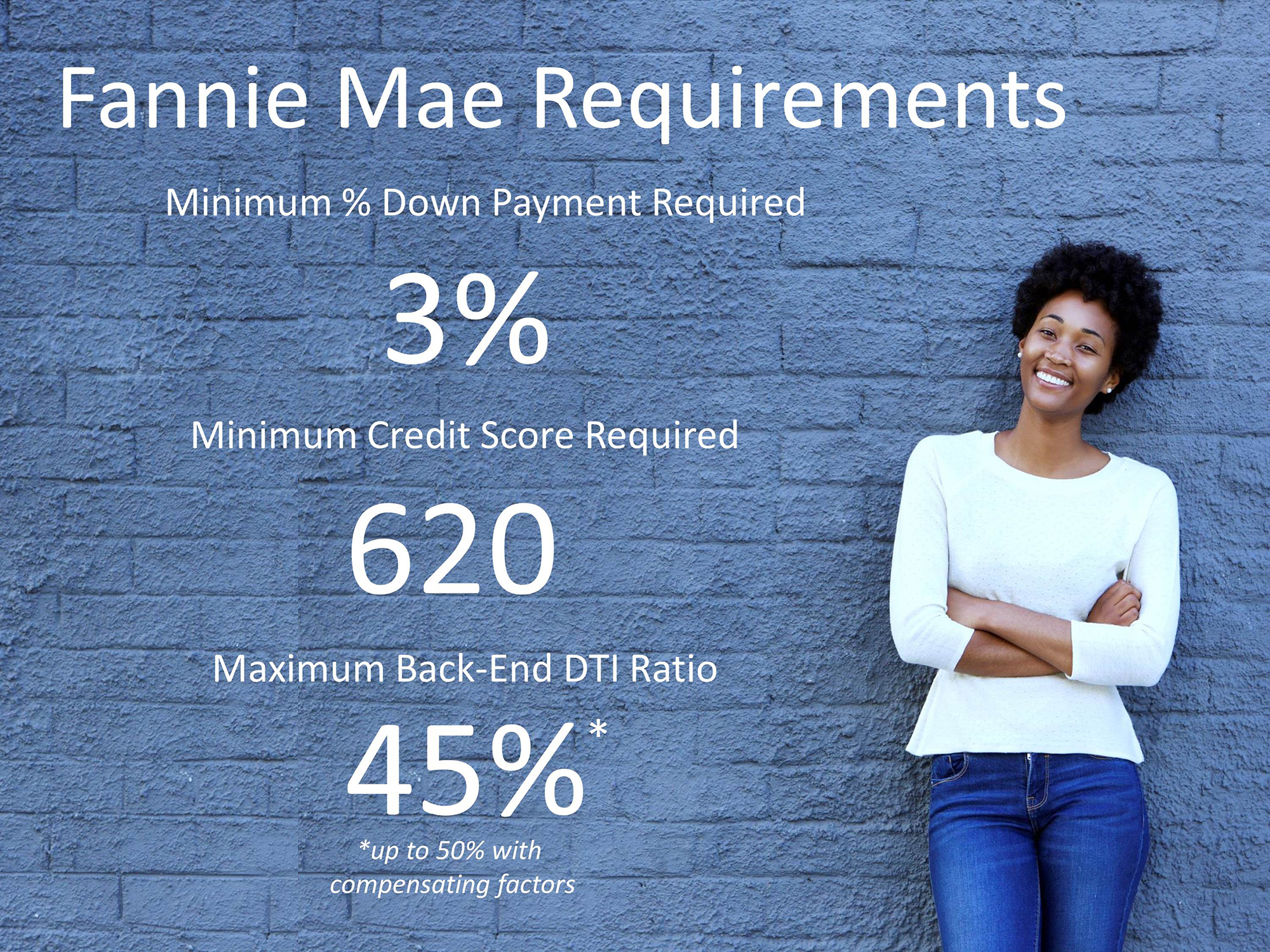

What is the minimum down payment required to purchase a home?

-

What is the minimum FICO score required to qualify for a mortgage?

-

What is the maximum Back-End DTI Ratio allowed?

A survey conducted by Fannie Mae revealed startling information: most Americans don’t know the answer to these three crucially important questions. Here is a graphic showing the results of the survey:

The percentages are quite disturbing but can explain why so many people believe they are not eligible to purchase a home whether it is a first home or a trade-up home. Here are the actually requirements as per Fannie Mae:

Bottom Line

If you are considering purchasing a home, make sure you are aware of all your options before moving forward.

|

Members: Sign in now to set up your Personalized Posts & start sharing today!

Not a Member Yet? Click Here to learn more about KCM’s newest feature, Personalized Posts. |