Mortgage Interest Rates Went Up Again… Should I Wait to Buy?

Mortgage interest rates, as reported by Freddie Mac, have increased over the last several weeks. Freddie Mac, along with Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors, is calling for mortgage rates to continue to rise over the next four quarters.

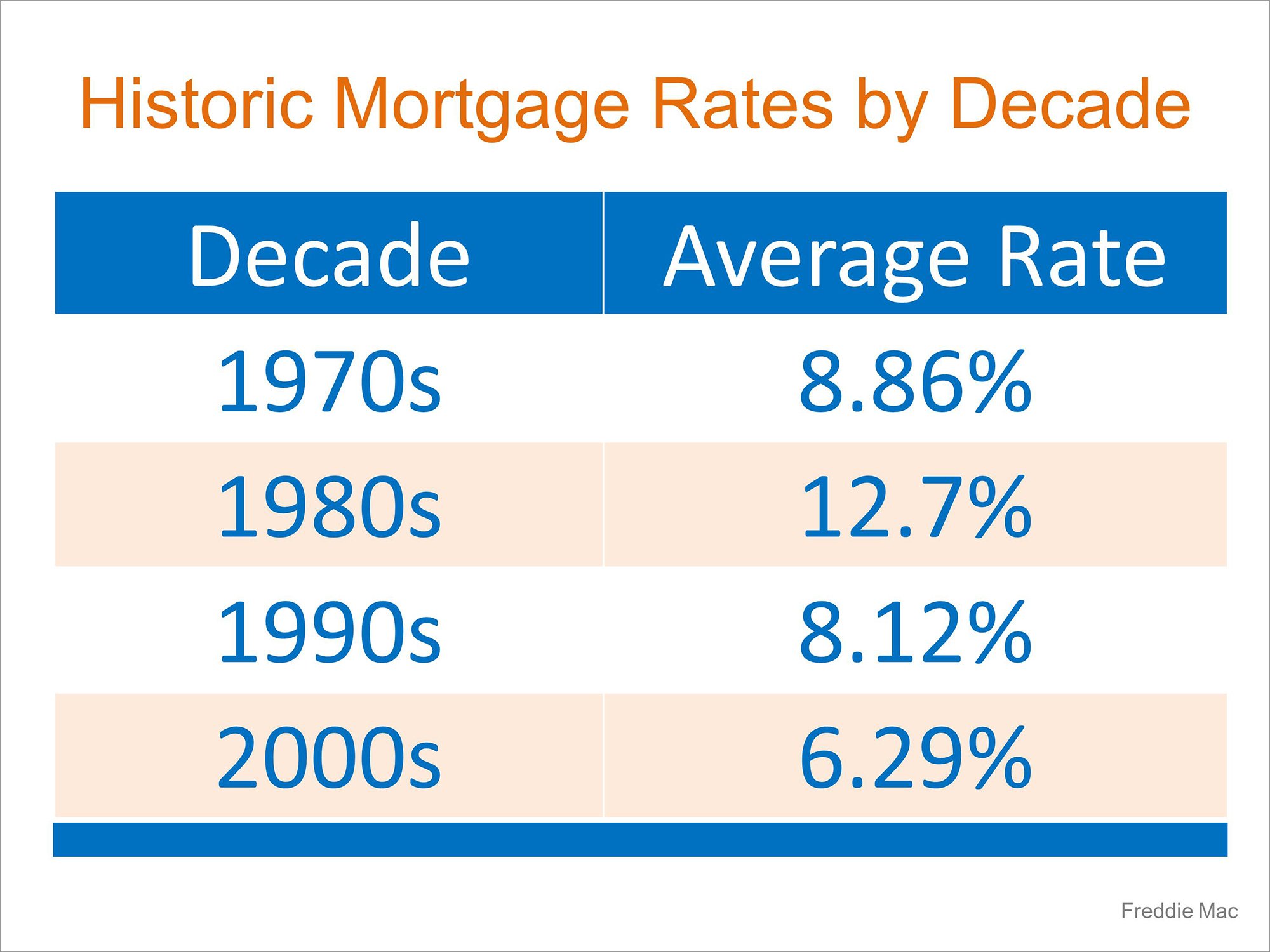

This has caused some purchasers to lament the fact they may no longer be able to get a rate below 4%. However, we must realize that current rates are still at historic lows.

Here is a chart showing the average mortgage interest rate over the last several decades.

Bottom Line

Though you may have missed getting the lowest mortgage rate ever offered, you can still get a better interest rate than your older brother or sister did ten years ago, a lower rate than your parents did twenty years ago, and a better rate than your grandparents did forty years ago.

|

Members: Sign in now to set up your Personalized Posts & start sharing today!

Not a Member Yet? Click Here to learn more about KCM’s newest feature, Personalized Posts. |