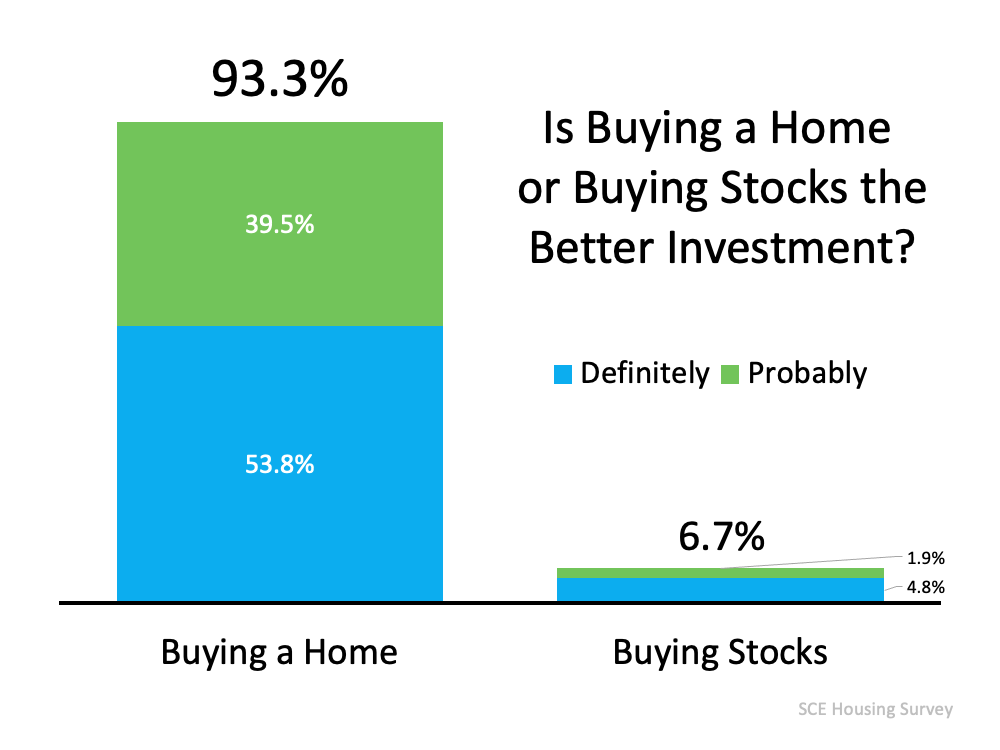

93% of Americans Believe a Home Is a Better Investment Than Stocks

A recent Survey of Consumer Finances study released by the Federal Reserve reveals the net worth of homeowners is forty times greater than that of renters. If you’re wondering if homeownership is a good investment, the study clearly answers that question, and the answer is yes.

Do Americans believe a home is a better investment than stocks?

In a post on the Liberty Street Economics blog, the Federal Reserve Bank of New York notes that 93.3% of Americans believe buying a home is definitely or probably a better investment than buying stocks.

Here’s how the results break down: The survey also shows a wide range of reasons why Americans feel that way (respondents were able to pick more than one answer):

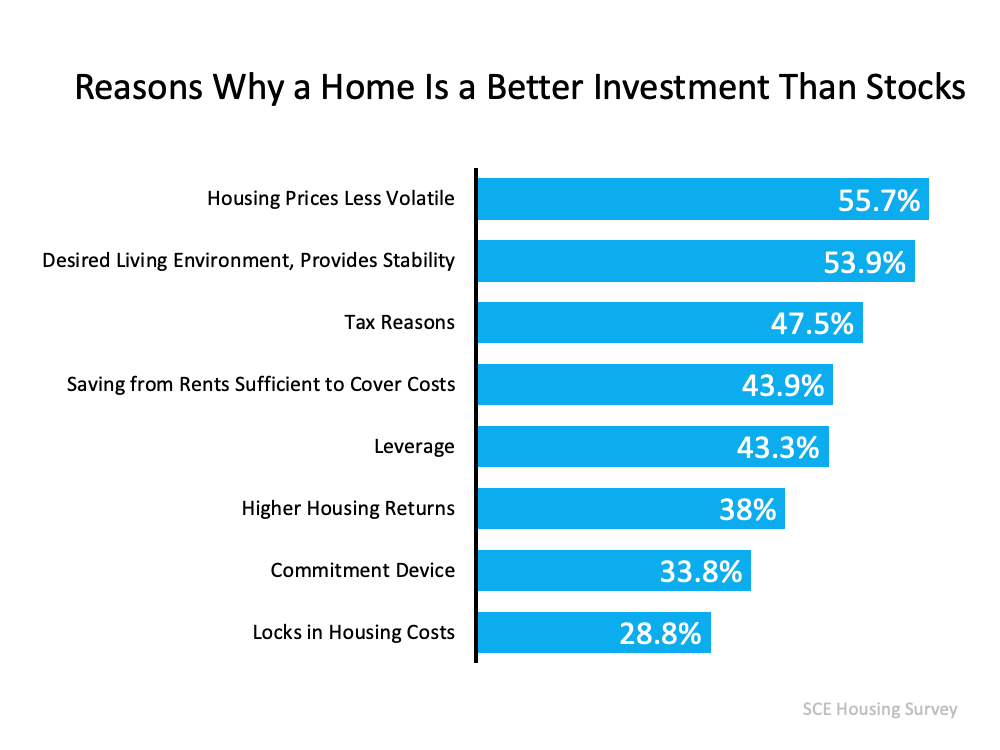

The survey also shows a wide range of reasons why Americans feel that way (respondents were able to pick more than one answer):

Bottom Line

The data show how strongly Americans believe in homeownership as an investment. That belief is warranted. The Liberty Street Economics blog put it best by saying:

“Housing represents the largest asset owned by most households and is a major means of wealth accumulation, particularly for the middle class.”

|

Members: Sign in now to set up your Personalized Posts & start sharing today!

Not a Member Yet? Click Here to learn more about KCM’s newest feature, Personalized Posts. |