(English) Buying a Home: The Cost of Waiting

(English)

Whether you are a first time buyer or a move-up buyer, you should look at the projections housing experts are making in two major areas: home prices and mortgage rates.

PRICES

Over 100 economists, real estate experts and investment & market strategists were recently surveyed. They were asked to project where home prices were headed. The average value appreciation projected over the next twelve month period was approximately 4%.

MORTGAGE INTEREST RATES

In their last Economic & Housing Market Outlook, Freddie Mac predicted that 30 year fixed mortgage rates would be 4.8% by this time next year. As of last week, the Freddie Mac rate was 4.14%.

What does this mean to you?

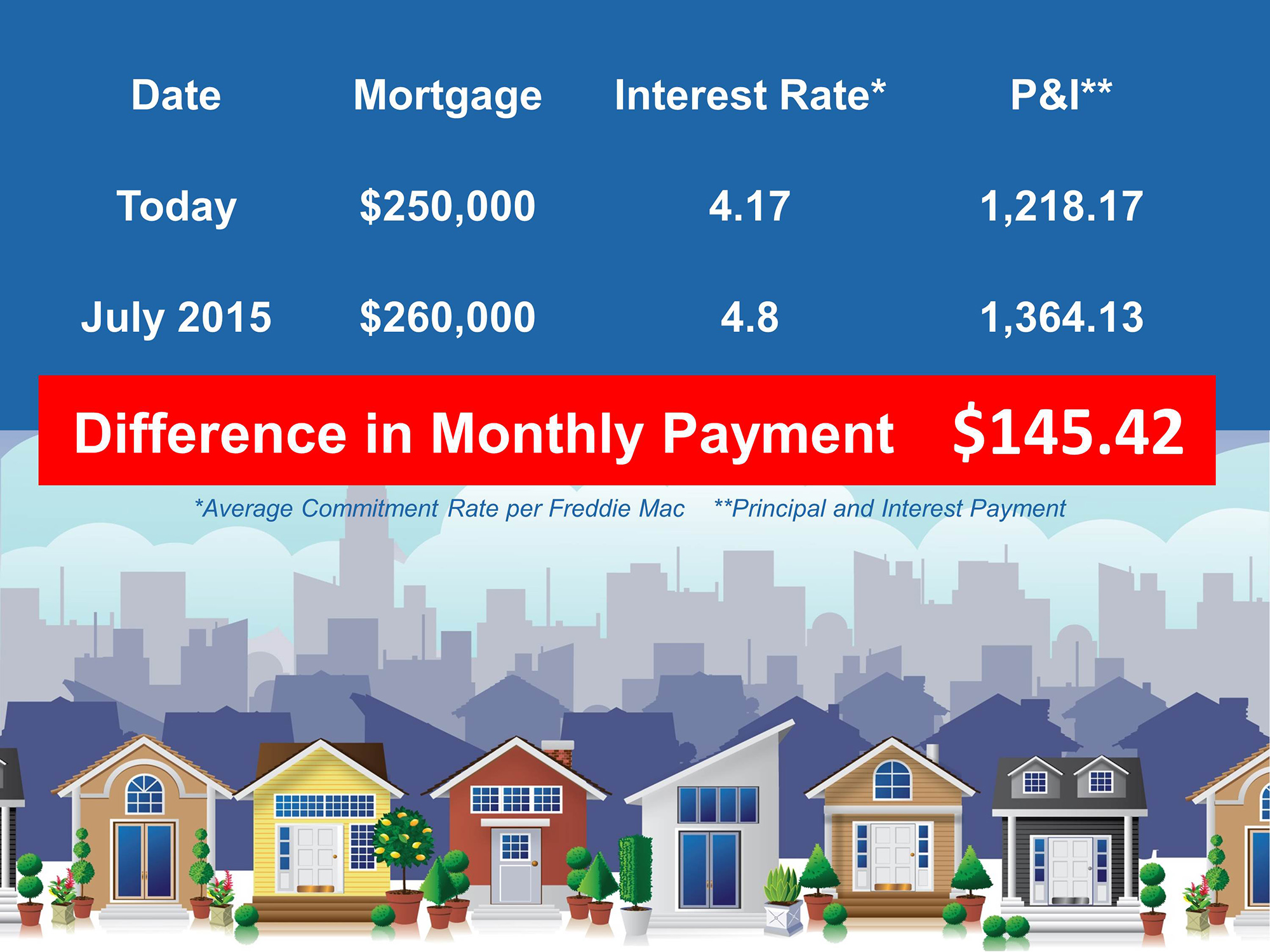

If you are a first time buyer currently looking at a home priced at $250,000, this is what it could cost you on a monthly basis if you wait to buy next year:

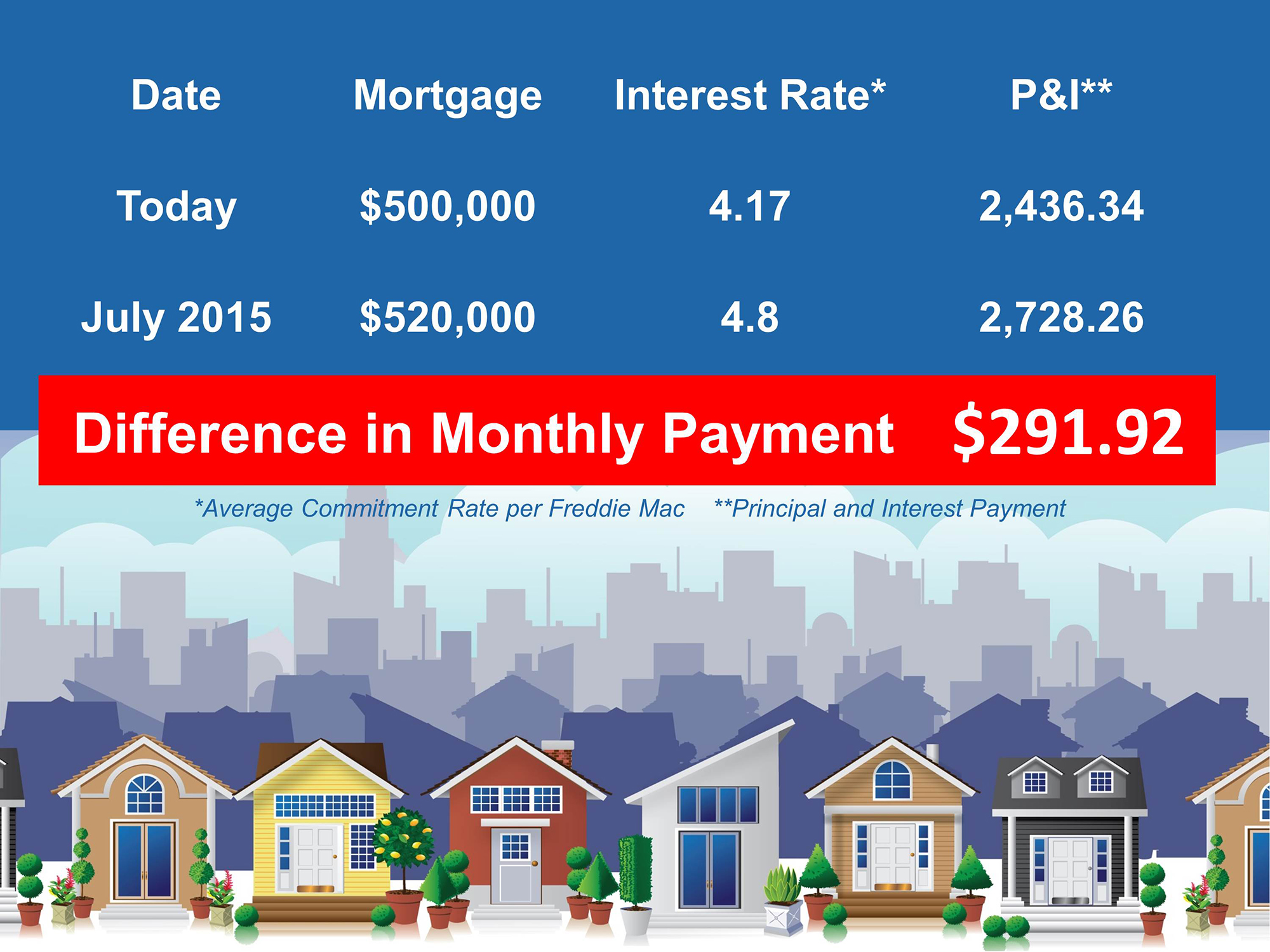

If you are a move-up buyer currently looking at a home priced at $500,000, this is what it could cost you on a monthly basis if you wait to buy next year:

Bottom Line

With both home prices and interest rates projected to increase, buying now instead of later might make sense.

| Miembros: ¡regístrese ahora y configure su Post Personalizado & empiece a compartirlo hoy!

¿No es un miembro aun? Haga un clic aquí para aprender más acerca de la nueva función de KCM, Post Personalizados. |

|