Se ensancha la brecha entre la opinión del propietario de casa & el tasador

En el mercado de la vivienda de hoy, donde el suministro está muy bajo y la demanda bien alta, el valor de las viviendas aumenta rápidamente. Uno de los desafíos principales en tal mercado es el tasador del banco.

Si los precios están aumentando, es difícil para los tasadores encontrar comparables de ventas adecuados (casas similares en el vecindario que cerraron recientemente) para defender el precio al realizar la evaluación para el banco.

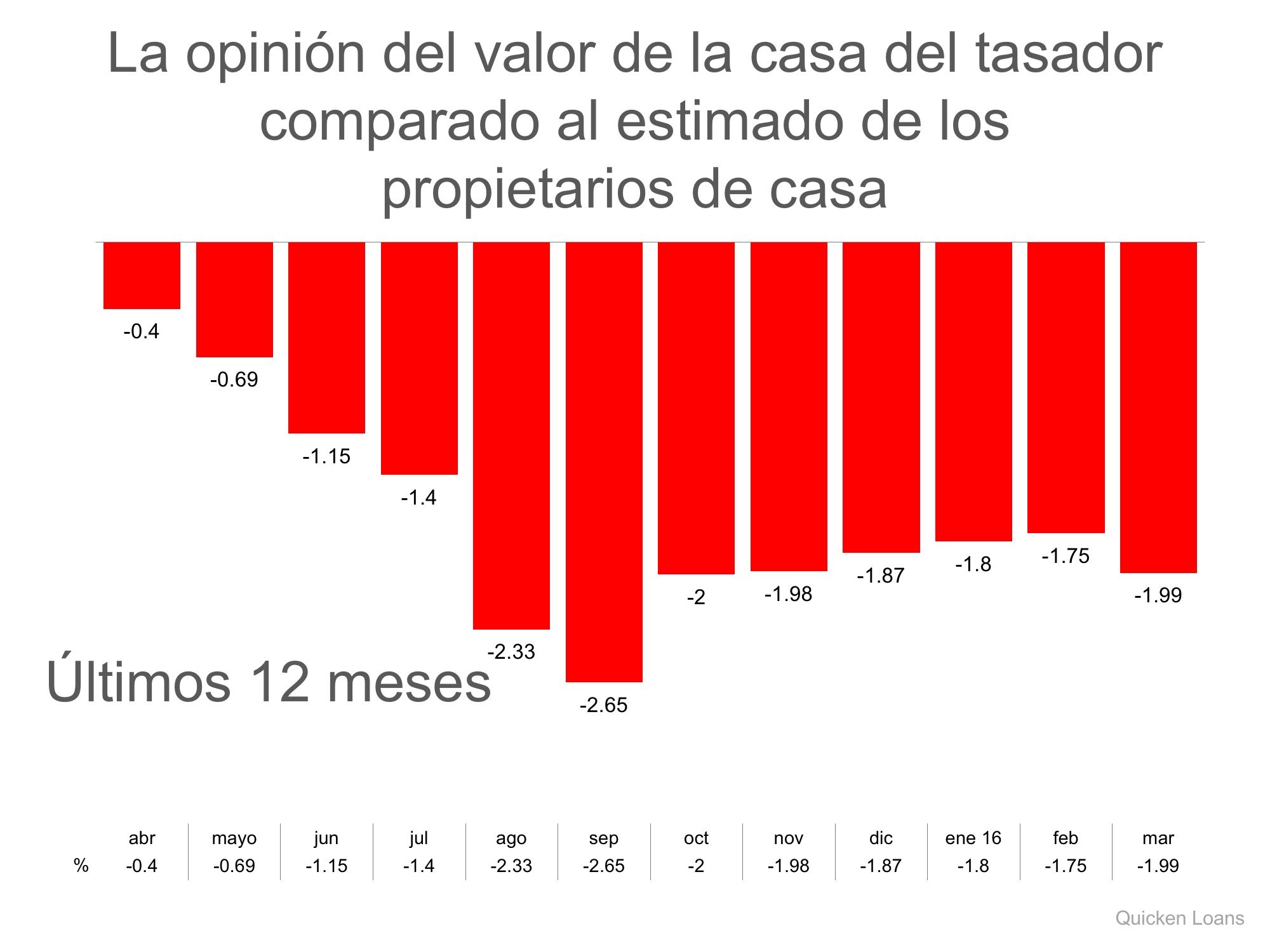

Cada mes, Quicken Loans mide la diferencia entre lo que el propietario de casa cree que vale su casa comparado con la evaluación del tasador en su índice ‘Home Price Perception Index (HPPI)’. Aquí está la tabla mostrando esa diferencia en cada uno de los últimos 12 meses.

La brecha entre el propietario de casa frente a la opinión del tasador se ha estado dirigiendo en una buena dirección (más cerca que nunca), hasta este último mes, cuando la brecha se amplió otra vez a 1.99 %.

En conclusión,

Cada casa en el mercado tiene que ser vendida dos veces; una a un posible comprador y entonces a el banco (a través del tasador del banco). Con la escalada de los precios, la segunda venta podría ser incluso más difícil que la primera. Si usted está planeando entrar al mercado de la vivienda este año, reunámonos para guiarlo a través de esto, y cualquier otro, obstáculo que pueda surgir.

| Miembros: ¡regístrese ahora y configure su Post Personalizado & empiece a compartirlo hoy!

¿No es un miembro aun? Haga un clic aquí para aprender más acerca de la nueva función de KCM, Post Personalizados. |

|