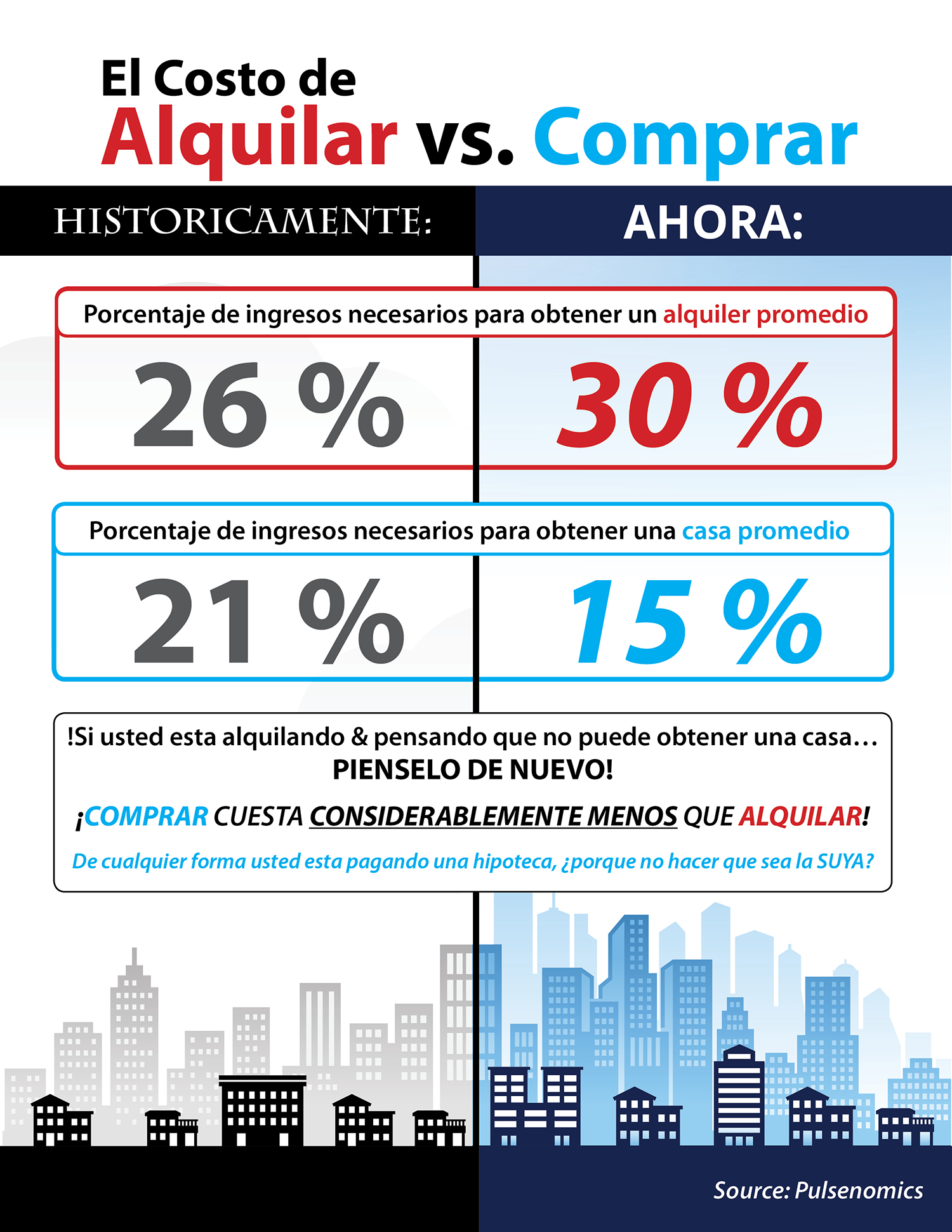

Alquilar vs. comprar: ¿Cuánto cuesta realmente? [infografía]

Algunos aspectos destacados

- El porcentaje de los ingresos necesarios para obtener una casa con precio medio es casi la mitad del porcentaje de los ingresos necesarios para obtener un alquiler promedio

- Los costos de comprar son significativamente menos que los costos de alquilar.

- El porcentaje de los ingresos necesarios para obtener una casa con precio medio son inferiores a la norma histórica.

| Miembros: ¡regístrese ahora y configure su Post Personalizado & empiece a compartirlo hoy!

¿No es un miembro aun? Haga un clic aquí para aprender más acerca de la nueva función de KCM, Post Personalizados. |

|