stdClass Object

(

[agents_bottom_line] => Even though the media may make things sound doom and gloom, the data shows home prices aren’t falling anymore. So, don’t let the headlines scare you or delay your plans. Let's connect so you have a trusted resource to cut through the noise and tell you what’s really happening in our area.

[assets] => Array

(

)

[banner_image] => https://files.keepingcurrentmatters.com/content/images/20231030/STM-Banner-Winter-2020-Buyer-Guide-13-1-.jpg

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => For Sellers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los vendedores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 9

[name] => Home Prices

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => home-prices

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Precios

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

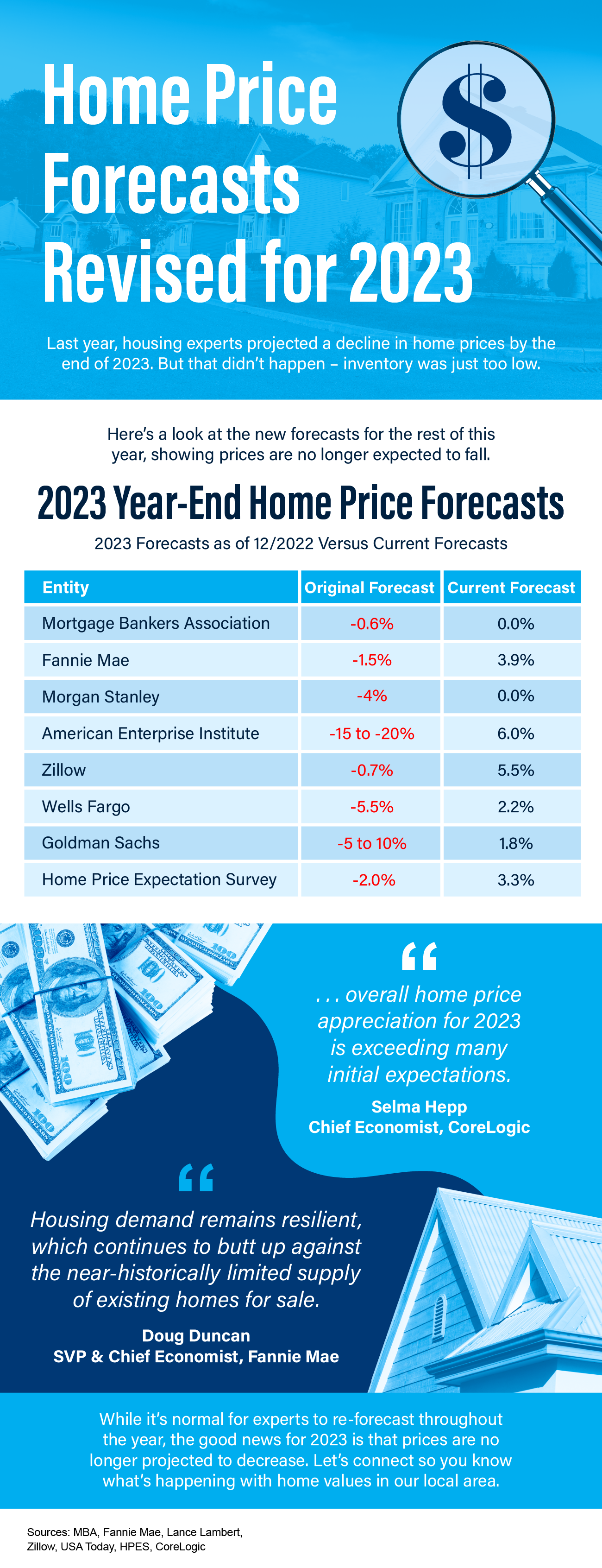

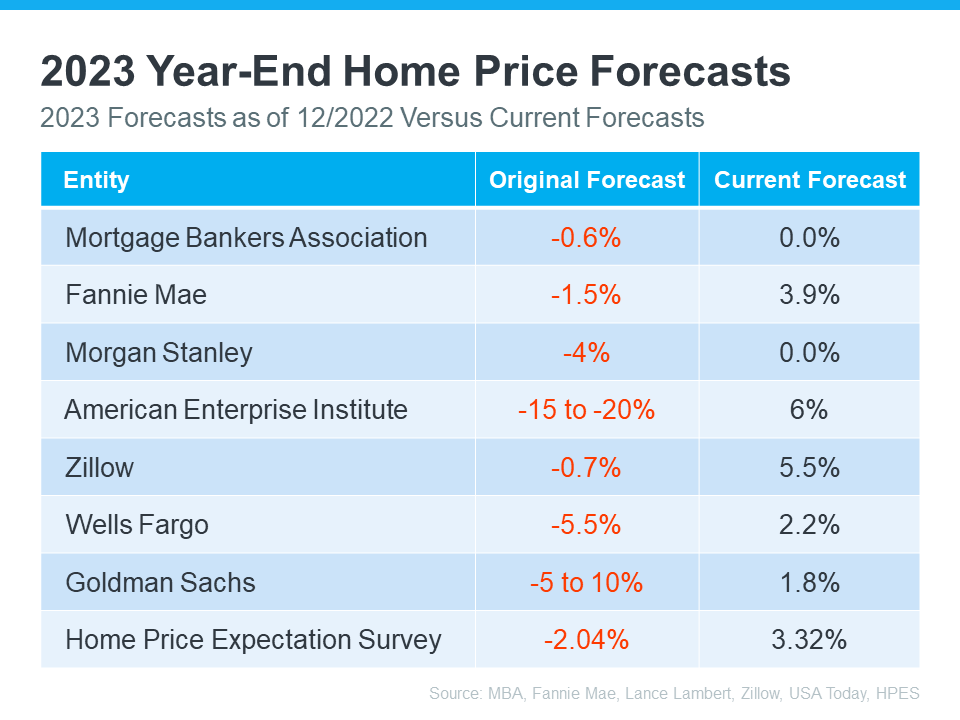

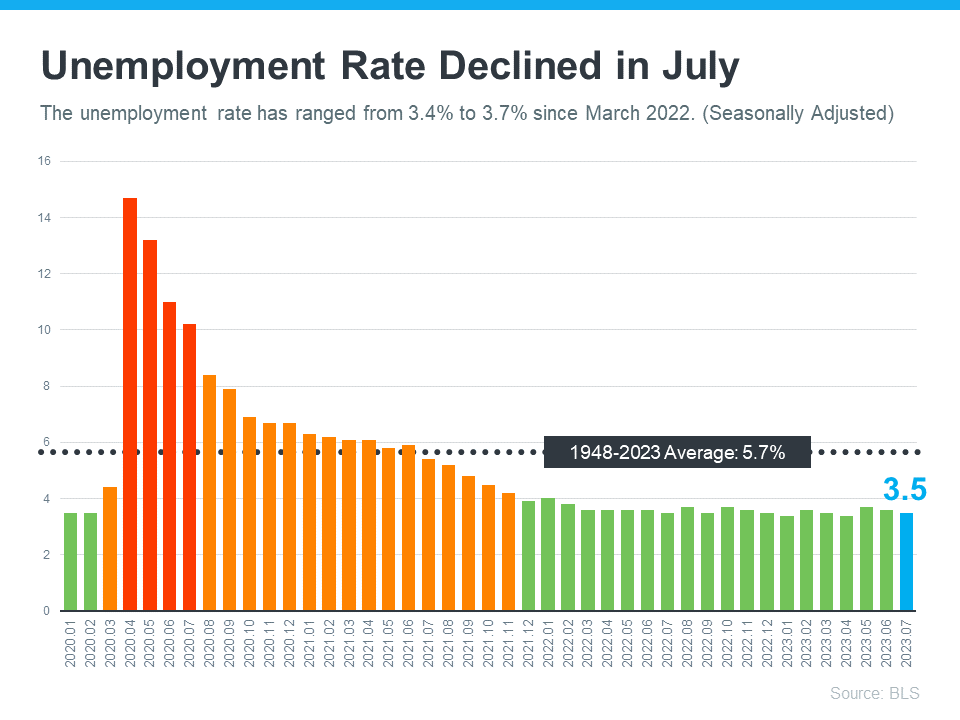

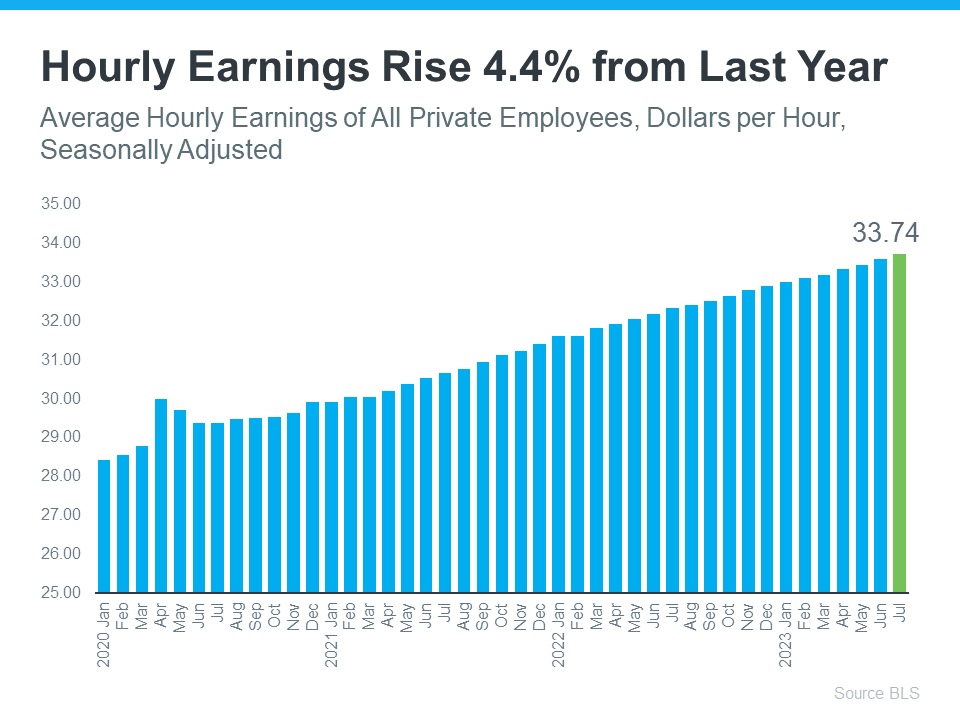

[contents] => During the fourth quarter of last year, some housing experts projected home prices were going to crash in 2023. The media ran with those forecasts and put out headlines calling for doom and gloom in the housing market. All of this negative news coverage made a lot of people have doubts about the strength of the residential real estate market.

If it made you question if you should delay your own plans to move, here’s what you really need to know.

Home Prices Never Crashed

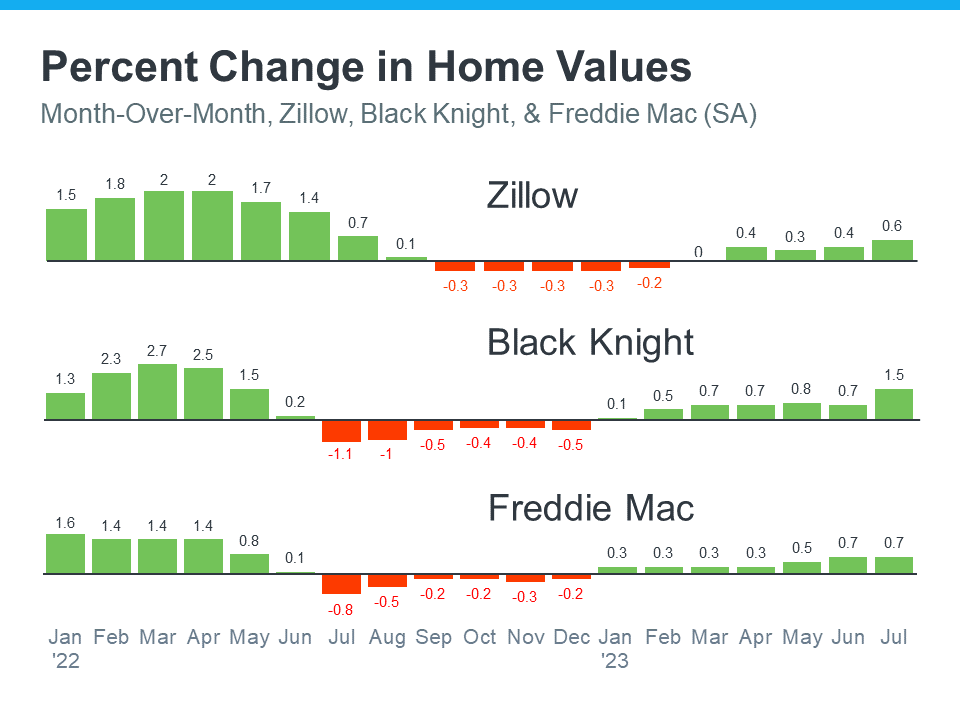

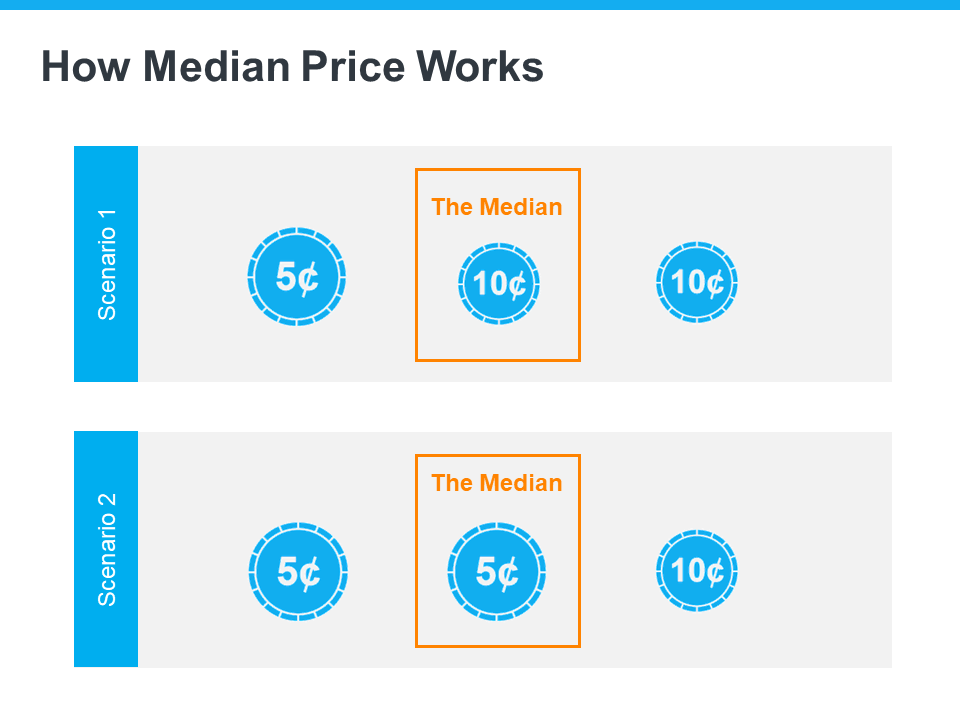

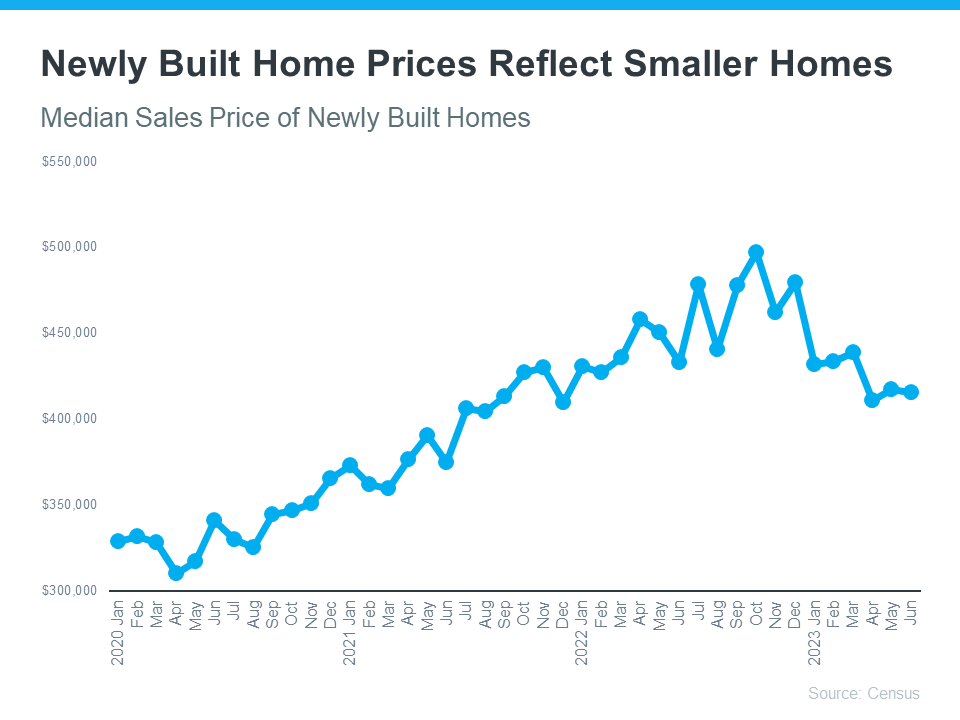

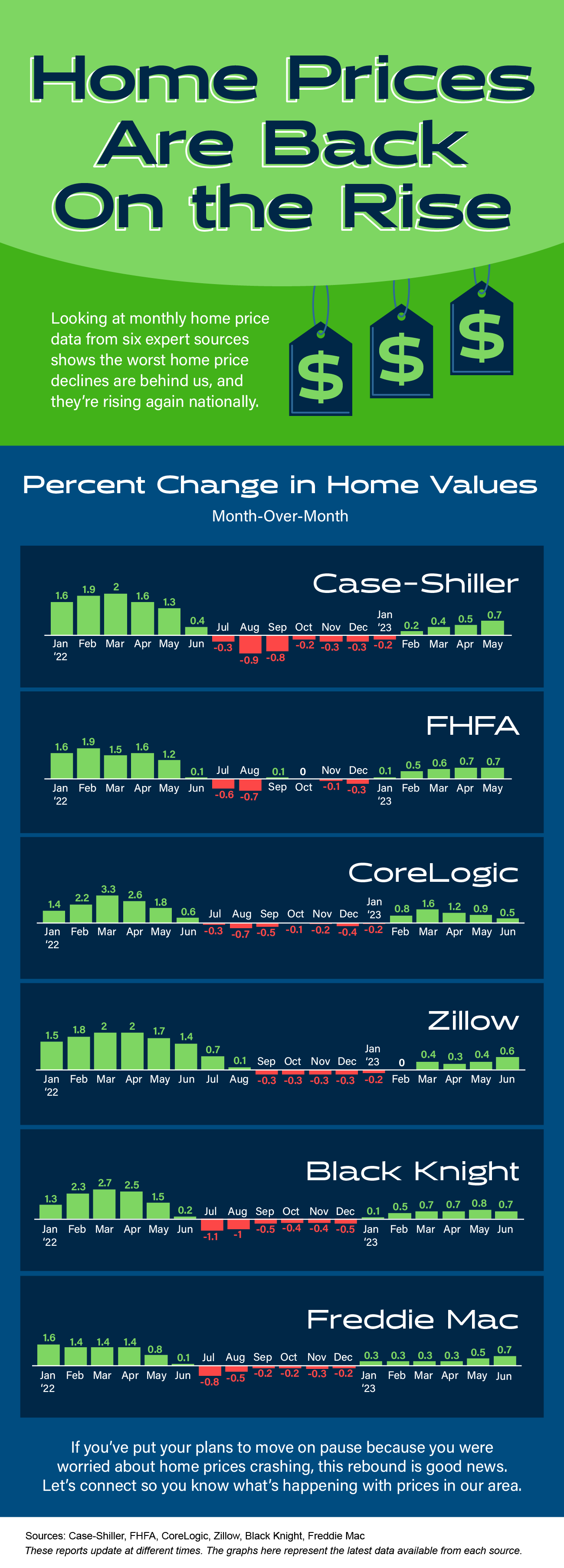

Disregard what you saw in the headlines. The actual data shows home prices were remarkably resilient and performed far better than the media would have you believe (see graph below):

This graph uses reports from three trusted sources to clearly illustrate prices have already rebounded after experiencing only slight declines nationally. That’s a far cry from the crash so many articles called for.

The declines that did happen (shown in red), weren’t drastic but were short-lived. As Nicole Friedman, a reporter at the Wall Street Journal (WSJ), says:

“Home prices aren’t falling anymore. . . The surprisingly quick recovery suggests that the residential real-estate downturn is turning out to be shorter and shallower than many housing economists expected . . .”

Even though some media coverage made a big deal about home prices pulling back, the slight correction that happened is already in the rearview mirror. Basically, this data shows you home prices aren’t falling anymore – they’re actually going back up.

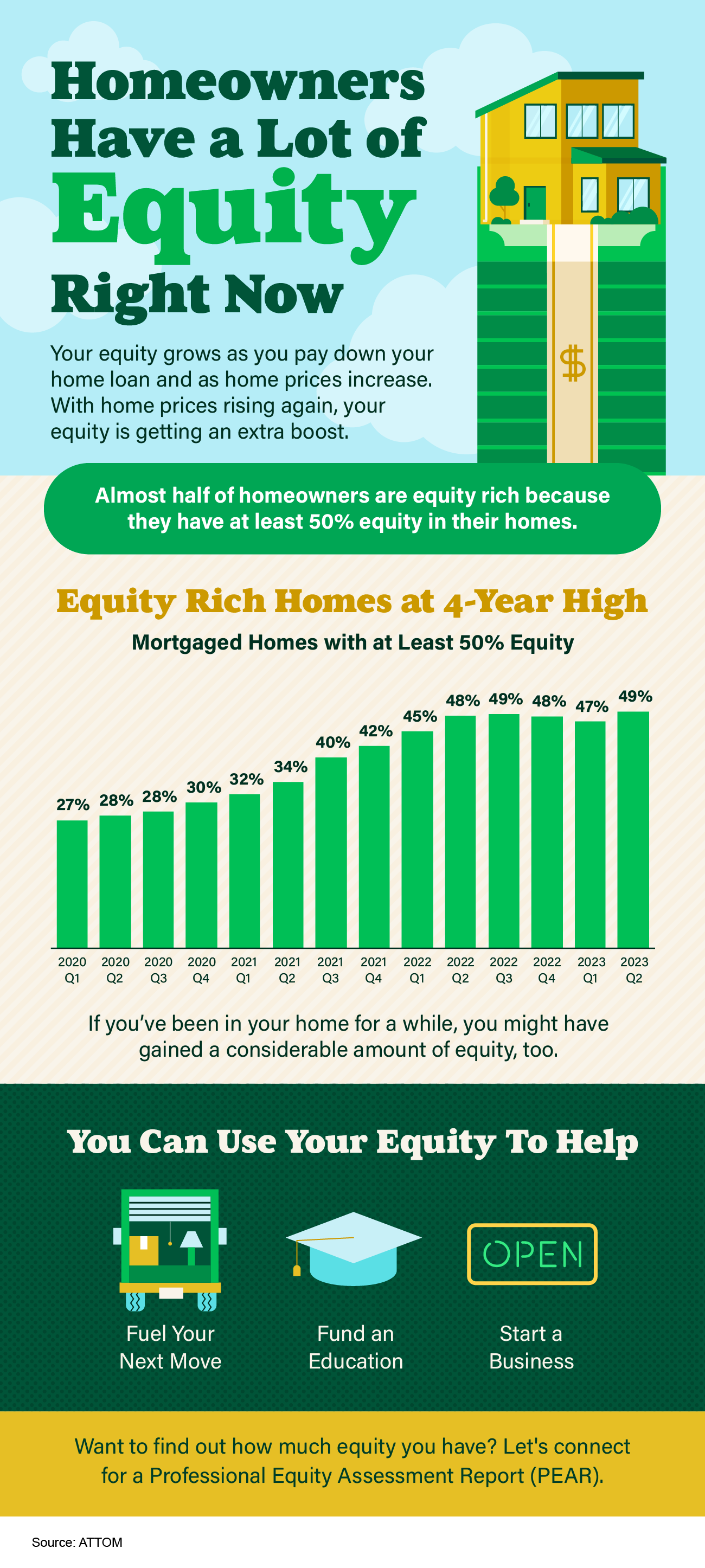

What’s Next for Home Prices?

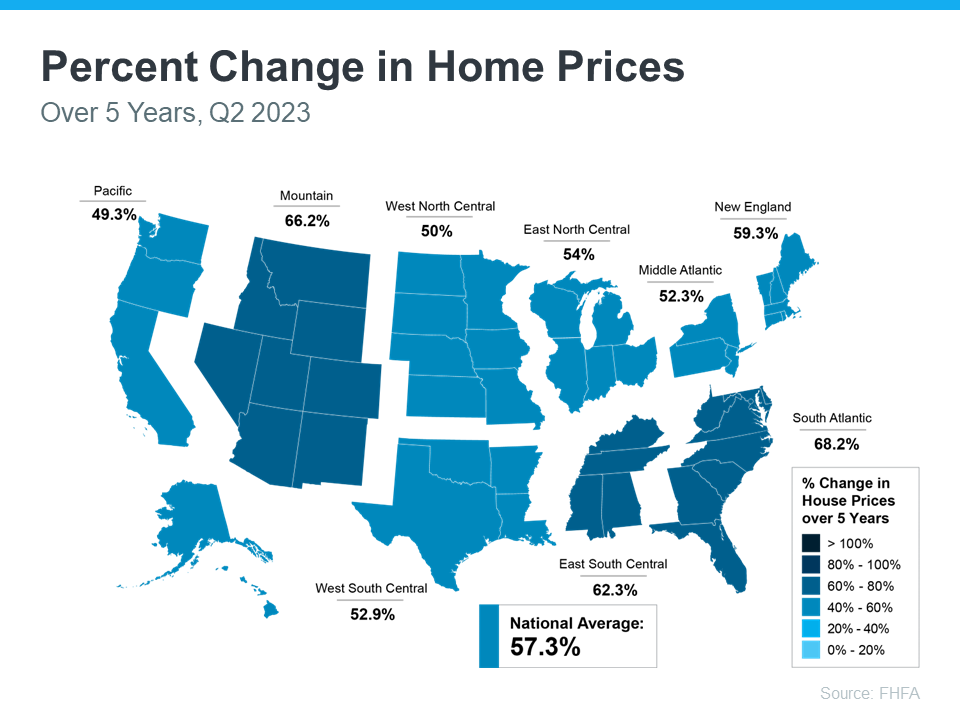

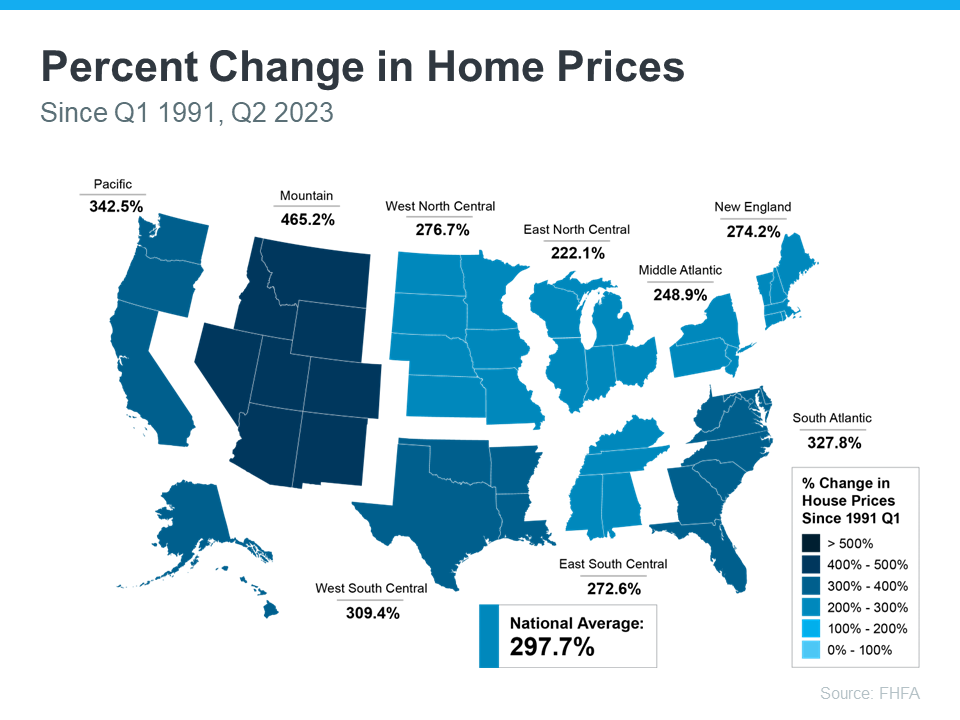

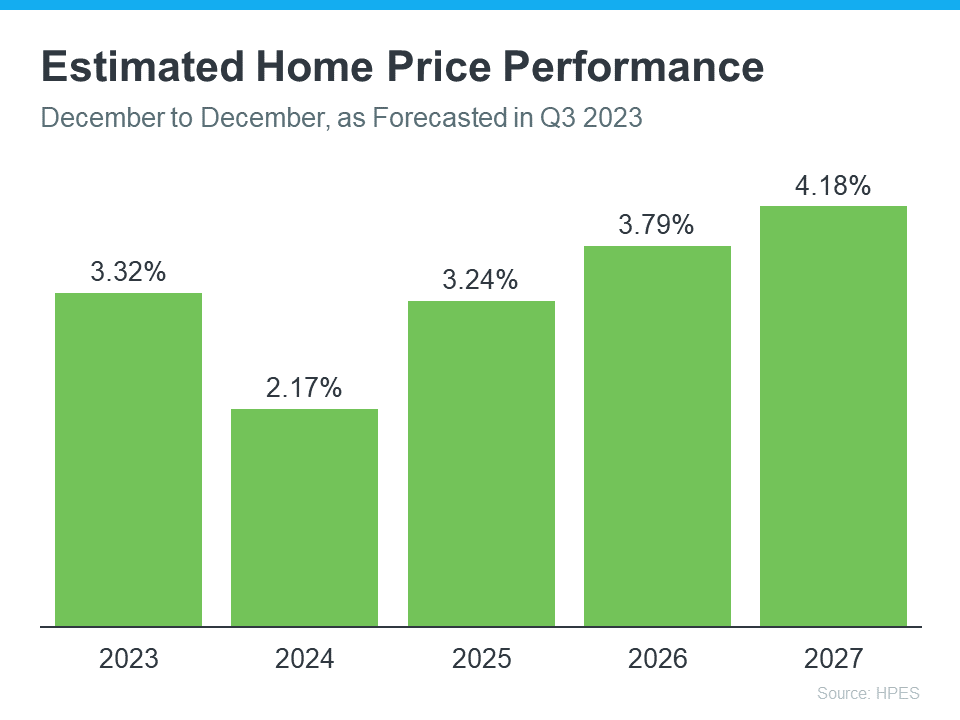

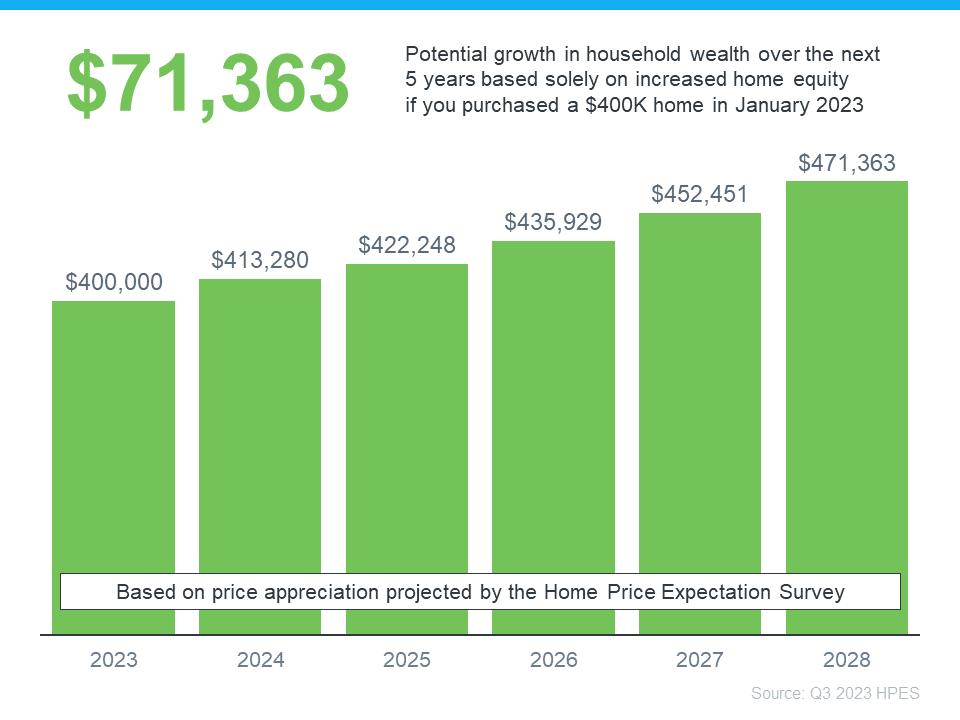

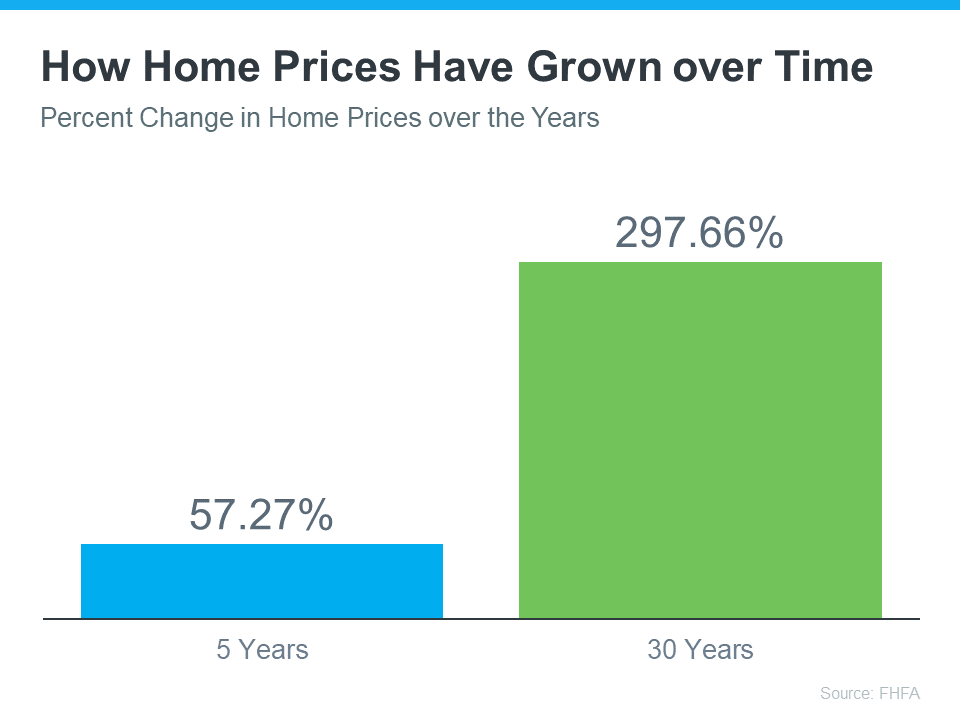

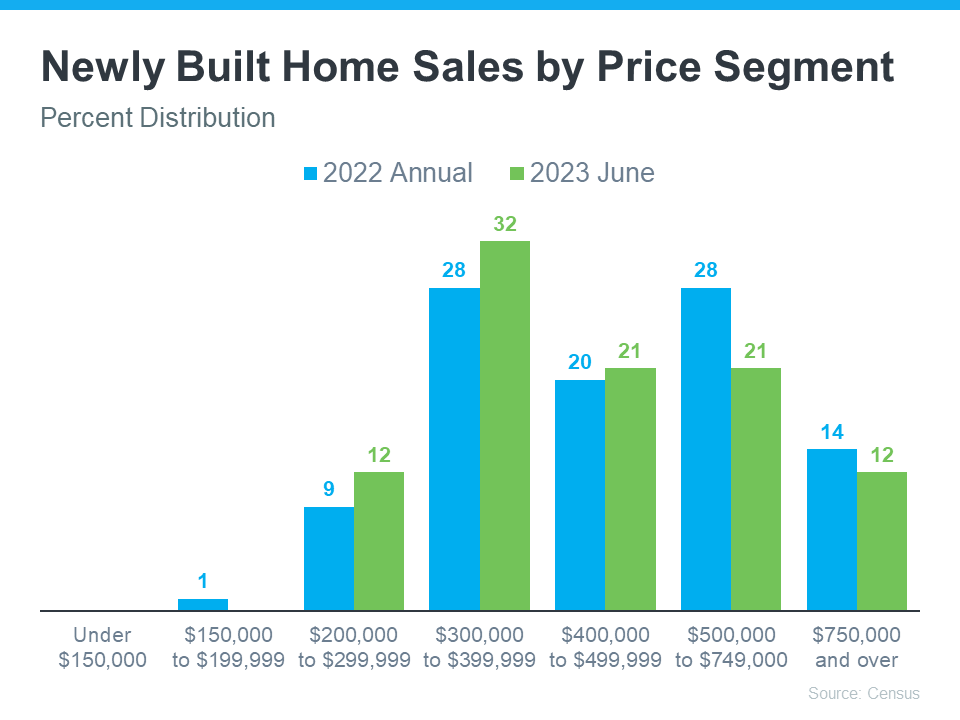

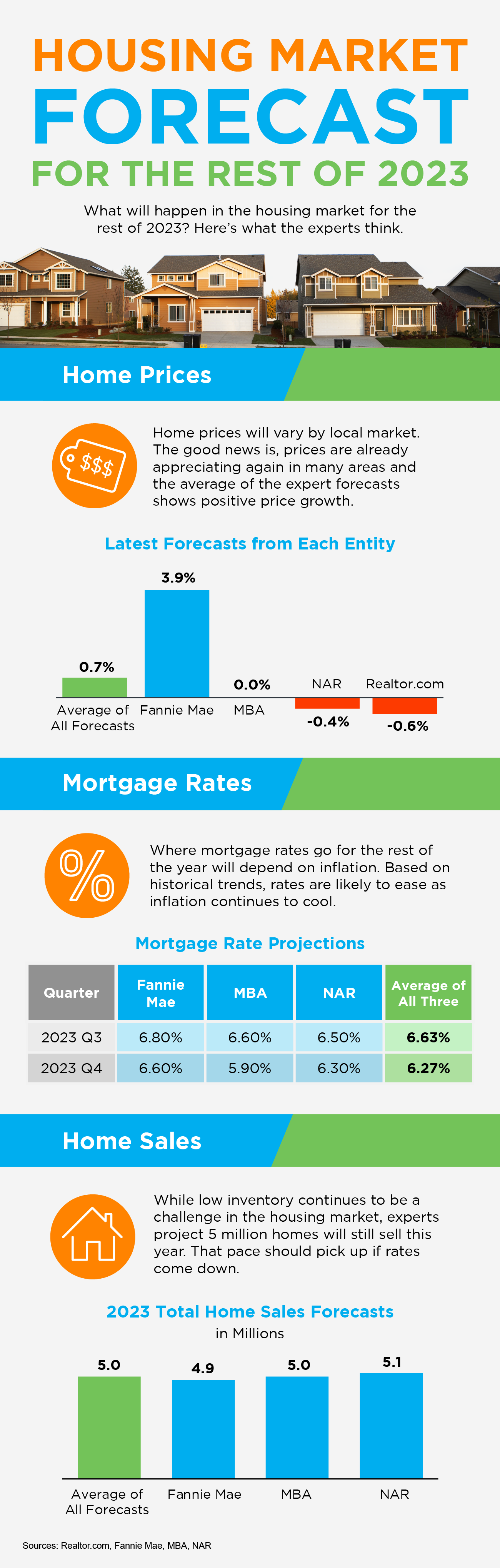

The consensus from experts is that home price growth will continue in the years ahead and is returning to normal levels for the market. That means we’ll still see home prices appreciating, just at a slower pace than the last few years – and that’s a good thing.

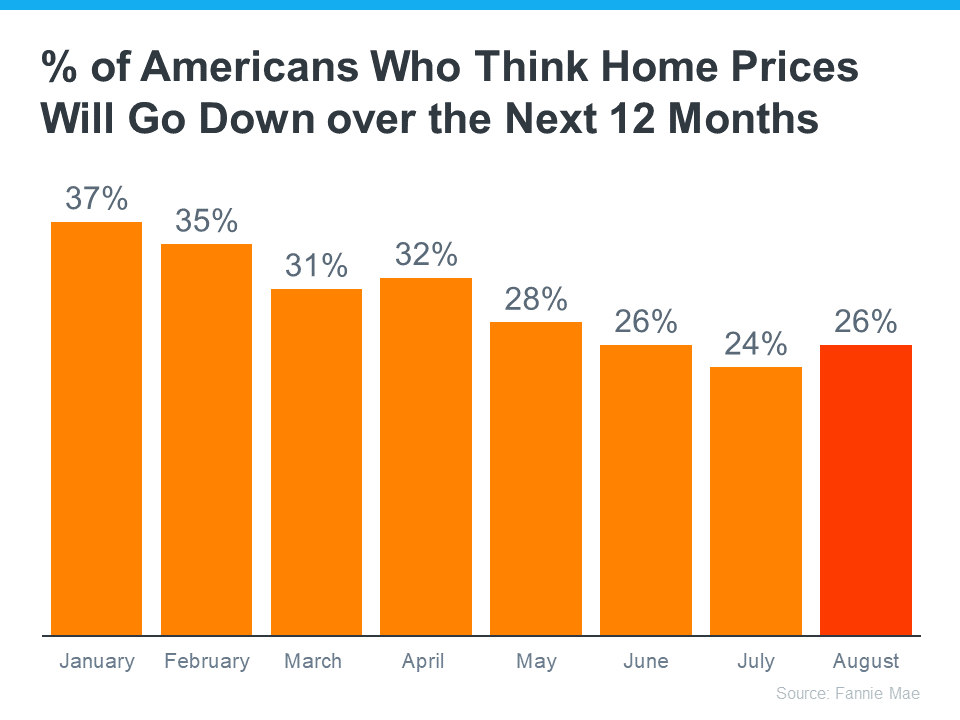

Some news sources will see home price growth slowing and put out stories that make you think prices are falling again. The return of misleading headlines like those is already having an impact on how homebuyers are feeling again. You can see how this affects general opinion in the Consumer Confidence Survey from Fannie Mae (see graph below):

While the percentage of Americans who think prices will fall has been slowly declining this year, the latest Consumer Confidence data indicates that’s ticked back up recently (shown in red). This change is surprising especially since the home price data shows prices are going up, not down. It tells you the impact the media still has on public opinion.

Don’t fall for the negative headlines and become part of this statistic. Remember, data from a number of sources shows home prices aren’t falling anymore.

[created_at] => 2023-09-29T14:21:52Z

[description] => During the fourth quarter of last year, some housing experts projected home prices were going to crash in 2023.

[expired_at] =>

[featured_image] => https://files.keepingcurrentmatters.com/content/images/20230929/20231003-Home-Prices-Are-Not-Falling.png

[id] => 15570

[kcm_ig_caption] => During the fourth quarter of last year, some housing experts projected home prices were going to crash in 2023. The media ran with those forecasts and put out headlines calling for doom and gloom in the housing market. All of this negative news coverage made a lot of people have doubts about the strength of the residential real estate market.

If it made you question if you should delay your own plans to move, here’s what you really need to know.

Home Prices Never Crashed

Disregard what you saw in the headlines. The actual data shows home prices were remarkably resilient and performed far better than the media would have you believe.

As Nicole Friedman, a reporter at the Wall Street Journal (WSJ), says: “Home prices aren’t falling anymore. . . The surprisingly quick recovery suggests that the residential real-estate downturn is turning out to be shorter and shallower than many housing economists expected . . .”

What’s Next for Home Prices?

The consensus from experts is that home price growth will continue in the years ahead and is returning to normal levels for the market. That means we’ll still see home prices appreciating, just at a slower pace than the last few years – and that’s a good thing.

Don’t fall for the negative headlines. Remember, data from a number of sources shows home prices aren’t falling anymore.

Even though the media may make things sound doom and gloom, the data shows home prices aren’t falling anymore. So, don’t let the headlines scare you or delay your plans. DM me so you have a trusted resource to cut through the noise and tell you what’s really happening in our area.

[kcm_ig_hashtags] => expertanswers,stayinformed,staycurrent,powerfuldecisions,confidentdecisions,realestate,homevalues,homeownership,homebuying,realestategoals,realestatetips,realestatelife,realestatenews,realestateagent,realestateexpert,realestateagency,realestateadvice,realestateblog,realestatemarket,realestateexperts,instarealestate,instarealtor,realestatetipsoftheday,realestatetipsandadvice,keepingcurrentmatters

[kcm_ig_quote] => Home prices are not falling.

[public_bottom_line] => Even though the media may make things sound doom and gloom, the data shows home prices aren’t falling anymore. So, don’t let the headlines scare you or delay your plans. Lean on a real estate professional so you have a trusted resource to cut through the noise and tell you what’s really happening in your area.

[published_at] => 2023-10-03T10:30:00Z

[related] => Array

(

)

[slug] => home-prices-are-not-falling

[status] => published

[tags] => Array

(

[0] => content-hub

)

[title] => Home Prices Are Not Falling

[updated_at] => 2023-11-29T16:05:37Z

[url] => /2023/10/03/home-prices-are-not-falling/

)

Home Prices Are Not Falling

During the fourth quarter of last year, some housing experts projected home prices were going to crash in 2023.