Don't Be Fooled... Homeownership Is A Great Investment! [INFOGRAPHIC]

![Don't Be Fooled... Homeownership Is A Great Investment! [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2016/03/Dont-Be-Fooled-STM.jpg)

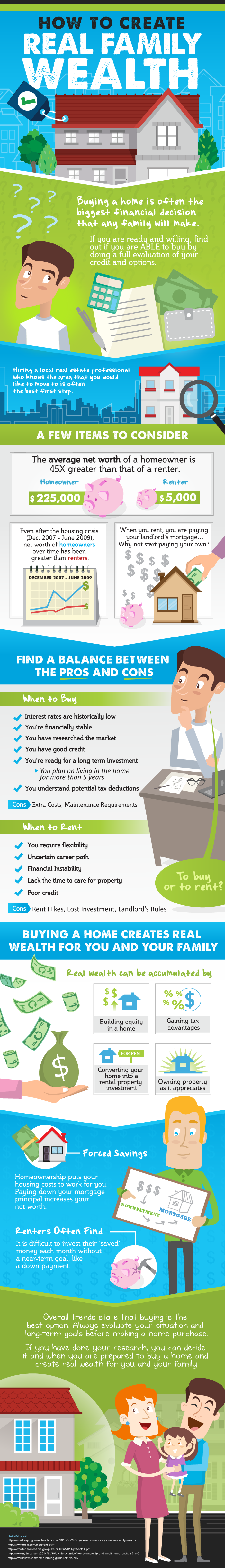

Some Highlights:

- Harvard University's Joint Center of Housing Studies recently released the top financial & emotional reasons to own a home.

- Owning is a good way to build up wealth that can be passed along to your family as it is usually a form of "forced savings."

- Whether you rent or own, you are paying a mortgage. Yours when you own, your landlord's when you rent.

![The Mortgage Process: What You Need To Know [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2016/03/Mortgage-Process-STM.jpg)