Where Are Mortgage Rates Headed?

The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate the greater the payment will be. That is why it is important to look at where rates are headed when deciding to buy now or wait until next year.

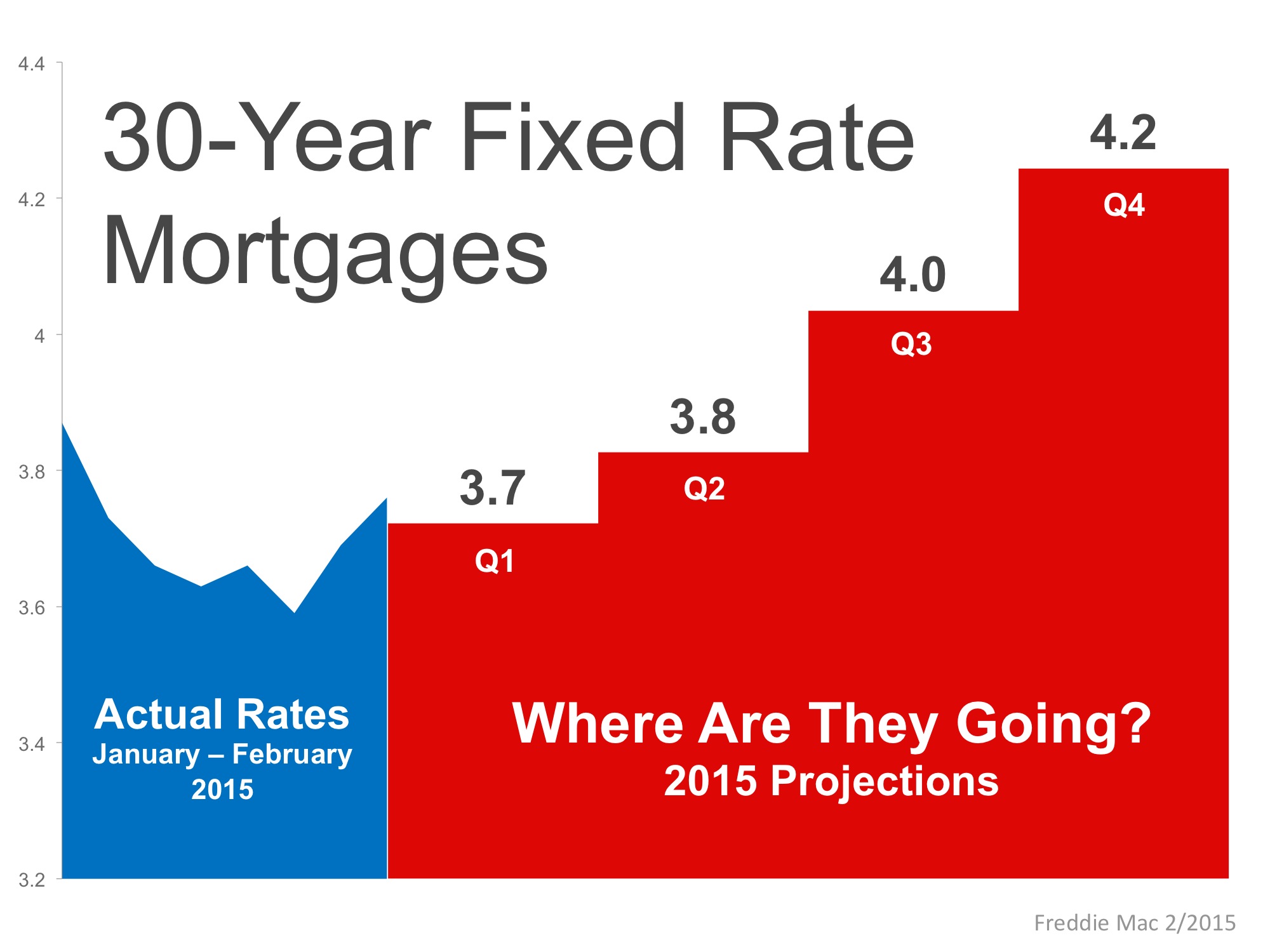

Below is a chart created using Freddie Mac’s February 2015 U.S. Economic & Housing Marketing Outlook. As you can see interest rates are projected to increase steadily over the course of 2015.

How Will This Impact Your Mortgage Payment?

Depending on the amount of the loan that you secure, a half of a percent (.5%) increase in interest rate can increase your monthly mortgage payment significantly.

Research released by Zillow touched on this point:

“As rates rise, new home buyers will confront higher financing costs and monthly mortgage payments. For many, this will mean tightening their budgets and sacrificing some luxuries they may take for granted today.”

The experts predict that home prices will appreciate by 4.4% over the course of 2015. If both predictions become reality, families would wind up paying considerably more for their home.

Bottom Line

Even a small increase in interest rate can impact your family’s wealth. Meet with a local real estate professional to evaluate your ability to purchase your dream home.

|

Members: Sign in now to set up your Personalized Posts & start sharing today!

Not a Member Yet? Click Here to learn more about KCM’s newest feature, Personalized Posts. |