Where Are Home Prices Heading in The Next 5 Years?

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts, and investment & market strategists about where they believe prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

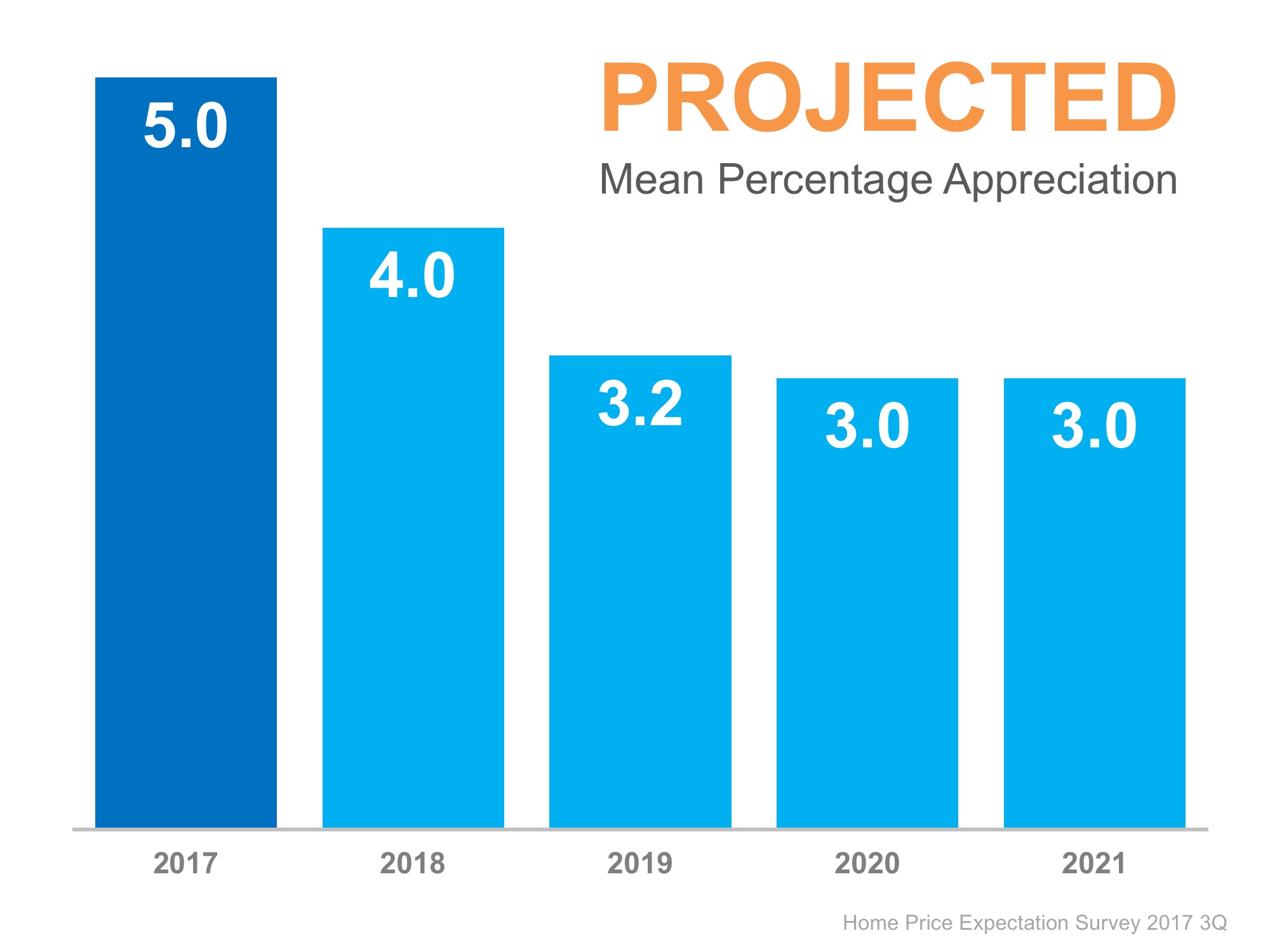

The results of their latest survey:

Home values will appreciate by 5.0% over the course of 2017, 4.0% in 2018, 3.2% in 2019, 3.0% in 2020, and 3.0% in 2021. That means the average annual appreciation will be 3.64% over the next 5 years.

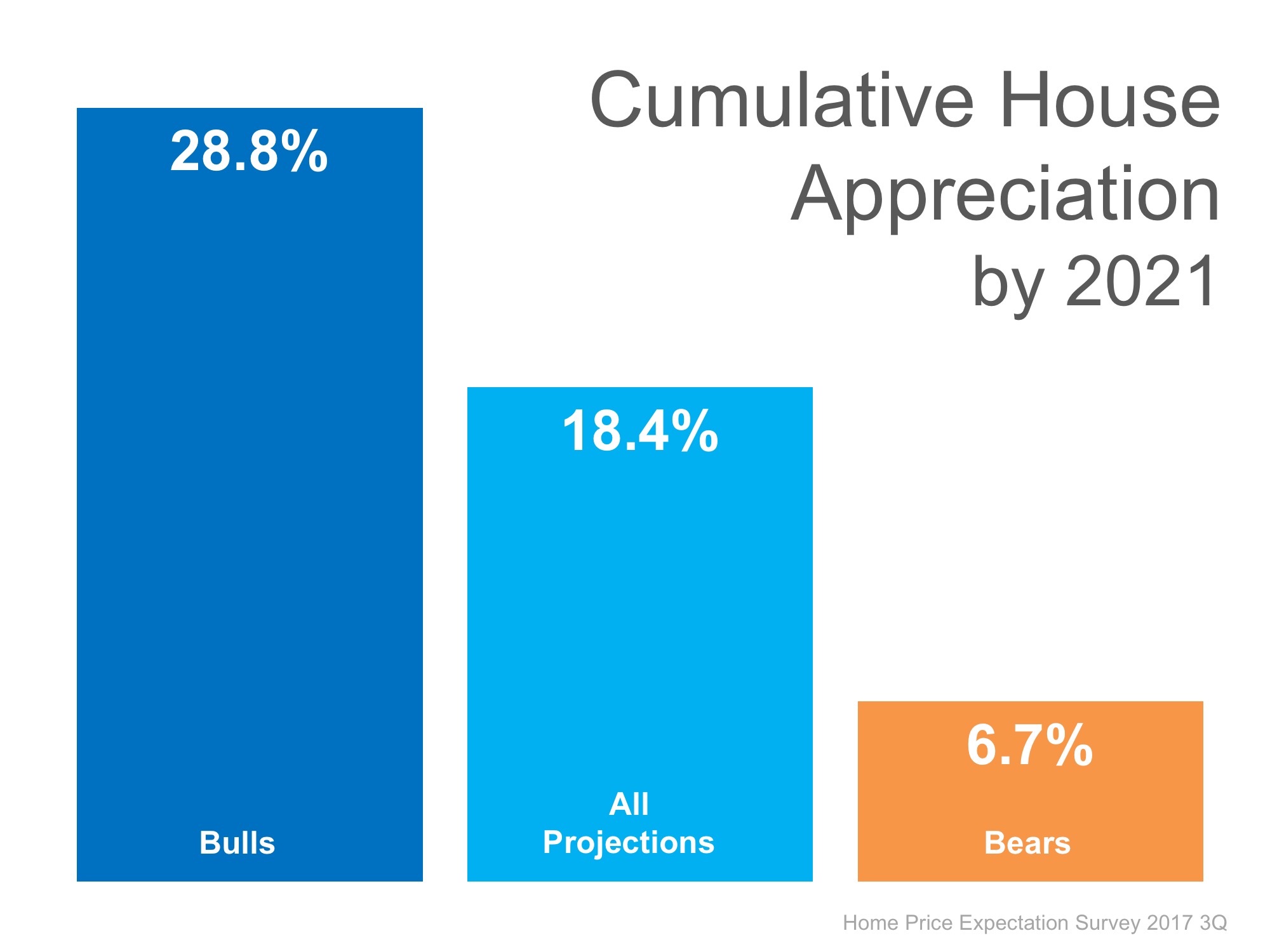

The prediction for cumulative appreciation increased from 17.8% to 18.4% by 2021. The experts making up the most bearish quartile of the survey are projecting a cumulative appreciation of 6.7%.

Bottom Line

Individual opinions make headlines. We believe this survey is a fairer depiction of future values.

|

Members: Sign in now to set up your Personalized Posts & start sharing today!

Not a Member Yet? Click Here to learn more about KCM’s newest feature, Personalized Posts. |