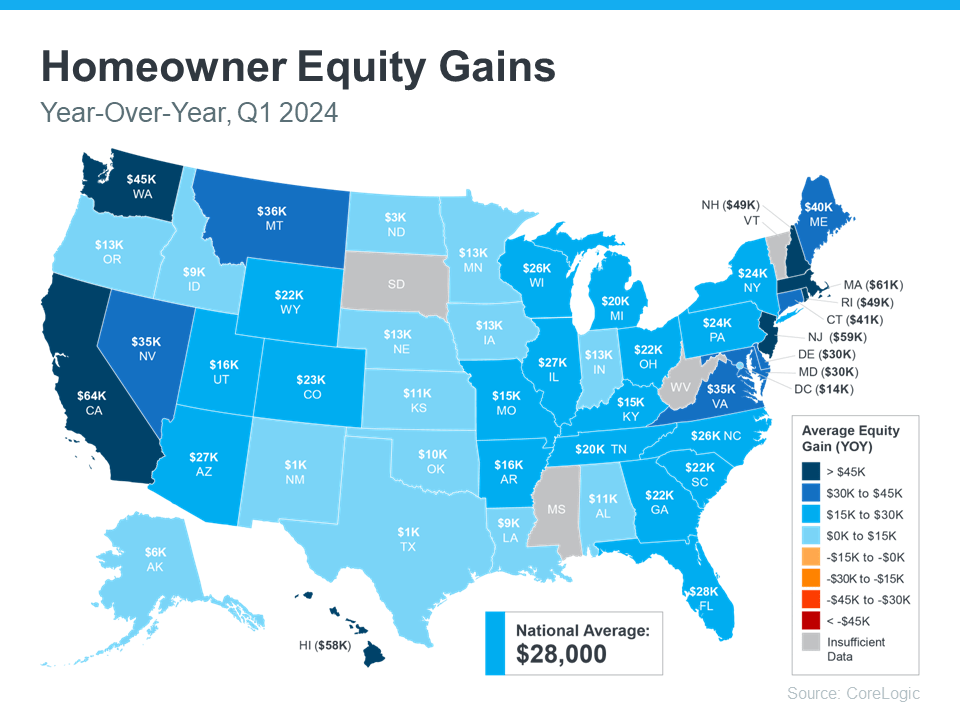

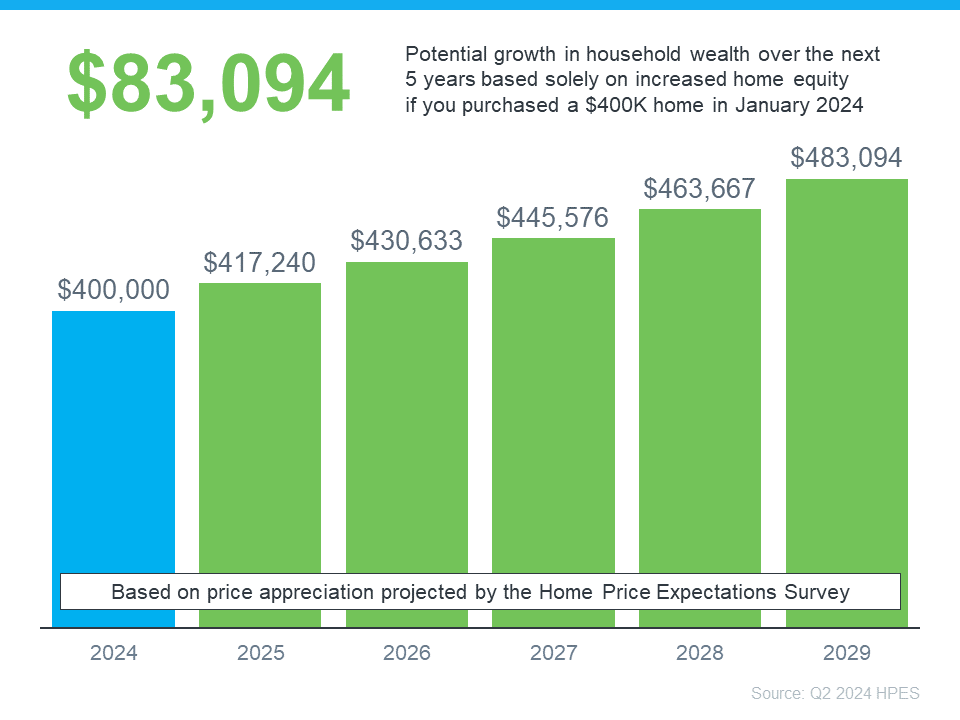

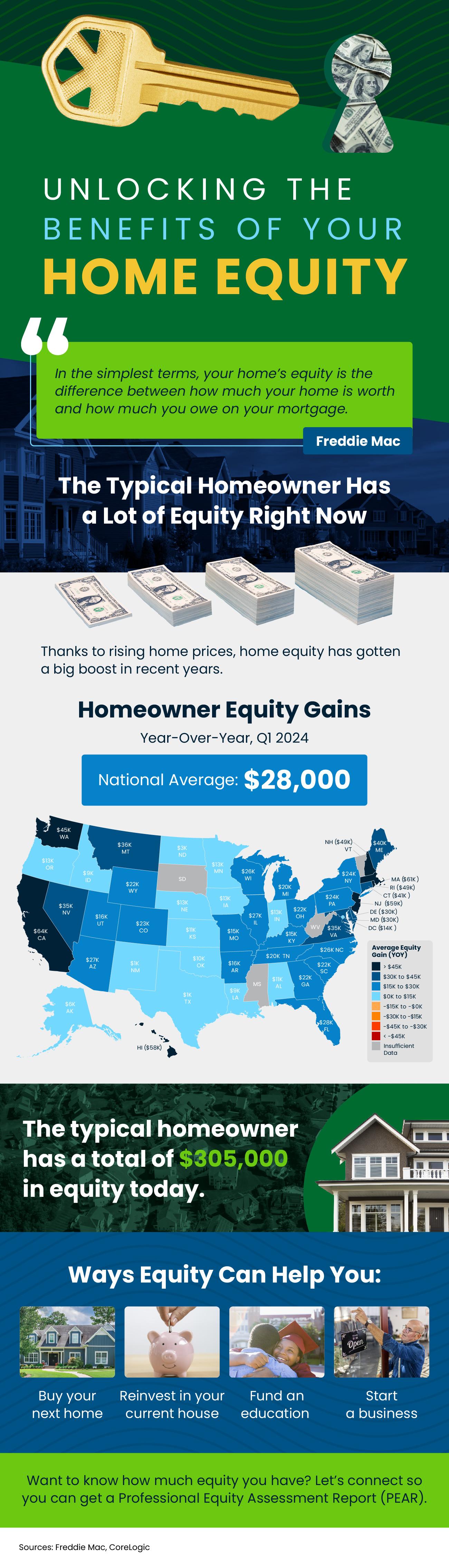

- Equity is the difference between what your house is worth and what you still owe on your mortgage.

- The typical homeowner gained $28,000 over the past year and has a grand total of $305,000 in equity. And there are a lot of great ways you can use that equity.

- Want to know how much equity you have? Let’s connect so you can get a Professional Equity Assessment Report (PEAR).

Equity is the difference between what your house is worth and what you still owe on your mortgage.

[exclusive_id] => [expired_at] => [featured_image] => https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240725/Unlocking-the-Benefits-of-Your-Home-Equity-KCM-Share-original.jpg [id] => 57677 [kcm_ig_caption] => Equity is the difference between what your house is worth and what you still owe on your mortgage. The typical homeowner gained $28,000 over the past year and has a grand total of $305,000 in equity. And there are a lot of great ways you can use that equity. Want to know how much equity you have? Let’s connect so you can get a Professional Equity Assessment Report (PEAR). [kcm_ig_hashtags] => homeequity,homeownership,keepingcurrentmatters [kcm_ig_quote] => Unlock the benefits of your home's equity. [public_bottom_line] =>- Equity is the difference between what your house is worth and what you still owe on your mortgage.

- The typical homeowner gained $28,000 over the past year and has a grand total of $305,000 in equity. And there are a lot of great ways you can use that equity.

- To find out how much equity you have, connect with a real estate agent who can give you a Professional Equity Assessment Report (PEAR).

Unlocking the Benefits of Your Home's Equity

Equity is the difference between what your house is worth and what you still owe on your mortgage.

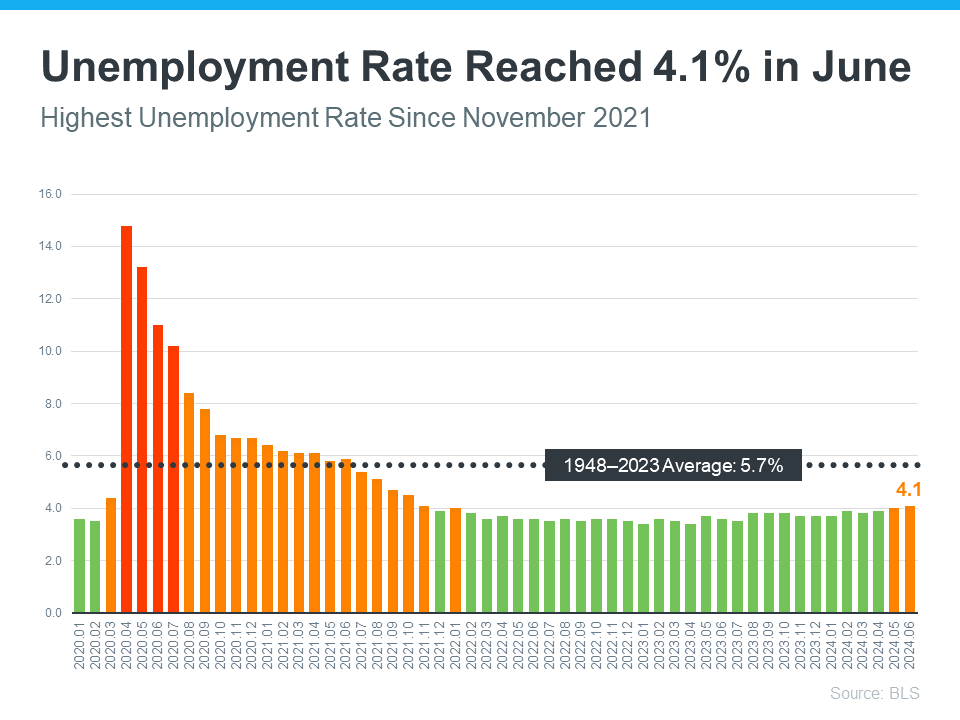

2. How Many Jobs the Economy Is Adding

2. How Many Jobs the Economy Is Adding