stdClass Object

(

[agents_bottom_line] => Buying a home is a big decision, and it’s essential to consider all your options. By looking into newly built homes, you might find a perfect fit for your needs and your budget.

Let’s explore the possibilities together. If you have any questions or want to see what’s available, feel free to reach out.

[assets] => Array

(

)

[banner_image] =>

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 9

[name] => Home Prices

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => home-prices

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Precios

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[2] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2024-04-10T16:19:38Z

[id] => 323

[name] => Buying Tips

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:19:44Z

[slug] => buying-tips

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Consejos de compra

)

)

[updated_at] => 2024-04-10T16:19:44Z

)

)

[content_type] => blog

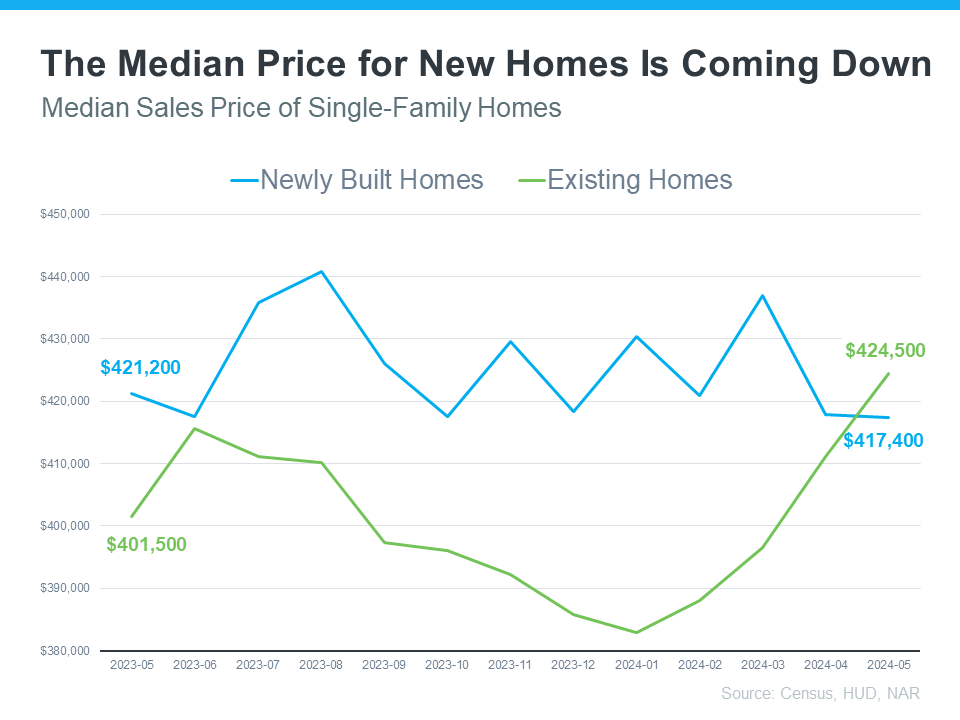

[contents] => If you’re in the market to buy a home, there’s some exciting news for you. Many people assume that newly built homes are more expensive than existing ones (houses that have already been lived in), but that’s not always the case. In fact, exploring newly built homes can sometimes lead to more cost-effective options, especially today. Hard to believe, right? But the data doesn’t lie.

Here are two key reasons working with your agent to look into new home construction could help you find a more budget-friendly option.

Reason 1: Lower Median Prices for Newly Built Homes

The median sales price for newly built homes is lower than the median sales price for existing homes today. This might seem surprising, but it’s true according to the latest data from the Census and the National Association of Realtors (NAR):

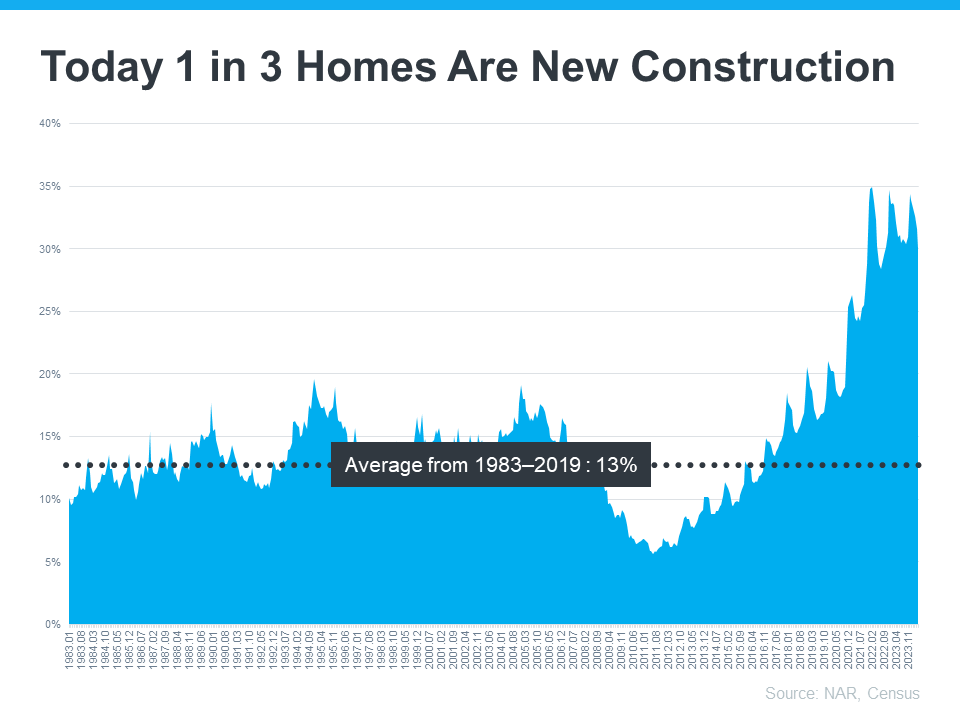

Why is that? Builders are focused on building what they can sell. And right now, there’s a very real need for smaller and more affordable homes – so that’s what they’ve been bringing to the market. At the same time, there are also more newly built homes already on the market than there have been over the past few years, so builders are motivated to make sure they’re selling what they’ve got available before adding more.

Reason 2: Attractive Incentives from Home Builders

Another big reason to consider a newly built home is the range of incentives that many home builders are offering. Again, since builders are aiming to sell their current inventory, some are providing special deals to sweeten the pot for homebuyers. HousingWire explains today’s trend:

“Overall, the usage of sales incentives was up to 61% in June, compared to 59% in May.”

One of the most appealing incentives right now is how builders are able to offer competitive mortgage rates. They may also provide other incentives, such as covering closing costs, or offering free upgrades.

Why This Matters to You

Considering a newly built home could open up opportunities you hadn’t thought of before. With competitive pricing and attractive incentives, you might just find that a brand-new home is the most appealing option for you.

[created_at] => 2024-07-22T18:40:00Z

[description] => If you’re in the market to buy a home, there’s some exciting news for you.

[exclusive_id] =>

[expired_at] =>

[featured_image] => https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240722/20240724-A-Newly-Built-Home-May-Actually-Be-More-Budget-Friendly-original.png

[id] => 57464

[kcm_ig_caption] => If you’re in the market to buy a home, there’s some exciting news for you.

Here are two key reasons working with your agent to look into new home construction could help you find a more budget-friendly option.

Reason 1: Lower Median Prices for Newly Built Homes

The median sales price for newly built homes is lower than the median sales price for existing homes today. This might seem surprising, but it’s true according to the latest data from the Census and the National Association of Realtors (NAR).

Why is that? Builders are focused on building what they can sell. And right now, there’s a very real need for smaller and more affordable homes – so that’s what they’ve been bringing to the market.

Reason 2: Attractive Incentives from Home Builders

Another big reason to consider a newly built home is the range of incentives that many home builders are offering. Again, since builders are aiming to sell their current inventory, some are providing special deals to sweeten the pot for homebuyers.

One of the most appealing incentives right now is how builders are able to offer competitive mortgage rates. They may also provide other incentives, such as covering closing costs, or offering free upgrades.

Why This Matters to You

Considering a newly built home could open up opportunities you hadn’t thought of before.

Buying a home is a big decision, and it’s essential to consider all your options. By looking into newly built homes, you might find a perfect fit for your needs and your budget.

Let’s explore the possibilities together. If you have any questions or want to see what’s available, feel free to reach out.

[kcm_ig_hashtags] => opportunity,housingmarket,keepingcurrentmatters

[kcm_ig_quote] => A newly built home may actually be more budget-friendly.

[public_bottom_line] => Buying a home is a big decision, and it’s essential to consider all your options. By looking into newly built homes, you might find a perfect fit for your needs and your budget.

Let’s explore the possibilities together. If you have any questions or want to see what’s available, reach out to a local real estate agent.

[published_at] => 2024-07-24T10:30:00Z

[related] => Array

(

)

[slug] => a-newly-built-home-may-actually-be-more-budget-friendly

[status] => published

[tags] => Array

(

[0] => content-hub

)

[title] => A Newly Built Home May Actually Be More Budget-Friendly

[updated_at] => 2024-07-24T10:30:22Z

[url] => /2024/07/24/a-newly-built-home-may-actually-be-more-budget-friendly/

)

A Newly Built Home May Actually Be More Budget-Friendly

If you’re in the market to buy a home, there’s some exciting news for you.