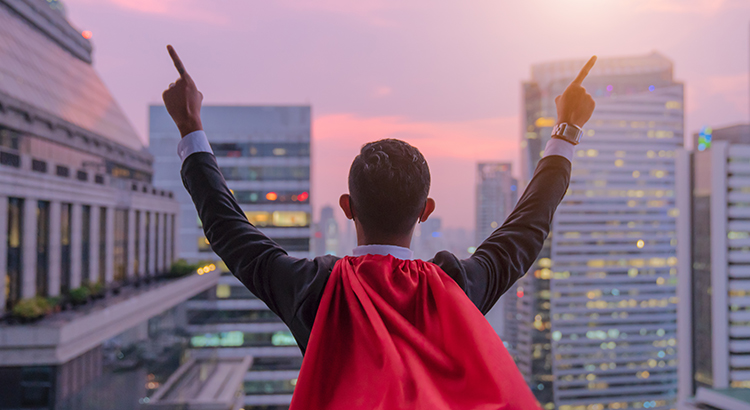

The #1 Thing You Can Do Now to Position Yourself to Buy a Home This Year

The last few weeks and months have caused a major health crisis throughout the world, leading to a pause in the U.S. economy as businesses and consumers work to slow the spread of the coronavirus. The rapid spread of the virus has been compared to prior pandemics and outbreaks not seen in many years. It also has consumers remembering the economic slowdown of 2008 that was caused by a housing crash. This economic slowdown, however, is very different from 2008.

![What You Can Do to Keep Your Dream of Homeownership Moving Forward [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2020/03/20200327-MEM-EN.jpg)

![10 Steps to Buying a Home [INFOGRAPHIC] | Keeping Current Matters](https://files.keepingcurrentmatters.com/wp-content/uploads/2020/02/20200228-MEM-EN.jpg)

![Top Reasons to Love Homeownership [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2020/02/Member-Feb-Infographic-01-ENG.jpg)

![5 Reasons Homeowners Throw Better Parties During the Big Game [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2020/01/20200131-MEM.jpg)

![Working with a Local Real Estate Professional Makes All the Difference [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2019/12/20191227-MEM.jpg)