About The KCM Crew

We believe every family should feel confident when buying & selling a home. KCM helps real estate professionals reach these families & enables the agent to simply & effectively explain a complex housing market. Take a 14-Day Free Trial of our monthly membership to see how we can help you!

Entries by The KCM Crew

How Much Should You Put Down?

Like most questions, the answer is “it depends”. Today, I thought I’d give you some things to consider. Let’s begin the discussion with loans that don’t require Mortgage Insurance. The suggestion is to borrow as much as you can afford. As an example, borrowing $310,000, as opposed to $300,000, will increase your mortgage payment by […]

The PRICE Is the Same, But the COST Is Less

There is more and more research coming out showing that it makes great financial sense to purchase a home today . Whether it be rent vs. buy ratios, income-to-price ratios or income-to-mortgage payment ratios, purchasing a home right now is a bargain compared to historic norms. Now we want to look at the COST of […]

One Thing That Still Concerns Us

There is no doubt that the housing market is stumbling to a recovery. This past week Lawrence Yun, NAR’s chief economist, predicted a 4% increase in sales next year. Last month, Celia Chen of Moody’s Analytics projected sales to increase over 20% in 2012. Any increase in transactions will be welcomed. However, we believe there […]

Is There a 3.8% Tax on Homes in the Health Bill?

As the presidential debates start to heat up, there will be comments about the Administration’s Health Care Bill. We are again getting many questions about a possible 3.8% tax on home sales that some claim is in the bill. To answer these questions, we have decided to re-run a blog post we did last year. – The KCM Crew […]

It’s Time to Buy a Home!

5 Things That Still Tick Me Off…

1.) When Loan Officers issue pre-approvals without reviewing the relevant bank statements, pay stubs, and tax returns. We all know that virtually every loan program requires these documents and that underwriters examine them closely. Loan Officers should obtain these documents and address potential challenges (like large deposits, payroll deductions, and unreimbursed expenses) up front. Issuing […]

Americans Still Believe in the Value of Homeownership

Last week, Fannie Mae released their National Housing Survey for the third quarter of 2011. They survey the American public on a multitude of questions concerning today’s housing market. Each quarter, we like to pull out some of the findings we deem most interesting. Here they are for the most recent report: Most Important Reasons to […]

The Ship Appears to be Turning

Today, we are again honored to have Ken H. Johnson, Ph.D. — Florida International University (FIU) and Editor of the Journal of Housing Research as our guest blogger. To view other research from FIU, visit http://realestate.fiu.edu/. Dr. Johnson will also be speaking at NAR’s Conference and Expo in Anaheim later this week. For more information click here. […]

Homeownership: Reports of Its Death are Exaggerated

There have been a growing number of reports announcing the death of American homeownership over the last two years. Some have said we are evolving into a rental society and even challenge the long standing belief that homeownership should be a part of the American Dream. They look at the falling rate of homeownership as […]

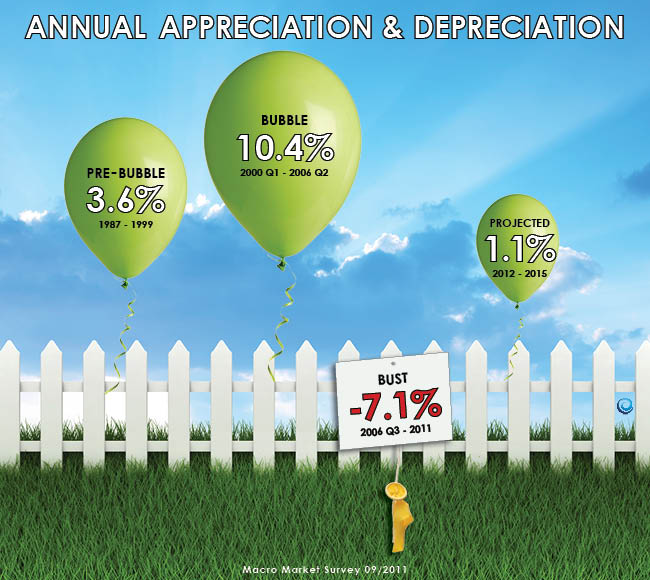

Real Estate as a Longer Term Investment

November 4, 2011 /7 Comments/by The KCM CrewInsurance Anyone?

I am often asked about the different types of insurances that surround real estate. And while I am no expert on the topic, I do feel qualified to give an overview and some insight to assist you in asking intelligent questions to true insurance professionals. So, here it goes: Homeowner’s Insurance covers the replacement cost of […]

Is It Really Time to Buy a Home?

On Monday, we gave you the links to four different articles that came to the same conclusion: it’s time to buy a home. Today, we want to take a closer look at one of the sources, the JP Morgan’s Market Insights report. Right from the beginning, the paper identifies the greatest challenge in today’s housing […]

Uncle Sam Wants You! – To Rent from Him

Today, we are again honored to have Ken H. Johnson, Ph.D. — Florida International University (FIU) and Editor of the Journal of Housing Research as our guest blogger. To view other research from FIU, visit http://realestate.fiu.edu/. Dr. Johnson will also be speaking at NAR’s Conference and Expo in Anaheim. For more information click here. – The KCM […]

It’s Simple: Now Is the Time to Buy a Home

“The millionaire says to a thousand people, ‘I read this book and it started me on the road to wealth.’ Guess how many go out and get the book? Very few. Isn’t that incredible? Why wouldn’t everyone get the book? A mystery of life.” – Jim Rohn Mr. Rohn explains that if we want to […]

Underwater Refinance Program Expanded

At a campaign stop in Nevada on Monday, President Obama announced an expansion of the HARP (Home Affordable Refinance Program) which would eliminate the current maximum LTV of 125%. The initiative is being looked at as a way to reward those homeowners who have been good payers of their mortgages but, because of declining home […]

Will the 30 Year Mortgage Disappear?

The federal government is reconsidering their involvement in the home mortgage process. They plan to still ‘guarantee’ certain mortgages. However, they appear to be redefining what they consider a ‘qualified purchaser’. They are discussing stricter lending guidelines in four different areas: The type of mortgage The minimum down payment The debt ratios of the buyer […]

Housing Affordability: Price to Income

Today, we are again honored to have Ken H. Johnson, Ph.D. — Florida International University (FIU) and Editor of the Journal of Housing Research as our guest blogger. To view other research from FIU, visit http://realestate.fiu.edu/. Dr. Johnson will also be speaking at NAR’s Conference and Expo in Anaheim. For more information click here. – The KCM […]

Long Term Benefits of Buying vs Renting [INFOGRAPHIC]

October 21, 2011 /8 Comments/by The KCM CrewWhat’s First? The House or the Mortgage?

Most people get it backwards. They shop for a home, THEN, they try to structure the financing for it. They make the emotional decision of buying the home of their dreams, THEN, try to apply logic in how they pay for it. Many even go “online” and play with what is affordable by underwriting standards […]

Why Do You Want to Buy a Home?

If you are in the market to buy a home of your own, you need to ask yourself one question: WHY? It seems like a simple enough question yet it is not. Experts are predicting that, in many markets, prices will continue to soften (see our blog from yesterday). That has caused many buyers to stay […]

House Prices: Where They Will Be in the Spring

Disclaimer: This blog covers the national housing market as a whole. Please check with a local real estate professional to discover how the following information will impact your region. – The KCM Crew Many sellers want to wait until the spring before putting their home on the market. This might be for any of several […]

Wall Street Journal & Forbes: It’s Time to Buy A Home

We believe very strongly that now is the time to buy a home. Some will say we are just saying this to create real estate transactions and commissions. Because of that, today we will quote what those outside the real estate profession are saying to the people who look to them for financial advice. The Wall […]

Attention All Real Estate Professionals…

To register for this webinar, click on the image above.

A Follow-up To Yesterday’s Blog

Yesterday, Steve Harney expressed his thoughts on how homeownership is being impacted in this country. Some believed that Steve thought the American people where losing faith in the importance of owning a home. That is not the case. He just worries about how housing policies may impact our neighbors and our neighborhoods. Here is a blog […]