- Home values will appreciate by 4.4% in 2014.

- The cumulative appreciation will be 19.5% by 2018.

- That means the average annual appreciation will be 3.6% over the next 5 years.

- Even the experts making up the most bearish quartile of the survey still are projecting a cumulative appreciation of 9.4% by 2018.

Today, many real estate conversations center on housing prices and where they may be headed. That is why the Home Price Expectation Survey is a great barometer. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

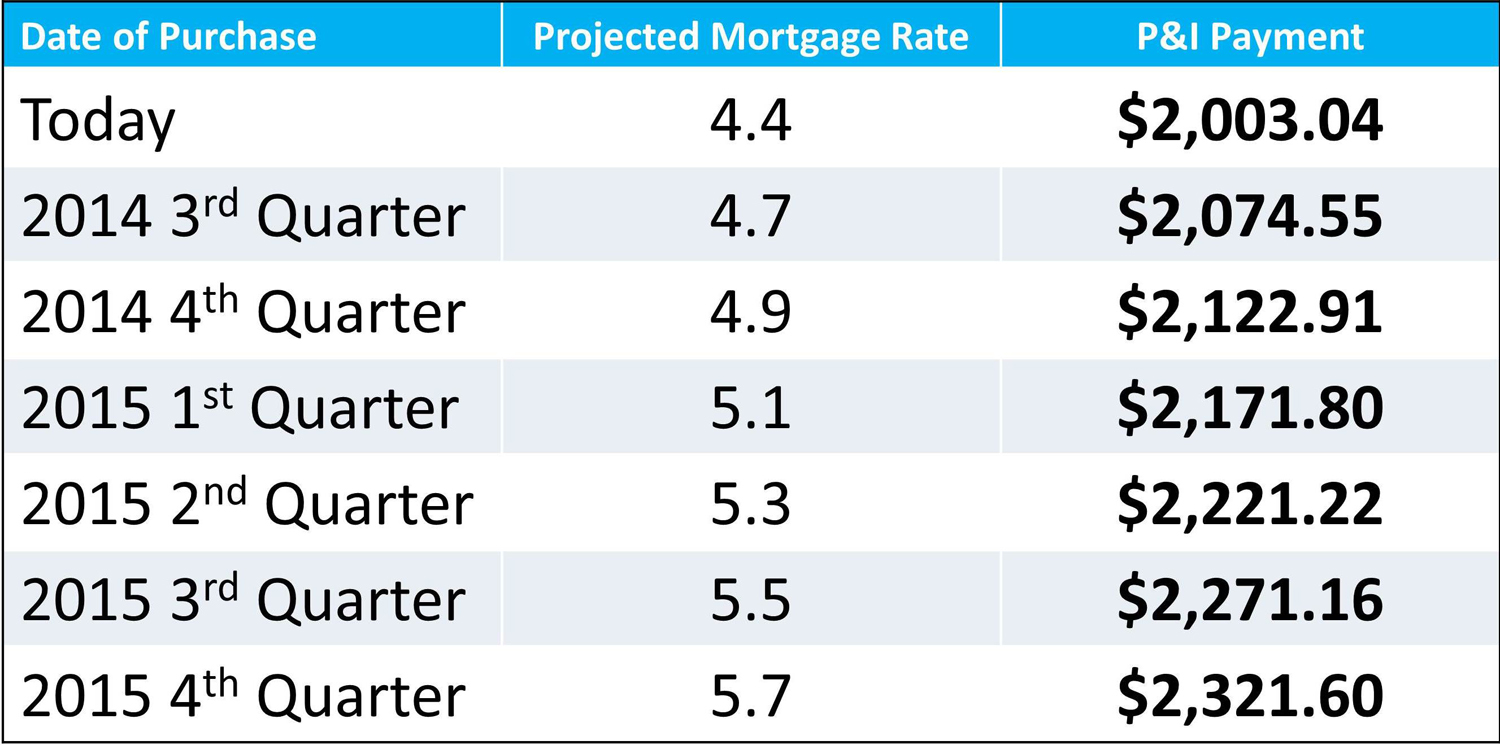

The results of their latest survey

Today, many real estate conversations center on housing prices and where they may be headed. That is why the Home Price Expectation Survey is a great barometer. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey

- Home values will appreciate by 4.4% in 2014.

- The cumulative appreciation will be 19.5% by 2018.

- That means the average annual appreciation will be 3.6% over the next 5 years.

- Even the experts making up the most bearish quartile of the survey still are projecting a cumulative appreciation of 9.4% by 2018.

Do as I Say… not as I Do

Do as I Say… not as I Do The Hispanic community was hit hardest by the housing crash. Now that the market is recovering, many of these families have the opportunity to either buy a home again, or those that lost home value during those years, are seeing equity return allowing them to sell and move to the home that they always wanted.

These buyers are ready, but according to a recent survey done by NAHREP (the National Association of Hispanic Real Estate Professionals) there are barriers that do not allow these buyers to enter the market right now. As real estate professionals is our duty to remove some of these barriers, if possible, and help as many families as we can become homeowners if they are willing ready and able to.

The Hispanic community is becoming a very important part of today’s real estate market, “The number of Hispanic households has grown to 14.7 million in 2013 and today a Hispanic youth turns 18 every minute of every day,” according to the 2013 State of Hispanic Homeownership Report.

4 out of 10 new households in the United States are expected to be Hispanic in 2014, this is a major opportunity for real estate professionals.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 1

[name] => No clasificado

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => uncategorized

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)

The Hispanic community was hit hardest by the housing crash. Now that the market is recovering, many of these families have the opportunity to either buy a home again, or those that lost home value during those years, are seeing equity return allowing them to sell and move to the home that they always wanted.

These buyers are ready, but according to a recent survey done by NAHREP (the National Association of Hispanic Real Estate Professionals) there are barriers that do not allow these buyers to enter the market right now. As real estate professionals is our duty to remove some of these barriers, if possible, and help as many families as we can become homeowners if they are willing ready and able to.

The Hispanic community is becoming a very important part of today’s real estate market, “The number of Hispanic households has grown to 14.7 million in 2013 and today a Hispanic youth turns 18 every minute of every day,” according to the 2013 State of Hispanic Homeownership Report.

4 out of 10 new households in the United States are expected to be Hispanic in 2014, this is a major opportunity for real estate professionals.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 1

[name] => No clasificado

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => uncategorized

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)  Whether you are buying or selling a home, you need an experienced Real Estate Professional to lead you toward your ultimate goal. In this world of instant gratification and Internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but rather have been strengthened in recent months due to

Whether you are buying or selling a home, you need an experienced Real Estate Professional to lead you toward your ultimate goal. In this world of instant gratification and Internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but rather have been strengthened in recent months due to  A

A

The price of any item (including residential real estate) is determined by ‘supply and demand’. If many people are looking to buy an item and the supply of that item is limited, the price of that item increases.

According to the National Association of Realtors (NAR), the supply of homes for sale is still

The price of any item (including residential real estate) is determined by ‘supply and demand’. If many people are looking to buy an item and the supply of that item is limited, the price of that item increases.

According to the National Association of Realtors (NAR), the supply of homes for sale is still  I have been a subscriber to the Wall Street Journal (WSJ) for as long as I can remember. In my opinion, it is the single greatest source of financial information and insights available. I don’t always agree with their analysis but I always respect their position.

However, in an article this past weekend,

I have been a subscriber to the Wall Street Journal (WSJ) for as long as I can remember. In my opinion, it is the single greatest source of financial information and insights available. I don’t always agree with their analysis but I always respect their position.

However, in an article this past weekend,  Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are three of those reasons.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are three of those reasons. In a

In a  In a recent

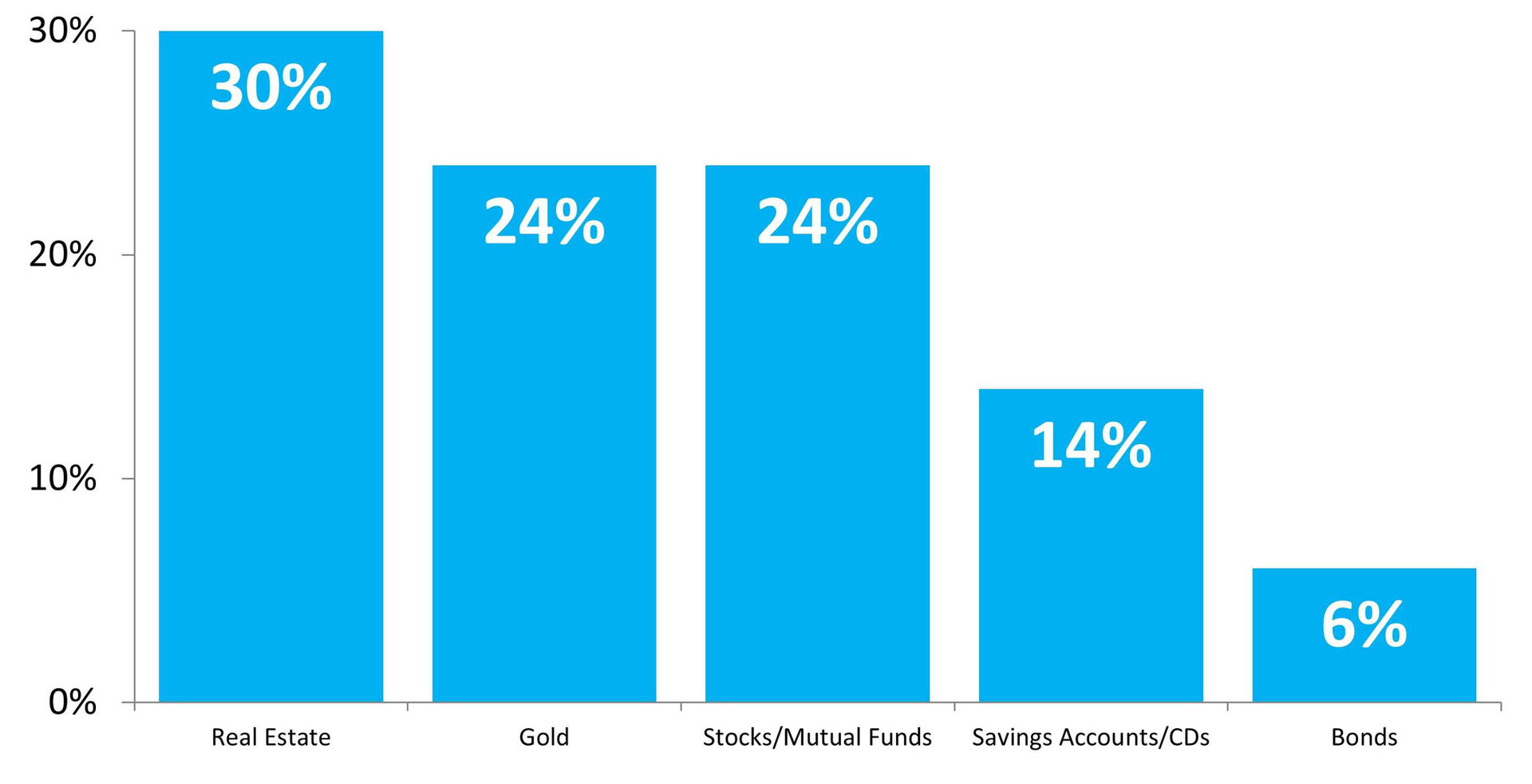

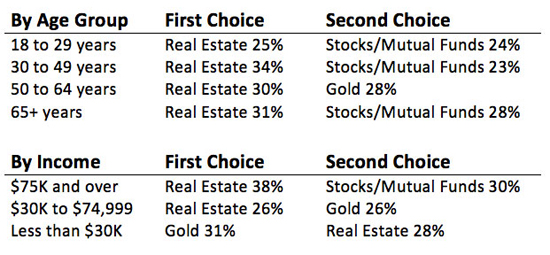

In a recent  The Gallup organization just released their

The Gallup organization just released their

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => Para los compradores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => Para los compradores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

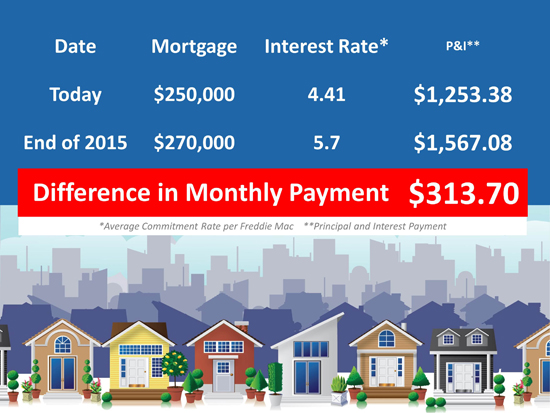

[contents] => (English)  There is a great opportunity that exists now for Millennials who are willing and able to purchase a home NOW... Here are a couple other ways to look at the cost of waiting.

Let’s say you're 30 and your dream house costs $250,000 today, at 4.41% your monthly Mortgage Payment with Interest would be $1,253.38.

But you’re busy, you like your apartment, moving is such a hassle...You decide to wait till the end of next year to buy and all of a sudden, you’re 31, that same house is $270,000, at 5.7%. Your new payment per month is $1,567.08.

There is a great opportunity that exists now for Millennials who are willing and able to purchase a home NOW... Here are a couple other ways to look at the cost of waiting.

Let’s say you're 30 and your dream house costs $250,000 today, at 4.41% your monthly Mortgage Payment with Interest would be $1,253.38.

But you’re busy, you like your apartment, moving is such a hassle...You decide to wait till the end of next year to buy and all of a sudden, you’re 31, that same house is $270,000, at 5.7%. Your new payment per month is $1,567.08.

There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with our parents rent free, you are paying a mortgage - either your mortgage or your landlord’s.

As a

There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with our parents rent free, you are paying a mortgage - either your mortgage or your landlord’s.

As a  Just like May flowers, every spring the housing market blossoms as buyers come out ready to purchase their dream house. This spring, we believe we are going to see the strongest purchasing market we have seen in a decade.

Why are we so bullish on the housing market this spring?

Here are a few reasons:

Just like May flowers, every spring the housing market blossoms as buyers come out ready to purchase their dream house. This spring, we believe we are going to see the strongest purchasing market we have seen in a decade.

Why are we so bullish on the housing market this spring?

Here are a few reasons:

The sales of vacation homes

The sales of vacation homes

The housing market is recovering nicely. Prices have increased nationally by double digits over the last twelve months. Competition from the shadow inventory of lower priced distressed properties (foreclosures and short sales) is diminishing rapidly. Now may be the perfect time to sell your home and move to the dream house or beautiful location your family has always talked about.

The one suggestion we would definitely offer: DON’T OVERPRICE IT!!

Even though prices have increased by more than 10% over the last year, the acceleration of appreciation has slowed dramatically over the last few months. As an example, in their April

The housing market is recovering nicely. Prices have increased nationally by double digits over the last twelve months. Competition from the shadow inventory of lower priced distressed properties (foreclosures and short sales) is diminishing rapidly. Now may be the perfect time to sell your home and move to the dream house or beautiful location your family has always talked about.

The one suggestion we would definitely offer: DON’T OVERPRICE IT!!

Even though prices have increased by more than 10% over the last year, the acceleration of appreciation has slowed dramatically over the last few months. As an example, in their April

The American desire to own a second home as a vacation home is alive and well!

The American desire to own a second home as a vacation home is alive and well! We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first time or repeat buyer, you must not be concerned about price but instead about the ‘long term cost’ of the home. Let us explain.

Recently, we

We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first time or repeat buyer, you must not be concerned about price but instead about the ‘long term cost’ of the home. Let us explain.

Recently, we

A recent

A recent  Several government agencies are reviewing data to determine what will be the minimum down payment required under the new Qualified Residential Mortgage (QRM) guidelines scheduled to be revealed in the next few months. In the original

Several government agencies are reviewing data to determine what will be the minimum down payment required under the new Qualified Residential Mortgage (QRM) guidelines scheduled to be revealed in the next few months. In the original  Several government agencies are reviewing data to determine what will be the minimum down payment required under the new Qualified Residential Mortgage (QRM) guidelines scheduled to be revealed in the next few months. In the original

Several government agencies are reviewing data to determine what will be the minimum down payment required under the new Qualified Residential Mortgage (QRM) guidelines scheduled to be revealed in the next few months. In the original