stdClass Object

(

[agents_bottom_line] =>  Mucha gente sufrió a través de la crisis de la vivienda. Nos dimos cuenta que la mayoría de los dolores de cabeza fueron el resultado de que la vivienda y el mercado de las hipotecases se volvieron locos. Muchos consumidores fueron arrastrados por las aguas de un mercado de la vivienda frenético, que dio lugar a una crisis que incluso los expertos no vieron venir.

Sin embargo, algunos de los sufrimientos fueron causados por las malas decisiones de compradores de casas y vendedores. ¡USTED NO! No compro esa casa que estiraba las finanzas de su familia más allá del punto de la sostenibilidad. Usted no obtuvo un préstamo sobre el capital en la propiedad y compro un esquí acuático nuevo. No hizo una refinanciación para sacar en efectivo la cantidad máxima posible.

En cambio, ¡usted compro una casa que su familia puede disfrutar- y pagar! Usted espero que las tasas de interés bajaran hasta el mínimo histórico y entonces refinancio su casa; no simple mente por sacar dinero pero para bajar sus pagos mensuales.

Usted tiene valor líquido en su casa y un buen, pago de hipoteca bajo. Usted ha jugado el mercado de la vivienda perfectamente.

Mucha gente sufrió a través de la crisis de la vivienda. Nos dimos cuenta que la mayoría de los dolores de cabeza fueron el resultado de que la vivienda y el mercado de las hipotecases se volvieron locos. Muchos consumidores fueron arrastrados por las aguas de un mercado de la vivienda frenético, que dio lugar a una crisis que incluso los expertos no vieron venir.

Sin embargo, algunos de los sufrimientos fueron causados por las malas decisiones de compradores de casas y vendedores. ¡USTED NO! No compro esa casa que estiraba las finanzas de su familia más allá del punto de la sostenibilidad. Usted no obtuvo un préstamo sobre el capital en la propiedad y compro un esquí acuático nuevo. No hizo una refinanciación para sacar en efectivo la cantidad máxima posible.

En cambio, ¡usted compro una casa que su familia puede disfrutar- y pagar! Usted espero que las tasas de interés bajaran hasta el mínimo histórico y entonces refinancio su casa; no simple mente por sacar dinero pero para bajar sus pagos mensuales.

Usted tiene valor líquido en su casa y un buen, pago de hipoteca bajo. Usted ha jugado el mercado de la vivienda perfectamente.

No se pierda la última jugada

Aun, hay una última jugada, que muchos deben considerar. Con las tasas de interés aun en los mínimos históricos y con la proyección de que los precios van a aumentar casi 20% durante los próximos cuatro años y medio, tal vez este es el momento para comprar una casa nueva.

Sea, que usted tiene una familia que está creciendo y está lista para mudarse a esa casa frente al agua que usted siempre quiso o un nido vacío que quiere algo más pequeño que tenga más sentido, ahora tal vez es el momento de comprar. Si usted a considerado el comprar una casa para las vacaciones/la jubilación, tal vez nunca ha habido un mejor momento para continuar con ese plan.

Usted ha sido fiscalmente lo suficientemente astuto para navegar las aguas torrentosas de un mercado de bienes raíces que hundió a muchos propietarios. Ahora, que los mares se han asentado, no piense que no hay mayores oportunidades en el horizonte.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => Para los compradores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => Para los vendedores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

[2] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 38

[name] => Compradores de casa mas grande

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:00:35Z

[slug] => move-up

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2024-04-10T16:00:35Z

)

)

[content_type] => blog

[contents] =>  Mucha gente sufrió a través de la crisis de la vivienda. Nos dimos cuenta que la mayoría de los dolores de cabeza fueron el resultado de que la vivienda y el mercado de las hipotecases se volvieron locos. Muchos consumidores fueron arrastrados por las aguas de un mercado de la vivienda frenético, que dio lugar a una crisis que incluso los expertos no vieron venir.

Sin embargo, algunos de los sufrimientos fueron causados por las malas decisiones de compradores de casas y vendedores. ¡USTED NO! No compro esa casa que estiraba las finanzas de su familia más allá del punto de la sostenibilidad. Usted no obtuvo un préstamo sobre el capital en la propiedad y compro un esquí acuático nuevo. No hizo una refinanciación para sacar en efectivo la cantidad máxima posible.

En cambio, ¡usted compro una casa que su familia puede disfrutar- y pagar! Usted espero que las tasas de interés bajaran hasta el mínimo histórico y entonces refinancio su casa; no simple mente por sacar dinero pero para bajar sus pagos mensuales.

Usted tiene valor líquido en su casa y un buen, pago de hipoteca bajo. Usted ha jugado el mercado de la vivienda perfectamente.

Mucha gente sufrió a través de la crisis de la vivienda. Nos dimos cuenta que la mayoría de los dolores de cabeza fueron el resultado de que la vivienda y el mercado de las hipotecases se volvieron locos. Muchos consumidores fueron arrastrados por las aguas de un mercado de la vivienda frenético, que dio lugar a una crisis que incluso los expertos no vieron venir.

Sin embargo, algunos de los sufrimientos fueron causados por las malas decisiones de compradores de casas y vendedores. ¡USTED NO! No compro esa casa que estiraba las finanzas de su familia más allá del punto de la sostenibilidad. Usted no obtuvo un préstamo sobre el capital en la propiedad y compro un esquí acuático nuevo. No hizo una refinanciación para sacar en efectivo la cantidad máxima posible.

En cambio, ¡usted compro una casa que su familia puede disfrutar- y pagar! Usted espero que las tasas de interés bajaran hasta el mínimo histórico y entonces refinancio su casa; no simple mente por sacar dinero pero para bajar sus pagos mensuales.

Usted tiene valor líquido en su casa y un buen, pago de hipoteca bajo. Usted ha jugado el mercado de la vivienda perfectamente.

No se pierda la última jugada

Aun, hay una última jugada, que muchos deben considerar. Con las tasas de interés aun en los mínimos históricos y con la proyección de que los precios van a aumentar casi 20% durante los próximos cuatro años y medio, tal vez este es el momento para comprar una casa nueva.

Sea, que usted tiene una familia que está creciendo y está lista para mudarse a esa casa frente al agua que usted siempre quiso o un nido vacío que quiere algo más pequeño que tenga más sentido, ahora tal vez es el momento de comprar. Si usted a considerado el comprar una casa para las vacaciones/la jubilación, tal vez nunca ha habido un mejor momento para continuar con ese plan.

Usted ha sido fiscalmente lo suficientemente astuto para navegar las aguas torrentosas de un mercado de bienes raíces que hundió a muchos propietarios. Ahora, que los mares se han asentado, no piense que no hay mayores oportunidades en el horizonte.

[created_at] => 2014-08-11T06:00:03Z

[description] =>

Mucha gente sufrió a través de la crisis de la vivienda. Nos dimos cuenta que la mayoría de los dolores de cabeza fueron el resultado de que la vivienda y el mercado de las hipotecases se volvieron locos. Muchos consumidores fueron arrastrados po...

[expired_at] =>

[featured_image] => https:///

[id] => 104

[published_at] => 2014-08-11T10:00:03Z

[related] => Array

(

)

[slug] => youve-played-the-housing-market-perfectly-dont-blow-it-now

[status] => published

[tags] => Array

(

)

[title] => Usted ha jugado el mercado de la vivienda perfectamente. ¡No lo estropee ahora!

[updated_at] => 2014-08-11T14:24:39Z

[url] => /es/2014/08/11/youve-played-the-housing-market-perfectly-dont-blow-it-now/

)

Usted ha jugado el mercado de la vivienda perfectamente. ¡No lo estropee ahora!

Mucha gente sufrió a través de la crisis de la vivienda. Nos dimos cuenta que la mayoría de los dolores de cabeza fueron el resultado de que la vivienda y el mercado de las hipotecases se volvieron locos. Muchos consumidores fueron arrastrados po...

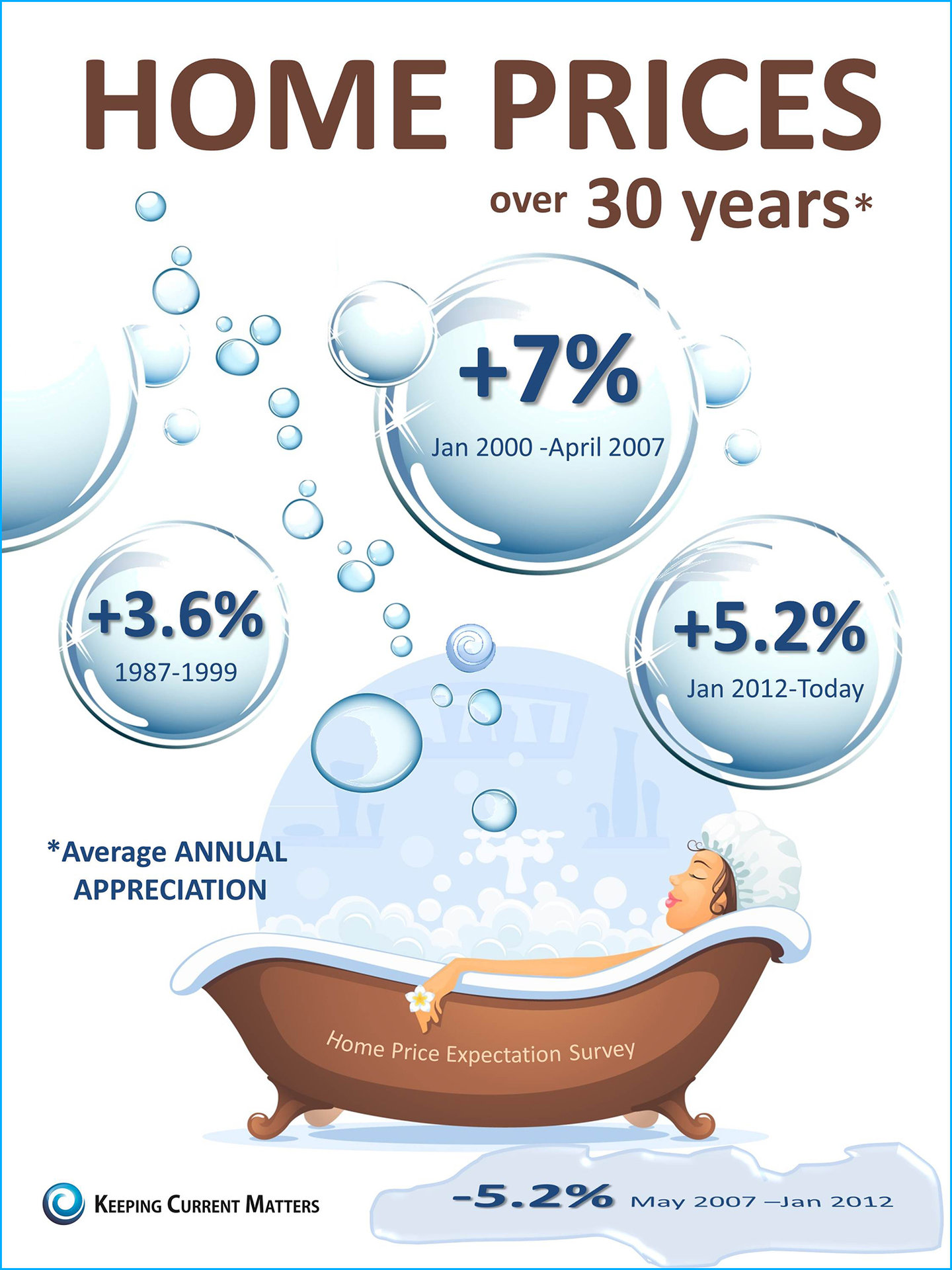

Hoy en día, muchas conversaciones de bienes raíces se centran en los precios de la vivienda y hacia donde se dirigen. Es por eso que nos gusta la encuesta Home Price Expectation. Cada trimestre, Pulsenomics encuesta a un panel nacional de más de cien economistas, expertos en bienes raíces e inversiones & estrategas del mercado; sobre hacia donde se dirigen los precios durante los próximos cinco años. Entonces ellos sacan un promedio de las proyecciones de los más de 100 expertos en un solo número.

Los resultados de su última encuesta:

Hoy en día, muchas conversaciones de bienes raíces se centran en los precios de la vivienda y hacia donde se dirigen. Es por eso que nos gusta la encuesta Home Price Expectation. Cada trimestre, Pulsenomics encuesta a un panel nacional de más de cien economistas, expertos en bienes raíces e inversiones & estrategas del mercado; sobre hacia donde se dirigen los precios durante los próximos cinco años. Entonces ellos sacan un promedio de las proyecciones de los más de 100 expertos en un solo número.

Los resultados de su última encuesta:

Aun estando ‘en y alrededor’ del negocio de bienes raíces por más de 30 años; seguimos confundidos acerca de la importancia que juntos, el vendedor y el agente en bienes raíces pone en la publicidad. Décadas atrás, anunciar una casa era importante para atraer un comprador, porque no había otra forma para que una oficina de bienes raíces anunciara al mundo que la casa ahora estaba en el mercado.

Pero los tiempos han cambiado. Con el desarrollo del Multiple Listing Systems (MLS por sus siglas en ingles), tan pronto como una casa entra en el mercado la entera población de agentes del área o la región es informada ¡instantáneamente! Cada agente trabajando con cada comprador es puesto sobre aviso que una nueva oportunidad de vender una casa está disponible. En muchos casos, a través de la tecnología, los compradores son informados directamente de la casa nueva en el mercado antes que el agente se pueda comunicar con ellos. Los compradores que ya están en el mercado sabrán que la casa está a la venta inmediatamente. Ningún anuncio es requerido para hacer esto.

Usted tal vez se pregunte ¿Qué pasa con el comprador que aún no está activamente involucrado con un agente en la búsqueda de una casa? Esos futuros compradores están buscando en internet por meses, antes de que ellos estén listos para comprometerse. En la mayoría de las áreas, una vez la casa es puesta en el sistema del MLS, aparece en una multitud de páginas electrónicas de bienes raíces donde un comprador puede encontrarla fácilmente.

¿Porque no hay compradores mirando la casa? Voy a argumentar que probablemente no es porque ellos desconozcan que esta para la venta. En 99% de los casos, tiene que ver con el precio. Ellos saben del precio, pero por alguna razón, ellos decidieron que no vale la pena verla. No vale eso para ellos.

Aun estando ‘en y alrededor’ del negocio de bienes raíces por más de 30 años; seguimos confundidos acerca de la importancia que juntos, el vendedor y el agente en bienes raíces pone en la publicidad. Décadas atrás, anunciar una casa era importante para atraer un comprador, porque no había otra forma para que una oficina de bienes raíces anunciara al mundo que la casa ahora estaba en el mercado.

Pero los tiempos han cambiado. Con el desarrollo del Multiple Listing Systems (MLS por sus siglas en ingles), tan pronto como una casa entra en el mercado la entera población de agentes del área o la región es informada ¡instantáneamente! Cada agente trabajando con cada comprador es puesto sobre aviso que una nueva oportunidad de vender una casa está disponible. En muchos casos, a través de la tecnología, los compradores son informados directamente de la casa nueva en el mercado antes que el agente se pueda comunicar con ellos. Los compradores que ya están en el mercado sabrán que la casa está a la venta inmediatamente. Ningún anuncio es requerido para hacer esto.

Usted tal vez se pregunte ¿Qué pasa con el comprador que aún no está activamente involucrado con un agente en la búsqueda de una casa? Esos futuros compradores están buscando en internet por meses, antes de que ellos estén listos para comprometerse. En la mayoría de las áreas, una vez la casa es puesta en el sistema del MLS, aparece en una multitud de páginas electrónicas de bienes raíces donde un comprador puede encontrarla fácilmente.

¿Porque no hay compradores mirando la casa? Voy a argumentar que probablemente no es porque ellos desconozcan que esta para la venta. En 99% de los casos, tiene que ver con el precio. Ellos saben del precio, pero por alguna razón, ellos decidieron que no vale la pena verla. No vale eso para ellos.

Cuando un propietario decide vender su casa; obviamente ellos quieren el mejor precio posible, con la menor cantidad de molestias. Sin embargo, para la gran mayoría de los vendedores, el resultado más importante es conseguir que realmente la casa sea vendida.

Para cumplir con estas tres metas, un vendedor debe darse cuenta de la importancia de emplear un profesional en bienes raíces. Estamos conscientes que la tecnología ha cambiado el comportamiento de los compradores durante el proceso de comprar una casa. Hoy, el 92% de todos los compradores utilizan el internet para buscar su casa según the National Association of Realtors’

Cuando un propietario decide vender su casa; obviamente ellos quieren el mejor precio posible, con la menor cantidad de molestias. Sin embargo, para la gran mayoría de los vendedores, el resultado más importante es conseguir que realmente la casa sea vendida.

Para cumplir con estas tres metas, un vendedor debe darse cuenta de la importancia de emplear un profesional en bienes raíces. Estamos conscientes que la tecnología ha cambiado el comportamiento de los compradores durante el proceso de comprar una casa. Hoy, el 92% de todos los compradores utilizan el internet para buscar su casa según the National Association of Realtors’  Nuestro fundador, Steve Harney, ocasionalmente pide hacer un post personal en lo que él considera importante para nuestra industria. Hoy es uno de esos días. ¡Disfrute! – El equipo de KCM

Ayer, Zillow anuncio la adquisición de Trulia. Algunos expertos de la industria predicen el final de la actividad de bienes raíces de la forma que nosotros la conocemos. Ellos usan palabras como

Nuestro fundador, Steve Harney, ocasionalmente pide hacer un post personal en lo que él considera importante para nuestra industria. Hoy es uno de esos días. ¡Disfrute! – El equipo de KCM

Ayer, Zillow anuncio la adquisición de Trulia. Algunos expertos de la industria predicen el final de la actividad de bienes raíces de la forma que nosotros la conocemos. Ellos usan palabras como  Aquí hay cuatro buenas razones que considerar al comprar una casa hoy en vez de esperar.

Aquí hay cuatro buenas razones que considerar al comprar una casa hoy en vez de esperar.

De acuerdo con el último

De acuerdo con el último

We are pleased to have KCM Founder and Chief Content Creator, Steve Harney, do a personal post today. Enjoy!

That is what a headline announced in a CNNMoney

We are pleased to have KCM Founder and Chief Content Creator, Steve Harney, do a personal post today. Enjoy!

That is what a headline announced in a CNNMoney  New reports are revealing that the number of months’ inventory of existing homes available for sale is increasing. Some of these sellers are moving up, some are downsizing and others are making a lateral move.

There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead.

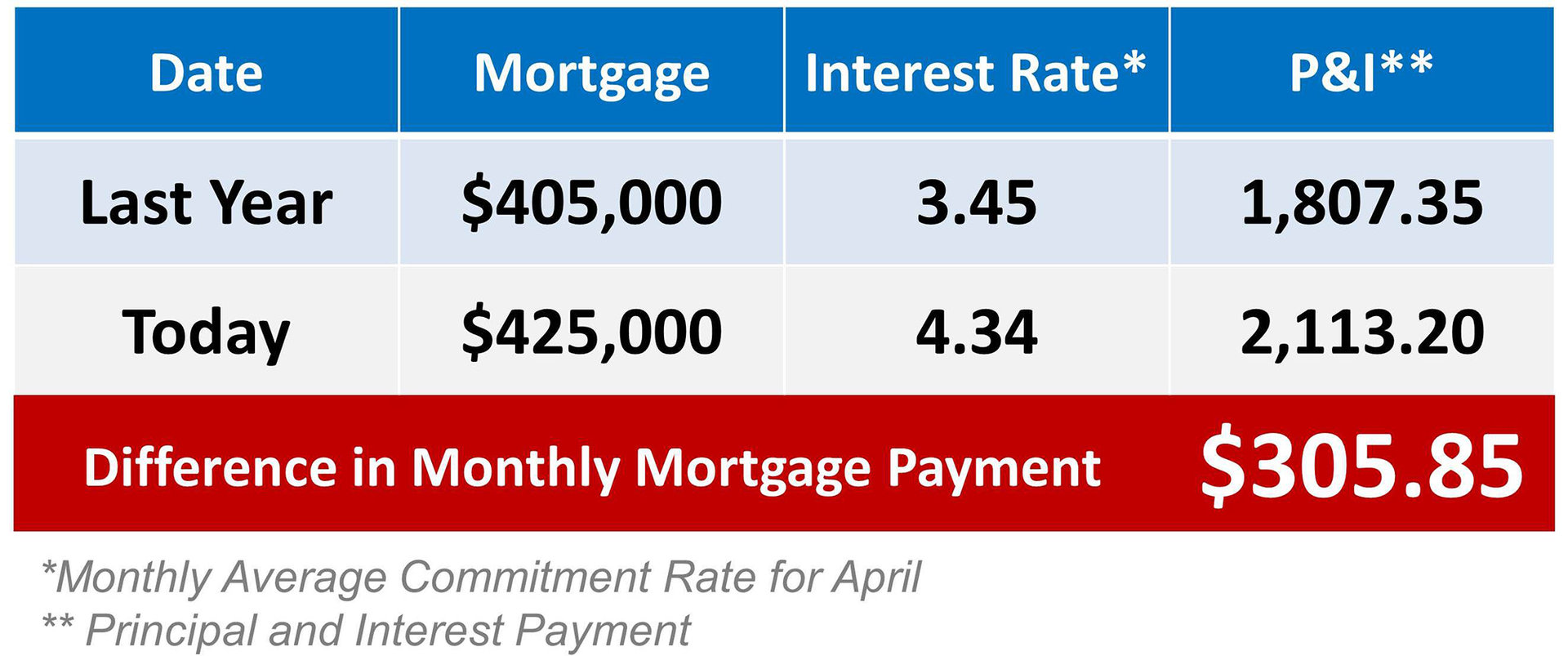

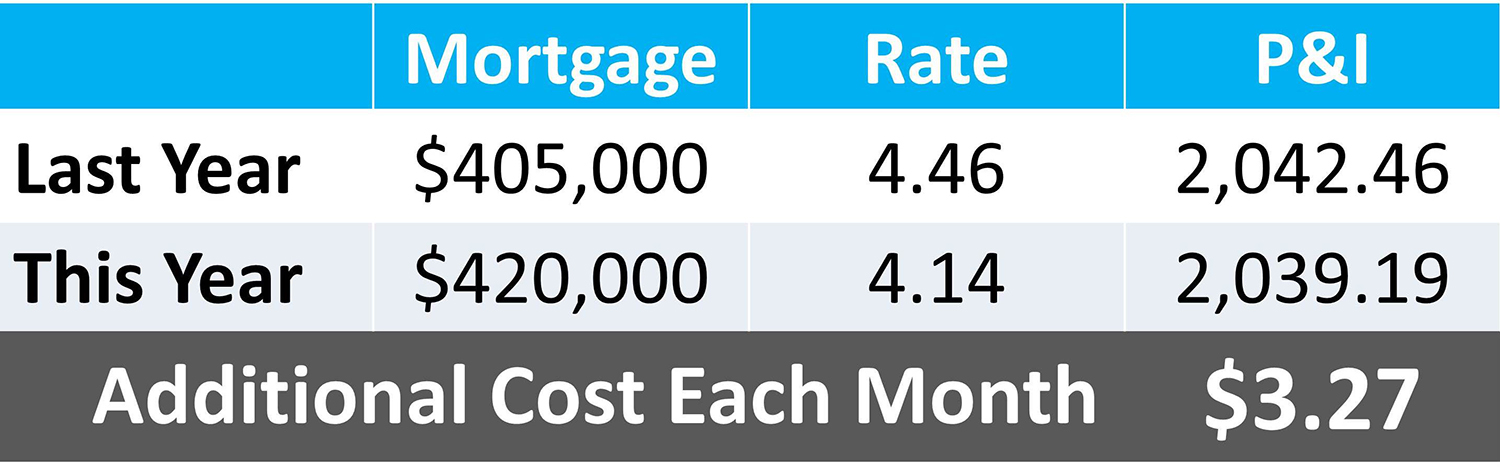

Assume, last year, they had a home worth $300,000 and were looking at a home for $450,000 (putting 10% down they would get a mortgage of $405,000). By waiting, their house appreciated by approximately 10% over the last year (national average based on the Case Shiller Pricing Index). Their home would now be worth $330,000. But, the $450,000 home would now be worth $495,000 (requiring a mortgage of $420,000 assuming the original $45,000 down plus the additional $30,000 from the sale of their home).

Here is a table showing what the difference in monthly cost (principal and interest) would be if a purchaser had waited:

New reports are revealing that the number of months’ inventory of existing homes available for sale is increasing. Some of these sellers are moving up, some are downsizing and others are making a lateral move.

There is no way for us to predict the future but we can look at what happened over the last year. Let’s look at buyers that considered moving up last year but decided to wait instead.

Assume, last year, they had a home worth $300,000 and were looking at a home for $450,000 (putting 10% down they would get a mortgage of $405,000). By waiting, their house appreciated by approximately 10% over the last year (national average based on the Case Shiller Pricing Index). Their home would now be worth $330,000. But, the $450,000 home would now be worth $495,000 (requiring a mortgage of $420,000 assuming the original $45,000 down plus the additional $30,000 from the sale of their home).

Here is a table showing what the difference in monthly cost (principal and interest) would be if a purchaser had waited:

We all realize that the best time to sell anything is when demand is high and the supply of that item is limited. The last two major reports issued by the National Association of Realtors (NAR) revealed information that suggests that now may be the best time to sell your house. Let’s look at the data covered by the latest

We all realize that the best time to sell anything is when demand is high and the supply of that item is limited. The last two major reports issued by the National Association of Realtors (NAR) revealed information that suggests that now may be the best time to sell your house. Let’s look at the data covered by the latest  Whether you are a first time buyer or a move-up buyer, you should look at the projections housing experts are making in two major areas: home prices and mortgage rates.

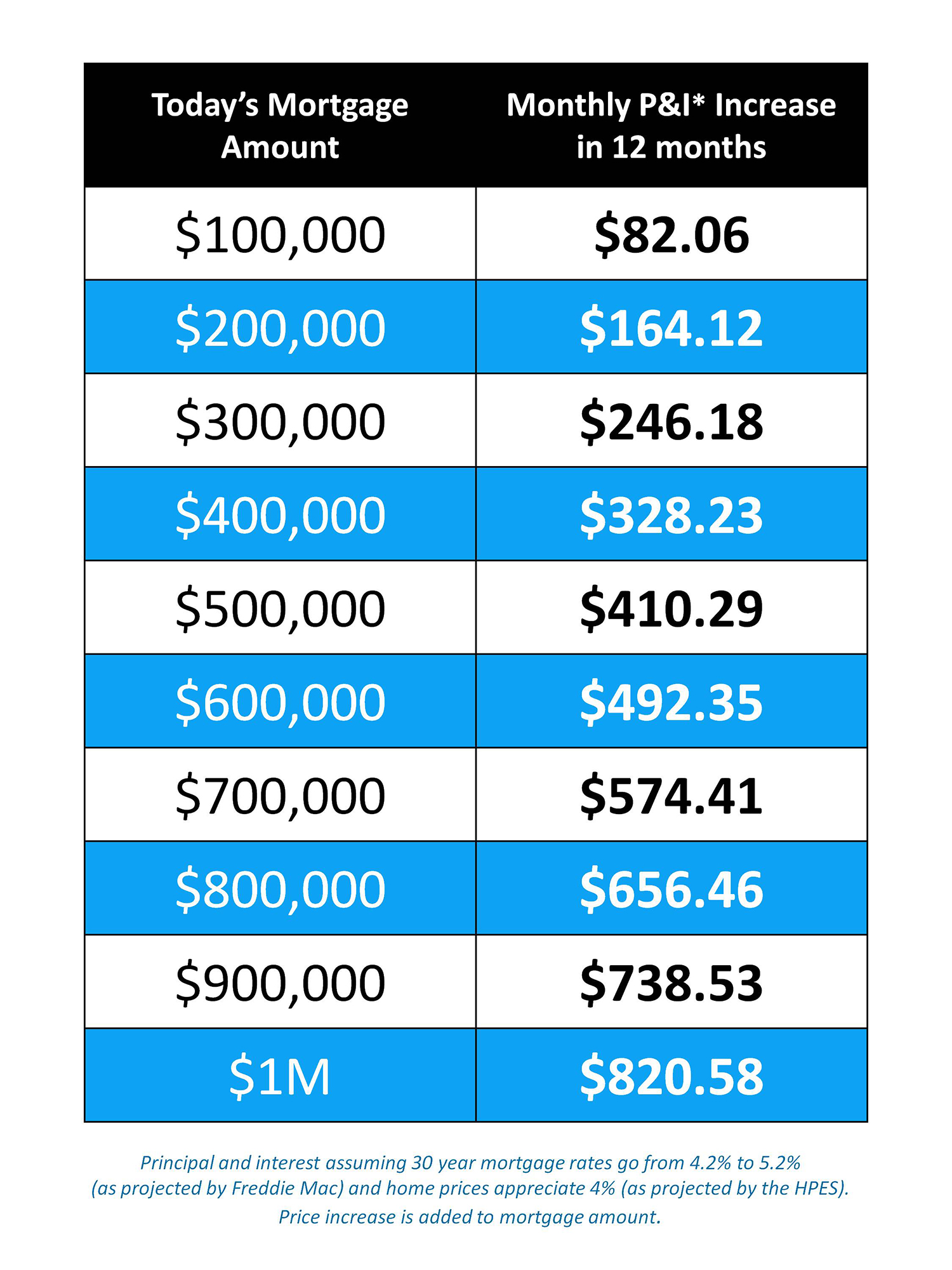

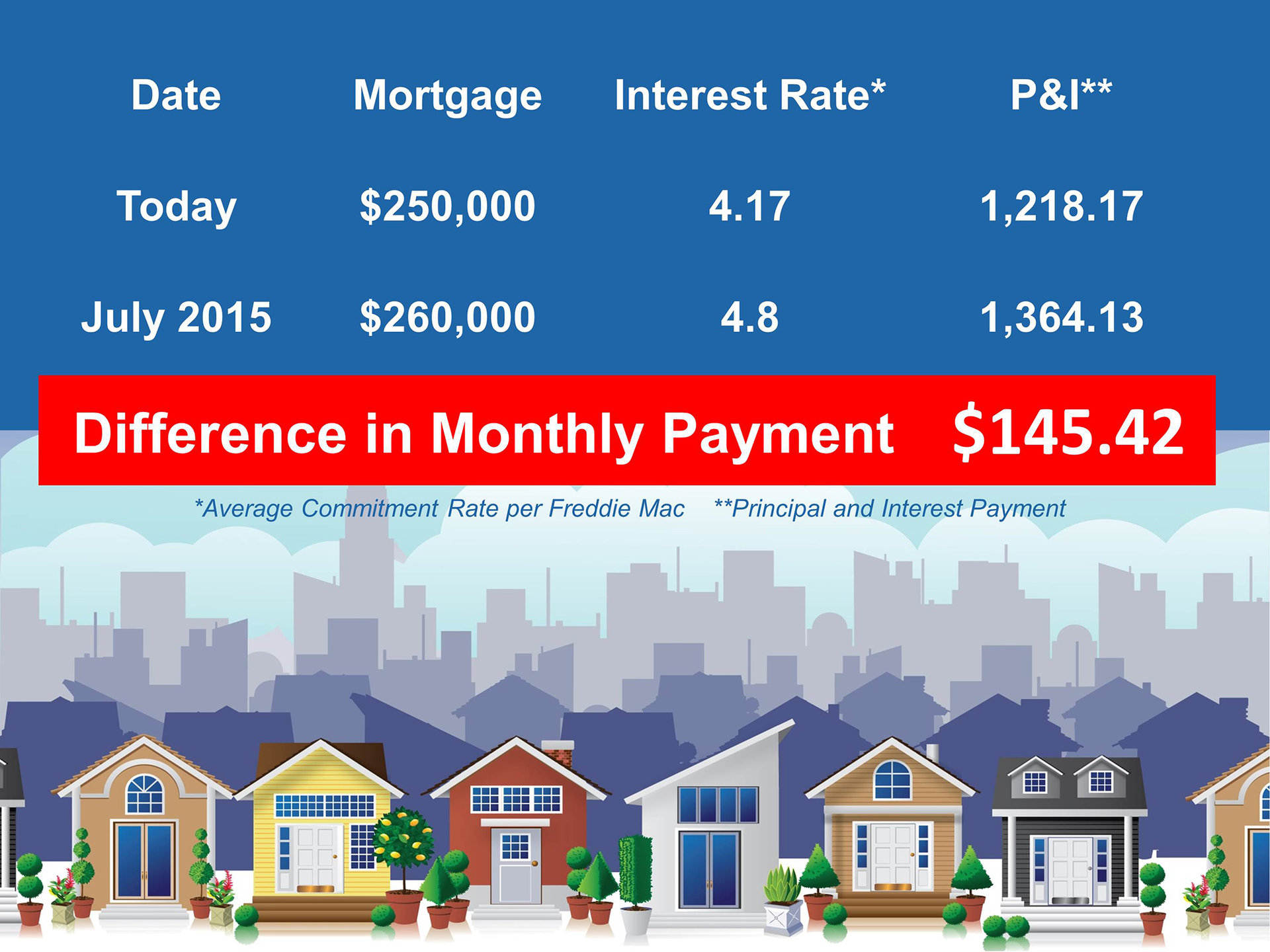

Whether you are a first time buyer or a move-up buyer, you should look at the projections housing experts are making in two major areas: home prices and mortgage rates.

Are you thinking of buying a home? Are you dreading having to walk through strangers’ houses? Are you concerned about getting the paperwork correct? Hiring a professional real estate agent can take away most of the challenges of buying. A great agent is always worth more than the commission they charge just like a great doctor or great accountant.

You want to deal with one of the best agents in your marketplace. To do this, you must be able to distinguish the average agent from the great one.

Here are the top 4 demands you need to make of your Real Estate Agent when buying a home:

Are you thinking of buying a home? Are you dreading having to walk through strangers’ houses? Are you concerned about getting the paperwork correct? Hiring a professional real estate agent can take away most of the challenges of buying. A great agent is always worth more than the commission they charge just like a great doctor or great accountant.

You want to deal with one of the best agents in your marketplace. To do this, you must be able to distinguish the average agent from the great one.

Here are the top 4 demands you need to make of your Real Estate Agent when buying a home:

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

There has been a lot written about how buying a home is less expensive than renting one in most parts of the country. Rents are skyrocketing and homes are still at great prices. These two situations are also causing some sellers to consider renting their home instead of selling it. After all, a homeowner can get great rental income now and perhaps wait until house values increase even further before selling.

This logic makes sense in some cases. There is a strong belief that residential real estate is a great investment right now. However, if you have no desire to actually become an educated investor in this sector, you may be headed for more trouble than you were looking for.

Before renting your home, you should answer the following questions to make sure this is the right course of action for you and your family.

There has been a lot written about how buying a home is less expensive than renting one in most parts of the country. Rents are skyrocketing and homes are still at great prices. These two situations are also causing some sellers to consider renting their home instead of selling it. After all, a homeowner can get great rental income now and perhaps wait until house values increase even further before selling.

This logic makes sense in some cases. There is a strong belief that residential real estate is a great investment right now. However, if you have no desire to actually become an educated investor in this sector, you may be headed for more trouble than you were looking for.

Before renting your home, you should answer the following questions to make sure this is the right course of action for you and your family.

Here are four great reasons to consider buying a home today, instead of waiting.

Here are four great reasons to consider buying a home today, instead of waiting.

American consumers’ perception of the residential real estate market was revealed in a recent

American consumers’ perception of the residential real estate market was revealed in a recent  Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

It's probably only natural for real estate agents to assume that most boomers or retirees bent on moving to a new city to enjoy their golden years will be on the trail to Florida, Arizona, or some other state blessed with warmth and plenty of sunshine. And those states are probably the ones best situated to offer plenty of age-in-place benefits, right?

Nope.

When a boomer or senior who's open-minded about where they wish to move and retire searches Google for the best cities to age in place or best cities to retire, they finds some spots that are a bit out of the norm, but quite intriguing nonetheless.

Places like Sioux Falls, SD; Provo, UT; Iowa City, IA; Bismarck, ND; Columbia, MO; Omaha, NE; Madison, WI; and Boston, MA top the list.

As adults 55+ begin to contemplate their future and plan for a possible move, they are hearing more and more about the importance of preparing to age-in-place. They already know they hope to live in their own home, independently, for as long as possible. And the cities listed above – plus many other non-traditional retirement options – are receiving plenty of attention as go-to spots for their aging-in-place benefits in the form of quality healthcare, accessible transportation, government initiatives in building the city as senior-friendly, and a number of other indexes.

The Milken Institute, a non-partisan think tank, compiled a list in 2012 of the 259 Best Cities to Age Successfully. Another ranking is due later this summer of 2014. It divided the rankings into "Large Metros" and 'Small Metros," with Provo, Utah topping the Large City list and Sioux Falls the Small City rankings.

Others in the Top 10 of Large Cities to Age Successfully include Pittsburgh, Toledo, Des Moines, Salt Lake City, and Washington D.C.

Others in the Top 10 of Small Cities to Age Successfully include Rochester, MN, Ann Arbor, MI, Missoula, MT, Durham-Chapel Hill, NC, and Gainesville, FL.

See the entire list here and learn more about the Milken Institute's approach to promoting aging-in-place awareness:

It's probably only natural for real estate agents to assume that most boomers or retirees bent on moving to a new city to enjoy their golden years will be on the trail to Florida, Arizona, or some other state blessed with warmth and plenty of sunshine. And those states are probably the ones best situated to offer plenty of age-in-place benefits, right?

Nope.

When a boomer or senior who's open-minded about where they wish to move and retire searches Google for the best cities to age in place or best cities to retire, they finds some spots that are a bit out of the norm, but quite intriguing nonetheless.

Places like Sioux Falls, SD; Provo, UT; Iowa City, IA; Bismarck, ND; Columbia, MO; Omaha, NE; Madison, WI; and Boston, MA top the list.

As adults 55+ begin to contemplate their future and plan for a possible move, they are hearing more and more about the importance of preparing to age-in-place. They already know they hope to live in their own home, independently, for as long as possible. And the cities listed above – plus many other non-traditional retirement options – are receiving plenty of attention as go-to spots for their aging-in-place benefits in the form of quality healthcare, accessible transportation, government initiatives in building the city as senior-friendly, and a number of other indexes.

The Milken Institute, a non-partisan think tank, compiled a list in 2012 of the 259 Best Cities to Age Successfully. Another ranking is due later this summer of 2014. It divided the rankings into "Large Metros" and 'Small Metros," with Provo, Utah topping the Large City list and Sioux Falls the Small City rankings.

Others in the Top 10 of Large Cities to Age Successfully include Pittsburgh, Toledo, Des Moines, Salt Lake City, and Washington D.C.

Others in the Top 10 of Small Cities to Age Successfully include Rochester, MN, Ann Arbor, MI, Missoula, MT, Durham-Chapel Hill, NC, and Gainesville, FL.

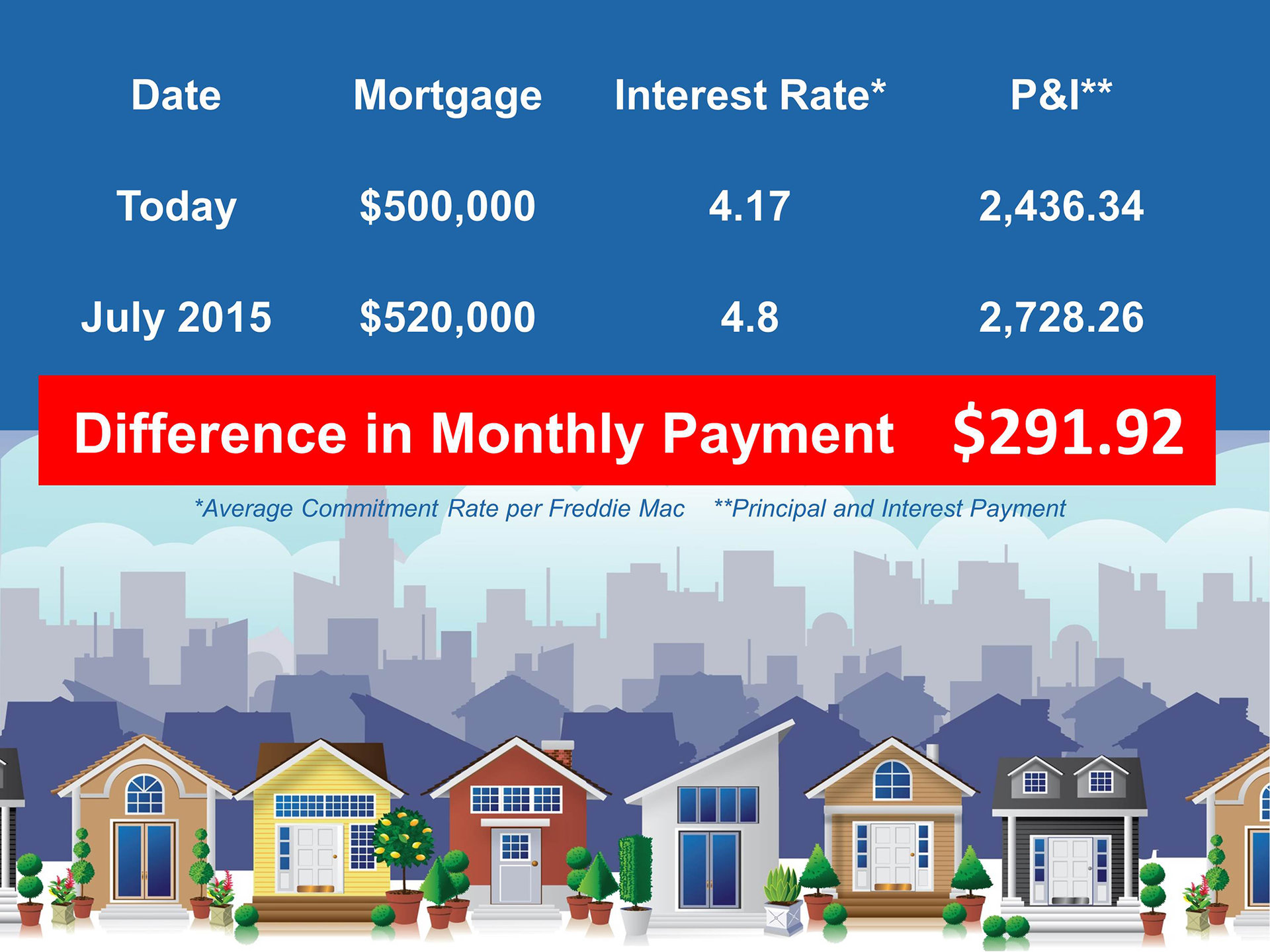

See the entire list here and learn more about the Milken Institute's approach to promoting aging-in-place awareness:  Many experts are currently discussing a variety of topics such as real estate as an investment, the movement on mortgage interest rates and reasons to buy now instead of waiting. It is important that we realize that this does not apply solely to the first time home buyer.

The opportunity that exists in real estate today is there for everyone.

However, the family that already owns a home might be thinking that, if they wait, their home could be worth more next year than it is now. And that may cause them to delay moving up to the home of their dreams thinking it makes good financial sense. Actually, the opposite is true. This is the best chance a family has to buy up into the home that makes sense for their family right now.

We must realize that whatever percentage of value we gain on our house will also be gained on our dream home.

Let’s assume your current home is worth $500,000. Your house will be worth $520,000 next year if prices rise by 4% over that time (a number projected by the Home Price Expectation Survey).

However, the $750,000 home you are hoping to move into will also appreciate by about that same 4%. That means next year it will be valued at $780,000. You wouldn’t make $20,000 by waiting. You would actually be losing $10,000 ($30,000 - $20,000).

And, you will pay a lower interest rate on the mortgage than you probably will next year.

Plug in the numbers that apply to your house and the home you are longing to buy and see what the bottom line turns out to be for you.

That is how wealth is built in this country - by purchasing real estate at the right time, at the right price and at the right terms.

Go out and find your family's dream house and buy it! Ten years from now, you will be glad you did!

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => Para los compradores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)

Many experts are currently discussing a variety of topics such as real estate as an investment, the movement on mortgage interest rates and reasons to buy now instead of waiting. It is important that we realize that this does not apply solely to the first time home buyer.

The opportunity that exists in real estate today is there for everyone.

However, the family that already owns a home might be thinking that, if they wait, their home could be worth more next year than it is now. And that may cause them to delay moving up to the home of their dreams thinking it makes good financial sense. Actually, the opposite is true. This is the best chance a family has to buy up into the home that makes sense for their family right now.

We must realize that whatever percentage of value we gain on our house will also be gained on our dream home.

Let’s assume your current home is worth $500,000. Your house will be worth $520,000 next year if prices rise by 4% over that time (a number projected by the Home Price Expectation Survey).

However, the $750,000 home you are hoping to move into will also appreciate by about that same 4%. That means next year it will be valued at $780,000. You wouldn’t make $20,000 by waiting. You would actually be losing $10,000 ($30,000 - $20,000).

And, you will pay a lower interest rate on the mortgage than you probably will next year.

Plug in the numbers that apply to your house and the home you are longing to buy and see what the bottom line turns out to be for you.

That is how wealth is built in this country - by purchasing real estate at the right time, at the right price and at the right terms.

Go out and find your family's dream house and buy it! Ten years from now, you will be glad you did!

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => Para los compradores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)  A recent

A recent