New Search

If you are not happy with the results below please do another search

1623 search results for: today is the day

Most homeowners believe that the winter is not a good time to sell. This belief is based on the fact that historically the number of buyers decreases in the winter and then increases dramatically during the spring buying market. Though this is st...

- Home values will appreciate by 4.8% in 2014.

- The cumulative appreciation will be 23.5% by 2019.

- That means the average annual appreciation will be 3.6% over the next 5 years.

- Even the experts making up the most bearish quartile of the survey still are projecting a cumulative appreciation of 15.1% by 2019.

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey

- Home values will appreciate by 4.8% in 2014.

- The cumulative appreciation will be 23.5% by 2019.

- That means the average annual appreciation will be 3.6% over the next 5 years.

- Even the experts making up the most bearish quartile of the survey still are projecting a cumulative appreciation of 15.1% by 2019.

Where Are Prices Headed Over the Next 5 Years?

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real esta...

Harvard’s 5 Financial Reasons to Buy a Home

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year, he released a paper on homeown...

Fear of Low Down Payments Mostly Unwarranted

After it was announced that Fannie Mae and Freddie Mac would again make available mortgage loans requiring as little as a 3% down payment, many people showed concern. Were we going back to the lower qualifying standards of a decade ago that cause...

Happy Veterans Day!

Thank you for your service!...

Debunking 4 Myths about Buying a Home

A recent study by the Joint Center for Housing Studies at Harvard University revealed when renters were asked why they do no plan to own in the future, financial constraints were a more common response than the perceived lifestyle benefits they m...

- The buyer who wants the best deal possible

- The buyer’s agent who solely represents the best interest of the buyer

- The buyer’s attorney (in some parts of the country)

- The home inspection companies which work for the buyer and will almost always find some problems with the house

- The appraiser if there is a question of value

- Your bank in the case of a short sale

2. Exposure to Prospective Purchasers

Recent studies have shown that 92% of buyers search online for a home. That is in comparison to only 28% looking at print newspaper ads. Most real estate agents have an extensive internet strategy to promote the sale of your home. Do you?3. Actual Results also come from the Internet

Where do buyers find the home they actually purchased?- 43% on the internet

- 9% from a yard sign

- 1% from newspapers

4. FSBOing has Become More and More Difficult

The paperwork involved in selling and buying a home has increased dramatically as industry disclosures and regulations have become mandatory. This is one of the reasons that the percentage of people FSBOing has dropped from 19% to 9% over the last 20+ years.5. You Net More Money when Using an Agent

Many homeowners believe that they will save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real commission. The seller and buyer can’t both save the same commission. Studies have shown that the typical house sold by the homeowner sells for $184,000 while the typical house sold by an agent sells for $230,000. This doesn’t mean that an agent can get $46,000 more for your home as studies have shown that people are more likely to FSBO in markets with lower price points. However, it does show that selling on your own might not make sense.Bottom Line

Before you decide to take on the challenges of selling your house on your own, sit with a real estate professional in your marketplace and see what they have to offer. [created_at] => 2014-11-03T06:00:10Z [description] => Some homeowners may consider trying to sell their home on without the assistance of a real estate professional, known in the industry as a For Sale by Owner (FSBO). We think there are several reasons this might not be a good idea for the vast maj... [expired_at] => [featured_image] => https:/// [id] => 164 [published_at] => 2014-11-03T10:00:10Z [related] => Array ( ) [slug] => 5-reasons-you-shouldnt-for-sale-by-owner-3 [status] => published [tags] => Array ( ) [title] => 5 Reasons You Shouldn’t For Sale by Owner [updated_at] => 2014-11-03T15:01:25Z [url] => /2014/11/03/5-reasons-you-shouldnt-for-sale-by-owner-3/ )5 Reasons You Shouldn’t For Sale by Owner

Some homeowners may consider trying to sell their home on without the assistance of a real estate professional, known in the industry as a For Sale by Owner (FSBO). We think there are several reasons this might not be a good idea for the vast maj...

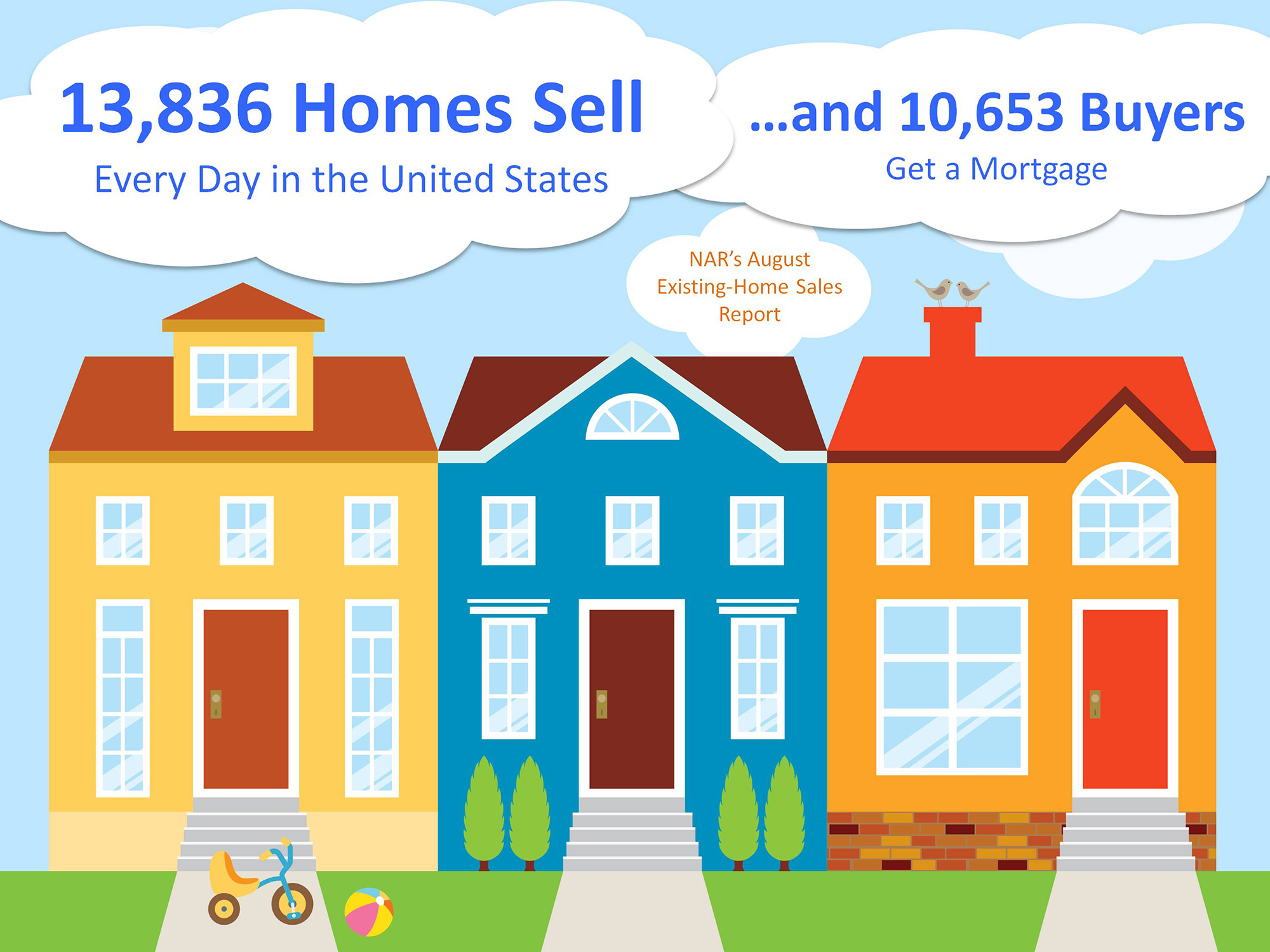

14,164 Homes Sold Yesterday! Did Yours?

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet this fall, maybe it's not priced pr...

- A good place to raise children and for them to get a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of the space

2. Where are home values headed?

When looking at future housing values, Home Price Expectation Survey provides a fair assessment. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number. Here is what the experts projected in the latest survey:- Home values will appreciate by 4% in 2015.

- The cumulative appreciation will be 19.5% by 2018.

- Even the experts making up the most bearish quartile of the survey still are projecting a cumulative appreciation of over 11.2% by 2018.

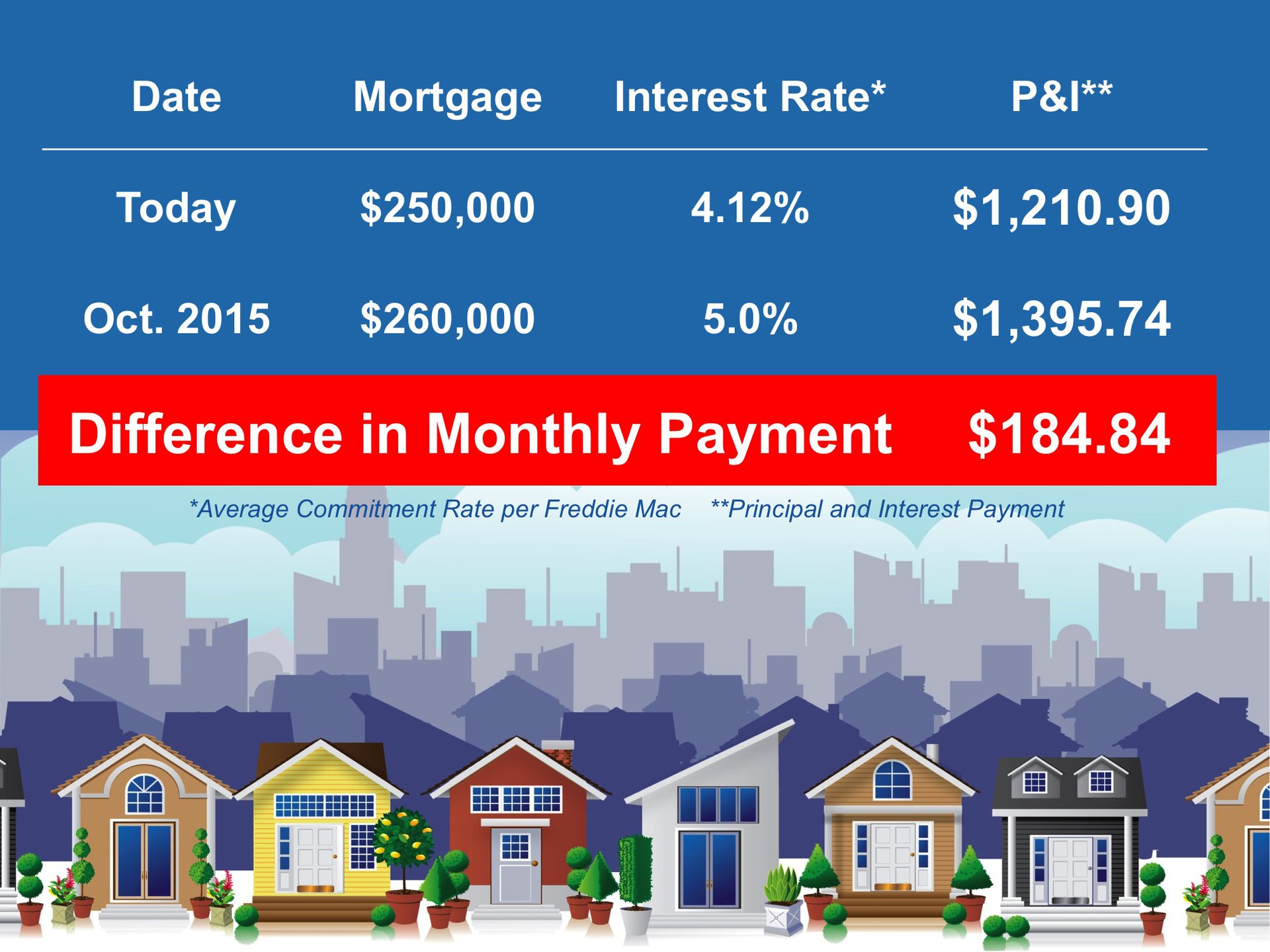

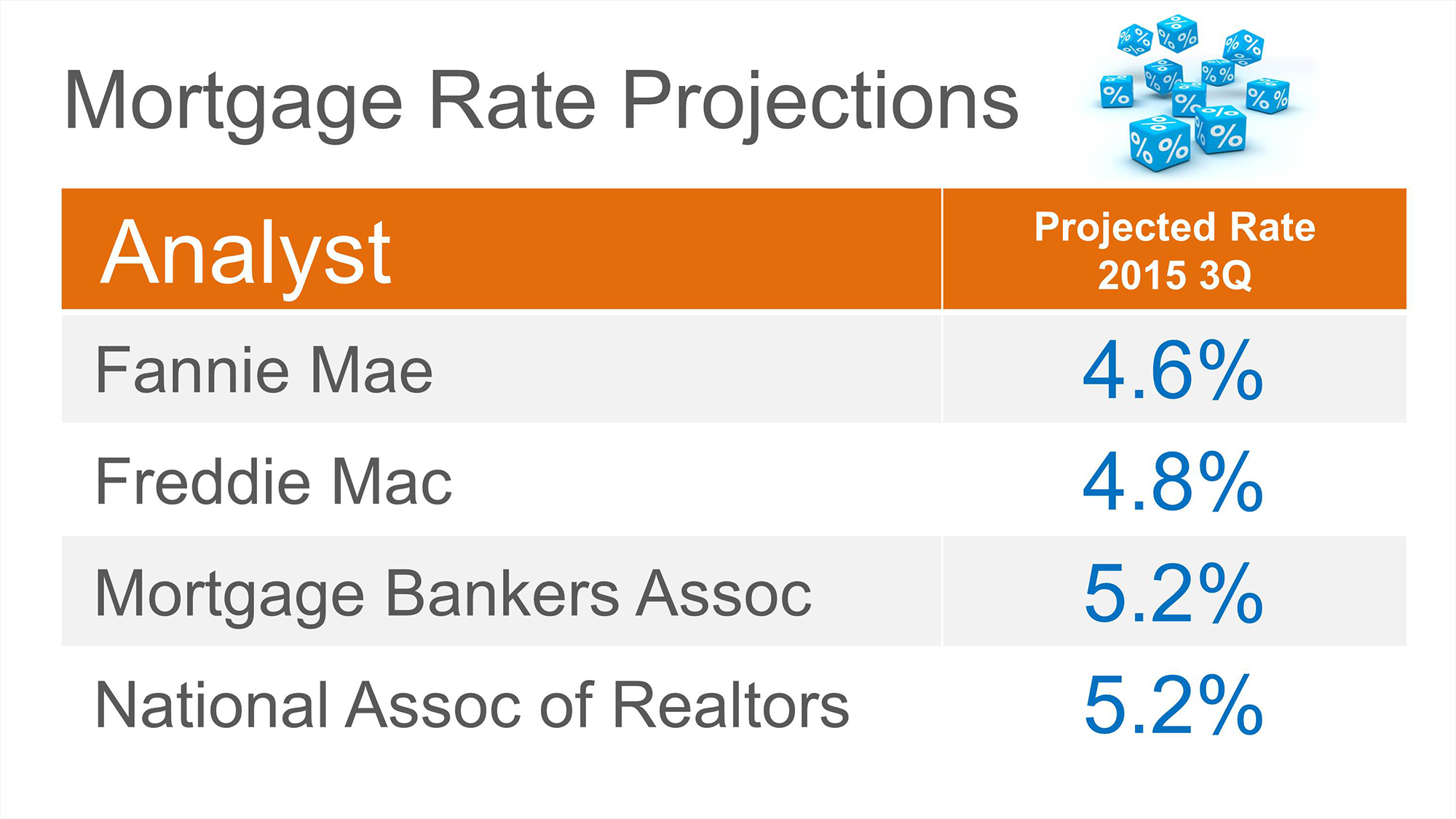

3. Where are mortgage interest rates headed?

A buyer must be concerned about more than just prices. The ‘long term cost’ of a home can be dramatically impacted by an increase in mortgage rates. The Mortgage Bankers Association (MBA), the National Association of Realtors, Fannie Mae and Freddie Mac have all projected that mortgage interest rates will increase by approximately one full percentage over the next twelve months.Bottom Line

Only you and your family can know for certain the right time to purchase a home. Answering these questions will help you make that decision. [created_at] => 2014-10-27T06:00:03Z [description] => If you are thinking about purchasing a home right now, you are surely getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in real est... [expired_at] => [featured_image] => https:/// [id] => 159 [published_at] => 2014-10-27T10:00:03Z [related] => Array ( ) [slug] => 3-questions-to-ask-before-buying-a-home-2 [status] => published [tags] => Array ( ) [title] => 3 Questions to Ask Before Buying a Home [updated_at] => 2014-10-28T19:34:02Z [url] => /2014/10/27/3-questions-to-ask-before-buying-a-home-2/ )3 Questions to Ask Before Buying a Home

If you are thinking about purchasing a home right now, you are surely getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in real est...

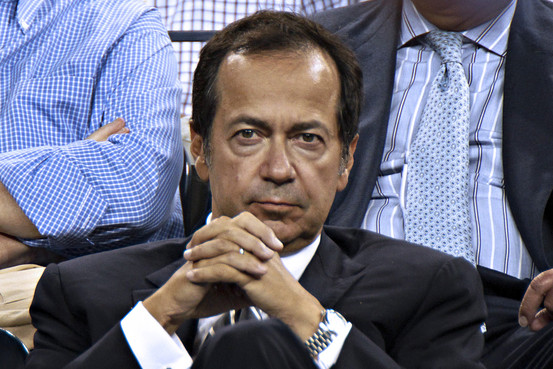

Billionaire Says Real Estate is Best Investment Possible

Billionaire money manager John Paulson was interviewed at the Delivering Alpha Conference presented by CNBC and Institutional Investor. During his session he boldly stated:

"I still think, from an individual perspective, the best deal investment...

5 Demands to Make on Your Real Estate Agent

Are you thinking of selling your house? Are you dreading having to deal with strangers walking through the house? Are you concerned about getting the paperwork correct? Hiring a professional real estate agent can take away most of the challenges of s...

- Homes sold by agents typically sell at a higher price

- Homes sold by agents typically spend less time on the market

- An agent will help you determine the best pricing for the house

- An agent will market the home

- An agent will be your advocate throughout the process

Do you really need an agent to sell your house in today’s market? Here’s what Fannie Mae suggests to sellers on the Know Your Options section of their website:

Do you really need an agent to sell your house in today’s market? Here’s what Fannie Mae suggests to sellers on the Know Your Options section of their website:

“Select how you'll market and list the home (e.g., with a real estate agent or for sale by owner). There are pros and cons to each, but unless you are experienced at selling homes, it usually makes financial sense to get professional help—homes sold by agents typically sell at a higher price and spend less time on the market. An agent will also help you determine the best pricing for the house, they'll market the home, and they'll be your advocate throughout the process.”

Let’s go over the points they made:

- Homes sold by agents typically sell at a higher price

- Homes sold by agents typically spend less time on the market

- An agent will help you determine the best pricing for the house

- An agent will market the home

- An agent will be your advocate throughout the process

Fannie Mae Agrees: Hire a Pro to Sell Your House

Do you really need an agent to sell your house in today’s market? Here’s what Fannie Mae suggests to sellers on the Know Your Options section of their website:

“Select how you'll market and list the home (e.g., with a real estate agent or for sa...

A Home’s Cost vs. Price Explained

In real estate there is a difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first time or repeat buyer, you must not be concern...

Buying a Home? Don't Let Fear Get in Your Way

Today we are excited to have Steve Harney, the Founder & Chief Content Creator for Keeping Current Matters as our guest blogger. Steve has over 30 years experience in real estate and is a trusted & sought after speaker. Enjoy!

Last week, ...

- 8.3 million new Millennial (Gen Y) households will form in the next five years

- $1.6 trillion will be spent on home purchases by Millennials and $600 billion on rent over the next five years

Millennials optimistic about their finances and homeownership

Of those surveyed:- 74% expect to move within the next five years

- 79% expect their financial situation to improve

- 75% believe homeownership is an important long-term goal

- 73% believe homeownership is an excellent investment

- 24% already own their home and

- An additional 60% plan to buy a home in the future

- 44% do think it would be difficult to qualify for a mortgage

What about the next generation (today’s teenagers)?

A recent survey by Better Homes and Gardens® revealed that Generation Z (teens ages 13-17) is very traditional in their views toward homeownership and is willing to sacrifice to attain the American Dream. Findings from the survey show:- 82% of Gen Z teens indicate that homeownership is the most important factor in achieving the American Dream.

- 89% said owning a home is part of their interpretation of the American Dream

- 97% believe they will own a home

- 77% percent chose owning a home over owning a business

Bottom Line

It seems that the belief that homeownership as a huge part of the American Dream still beats in the hearts of the young people of this country. [created_at] => 2014-10-01T06:00:24Z [description] => Two recently released reports indicate that both young adults (Millennials) and teenagers (Generation Z) still see homeownership as an important piece of their future success. A report by The Demand Institute, Millennials and Their Homes: Stil... [expired_at] => [featured_image] => https:/// [id] => 141 [published_at] => 2014-10-01T10:00:24Z [related] => Array ( ) [slug] => future-homeowners-share-american-dream [status] => published [tags] => Array ( ) [title] => Future Homeowners Share American Dream [updated_at] => 2014-10-01T14:18:26Z [url] => /2014/10/01/future-homeowners-share-american-dream/ )Future Homeowners Share American Dream

Two recently released reports indicate that both young adults (Millennials) and teenagers (Generation Z) still see homeownership as an important piece of their future success.

A report by The Demand Institute, Millennials and Their Homes: Stil...

Homeownership: A Few Stats and Quotes

2014 American Express Spending & Saving Tracker

“About two-thirds (65%) of homeowners say they are confident they would get the asking price for their home if they were to put it on the market today (up from 40% in 2010).”

Financial Security ...

- FICO credit score from Fair Isaac Corporation/myfico.com, range 300 to 850

- Plus Score from Experian, range 320 to 830

- Trans Risk Score from TransUnion, range 300 to 850

- Equifax Credit Score from Equifax, range 300 to 850

- Vantage Score from all three bureaus, two ranges, 300 to 850 and 501-990

What is a FICO Score?

In 1958, Bill Fair and Earl Isaac, a mathematician and engineer, formed a company in San Rafael, California. They created tools to help risk managers make a better decision when taking financial risk. Today, 90 percent of all lenders use the FICO score, first created in 1989 by Fair Isaac, and it’s the only score Fannie Mae and Freddie Mac, the Federal Housing Agency and Veterans Affairs will accept in underwriting loans they guarantee.What is a Consumer Score?

The three credit bureaus, in their understanding of the credit scoring model created by FICO, decided to create their own scoring models, and in 2004 – 2006 they unveiled the “consumer” scores: Plus Score, Trans Risk Score, Equifax Credit Score, and Vantage Score. However, these are not genuine FICO scores, and mortgage lenders don’t use them. Consider this comparison: Would you buy a watch that gives the approximate time of day? The three credit bureaus work with major financial institutions, professional organizations, comparison sites, personal finance businesses, clubs such as Costco, AAA, Sam’s Club, and many data-mining brokers to bombard consumers in the race of the free credit score mania, all with the enticement of a “consumer” score that is not used by lenders, in hopes of obtaining subscriptions or fees from consumers. Fees that are totally unnecessary!Know Your Score

Gaining access to one’s own credit report and credit score prior to loan approval with no strings attached could be helpful, and at all times beneficial. With little effort, inaccuracy of information can be instantly corrected at the credit bureau level, and with a few simple steps, credit scores could be enhanced. For example, paying down revolving account balances before a creditor’s statement-ending date (the creditor later updates account information with the credit bureaus), thus reducing revolving account balances at a particular point in time, will positively add more points to a score. It’s priceless.More Information

Consumers have a legal right to access their annual credit report at no charge once a year from annualcreditreport.com, a site sponsored by the three major credit bureaus: Experian, Equifax and TransUnion. These reports provide all the basic consumer data, but do not reveal a credit score. If you have a need for the FICO credit score that is actually used by mortgage lenders, myfico.com is the website to visit. For $19.95 per bureau, consumers can purchase a customized credit report with a genuine FICO score. Additional websites to visit: the Federal Trade Commission (ftc.gov) and the Consumer Financial Protection Bureau (cfpb.gov) for true answers to questions about any financial concepts, financial products, dispute and complaint submissions, and much more. Today’s homebuyer has instant access to answers. To be relevant in today’s market, real estate professionals need to know the absolute correct response to basic credit questions. It’s important. Copyright 2014 Nabil Captan, Captan & Company. All rights reserved. [assets] => Array ( ) [can_share] => no [categories] => Array ( [0] => stdClass Object ( [category_type] => standard [children] => [created_at] => 2019-06-03T18:18:43Z [id] => 5 [name] => For Buyers [parent] => [parent_id] => [published_at] => 2019-06-03T18:18:43Z [slug] => buyers [status] => public [translations] => stdClass Object ( [es] => stdClass Object ( [name] => Para los compradores ) ) [updated_at] => 2019-06-03T18:18:43Z ) [1] => stdClass Object ( [category_type] => standard [children] => [created_at] => 2019-06-03T18:18:43Z [id] => 6 [name] => For Sellers [parent] => [parent_id] => [published_at] => 2019-06-03T18:18:43Z [slug] => sellers [status] => public [translations] => stdClass Object ( [es] => stdClass Object ( [name] => Para los vendedores ) ) [updated_at] => 2019-06-03T18:18:43Z ) ) [content_type] => blog [contents] => Today we are excited to have Nabil Captan as our guest blogger. Nabil is a nationally recognized credit scoring expert, educator, author and producer. In today’s post, he explains how what you don’t know about your credit score could end up costing you. Enjoy!

Informed consumers considering a home purchase today want to do the right thing and plan ahead. Many do not seek immediate professional guidance from a Realtor or a mortgage loan officer. Instead, they hunt for hours online, looking at numerous websites for available homes for sale. They also consult websites to find the best interest rate and terms for future monthly mortgage payments. Many consumers feel betrayed, cheated and at times embarrassed to learn that the credit scores they counted on, to get that specific interest rate for their loan, are not used by mortgage lenders.

When shopping for a good mortgage interest rate, consumers also need to know their credit score, and utilize an online mortgage calculator to compute future monthly mortgage payments. A Google search for “credit score” will yield hundreds of results. The consumer accepts the provider’s terms and conditions to get a free credit score. Terrific! Unaware that in exchange they just received a meaningless credit score that lenders never use. They also handed over their Non-Public Personal Information (NPPI) to that credit score provider for life.

Before we go any further, let’s look at available credit scoring products available to consumers today:

Today we are excited to have Nabil Captan as our guest blogger. Nabil is a nationally recognized credit scoring expert, educator, author and producer. In today’s post, he explains how what you don’t know about your credit score could end up costing you. Enjoy!

Informed consumers considering a home purchase today want to do the right thing and plan ahead. Many do not seek immediate professional guidance from a Realtor or a mortgage loan officer. Instead, they hunt for hours online, looking at numerous websites for available homes for sale. They also consult websites to find the best interest rate and terms for future monthly mortgage payments. Many consumers feel betrayed, cheated and at times embarrassed to learn that the credit scores they counted on, to get that specific interest rate for their loan, are not used by mortgage lenders.

When shopping for a good mortgage interest rate, consumers also need to know their credit score, and utilize an online mortgage calculator to compute future monthly mortgage payments. A Google search for “credit score” will yield hundreds of results. The consumer accepts the provider’s terms and conditions to get a free credit score. Terrific! Unaware that in exchange they just received a meaningless credit score that lenders never use. They also handed over their Non-Public Personal Information (NPPI) to that credit score provider for life.

Before we go any further, let’s look at available credit scoring products available to consumers today:

- FICO credit score from Fair Isaac Corporation/myfico.com, range 300 to 850

- Plus Score from Experian, range 320 to 830

- Trans Risk Score from TransUnion, range 300 to 850

- Equifax Credit Score from Equifax, range 300 to 850

- Vantage Score from all three bureaus, two ranges, 300 to 850 and 501-990

What is a FICO Score?

In 1958, Bill Fair and Earl Isaac, a mathematician and engineer, formed a company in San Rafael, California. They created tools to help risk managers make a better decision when taking financial risk. Today, 90 percent of all lenders use the FICO score, first created in 1989 by Fair Isaac, and it’s the only score Fannie Mae and Freddie Mac, the Federal Housing Agency and Veterans Affairs will accept in underwriting loans they guarantee.What is a Consumer Score?

The three credit bureaus, in their understanding of the credit scoring model created by FICO, decided to create their own scoring models, and in 2004 – 2006 they unveiled the “consumer” scores: Plus Score, Trans Risk Score, Equifax Credit Score, and Vantage Score. However, these are not genuine FICO scores, and mortgage lenders don’t use them. Consider this comparison: Would you buy a watch that gives the approximate time of day? The three credit bureaus work with major financial institutions, professional organizations, comparison sites, personal finance businesses, clubs such as Costco, AAA, Sam’s Club, and many data-mining brokers to bombard consumers in the race of the free credit score mania, all with the enticement of a “consumer” score that is not used by lenders, in hopes of obtaining subscriptions or fees from consumers. Fees that are totally unnecessary!Know Your Score

Gaining access to one’s own credit report and credit score prior to loan approval with no strings attached could be helpful, and at all times beneficial. With little effort, inaccuracy of information can be instantly corrected at the credit bureau level, and with a few simple steps, credit scores could be enhanced. For example, paying down revolving account balances before a creditor’s statement-ending date (the creditor later updates account information with the credit bureaus), thus reducing revolving account balances at a particular point in time, will positively add more points to a score. It’s priceless.More Information

Consumers have a legal right to access their annual credit report at no charge once a year from annualcreditreport.com, a site sponsored by the three major credit bureaus: Experian, Equifax and TransUnion. These reports provide all the basic consumer data, but do not reveal a credit score. If you have a need for the FICO credit score that is actually used by mortgage lenders, myfico.com is the website to visit. For $19.95 per bureau, consumers can purchase a customized credit report with a genuine FICO score. Additional websites to visit: the Federal Trade Commission (ftc.gov) and the Consumer Financial Protection Bureau (cfpb.gov) for true answers to questions about any financial concepts, financial products, dispute and complaint submissions, and much more. Today’s homebuyer has instant access to answers. To be relevant in today’s market, real estate professionals need to know the absolute correct response to basic credit questions. It’s important. Copyright 2014 Nabil Captan, Captan & Company. All rights reserved. [created_at] => 2014-09-24T06:00:28Z [description] => Today we are excited to have Nabil Captan as our guest blogger. Nabil is a nationally recognized credit scoring expert, educator, author and producer. In today’s post, he explains how what you don’t know about your credit score could end up costi... [expired_at] => [featured_image] => https:/// [id] => 136 [published_at] => 2014-09-24T10:00:28Z [related] => Array ( ) [slug] => what-you-dont-know-about-your-credit-score-could-cost-you [status] => published [tags] => Array ( ) [title] => What You Don't Know About Your Credit Score... Could Cost You! [updated_at] => 2014-10-08T15:14:43Z [url] => /2014/09/24/what-you-dont-know-about-your-credit-score-could-cost-you/ )What You Don't Know About Your Credit Score... Could Cost You!

Today we are excited to have Nabil Captan as our guest blogger. Nabil is a nationally recognized credit scoring expert, educator, author and producer. In today’s post, he explains how what you don’t know about your credit score could end up costi...

- 30% of respondents believe that only individuals with high incomes can obtain a mortgage

- 64% of respondents believe they must have a “very good” credit score to buy a home

- 44% believe that a 20% down payment is required

“Did you know 40 percent of today's homebuyers using mortgage financing are making down payments that are less than 10 percent? And how about this: since 2010, the number of people putting down less than 10 percent for conventional loans has grown three fold. So, not only are low down payment options real, they represent a significant portion of today's purchases.”In a separate Executive Perspectives, Christina Boyle, Freddie Mac’s VP and Head of Single-Family Sales & Relationship Management explained further:

- A person “can get a conforming, conventional mortgage with a down payment of as little as 5 percent (sometimes with as little as 3 percent coming out of their own pockets)”.

- Qualified borrowers can further reduce the down payment coming out of their own pockets to 3 percent by lining up gifts from family, grants or loans from non-profits or public agencies.

Education is the Key

Boyle talked about the importance of educating potential buyers:“Letting more consumers know how down payments are determined could bring more qualified borrowers off the sidelines. Depending on their credit history and other factors, many borrowers can expect to make a down payment of about 5 or 10 percent.”Codel agreed:

“It is important for prospective homebuyers to feel empowered to ask lenders and real estate agents questions about available options, such as down payment assistance or FHA loan programs or VA loans for veterans.”

Bottom Line

If you are saving for either your first home or that perfect move-up dream house, make sure you know all your options. You may be pleasantly surprised. [created_at] => 2014-09-23T06:00:09Z [description] => In a recent survey, How America Views Homeownership, it was revealed that 68% of Americans feel that now is a good time to buy a home and 95%said they want to own a home if they don’t already. Franklin Codel, head of Wells Fargo home mortgagep... [expired_at] => [featured_image] => https:/// [id] => 135 [published_at] => 2014-09-23T10:00:09Z [related] => Array ( ) [slug] => the-truth-about-buying-a-home-you-dont-need-20-down [status] => published [tags] => Array ( ) [title] => The Truth About Buying a Home: You DON'T Need 20% Down [updated_at] => 2014-09-23T13:23:07Z [url] => /2014/09/23/the-truth-about-buying-a-home-you-dont-need-20-down/ )The Truth About Buying a Home: You DON'T Need 20% Down

In a recent survey, How America Views Homeownership, it was revealed that 68% of Americans feel that now is a good time to buy a home and 95%said they want to own a home if they don’t already.

Franklin Codel, head of Wells Fargo home mortgagep...

How Interest Rates Impact Family Wealth

With interest rates still in the low 4%’s, many buyers may be on the fence as to whether to act now and purchase a new home, or wait until next year.

If you look at what the experts are predicting for 2015, it may make the decision for you.

E...

Getting A Mortgage: Why So Much Paperwork?

We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and eve...

You Need A Professional When Buying A Home

Many people wonder whether they should hire a real estate professional to assist them in buying their dream home or if they should first try to go it on their own. In today’s market: you need an experienced professional!

You Need an Expert Guide...

Enjoy the Weekend!

...

Don’t Get Caught in the ‘Renter’s Trap’

In a recent press release, Zillow stated that the affordability of the nation’s rental inventory is currently much worse than affordability of the country’s home sale inventory. The release revealed two things:Nationally, renters signing a lease at t...

14,109 Houses Sold Yesterday! Did Yours?

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold over the summer, maybe it's not priced prop...

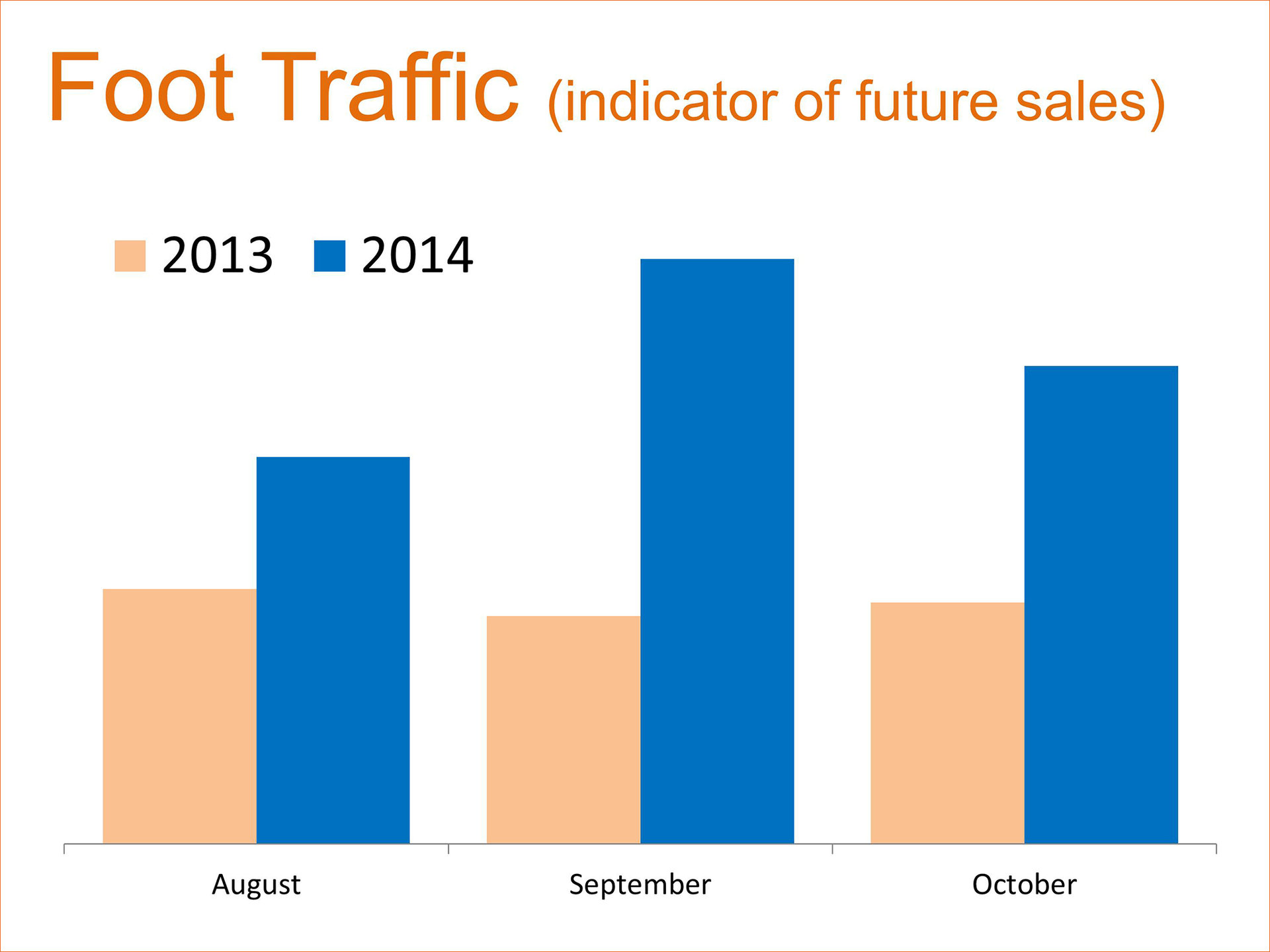

Most homeowners believe that the winter is not a good time to sell. This belief is based on the fact that historically the number of buyers decreases in the winter and then increases dramatically during the spring buying market. Though this is still true, there is an interesting pattern developing over the last few months.

The number of prospective purchasers actively looking at a home (foot traffic) has remained strong going into the fall. As a matter of fact, the foot traffic far exceeds the numbers reported for the same months last year (see chart):

Most homeowners believe that the winter is not a good time to sell. This belief is based on the fact that historically the number of buyers decreases in the winter and then increases dramatically during the spring buying market. Though this is still true, there is an interesting pattern developing over the last few months.

The number of prospective purchasers actively looking at a home (foot traffic) has remained strong going into the fall. As a matter of fact, the foot traffic far exceeds the numbers reported for the same months last year (see chart):

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year, he released a paper on homeownership -

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year, he released a paper on homeownership -  Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year, he released a paper on homeownership -

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year, he released a paper on homeownership -  After it was announced that Fannie Mae and Freddie Mac would again make available mortgage loans requiring as little as a

After it was announced that Fannie Mae and Freddie Mac would again make available mortgage loans requiring as little as a

A

A  Some homeowners may consider trying to sell their home on without the assistance of a real estate professional, known in the industry as a For Sale by Owner (FSBO). We think there are several reasons this might not be a good idea for the vast majority of sellers.

Some homeowners may consider trying to sell their home on without the assistance of a real estate professional, known in the industry as a For Sale by Owner (FSBO). We think there are several reasons this might not be a good idea for the vast majority of sellers.

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet this fall, maybe it's not priced properly.

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet this fall, maybe it's not priced properly.

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet this fall, maybe it's not priced properly.

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet this fall, maybe it's not priced properly.

If you are thinking about purchasing a home right now, you are surely getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in real estate. Let’s look at whether or not now is actually a good time for you to buy a home.

There are three questions you should ask before purchasing in today’s market:

If you are thinking about purchasing a home right now, you are surely getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in real estate. Let’s look at whether or not now is actually a good time for you to buy a home.

There are three questions you should ask before purchasing in today’s market:

Billionaire money manager John Paulson was

Billionaire money manager John Paulson was  In real estate there is a difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first time or repeat buyer, you must not be concerned about price but instead about the ‘long term cost’ of the home.

In real estate there is a difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first time or repeat buyer, you must not be concerned about price but instead about the ‘long term cost’ of the home.

Two recently released reports indicate that both young adults (Millennials) and teenagers (Generation Z) still see homeownership as an important piece of their future success.

A report by The Demand Institute,

Two recently released reports indicate that both young adults (Millennials) and teenagers (Generation Z) still see homeownership as an important piece of their future success.

A report by The Demand Institute,

In a recent survey,

In a recent survey,  With interest rates still in the

With interest rates still in the

We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago.

There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any time in history.

We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago.

There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any time in history.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 1

[name] => Uncategorized

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => uncategorized

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => No clasificado

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] =>

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 1

[name] => Uncategorized

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => uncategorized

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => No clasificado

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] =>