The Biggest Mistakes Buyers Are Making Today

Buyers face challenges in any market – and today’s is no different.

/by

KCM CREW

How Do Climate Risks Affect Your Next Home?

Climate change is impacting where people buy homes.

/by

KCM CREW

How VA Loans Can Help You Buy a Home

For over 80 years, Veterans Affairs (VA) home loans have helped millions of veterans buy their own homes.

/by

KCM CREW

Worried About Home Maintenance Costs? Consider This

If one of the main reasons you’re hesitant to buy a home is because you’re worried about the upkeep, here’s some information you may find interesting on both new home construction and existing homes.

/by

KCM CREW

What’s Next for Home Prices and Mortgage Rates?

If you’re thinking of making a move this year, there are two housing market factors that are probably on your mind: home prices and mortgage rates.

/by

KCM CREW

The Number of Homes for Sale Is Increasing

There’s no denying the last couple of years have been tough for anyone trying to buy a home because there haven’t been enough houses to go around.

/by

KCM CREW

Why a Condo May Be a Great Option for Your First Home

Having a hard time finding a first home that's right for you and your wallet?

/by

KCM CREW

Home Prices Are Climbing in These Top Cities

Thinking about buying a home or selling your current one to find a better fit?

/by

KCM CREW

The Top 2 Reasons To Consider a Newly Built Home

When you’re planning a move, it’s normal to wonder where you’ll end up and what your future home is going to look like.

/by

KCM CREW

How Buying or Selling a Home Benefits Your Community

If you're thinking of buying or selling a house, it's important to know it doesn't just impact you—it helps out the local economy and your community, too.

/by

KCM CREW

Tips for Younger Homebuyers: How To Make Your Dream a Reality

If you’re a member of a younger generation, like Gen Z, you may be asking the question: will I ever be able to buy a home?

/by

KCM CREW

Is a Multi-Generational Home Right for You?

Ever thought about living in the same house with your grandparents, parents, or other loved ones?

/by

KCM CREW

The Best Way To Keep Track of Mortgage Rate Trends

If you’re thinking about buying a home, chances are you’ve got mortgage rates on your mind.

/by

KCM CREW

Is It Getting More Affordable To Buy a Home?

Over the past year or so, a lot of people have been talking about how tough it is to buy a home.

/by

KCM CREW

Is It Better To Rent Than Buy a Home Right Now?

You may have seen reports in the news recently saying it’s more affordable to rent right now than it is to buy a home.

/by

KCM CREW

Ways To Use Your Tax Refund If You Want To Buy a Home

Have you been saving up to buy a home this year?

/by

KCM CREW

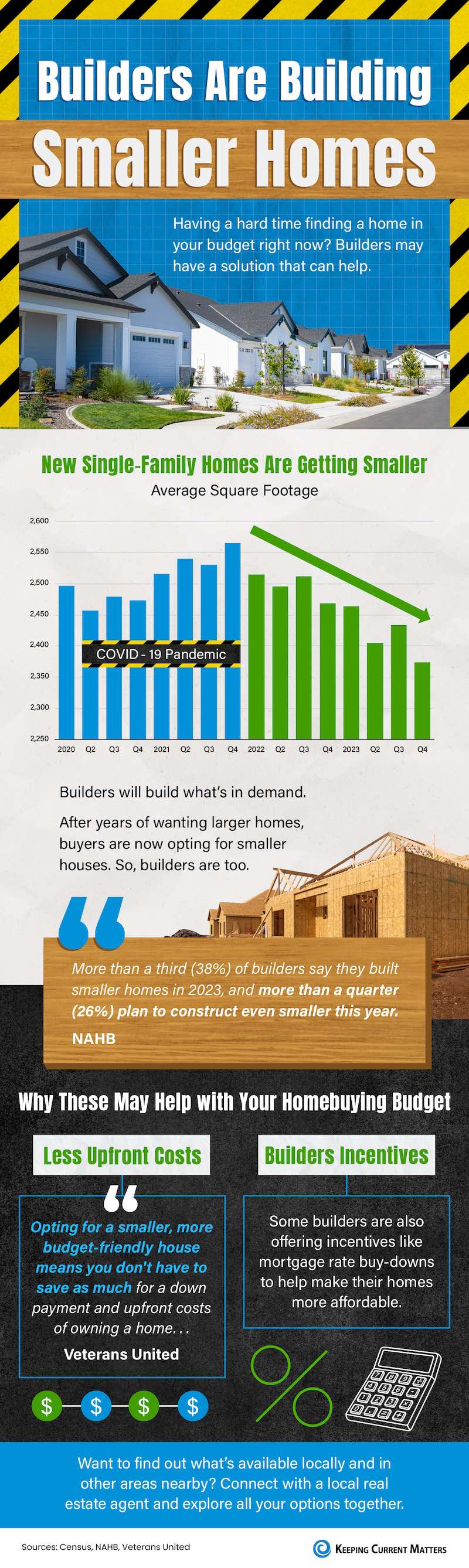

Builders Are Building Smaller Homes

There’s no arguing it, affordability is still tight.

/by

KCM CREW

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

You may have heard headlines in the news lately about agents in the real estate industry and discussions about their commissions.

/by

KCM CREW

Don’t Let Your Student Loans Delay Your Homeownership Plans

If you have student loans and want to buy a home, you might have questions about how your debt affects your plans.

/by

KCM CREW

Newly Built Homes Could Be a Game Changer This Spring

Buying a home this spring?

/by

KCM CREW

Is It Easier To Find a Home To Buy Now?

One of the biggest hurdles buyers have faced over the past few years has been a lack of homes available for sale.

/by

KCM CREW