New & Existing Home Sales Climb [INFOGRAPHIC]

![New & Existing Home Sales Climb [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2016/05/20160527-EHS-APR-STM.jpg)

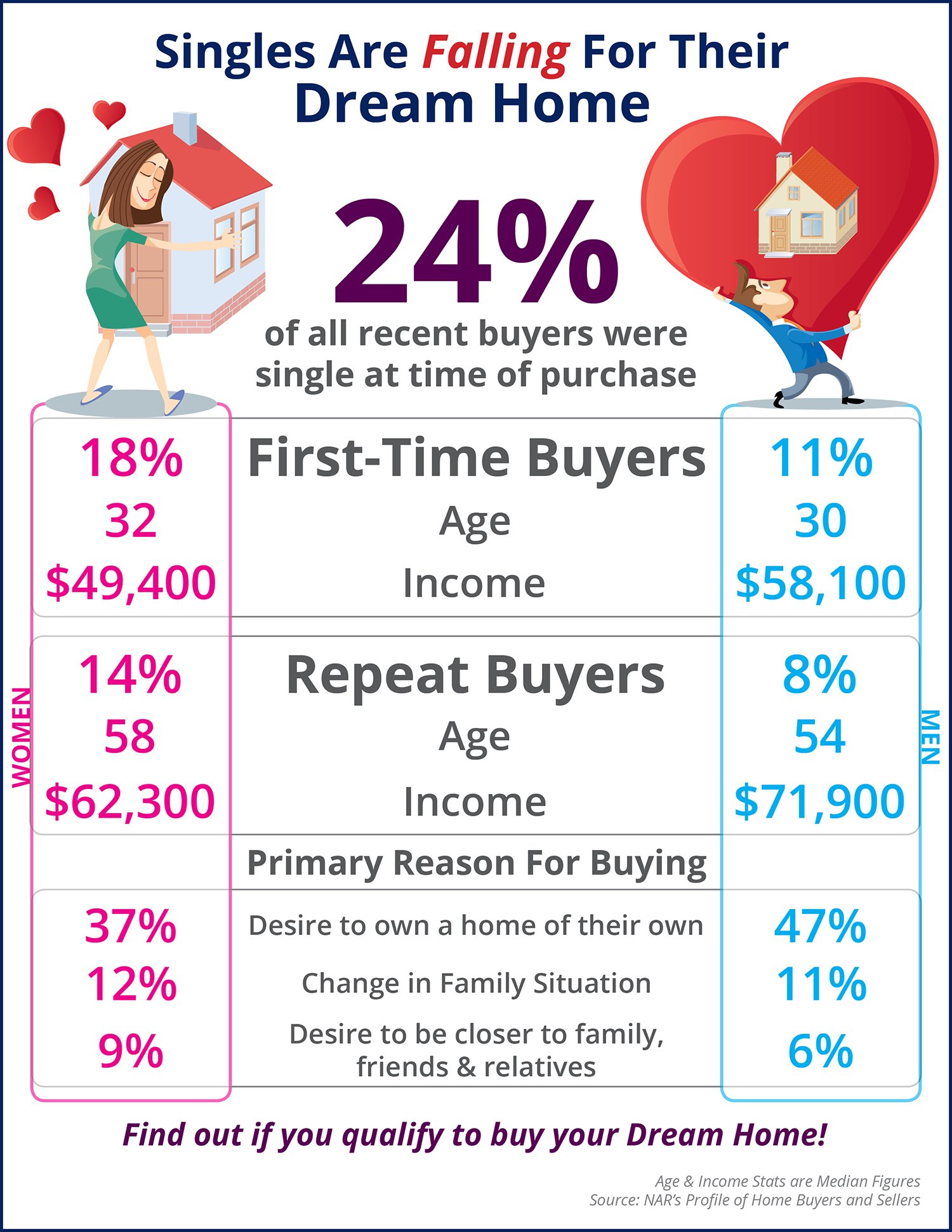

Some Highlights:

- Both New Home Sales and Existing Home Sales are up month-over-month and year-over-year.

- Inventory remains low which continues to drive home prices up as demand continues to exceed the 4.7-month inventory.

- The median price of new homes is up 12% from March 2016, while the median price of existing homes is up 6.3% from April 2015.

![Renting vs. Buying: What Does it Really Cost? [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2016/05/Rent-vs.-Buy-STM.jpg)

![Housing Market Snapshot [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2016/05/Housing-Market-Update-STM.jpg)

![Vacation Home Sales Reach 2nd Highest Mark Since 2006 [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2016/04/Vacation-Homes-STM.jpg)