- They require less maintenance. Condos are great if you want to own your place but don't want to mow the lawn, shovel snow, or fix the roof. Your real estate agent can help explain any associated fees and details for the condos you’re interested in.

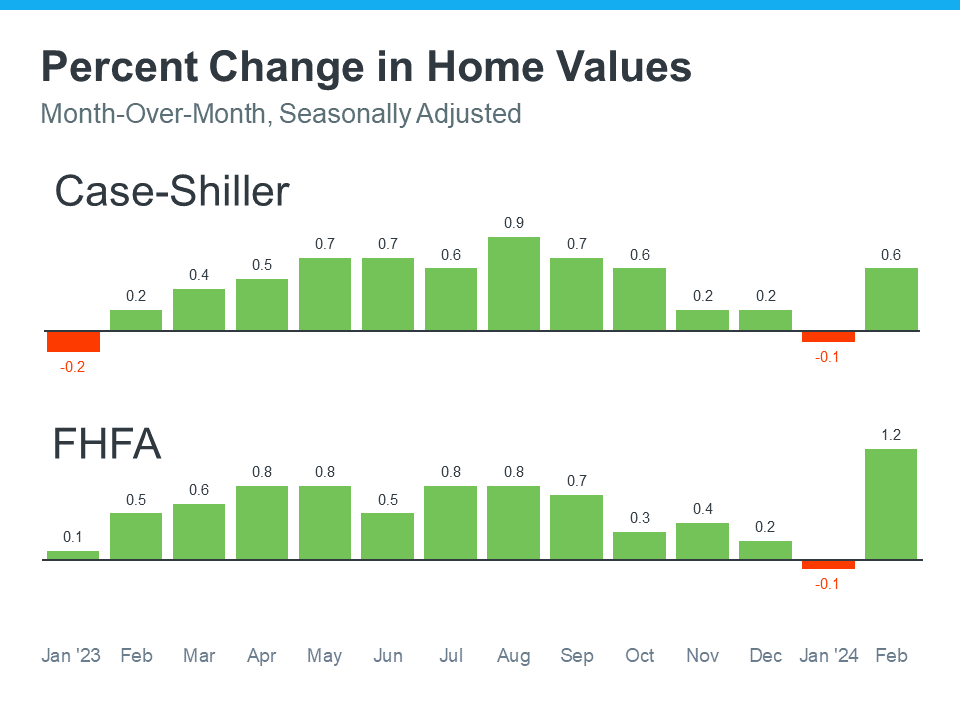

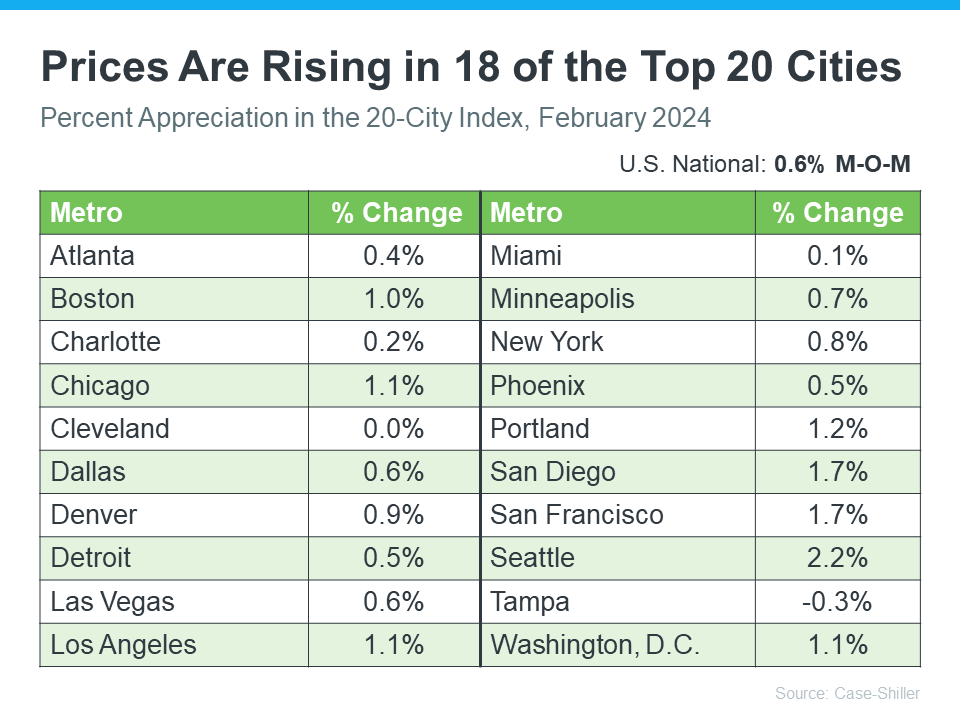

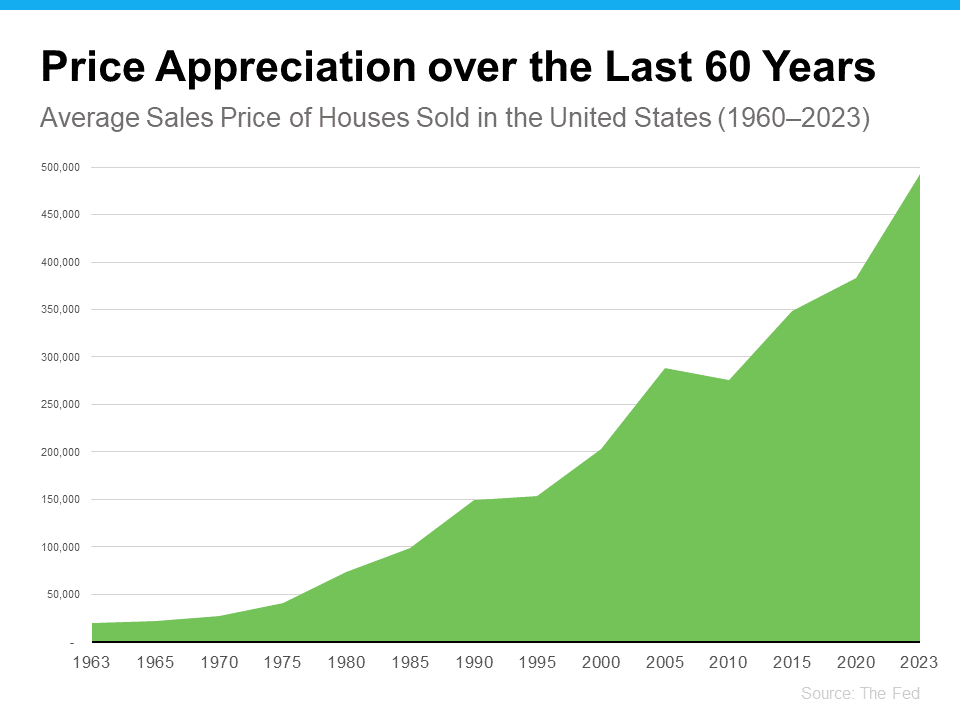

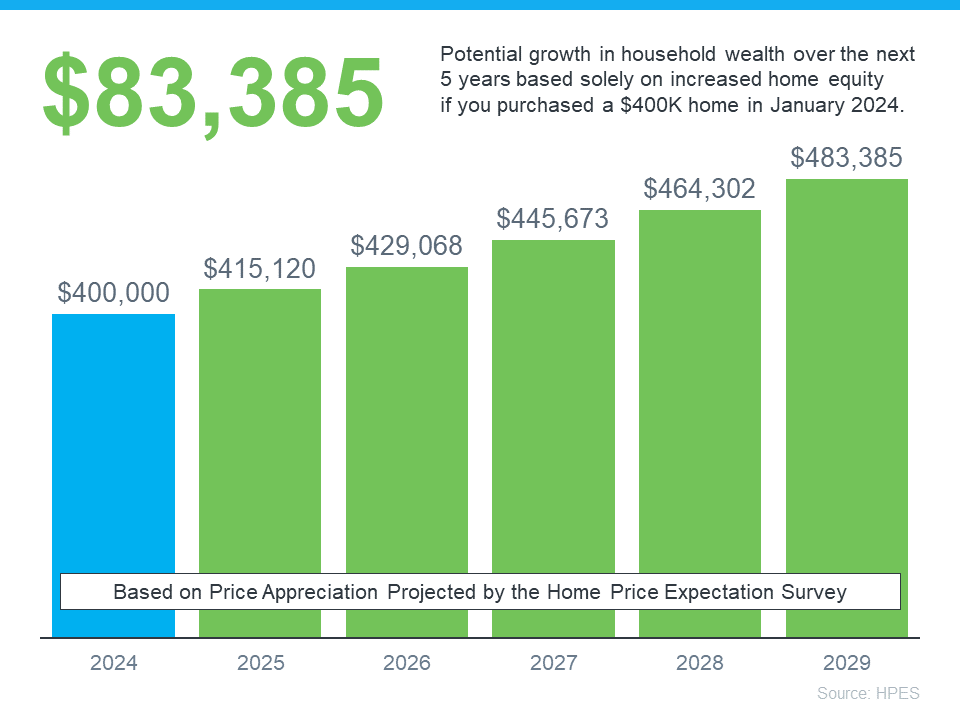

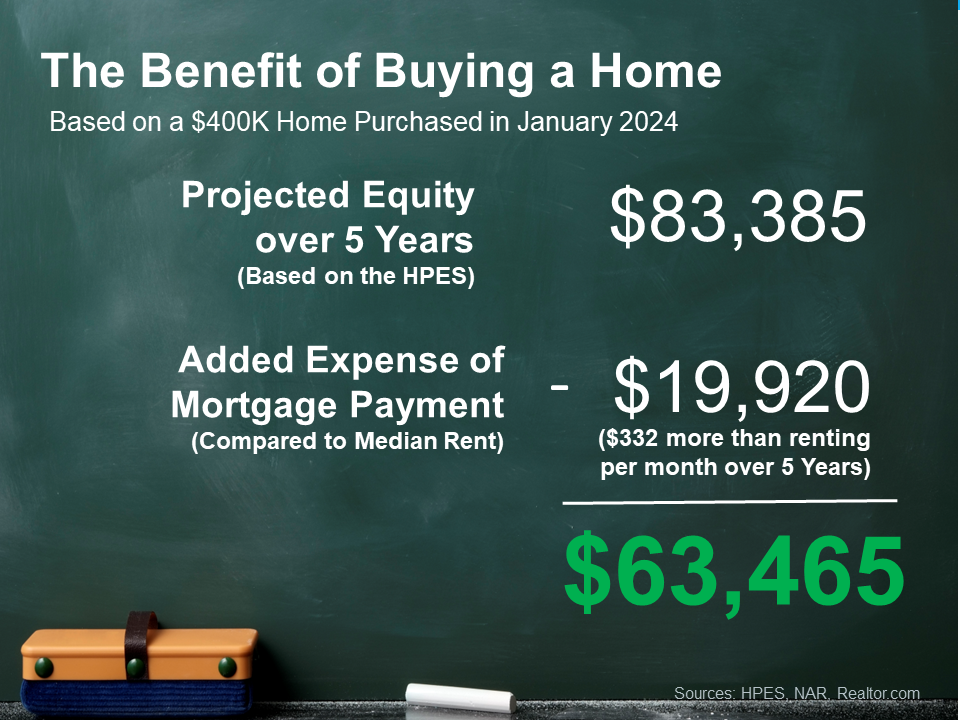

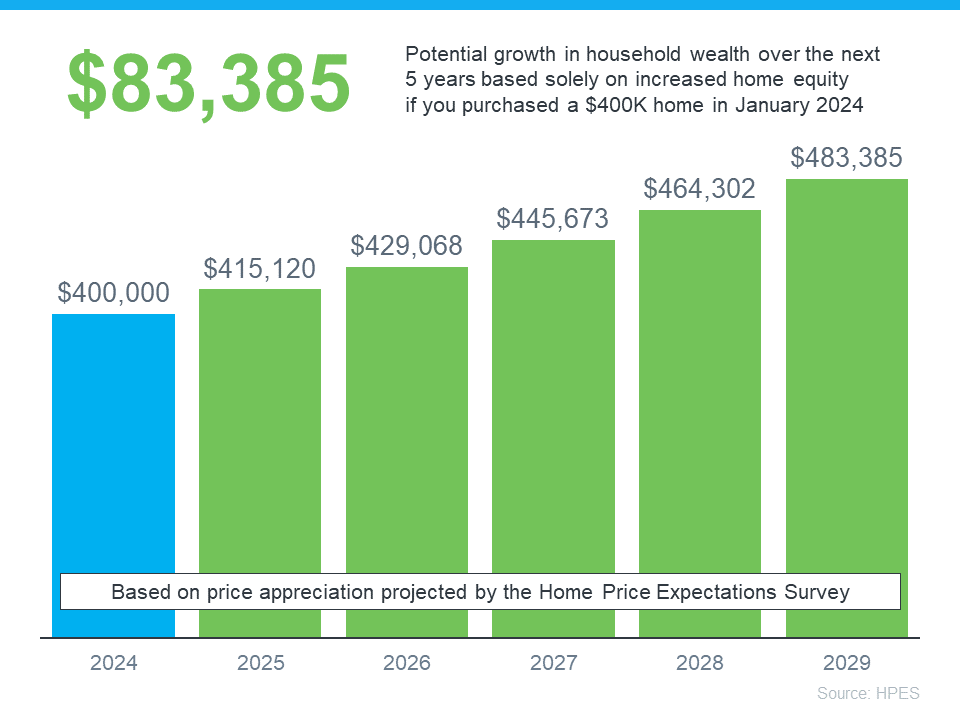

- They allow you to start building equity. When you buy a condo, you build equity and your net worth as you make your mortgage payments and as your condo’s value goes up over time.

- They often come with added amenities. Your condo might come with access to amenities like a pool, dog park, or parking. And the best part? You don’t have to take care of any of them.

- They provide you with a sense of community. Buying a condo means you'll be living close to other people, which is nice if you enjoy having neighbors around and making friends. Many condo communities hold fun events like barbecues and parties during holidays for everyone to enjoy.

Remember, your first home doesn't have to be the one you stay in forever. The important thing is to get your foot in the door as a homeowner so you can start to gain home equity. Later on, that equity can help you buy another place if you need something different.

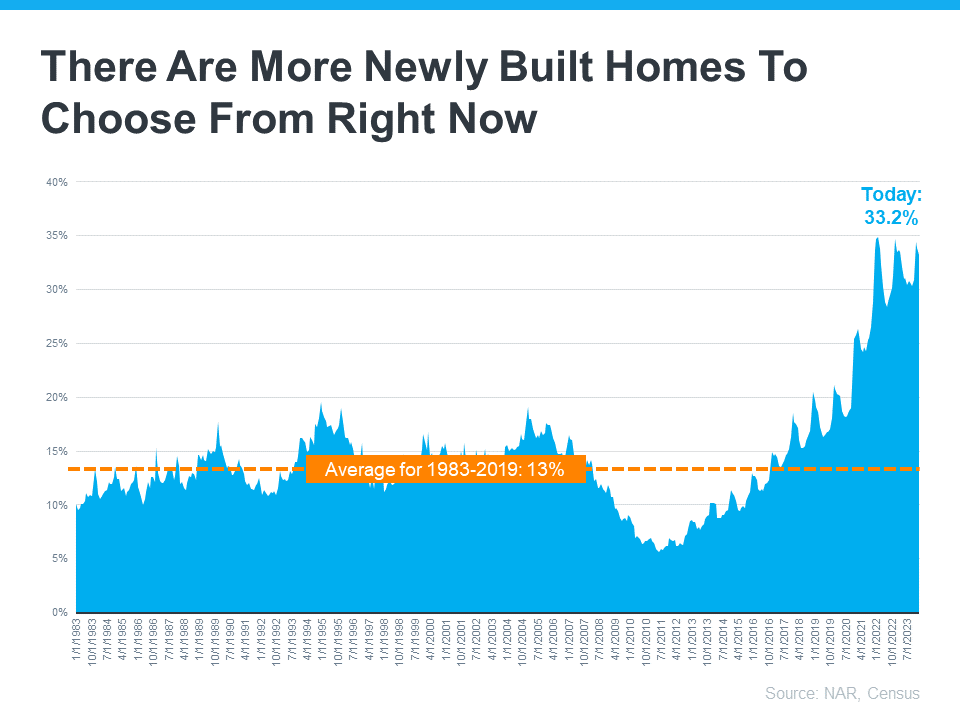

Ultimately, owning and living in a condo is a lifestyle choice. And if it’s one that appeals to you, they could provide the added options you need in today’s market.

[created_at] => 2024-05-13T18:36:02Z [description] =>Having a hard time finding a first home that's right for you and your wallet?

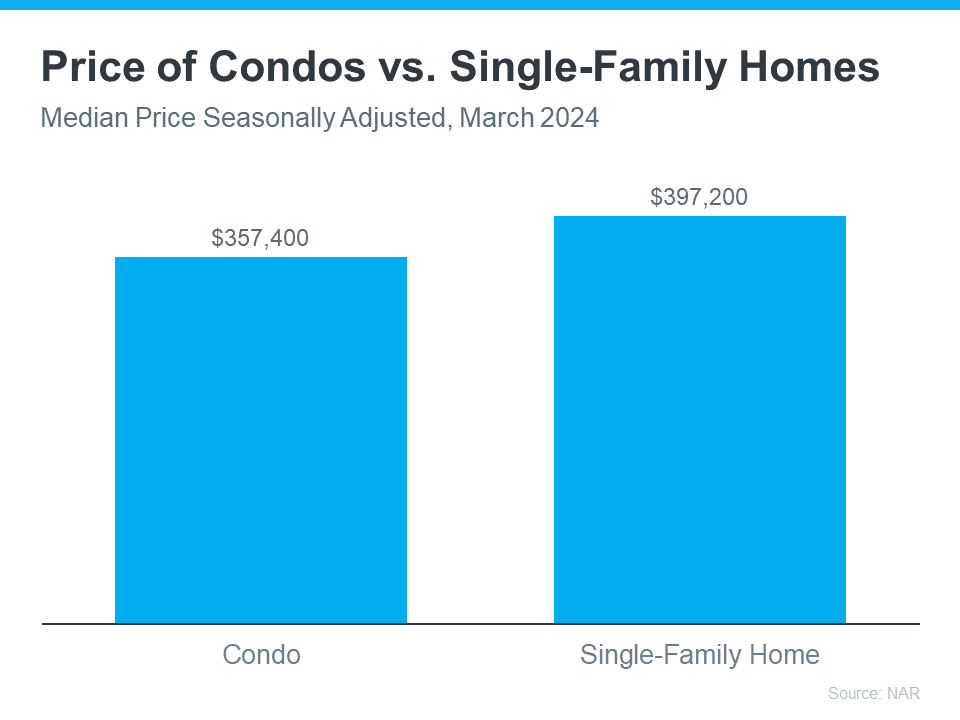

[expired_at] => [featured_image] => https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240513/20240515-Why-a-Condo-May-Be-a-Great-Option-for-Your-First-Home.png [id] => 52117 [kcm_ig_caption] => Having a hard time finding a first home that's right for you and your wallet? Well, here's a tip – think about condominiums, or condos for short. They're usually smaller than single-family homes, but that's exactly why they can be easier on your budget. So, if you're comfortable with a smaller space and want to buy your first home this year, adding condos to your search might be easier on your wallet. Besides giving you more options for your home search and maybe fitting your budget better, living in a condo has a bunch of other perks, too. According to Rocket Mortgage: “From community living to walkable urban areas, condos are great options for first-time home buyers and people looking to enjoy homeownership without extensive upkeep.” Let’s dive into a few of the draws of condos for first-time buyers from Bankrate: • They require less maintenance. • They allow you to start building equity. • They often come with added amenities. • They provide you with a sense of community. Remember, your first home doesn't have to be the one you stay in forever. The important thing is to get your foot in the door as a homeowner so you can start to gain home equity. Later on, that equity can help you buy another place if you need something different. Ultimately, owning and living in a condo is a lifestyle choice. And if it’s one that appeals to you, they could provide the added options you need in today’s market. It might be a good idea to think about condos in your home search. If you're ready to see what's out there, let's get in touch today. [kcm_ig_hashtags] => firsttimehomebuyer,opportunity,housingmarket [kcm_ig_quote] => Why a condo may be a great option for your first home. [public_bottom_line] =>It might be a good idea to think about condos in your home search. If you're ready to see what's out there, get in touch with a local real estate agent today.

[published_at] => 2024-05-15T10:30:00Z [related] => Array ( ) [slug] => why-a-condo-may-be-a-great-option-for-your-first-home [status] => published [tags] => Array ( [0] => content-hub ) [title] => Why a Condo May Be a Great Option for Your First Home [updated_at] => 2024-05-15T10:30:16Z [url] => /2024/05/15/why-a-condo-may-be-a-great-option-for-your-first-home/ )Why a Condo May Be a Great Option for Your First Home

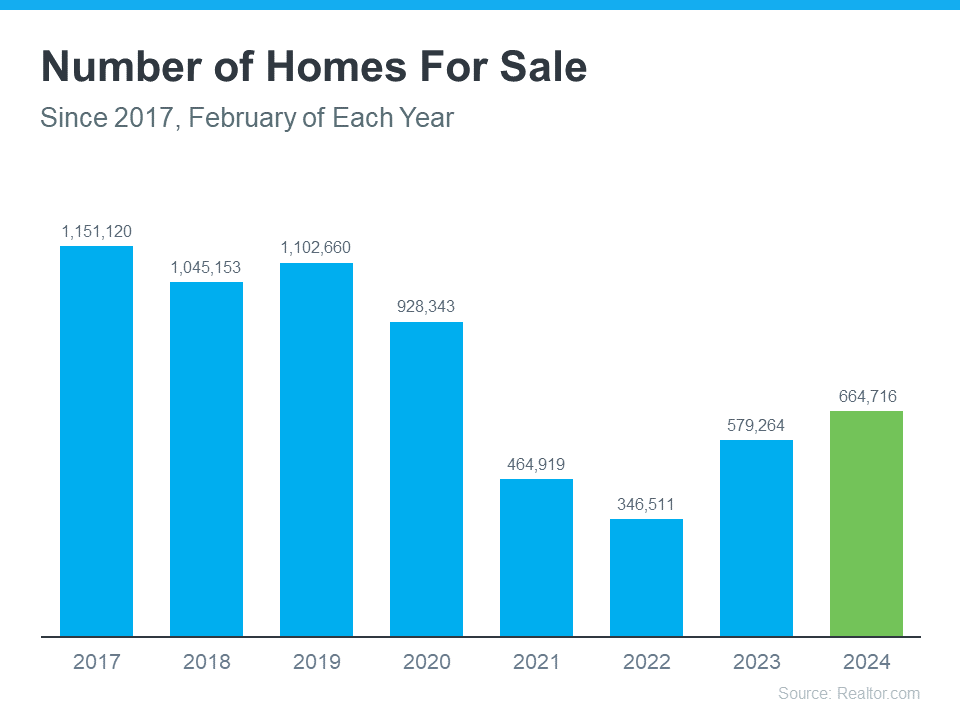

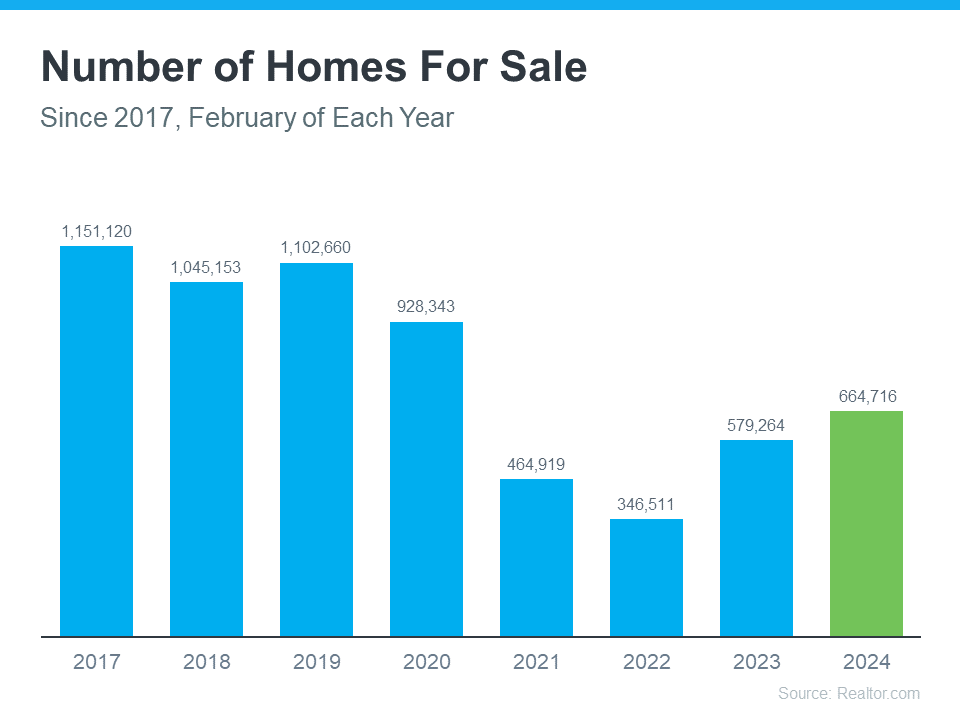

Having a hard time finding a first home that's right for you and your wallet?