stdClass Object

(

[agents_bottom_line] =>  As we finish 2014, it appears the real estate market is once again on solid footing and ready to advance forward over the next few years. The strength of the market can be viewed using two metrics: projected home values and projected house sales.

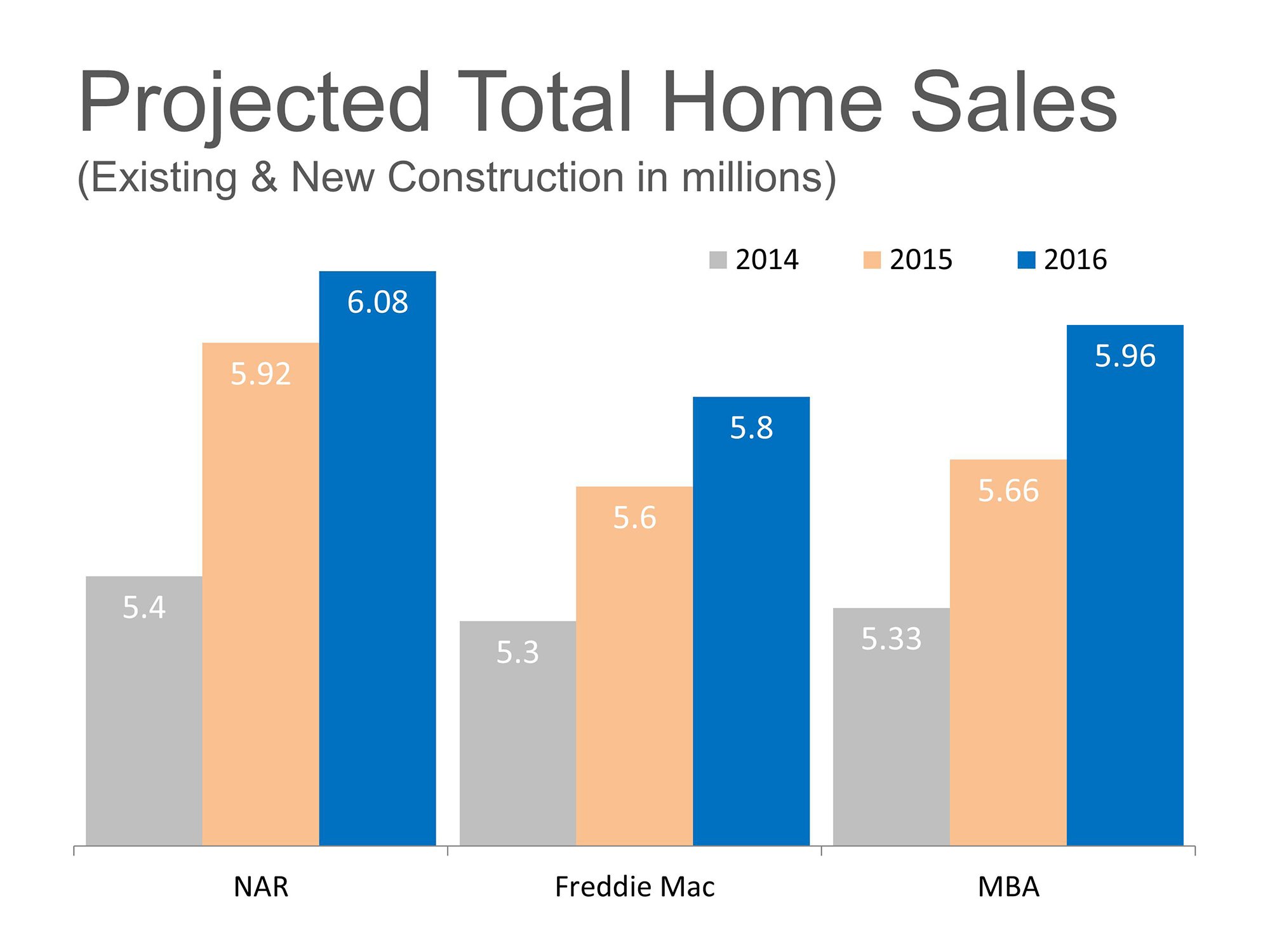

We recently reported that the Home Price Expectation Survey revealed future home values will continue to appreciate nicely. Today we want to look at projections on the number of home sales (existing and new construction) we will see over the next two years. We researched what the National Association of Realtors (NAR), Freddie Mac and the Mortgage Bankers’ Association (MBA) are projecting for the housing industry going forward.

Here is what we found:

As we finish 2014, it appears the real estate market is once again on solid footing and ready to advance forward over the next few years. The strength of the market can be viewed using two metrics: projected home values and projected house sales.

We recently reported that the Home Price Expectation Survey revealed future home values will continue to appreciate nicely. Today we want to look at projections on the number of home sales (existing and new construction) we will see over the next two years. We researched what the National Association of Realtors (NAR), Freddie Mac and the Mortgage Bankers’ Association (MBA) are projecting for the housing industry going forward.

Here is what we found:

All three entities see the number of home sales increasing in both 2015 and 2016. This is further proof the housing market is back.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => For Sellers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los vendedores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] =>

All three entities see the number of home sales increasing in both 2015 and 2016. This is further proof the housing market is back.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => For Sellers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los vendedores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] =>  As we finish 2014, it appears the real estate market is once again on solid footing and ready to advance forward over the next few years. The strength of the market can be viewed using two metrics: projected home values and projected house sales.

We recently reported that the Home Price Expectation Survey revealed future home values will continue to appreciate nicely. Today we want to look at projections on the number of home sales (existing and new construction) we will see over the next two years. We researched what the National Association of Realtors (NAR), Freddie Mac and the Mortgage Bankers’ Association (MBA) are projecting for the housing industry going forward.

Here is what we found:

As we finish 2014, it appears the real estate market is once again on solid footing and ready to advance forward over the next few years. The strength of the market can be viewed using two metrics: projected home values and projected house sales.

We recently reported that the Home Price Expectation Survey revealed future home values will continue to appreciate nicely. Today we want to look at projections on the number of home sales (existing and new construction) we will see over the next two years. We researched what the National Association of Realtors (NAR), Freddie Mac and the Mortgage Bankers’ Association (MBA) are projecting for the housing industry going forward.

Here is what we found:

All three entities see the number of home sales increasing in both 2015 and 2016. This is further proof the housing market is back.

[created_at] => 2014-12-03T07:00:27Z

[description] =>

As we finish 2014, it appears the real estate market is once again on solid footing and ready to advance forward over the next few years. The strength of the market can be viewed using two metrics: projected home values and projected house sales....

[expired_at] =>

[featured_image] => https:///

[id] => 186

[published_at] => 2014-12-03T07:00:27Z

[related] => Array

(

)

[slug] => the-real-estate-market-has-turned-the-corner

[status] => published

[tags] => Array

(

)

[title] => The Real Estate Market Has Turned The Corner

[updated_at] => 2014-12-01T12:54:22Z

[url] => /2014/12/03/the-real-estate-market-has-turned-the-corner/

)

All three entities see the number of home sales increasing in both 2015 and 2016. This is further proof the housing market is back.

[created_at] => 2014-12-03T07:00:27Z

[description] =>

As we finish 2014, it appears the real estate market is once again on solid footing and ready to advance forward over the next few years. The strength of the market can be viewed using two metrics: projected home values and projected house sales....

[expired_at] =>

[featured_image] => https:///

[id] => 186

[published_at] => 2014-12-03T07:00:27Z

[related] => Array

(

)

[slug] => the-real-estate-market-has-turned-the-corner

[status] => published

[tags] => Array

(

)

[title] => The Real Estate Market Has Turned The Corner

[updated_at] => 2014-12-01T12:54:22Z

[url] => /2014/12/03/the-real-estate-market-has-turned-the-corner/

)

The Real Estate Market Has Turned The Corner

As we finish 2014, it appears the real estate market is once again on solid footing and ready to advance forward over the next few years. The strength of the market can be viewed using two metrics: projected home values and projected house sales....

The National Association of Realtors’ most recent

The National Association of Realtors’ most recent

The National Association of Realtors’ most recent

The National Association of Realtors’ most recent

In a recent

In a recent

In a recent

In a recent

Every year the National Association of REALTORS releases their

Every year the National Association of REALTORS releases their  As we discussed last week one reason to sell now is demand is

As we discussed last week one reason to sell now is demand is  As we discussed last week one reason to sell now is demand is

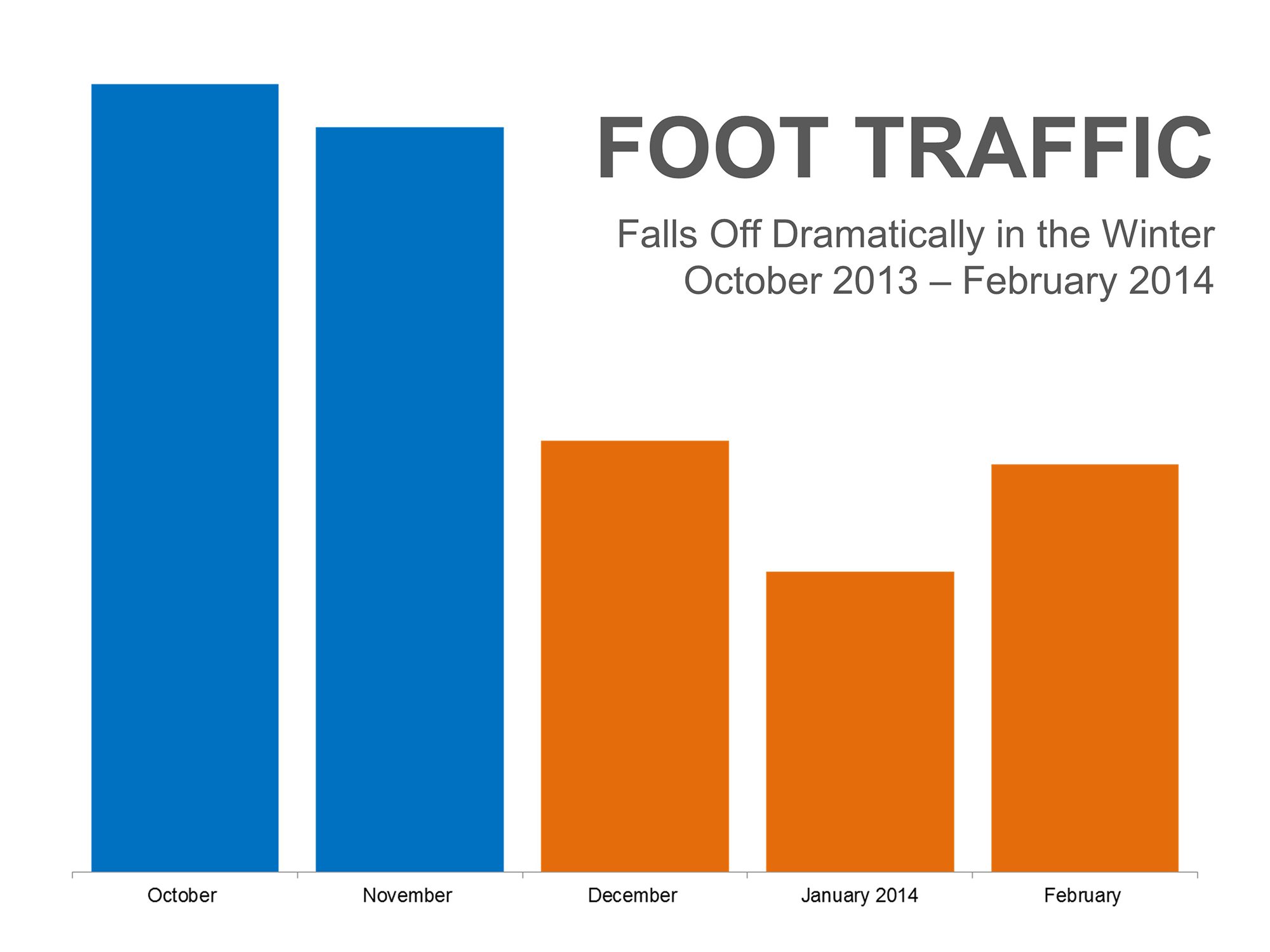

As we discussed last week one reason to sell now is demand is  Most homeowners believe that the winter is not a good time to sell. This belief is based on the fact that historically the number of buyers decreases in the winter and then increases dramatically during the spring buying market. Though this is still true, there is an interesting pattern developing over the last few months.

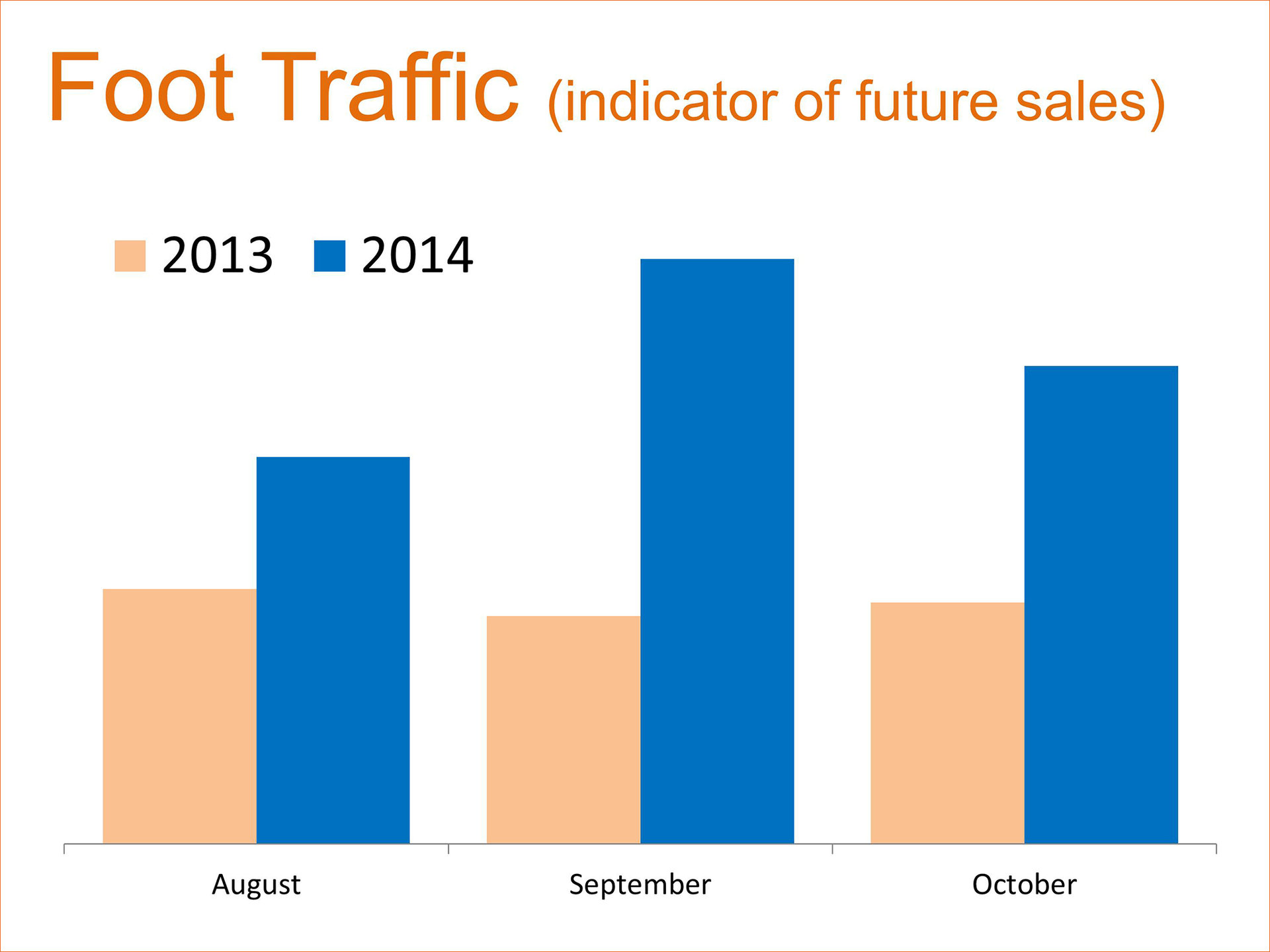

The number of prospective purchasers actively looking at a home (foot traffic) has remained strong going into the fall. As a matter of fact, the foot traffic far exceeds the numbers reported for the same months last year (see chart):

Most homeowners believe that the winter is not a good time to sell. This belief is based on the fact that historically the number of buyers decreases in the winter and then increases dramatically during the spring buying market. Though this is still true, there is an interesting pattern developing over the last few months.

The number of prospective purchasers actively looking at a home (foot traffic) has remained strong going into the fall. As a matter of fact, the foot traffic far exceeds the numbers reported for the same months last year (see chart):

When a homeowner decides to sell their house, they obviously want the best possible price with the least amount of hassles. However, for the vast majority of sellers, the most important result is to actually get the home sold.

In order to accomplish all three goals, a seller should realize the importance of using a real estate professional. We realize that technology has changed the purchaser’s behavior during the home buying process. For the past two years, 92% of all buyers have used the internet in their home search according to the National Association of Realtors’

When a homeowner decides to sell their house, they obviously want the best possible price with the least amount of hassles. However, for the vast majority of sellers, the most important result is to actually get the home sold.

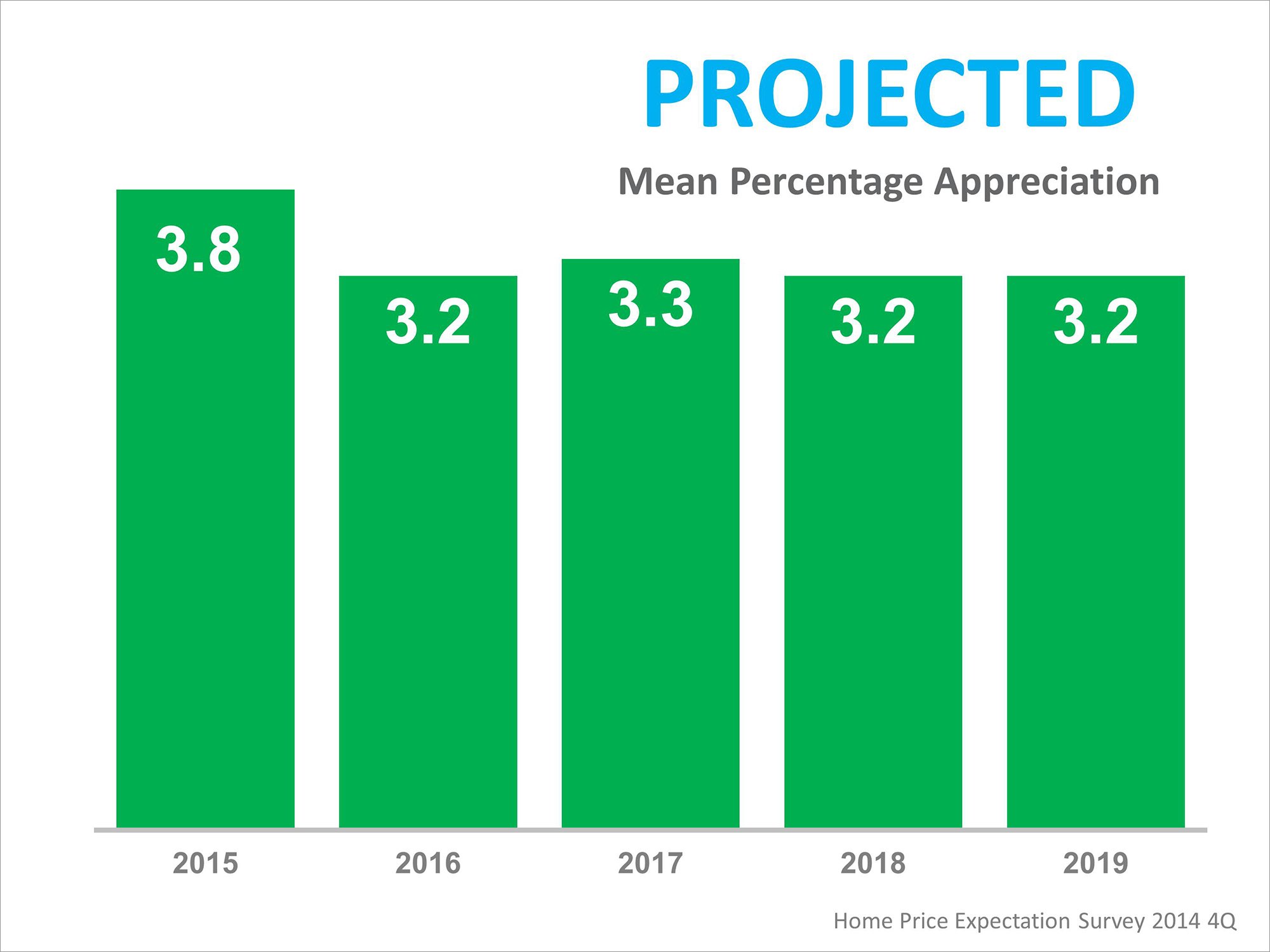

In order to accomplish all three goals, a seller should realize the importance of using a real estate professional. We realize that technology has changed the purchaser’s behavior during the home buying process. For the past two years, 92% of all buyers have used the internet in their home search according to the National Association of Realtors’  Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year, he released a paper on homeownership -

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year, he released a paper on homeownership -  Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year, he released a paper on homeownership -

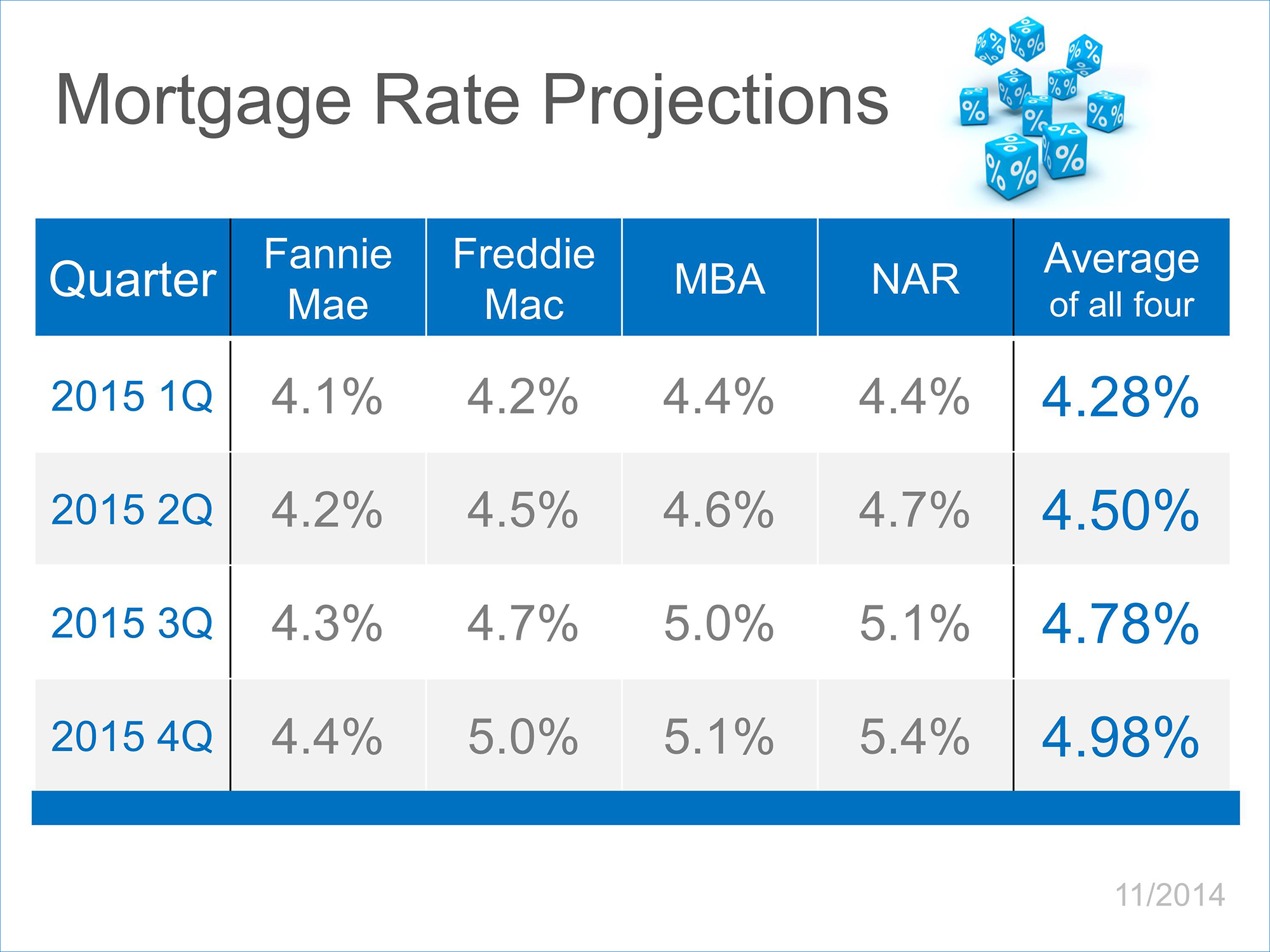

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year, he released a paper on homeownership -  After it was announced that Fannie Mae and Freddie Mac would again make available mortgage loans requiring as little as a

After it was announced that Fannie Mae and Freddie Mac would again make available mortgage loans requiring as little as a  Whether you are buying or selling a home, it can be quite an adventurous journey. You need an experienced Real Estate Professional to lead you to your ultimate goal. In this world of instant gratification and internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but have rather been strengthened due to the projections of

Whether you are buying or selling a home, it can be quite an adventurous journey. You need an experienced Real Estate Professional to lead you to your ultimate goal. In this world of instant gratification and internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but have rather been strengthened due to the projections of  It's that time of year, the seasons are changing and with them bring thoughts of the upcoming holidays, family get togethers, and planning for a new year. Those who are on the fence about whether now is the right time to buy don't have to look much farther to find four great reasons to consider buying a home now, instead of waiting.

It's that time of year, the seasons are changing and with them bring thoughts of the upcoming holidays, family get togethers, and planning for a new year. Those who are on the fence about whether now is the right time to buy don't have to look much farther to find four great reasons to consider buying a home now, instead of waiting.

In Trulia’s latest

In Trulia’s latest  A

A  There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either your mortgage or your landlord’s.

As a

There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either your mortgage or your landlord’s.

As a  Some homeowners may consider trying to sell their home on without the assistance of a real estate professional, known in the industry as a For Sale by Owner (FSBO). We think there are several reasons this might not be a good idea for the vast majority of sellers.

Some homeowners may consider trying to sell their home on without the assistance of a real estate professional, known in the industry as a For Sale by Owner (FSBO). We think there are several reasons this might not be a good idea for the vast majority of sellers.

We have

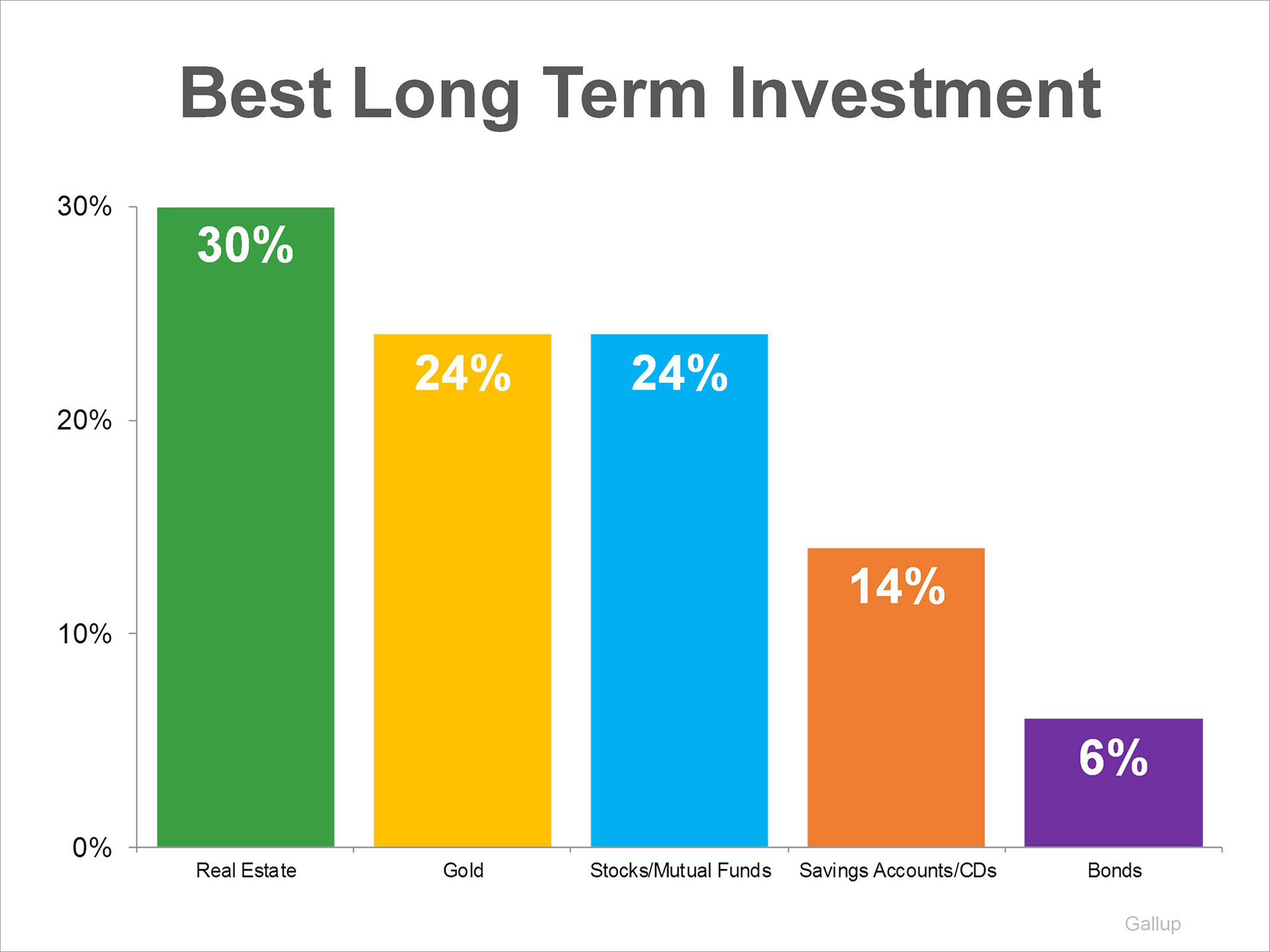

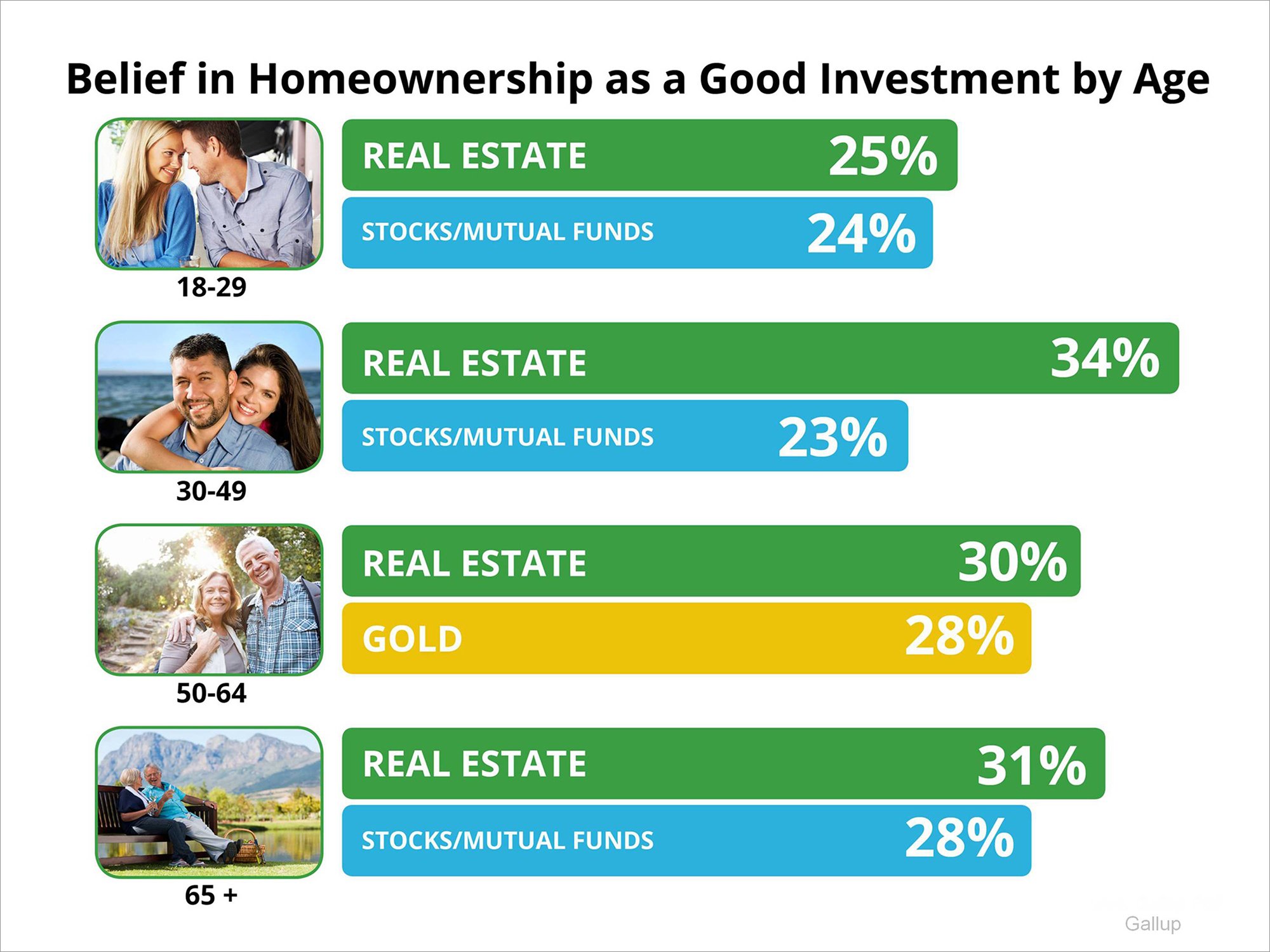

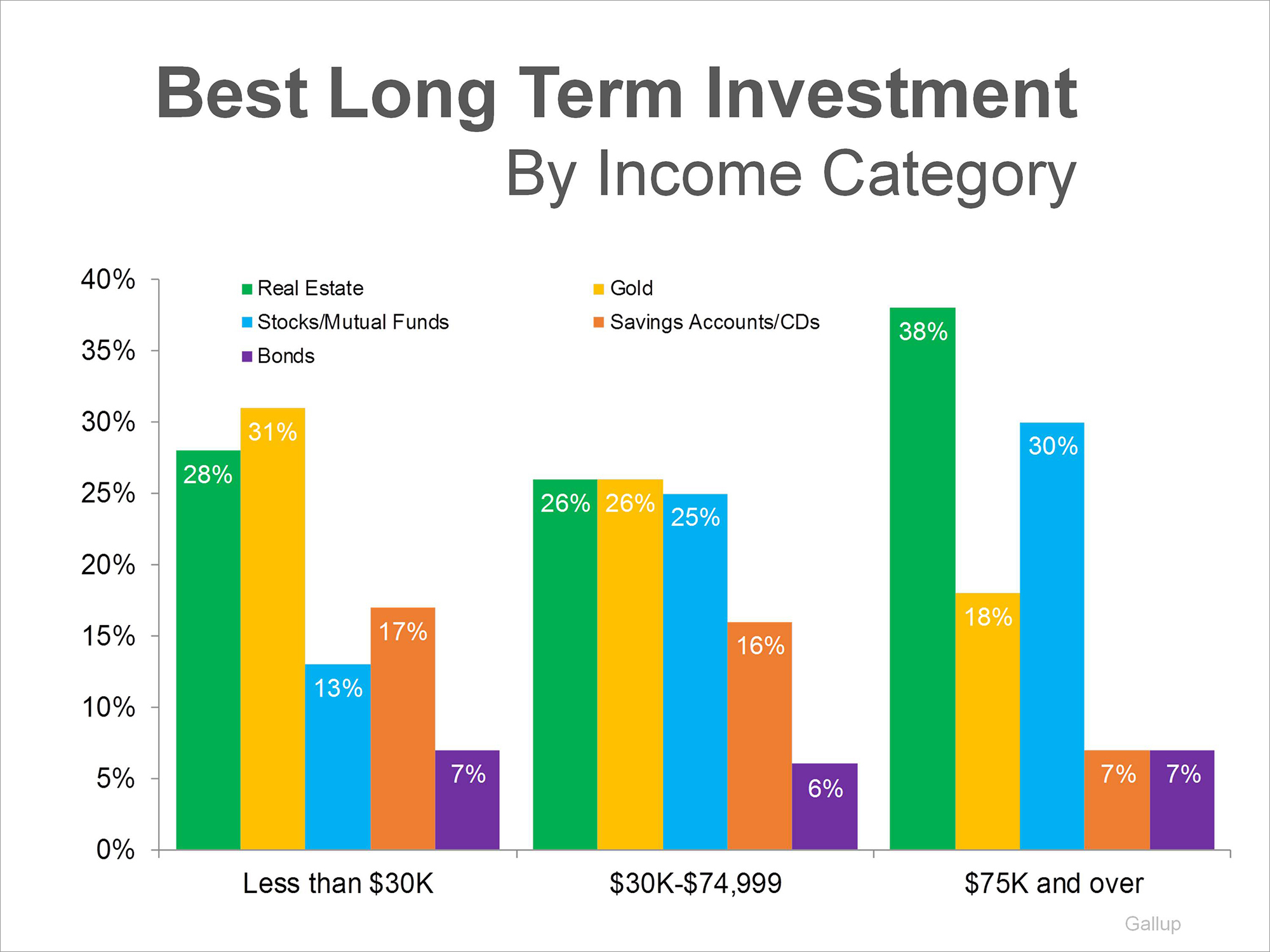

We have  The Gallup organization conducts an annual report entitled the

The Gallup organization conducts an annual report entitled the

The Gallup organization conducts an annual report entitled the

The Gallup organization conducts an annual report entitled the

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet this fall, maybe it's not priced properly.

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet this fall, maybe it's not priced properly.

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet this fall, maybe it's not priced properly.

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet this fall, maybe it's not priced properly.

If you are thinking about purchasing a home right now, you are surely getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in real estate. Let’s look at whether or not now is actually a good time for you to buy a home.

There are three questions you should ask before purchasing in today’s market:

If you are thinking about purchasing a home right now, you are surely getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in real estate. Let’s look at whether or not now is actually a good time for you to buy a home.

There are three questions you should ask before purchasing in today’s market:

Billionaire money manager John Paulson was

Billionaire money manager John Paulson was  The price of any item (including residential real estate) is determined by ‘supply and demand’. If the supply of an item is larger than the amount of people looking to purchase that item, the price will decrease.

According to the National Association of Realtors (NAR), historically there is a natural decline in buyers looking to purchase a home (also known as foot traffic) as the winter months approach. Shown in the graph below:

The price of any item (including residential real estate) is determined by ‘supply and demand’. If the supply of an item is larger than the amount of people looking to purchase that item, the price will decrease.

According to the National Association of Realtors (NAR), historically there is a natural decline in buyers looking to purchase a home (also known as foot traffic) as the winter months approach. Shown in the graph below:

Do you really need an agent to sell your house in today’s market? Here’s what Fannie Mae suggests to sellers on the

Do you really need an agent to sell your house in today’s market? Here’s what Fannie Mae suggests to sellers on the