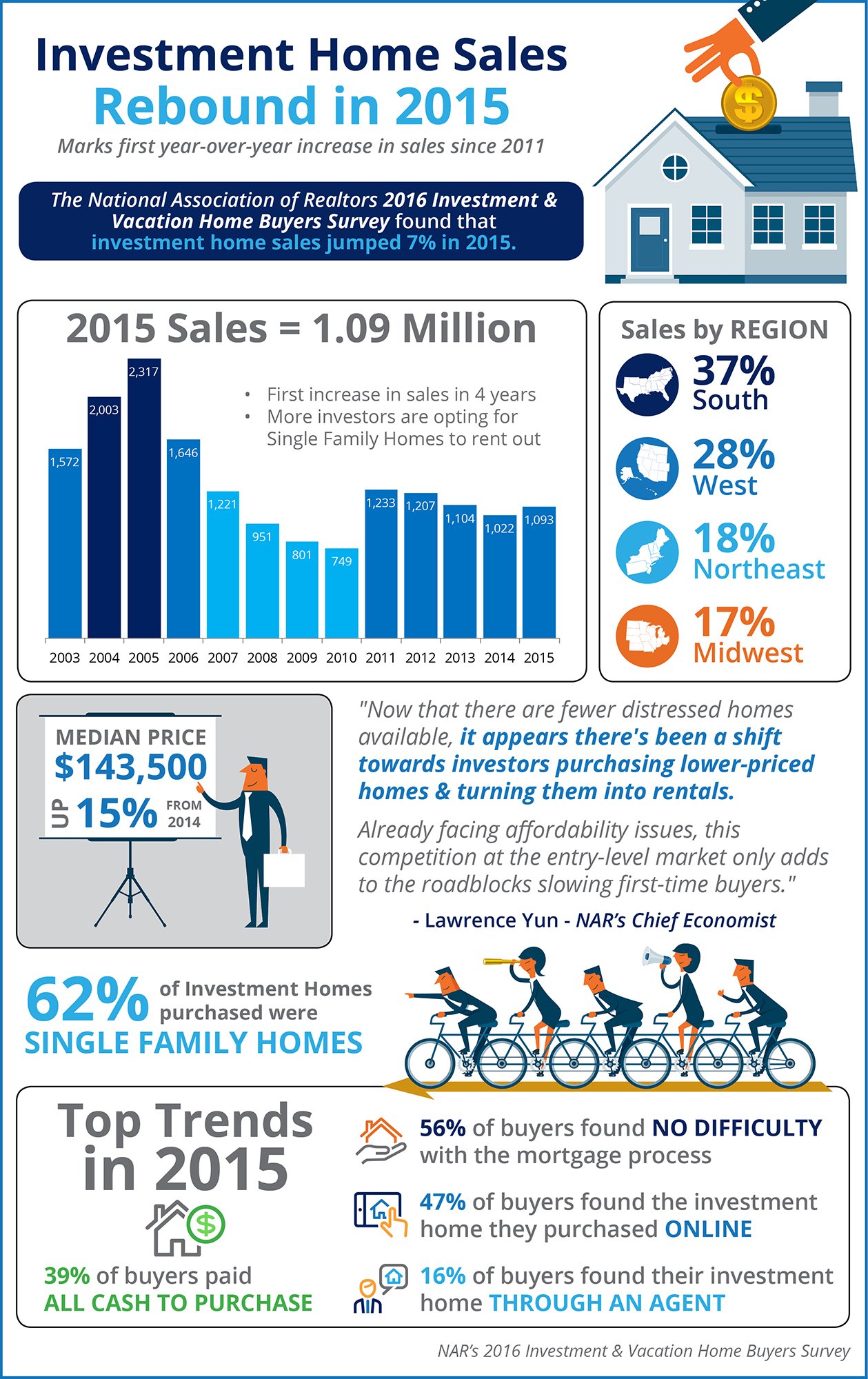

Investment Home Sales Rebound in 2015 [INFOGRAPHIC]

Some Highlights:

- 2015 marks the first year-over-year increase in investment home sales since 2011.

- 62% of all investment homes purchased were single family homes.

- The South saw the highest percentage of investment home sales (39%) with the West coming in second (28%).

Investors: More Sales and Higher Prices

The National Association of Realtors recently released their 2016 Investment and Vacation Home Buyers Survey. The survey revealed many characteristics of both vacation home purchasers and investors. Two weeks ago, we posted on the vacation home market. Today, we want to concentrate on the investor real estate market.

One More Time… You Do Not Need 20% Down To Buy NOW

A survey by Ipsos found that the American public is still somewhat confused about what is actually necessary to qualify for a home mortgage loan in today’s housing market. The study pointed out two major misconceptions that we want to address today.

Thinking of Selling? The Market Needs Your Listing!!

The housing market is really heating up and buyer demand is dramatically increasing as we enter the spring season. However, one challenge to the current market is a major shortage of inventory. Below are a few comments made in the last month by industry experts.

Buying a Home is 36% Less Expensive Than Renting Nationwide!

In the latest Rent vs. Buy Report from Trulia, they explained that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States.

Vacation Home Sales Reach 2nd Highest Mark Since 2006 [INFOGRAPHIC]

![Vacation Home Sales Reach 2nd Highest Mark Since 2006 [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2016/04/Vacation-Homes-STM.jpg)

Some Highlights:

- 58% of vacation homes purchased were single family homes.

- 51% of vacation homes that were purchased were found online.

- The median price of a vacation home is up 28% from 2014.

Vacation Home Sales: Sales Down, Prices Up

The National Association of Realtors recently released their 2016 Investment and Vacation Home Buyers Survey. The survey revealed many characteristics of both vacation home purchasers and investors. Today, we want to concentrate on the vacation real estate market.

The Top Reasons Why Americans Buy Homes

Last week, the inaugural “Homebuyer Insights Report” was released by the Bank of America. The report revealed the reasons why consumers purchase homes and what their feelings are regarding homeownership.

Over Half of Americans Planning on Buying in the Next 5 Years

According to the BMO Harris Bank Home Buying Report, 52% of Americans say they are likely to buy a home in the next five years. Americans surveyed for the report said that they would be willing to pay an average of $296,000 for a home and would average a 21% down payment. The report also included other interesting revelations.

You Can Save for a Down Payment Faster Than You Think

In a study conducted by Builder.com, researchers determined that nationwide, it would take “nearly eight years” for a first-time buyer to save enough for a down payment on their dream home.

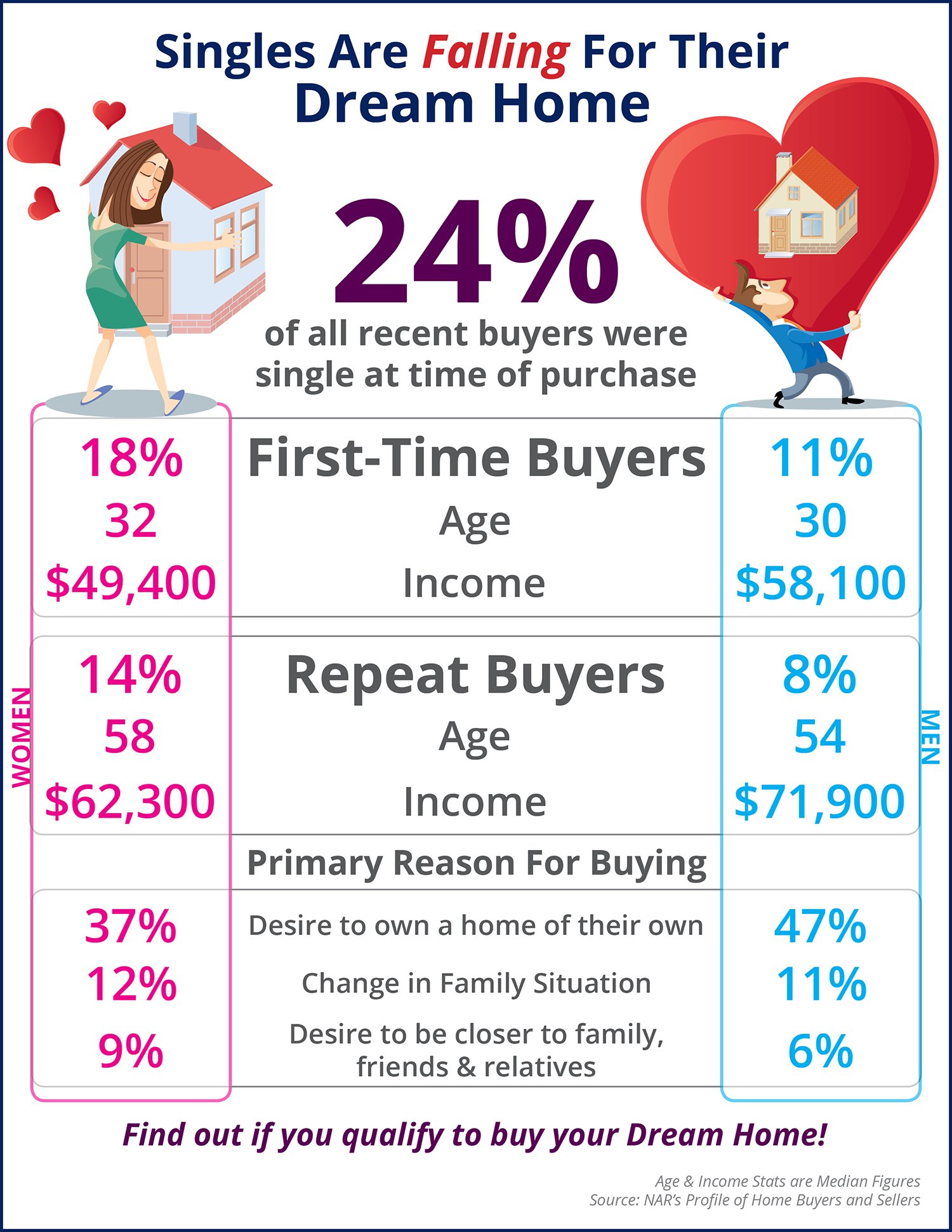

More & More Singles Are Falling For Their Dream Home [INFOGRAPHIC]

Some Highlights:

- 24% of all recent home buyers were single at the time of purchase.

- 47% of single men cite the desire to own a home of their own as the primary reason to buy.

- 18% of first-time buyers were single women.

Building Wealth: First Rung on the Ladder is Housing

How Housing Matters is a joint project of the Urban Land Institute and the MacArthur Foundation. It is “an online resource for the most rigorous research and practical information on how a quality, stable, affordable home in a vibrant community contributes to individual and community success”.

Real Estate: 2016 Will Be the Best Year in a Decade

A few weeks ago, Jonathan Smoke, the Chief Economist at realtor.com, exclaimed: “All indicators point to this spring being the busiest since 2006.”

Rent or Buy: Either Way You’re Paying A Mortgage

There are some renters that have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either your mortgage or your landlord’s.

Don’t Wait! Move Up To Your Dream Home Now!

Now that the housing market has stabilized, more and more homeowners are considering moving up to the home they have always dreamed of. Prices are still below those of a few years ago and interest rates have stayed near historic lows.

Don't Be Fooled... Homeownership Is A Great Investment! [INFOGRAPHIC]

![Don't Be Fooled... Homeownership Is A Great Investment! [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2016/03/Dont-Be-Fooled-STM.jpg)

Some Highlights:

- Harvard University's Joint Center of Housing Studies recently released the top financial & emotional reasons to own a home.

- Owning is a good way to build up wealth that can be passed along to your family as it is usually a form of "forced savings."

- Whether you rent or own, you are paying a mortgage. Yours when you own, your landlord's when you rent.

2016 Home Sales Doing Just Fine!!

Some of the housing headlines are causing concern for some consumers who are in the process of either buying or selling a home. Pundits are concerned over the lack of new construction or the month-over-month sales numbers. Let’s set the record straight; 2015 was a good year for residential real estate in the United States and 2016 is starting out stronger.

Past, Present & Future Home Values

In CoreLogic’s latest Home Price Index, they revealed home appreciation in three categories: percentage appreciation over the last year, over the last month, and projected appreciation over the next twelve months.

Sales Contracts Hit Highest Level in Months

The National Association of Realtors (NAR) just announced that the February Pending Home Sales Index reached its highest reading since July 2015.

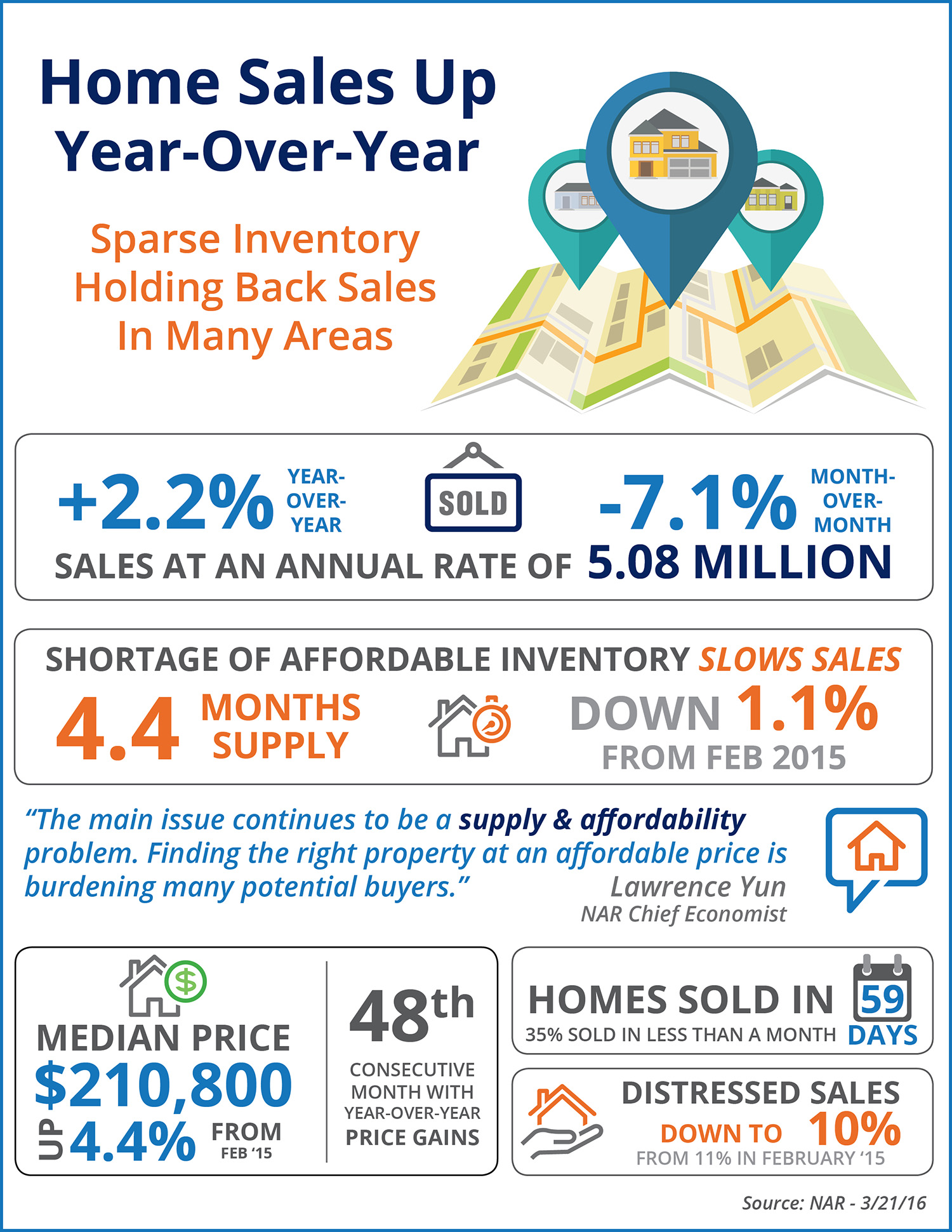

Home Sales Up Year-Over-Year [INFOGRAPHIC]

Some Highlights

- This is the 48th consecutive month with year-over-year price gains.

- Lawrence Yun, NAR's Chief Economist says that, "The main issue continues to be a supply & affordability problem. Finding the right property at an affordable price is burdening many potential buyers."

- Inventory is still below historic norms at a 4.4 month supply.

Further Proof This Isn’t a Housing Bubble

Two weeks ago, we posted a blog which explained that current increases in home prices were the result of the well-known concept of supply & demand and should not lead to conversations of a new housing bubble. Today, we want to look at home prices as compared to current incomes.

91.5% of Homes in the US Have Positive Equity

CoreLogic’s latest Equity Report revealed that one million borrowers regained equity in their homes in 2015. The outlook for 2016 remains positive as well, as an additional 850,000 properties would regain equity if home prices rose another 5% this year.

The Importance of Using an Agent To Sell Your House

When a homeowner decides to sell their house, they obviously want the best possible price with the least amount of hassles. However, for the vast majority of sellers, the most important result is to actually get the home sold.

The Mortgage Process: What You Need To Know [INFOGRAPHIC]

![The Mortgage Process: What You Need To Know [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2016/03/Mortgage-Process-STM.jpg)

Some Highlights:

- Many buyers are purchasing a home with a down payment as little as 3 percent.

- You may already qualify for a loan, even if you don't have perfect credit.

- Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford.

What If I Wait Until Next Year To Buy A Home?

As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first-time or repeat buyer, you must not be concerned only about price but also about the ‘long term cost’ of the home.