stdClass Object

(

[agents_bottom_line] => El último informe de la plusvalía de CoreLogic reveló que 256,000 propiedades recuperaron la plusvalía en el tercer trimestre de 2015. Esta es una gran noticia para el país, ya que el 92 % de las propiedades con hipotecas están ahora en una situación de plusvalía positiva.

Apreciación de los precios = buenas noticias para los propietarios de casa

Frank Nothaft, el Economista principal de CoreLogic, explicó:

“El aumento de los precios de las casas continúo levantando la posición de capital del prestatario y aumentando el número de prestatarios con suficiente capital para participar en el mercado hipotecario. En los últimos tres años, los prestatarios con por lo menos 20 por ciento de plusvalía han aumentado por 11 millones, un aumento sustancial que está impulsando un crecimiento rápido en originaciones de préstamos sobre el valor acumulado”.

Anand Nallathambi, Presidente y CEO de CoreLogic, cree que este es un buen signo también para el mercado en 2016, y él dijo esto:

“La plusvalía de los propietarios de casa es la mayor fuente de riqueza para muchos estadounidenses. El aumento en los precios de las casas, que se espera que sea por lo menos del 5 % en 2016, continuará creando riqueza y confianza a través de estados unidos. A medida que continúe este progreso, proveerá apoyo al mercado de la vivienda y la economía en general través [del] año.”

¡Esto es una gran noticia para los propietarios de casa! Pero ¿Se han dado cuenta ellos que su posición de capital ha cambiado?

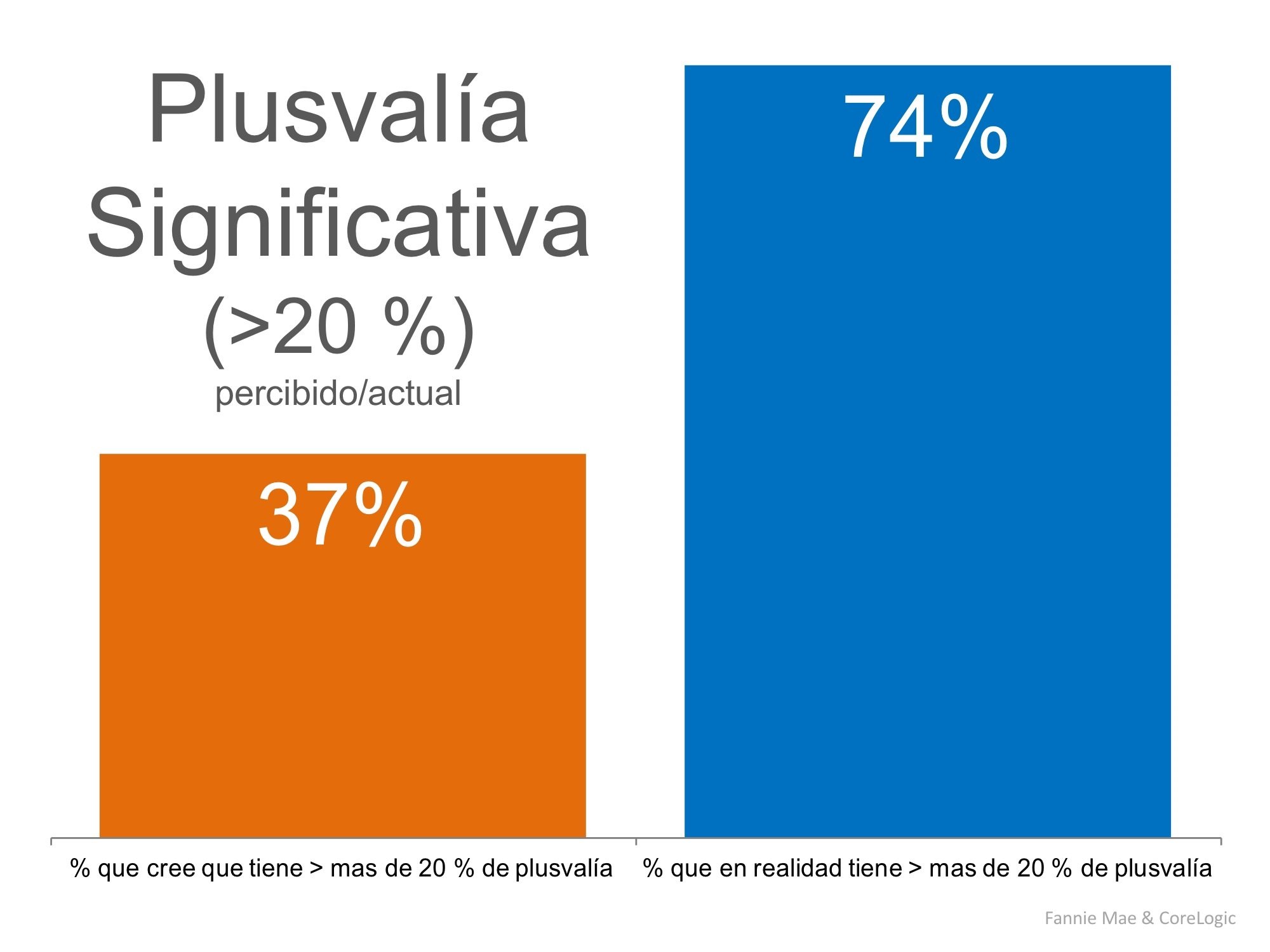

Un estudio de Fannie Mae sugiere que muchos de los propietarios de casa no están conscientes que han recobrado la plusvalía en su casa a medida que su inversión ha aumentado en valor. Por ejemplo, su estudio mostró que el 23 % de los estadounidenses aún creen que su casa está en una posición de plusvalía negativa cuando, en realidad, El informe de CoreLogic mostró que sólo 8 % de las casas están en esa posición. (bajo del 9 % en el segundo trimestre).

¡El estudio también reveló que, aunque el 37 % de los estadounidenses creen que ellos tienen “plusvalía significativa” (superior al 20 %), cuando en realidad, 74 % la tienen!

Esto significa que el 37 % de los estadounidenses con una hipoteca no se dan cuenta de la situación oportuna en la que se encuentran. Con una posición de considerable capital, muchos propietarios de casa podrían moverse fácilmente en una situación de la vivienda que mejor satisfaga sus necesidades actuales (mudarse a una casa más grande o a una más pequeña).

Fannie Mae mencionó esta cuestión en su informe:

Esto significa que el 37 % de los estadounidenses con una hipoteca no se dan cuenta de la situación oportuna en la que se encuentran. Con una posición de considerable capital, muchos propietarios de casa podrían moverse fácilmente en una situación de la vivienda que mejor satisfaga sus necesidades actuales (mudarse a una casa más grande o a una más pequeña).

Fannie Mae mencionó esta cuestión en su informe:

“Los propietarios de casa que subestiman el valor de sus casas no solo subestiman la plusvalía de sus casas, ellos probablemente también subestiman 1) qué tan grande podría ser la cuota inicial que ellos pueden hacer con la plusvalía de sus casas. 2) Sus posibilidades de calificar para una hipoteca, y, por lo tanto, 3) sus oportunidades de vender sus casas actuales y comprar casas diferentes”.

En conclusión

¡Si usted es uno de los muchos estadounidenses que no están seguros que tanta plusvalía tiene en su casa, no deje que esa sea la razón por la que no se muda a la casa de sus sueños en 2016! ¡Reunámonos para evaluar su situación!

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => Para los vendedores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 38

[name] => Compradores de casa mas grande

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:00:35Z

[slug] => move-up

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2024-04-10T16:00:35Z

)

)

[content_type] => blog

[contents] => El último informe de la plusvalía de CoreLogic reveló que 256,000 propiedades recuperaron la plusvalía en el tercer trimestre de 2015. Esta es una gran noticia para el país, ya que el 92 % de las propiedades con hipotecas están ahora en una situación de plusvalía positiva.

Apreciación de los precios = buenas noticias para los propietarios de casa

Frank Nothaft, el Economista principal de CoreLogic, explicó:

“El aumento de los precios de las casas continúo levantando la posición de capital del prestatario y aumentando el número de prestatarios con suficiente capital para participar en el mercado hipotecario. En los últimos tres años, los prestatarios con por lo menos 20 por ciento de plusvalía han aumentado por 11 millones, un aumento sustancial que está impulsando un crecimiento rápido en originaciones de préstamos sobre el valor acumulado”.

Anand Nallathambi, Presidente y CEO de CoreLogic, cree que este es un buen signo también para el mercado en 2016, y él dijo esto:

“La plusvalía de los propietarios de casa es la mayor fuente de riqueza para muchos estadounidenses. El aumento en los precios de las casas, que se espera que sea por lo menos del 5 % en 2016, continuará creando riqueza y confianza a través de estados unidos. A medida que continúe este progreso, proveerá apoyo al mercado de la vivienda y la economía en general través [del] año.”

¡Esto es una gran noticia para los propietarios de casa! Pero ¿Se han dado cuenta ellos que su posición de capital ha cambiado?

Un estudio de Fannie Mae sugiere que muchos de los propietarios de casa no están conscientes que han recobrado la plusvalía en su casa a medida que su inversión ha aumentado en valor. Por ejemplo, su estudio mostró que el 23 % de los estadounidenses aún creen que su casa está en una posición de plusvalía negativa cuando, en realidad, El informe de CoreLogic mostró que sólo 8 % de las casas están en esa posición. (bajo del 9 % en el segundo trimestre).

¡El estudio también reveló que, aunque el 37 % de los estadounidenses creen que ellos tienen “plusvalía significativa” (superior al 20 %), cuando en realidad, 74 % la tienen!

Esto significa que el 37 % de los estadounidenses con una hipoteca no se dan cuenta de la situación oportuna en la que se encuentran. Con una posición de considerable capital, muchos propietarios de casa podrían moverse fácilmente en una situación de la vivienda que mejor satisfaga sus necesidades actuales (mudarse a una casa más grande o a una más pequeña).

Fannie Mae mencionó esta cuestión en su informe:

Esto significa que el 37 % de los estadounidenses con una hipoteca no se dan cuenta de la situación oportuna en la que se encuentran. Con una posición de considerable capital, muchos propietarios de casa podrían moverse fácilmente en una situación de la vivienda que mejor satisfaga sus necesidades actuales (mudarse a una casa más grande o a una más pequeña).

Fannie Mae mencionó esta cuestión en su informe:

“Los propietarios de casa que subestiman el valor de sus casas no solo subestiman la plusvalía de sus casas, ellos probablemente también subestiman 1) qué tan grande podría ser la cuota inicial que ellos pueden hacer con la plusvalía de sus casas. 2) Sus posibilidades de calificar para una hipoteca, y, por lo tanto, 3) sus oportunidades de vender sus casas actuales y comprar casas diferentes”.

En conclusión

¡Si usted es uno de los muchos estadounidenses que no están seguros que tanta plusvalía tiene en su casa, no deje que esa sea la razón por la que no se muda a la casa de sus sueños en 2016! ¡Reunámonos para evaluar su situación!

[created_at] => 2016-02-10T06:00:29Z

[description] => El último informe de la plusvalía de CoreLogic reveló que 256,000 propiedades recuperaron la plusvalía en el tercer trimestre de 2015. Esta es una gran noticia para el país, ya que el 92 % de las propiedades con hipotecas están ahora en una situación de plusvalía positiva.

[expired_at] =>

[featured_image] => https://simplifyingmedia/wp-content/uploads/2016/02/01161729/Home-Equity-STM.jpg

[id] => 492

[published_at] => 2016-02-10T10:00:29Z

[related] => Array

(

)

[slug] => do-you-know-how-much-equity-you-have-in-your-home-you-may-be-surprised

[status] => published

[tags] => Array

(

)

[title] => ¿Sabe usted cuánta plusvalía tiene en su casa? ¡Le sorprenderá!

[updated_at] => 2016-02-08T18:10:09Z

[url] => /es/2016/02/10/do-you-know-how-much-equity-you-have-in-your-home-you-may-be-surprised/

)

¿Sabe usted cuánta plusvalía tiene en su casa? ¡Le sorprenderá!

El último informe de la plusvalía de CoreLogic reveló que 256,000 propiedades recuperaron la plusvalía en el tercer trimestre de 2015. Esta es una gran noticia para el país, ya que el 92 % de las propiedades con hipotecas están ahora en una situación de plusvalía positiva.

![Destruyendo los mitos sobre la compra de una casa [INFOGRAFíA] | Simplifying The Market](http://www.simplifyingthemarket.com/wp-content/uploads/2015/11/Mitos.jpg)

![Destruyendo los mitos sobre la compra de una casa [INFOGRAFíA] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2015/11/Mitos.jpg)

![¡Comprar una casa puede ser aterrador… hasta que usted conoce la REALIDAD! [INFOGRAFíA] | Simplifying The Market](http://www.simplifyingthemarket.com/wp-content/uploads/2015/10/Comprar-una-casa-puede-ser-aterrador2.jpg)

![¡Comprar una casa puede ser aterrador… hasta que usted conoce la REALIDAD! [INFOGRAFíA] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2015/10/Comprar-una-casa-puede-ser-aterrador2.jpg)

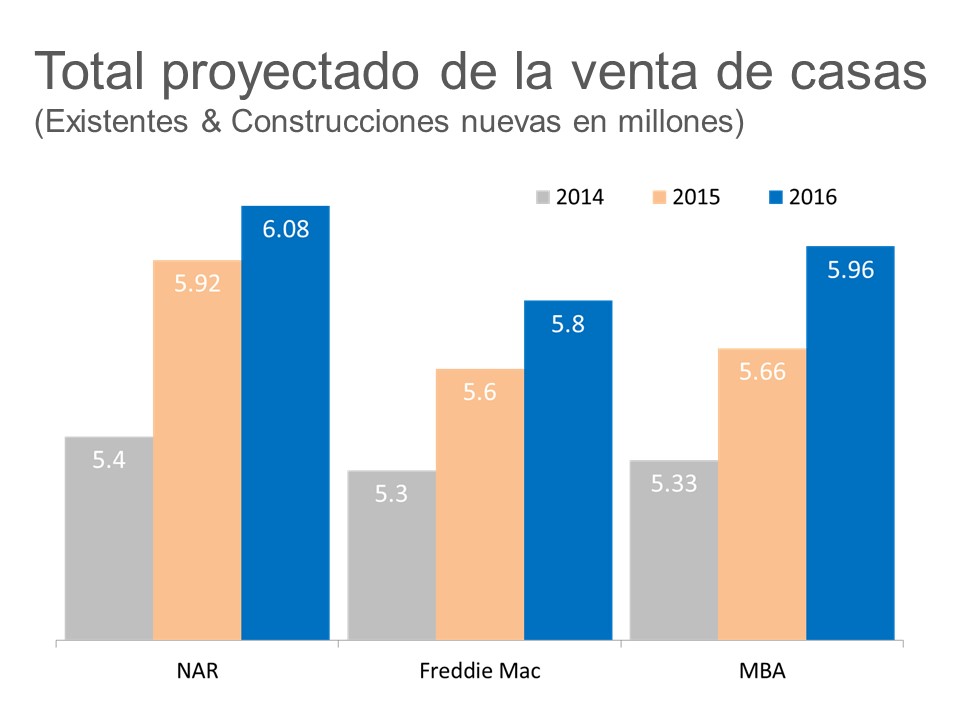

A medida que terminamos 2014, parece que el mercado de bienes raíces esta nuevamente en tierra firme y listo para avanzar en los próximos años. La fuerza del mercado puede ser vista usando dos métricas: la proyección del valor de las casas y la proyección de las ventas de las casas.

Recientemente informamos que la Encuesta de la Expectativa de los Precios de las Casas revelo que el valor futuro de las casas va a continuar apreciando de buena forma. Hoy queremos mirar las proyecciones en el número de ventas de las casas (existentes y construcciones nuevas) que vamos a ver durante los próximos dos años. Investigamos cuales son las proyecciones de la Asociación Nacional de Realtors (NAR por sus siglas en inglés) Freddie Mac y la Asociación de Banqueros Hipotecarios (MBA por sus siglas en inglés) para la industria de la vivienda en el futuro. Esto es lo que encontramos:

A medida que terminamos 2014, parece que el mercado de bienes raíces esta nuevamente en tierra firme y listo para avanzar en los próximos años. La fuerza del mercado puede ser vista usando dos métricas: la proyección del valor de las casas y la proyección de las ventas de las casas.

Recientemente informamos que la Encuesta de la Expectativa de los Precios de las Casas revelo que el valor futuro de las casas va a continuar apreciando de buena forma. Hoy queremos mirar las proyecciones en el número de ventas de las casas (existentes y construcciones nuevas) que vamos a ver durante los próximos dos años. Investigamos cuales son las proyecciones de la Asociación Nacional de Realtors (NAR por sus siglas en inglés) Freddie Mac y la Asociación de Banqueros Hipotecarios (MBA por sus siglas en inglés) para la industria de la vivienda en el futuro. Esto es lo que encontramos:

Every day we are pleasantly surprised with the research coming forward regarding the Millennial generation. Whether it was

Every day we are pleasantly surprised with the research coming forward regarding the Millennial generation. Whether it was

For almost a year now, we have been trying to debunk the myth that student debt is keeping the vast majority of Millennials from purchasing a home.

We explained that Millennials have purchased more homes over a recent twelve month period than any other generation as was

For almost a year now, we have been trying to debunk the myth that student debt is keeping the vast majority of Millennials from purchasing a home.

We explained that Millennials have purchased more homes over a recent twelve month period than any other generation as was  Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Do as I Say… not as I Do

Do as I Say… not as I Do Growing up it seemed ‘white lies’ were okay while lying was a sin. As children, we sometimes had difficulty understanding where the line was. As we matured, we realized there most definitely was a difference.

Growing up it seemed ‘white lies’ were okay while lying was a sin. As children, we sometimes had difficulty understanding where the line was. As we matured, we realized there most definitely was a difference. Someone said to me recently, “Sixty-five is the new forty-five.” We chuckled, but the more I thought about it, the more I found myself in full agreement.

With more and more people working beyond traditional retirement age and the advances in modern medicine, the lines between middle and late adulthood are becoming a bit blurred.

Someone said to me recently, “Sixty-five is the new forty-five.” We chuckled, but the more I thought about it, the more I found myself in full agreement.

With more and more people working beyond traditional retirement age and the advances in modern medicine, the lines between middle and late adulthood are becoming a bit blurred.

Millennials have become an important topic of discussion for media outlets and blogs throughout the Country. While some argue that my generation is blossoming later than our predecessors, optimists such as myself believe that with our rebounding economy will help Millennials finally arrive in the economic arena that allows them the growth potential generations before us were afforded.

While I truly believe Millennials are positioned to become an important force in the new economy, the widening economic policy that minimizes retirement accounts and creates underemployment of Millennials threatens what is now America’s largest demographic.

Millennials have become an important topic of discussion for media outlets and blogs throughout the Country. While some argue that my generation is blossoming later than our predecessors, optimists such as myself believe that with our rebounding economy will help Millennials finally arrive in the economic arena that allows them the growth potential generations before us were afforded.

While I truly believe Millennials are positioned to become an important force in the new economy, the widening economic policy that minimizes retirement accounts and creates underemployment of Millennials threatens what is now America’s largest demographic.

Nielsen recently released their report “

Nielsen recently released their report “