stdClass Object

(

[agents_bottom_line] => (English)  Growing up it seemed ‘white lies’ were okay while lying was a sin. As children, we sometimes had difficulty understanding where the line was. As we matured, we realized there most definitely was a difference.

Growing up it seemed ‘white lies’ were okay while lying was a sin. As children, we sometimes had difficulty understanding where the line was. As we matured, we realized there most definitely was a difference.

If a husband or wife asks if it is okay to invite their parents over for dinner, the spouse would probably say ‘sure’ even if it wasn’t 100% the truth. That was a ‘white lie’. If a young boy dresses up as a monster on Halloween and asks his father if he looks ‘really scary’, it was okay for his dad to say ‘YES’! That was a ‘white lie’.

In both cases, the person telling the ‘white lie’ was saying what the other person wanted to hear. In both cases, there was no harm in not telling the 100% truth. In both cases, it was a ‘white lie’. However, if we are not telling the 100% truth in order to save someone’s feelings AND IT HURTS THEM, we are lying.

What does this have to do with real estate?

We believe there are some in the real estate industry more worried about a homeowner’s feelings than they are about telling the truth about the current value of their home. These agents are not necessarily malicious. They just realize they may disappoint a seller at a listing appointment by telling the truth about what the house will sell for. They find it difficult to deliver tough news. To make sellers feel better, they lie.

Good agents can deliver good news. Great agents know how to deliver tough news.

In today’s real estate market, you need an agent that will tell you the truth, even when you don’t want to hear it. You need an agent more worried about your family than they are about your feelings. You need an agent who can get the house sold!

What this means to you

If you are interviewing potential listing agents, demand they tell you the truth. Don’t hire the agent that tells you what you want to hear. Hire the agent that tells you what you need to know. Reward their honesty.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => Para los vendedores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)  Growing up it seemed ‘white lies’ were okay while lying was a sin. As children, we sometimes had difficulty understanding where the line was. As we matured, we realized there most definitely was a difference.

Growing up it seemed ‘white lies’ were okay while lying was a sin. As children, we sometimes had difficulty understanding where the line was. As we matured, we realized there most definitely was a difference.

If a husband or wife asks if it is okay to invite their parents over for dinner, the spouse would probably say ‘sure’ even if it wasn’t 100% the truth. That was a ‘white lie’. If a young boy dresses up as a monster on Halloween and asks his father if he looks ‘really scary’, it was okay for his dad to say ‘YES’! That was a ‘white lie’.

In both cases, the person telling the ‘white lie’ was saying what the other person wanted to hear. In both cases, there was no harm in not telling the 100% truth. In both cases, it was a ‘white lie’. However, if we are not telling the 100% truth in order to save someone’s feelings AND IT HURTS THEM, we are lying.

What does this have to do with real estate?

We believe there are some in the real estate industry more worried about a homeowner’s feelings than they are about telling the truth about the current value of their home. These agents are not necessarily malicious. They just realize they may disappoint a seller at a listing appointment by telling the truth about what the house will sell for. They find it difficult to deliver tough news. To make sellers feel better, they lie.

Good agents can deliver good news. Great agents know how to deliver tough news.

In today’s real estate market, you need an agent that will tell you the truth, even when you don’t want to hear it. You need an agent more worried about your family than they are about your feelings. You need an agent who can get the house sold!

What this means to you

If you are interviewing potential listing agents, demand they tell you the truth. Don’t hire the agent that tells you what you want to hear. Hire the agent that tells you what you need to know. Reward their honesty.

[created_at] => 2014-05-07T06:00:39Z

[description] => (English) Growing up it seemed ‘white lies’ were okay while lying was a sin. As children, we sometimes had difficulty understanding where the line was. As we matured, we realized there most definitely was a difference.

If a husband or wife asks if i...

[expired_at] =>

[featured_image] => https:///

[id] => 36

[published_at] => 2014-05-07T10:00:39Z

[related] => Array

(

)

[slug] => difference-between-a-white-lie-and-lying-2

[status] => published

[tags] => Array

(

)

[title] => (English) Difference Between a ‘White Lie’ and Lying

[updated_at] => 2014-05-07T14:50:05Z

[url] => /es/2014/05/07/difference-between-a-white-lie-and-lying-2/

)

Buscar

Si los resultados no te satisfacen, intenta una nueva búsqueda con otros términos.

2434 search results for: our new home

(English) Growing up it seemed ‘white lies’ were okay while lying was a sin. As children, we sometimes had difficulty understanding where the line was. As we matured, we realized there most definitely was a difference.

If a husband or wife asks if i...

(English) Homeownership: This Time the Wall Street Journal Got it Wrong

(English) Today's post is written by Steve Harney of Keeping Current Matters.

I have been a subscriber to the Wall Street Journal (WSJ) for as long as I can remember. In my opinion, it is the single greatest source of financial information and ins...

(English) 3 Reasons to Sell Your Home this Spring

(English) Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. H...

(English) Rethinking the 55+ Market

We are excited to have Nikki Buckelew back as our guest blogger for today. Nikki is considered a leading authority on seniors real estate and housing.

Someone said to me recently, “Sixty-five is the new forty-five.” We chuckled, but the more I th...

(English) Shiller ‘FINE’ with his Son Buying a Home

(English) In a recent interview on CNBC’s ‘Squawk Box’, Robert Shiller, Nobel Prize-winning economist and founder of the Case Shiller Price Index, discussed today’s housing market in a rather personal way.

Shiller first commented that he believes...

(English) FreddieMac: Housing is Stronger Today

(English) In a recent blog post, FreddieMac explained that “housing is stronger today than at any point since the Great Recession began and hit bottom in 2009”. They then gave three reasons which support their position:

Home sales are up 13% sinc...

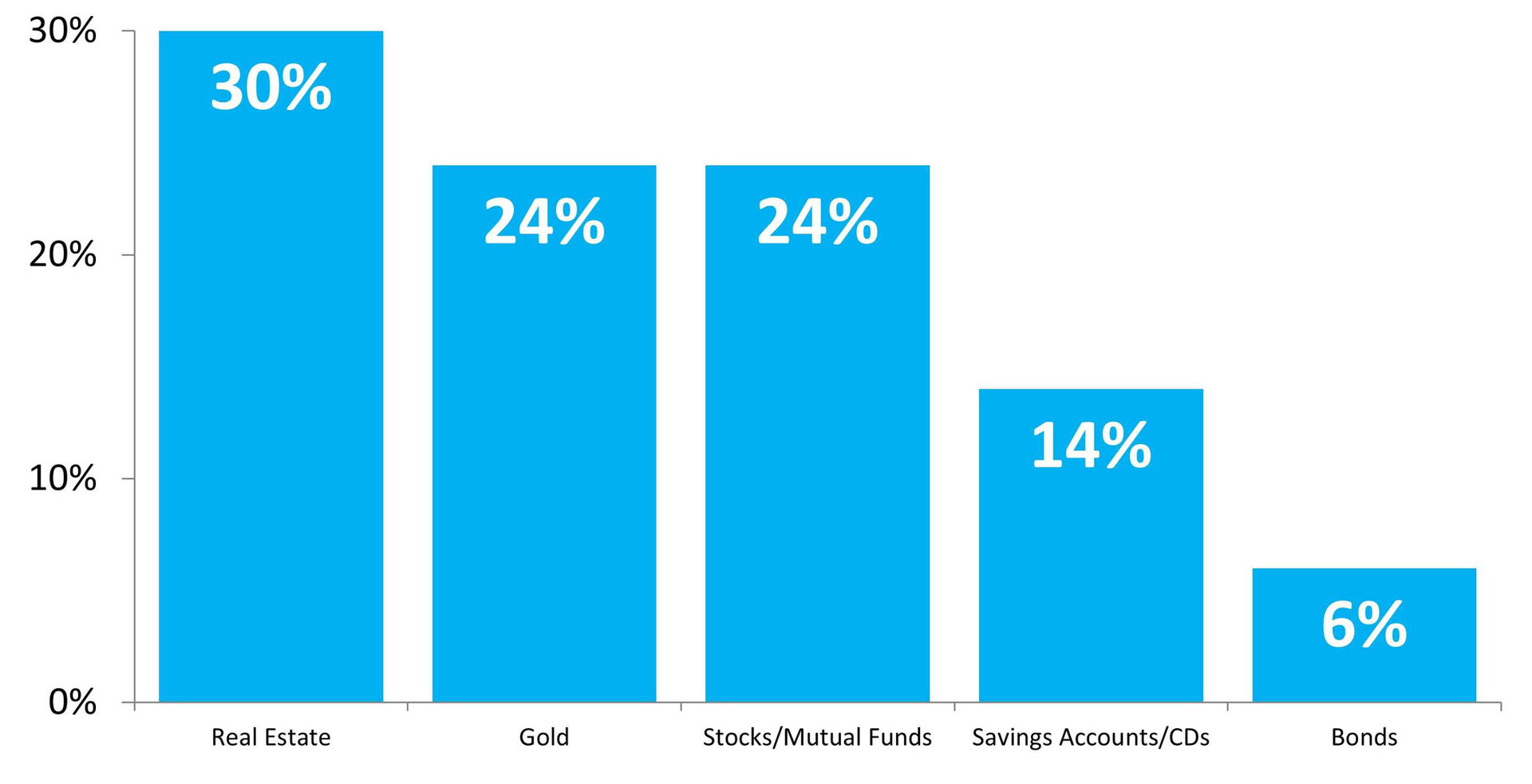

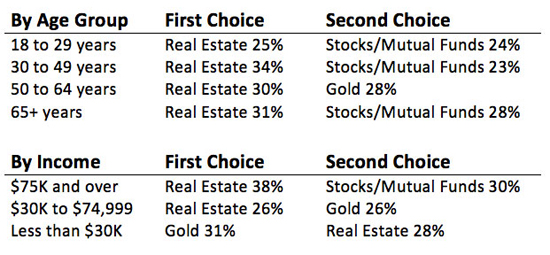

(English) Gallup Poll: Real Estate Best Long Term Investment

(English) The Gallup organization just released their April Economy and Personal Finances Poll which asked Americans to choose the best option for long term investment. It was no surprise to us that real estate returned to the top position over other...

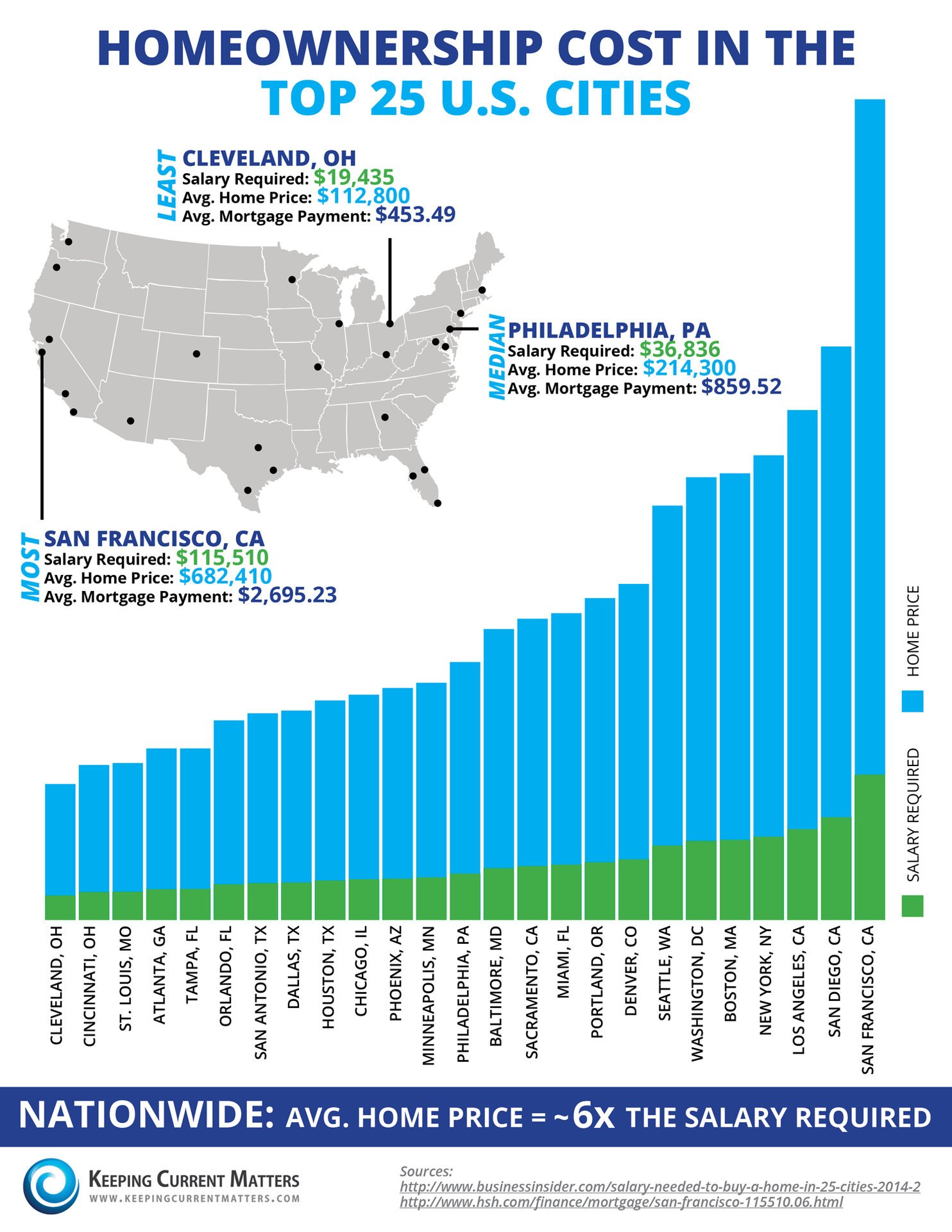

(English) Homeownership Cost in the Top 25 US Cities [INFOGRAPHIC]

(English) ...

- Since 2010, Hispanics have accounted for a net increase of 559,000 owner households, representing 56 percent of the total net growth of owner households in the U.S.

- The number of Hispanic households has grown from 9.2 million in 2000 to 14.7 million in 2013, an increase of 5.5 million, representing a growth rate of 60 percent.

- Four out of 10 new households between 2010 and 2020 are expected to be Hispanic.

- By the end of the decade, Hispanics alone will account for approximately five million net new households, out of an estimated 12 to 14 million net new households in the country.

- The median age of the Hispanic population is 27 years old, which is ten years younger than the median age of the overall U.S. population.

- Hispanics are heavily represented in the 26 to 46 year age range.

- A Hispanic youth turns 18 every minute of every day.

- Hispanics with incomes between $50,000 and $100,000 represent 29 percent of all Hispanic households and comprise nearly 40 percent of Hispanic purchasing power.

- Three out of every four prosperous Hispanics are under the age of 45 and own a home.

- Twenty-two percent of all Hispanic households earn more than $75,000 annually.

- The number of Hispanic-owned businesses in the U.S. nearly doubled from more than a decade ago, growing from 1.7 million in 2002 to an estimated 3.2 million in 2013.

- Latina entrepreneurs are launching businesses at a rate SIX TIMES the national average.

- Hispanic businesses contribute in excess of $465 billion to the nation’s economy annually and employ more than two million workers.

- Latinos now own one out of every 20 businesses in the U.S., while Latinas own 10 percent of all women-owned businesses.

This month the National Association of Hispanic Real Estate Professionals (NAHREP) released their annual State of Hispanic Homeownership Report for 2013. A 35 page report designed to highlight “the homeownership growth and household formation rates of Hispanics as well as their educational achievements, entrepreneurial endeavors, labor force profile, and purchasing power in the United States”.

This report is full of great information and you should download it and read all 35 pages. In this blog post, I will mention a few facts that, in my opinion, are relevant to all of us:

Household formation

This month the National Association of Hispanic Real Estate Professionals (NAHREP) released their annual State of Hispanic Homeownership Report for 2013. A 35 page report designed to highlight “the homeownership growth and household formation rates of Hispanics as well as their educational achievements, entrepreneurial endeavors, labor force profile, and purchasing power in the United States”.

This report is full of great information and you should download it and read all 35 pages. In this blog post, I will mention a few facts that, in my opinion, are relevant to all of us:

Household formation

- Since 2010, Hispanics have accounted for a net increase of 559,000 owner households, representing 56 percent of the total net growth of owner households in the U.S.

- The number of Hispanic households has grown from 9.2 million in 2000 to 14.7 million in 2013, an increase of 5.5 million, representing a growth rate of 60 percent.

- Four out of 10 new households between 2010 and 2020 are expected to be Hispanic.

- By the end of the decade, Hispanics alone will account for approximately five million net new households, out of an estimated 12 to 14 million net new households in the country.

- The median age of the Hispanic population is 27 years old, which is ten years younger than the median age of the overall U.S. population.

- Hispanics are heavily represented in the 26 to 46 year age range.

- A Hispanic youth turns 18 every minute of every day.

- Hispanics with incomes between $50,000 and $100,000 represent 29 percent of all Hispanic households and comprise nearly 40 percent of Hispanic purchasing power.

- Three out of every four prosperous Hispanics are under the age of 45 and own a home.

- Twenty-two percent of all Hispanic households earn more than $75,000 annually.

- The number of Hispanic-owned businesses in the U.S. nearly doubled from more than a decade ago, growing from 1.7 million in 2002 to an estimated 3.2 million in 2013.

- Latina entrepreneurs are launching businesses at a rate SIX TIMES the national average.

- Hispanic businesses contribute in excess of $465 billion to the nation’s economy annually and employ more than two million workers.

- Latinos now own one out of every 20 businesses in the U.S., while Latinas own 10 percent of all women-owned businesses.

(English) The State of Hispanic Homeownership

(English) This month the National Association of Hispanic Real Estate Professionals (NAHREP) released their annual State of Hispanic Homeownership Report for 2013. A 35 page report designed to highlight “the homeownership growth and household formati...

(English) 12,575 Houses Sold Yesterday!

(English) If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when ...

- That’s your morning coffee everyday on the way to work (Average $2) with $12 left for lunch!

- There goes Friday Sushi Night! ($80 x 4)

- Stressed Out? How about 3 deep tissue massages with tip!

- Need a new car? You could get a brand new $22,000 car for $313.00 per month.

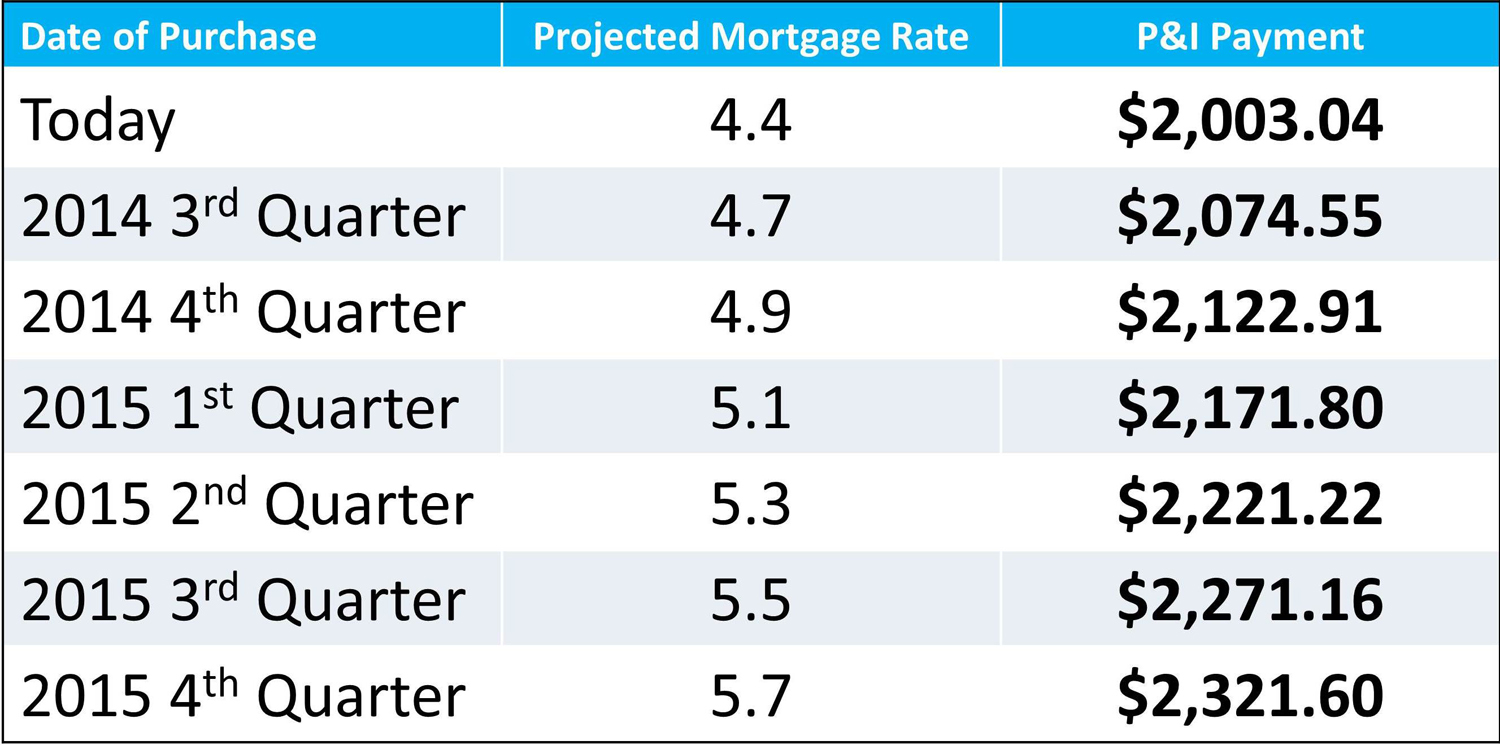

There is a great opportunity that exists now for Millennials who are willing and able to purchase a home NOW... Here are a couple other ways to look at the cost of waiting.

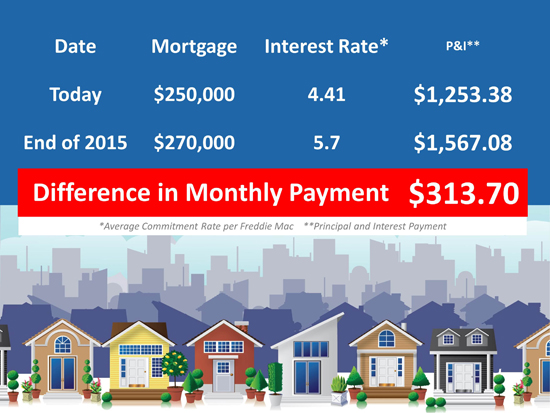

Let’s say you're 30 and your dream house costs $250,000 today, at 4.41% your monthly Mortgage Payment with Interest would be $1,253.38.

But you’re busy, you like your apartment, moving is such a hassle...You decide to wait till the end of next year to buy and all of a sudden, you’re 31, that same house is $270,000, at 5.7%. Your new payment per month is $1,567.08.

There is a great opportunity that exists now for Millennials who are willing and able to purchase a home NOW... Here are a couple other ways to look at the cost of waiting.

Let’s say you're 30 and your dream house costs $250,000 today, at 4.41% your monthly Mortgage Payment with Interest would be $1,253.38.

But you’re busy, you like your apartment, moving is such a hassle...You decide to wait till the end of next year to buy and all of a sudden, you’re 31, that same house is $270,000, at 5.7%. Your new payment per month is $1,567.08.

The difference in payment is $313.70 PER MONTH!

That’s like taking a $10 bill and tossing it out the window EVERY DAY! Or you could look at it this way:- That’s your morning coffee everyday on the way to work (Average $2) with $12 left for lunch!

- There goes Friday Sushi Night! ($80 x 4)

- Stressed Out? How about 3 deep tissue massages with tip!

- Need a new car? You could get a brand new $22,000 car for $313.00 per month.

(English) With Rates & Prices on the Rise, Do You Know the True Cost of Waiting?

(English) There is a great opportunity that exists now for Millennials who are willing and able to purchase a home NOW... Here are a couple other ways to look at the cost of waiting.

Let’s say you're 30 and your dream house costs $250,000 today, a...

Either Way, You’re Still Paying a Mortgage

(English) There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with our parents rent free, you are paying a mortgage - either y...

(English) A Snapshot of Homeowners [INFOGRAPHIC]

(English) ...

(English) Real Estate: This Spring Will Be Different

(English) Just like May flowers, every spring the housing market blossoms as buyers come out ready to purchase their dream house. This spring, we believe we are going to see the strongest purchasing market we have seen in a decade.

Why are we so b...

(English) Real Estate: We are NOT the Only Ones Saying You Should Buy

(English) We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family is ready, willing and able to purchase a home, we believe that owning is much better than ren...

Thinking of Buying a Vacation/Retirement Home? Why Wait?

(English) The sales of vacation homes skyrocketed last year. A recent study also revealed that 25% of those surveyed said they’d likely buy a second home, such as a vacation or beach house, to use during retirement. For many Baby Boomers, the idea of...

¿Quiere Vender su casa? ¡Póngale el precio correcto!

(English) The housing market is recovering nicely. Prices have increased nationally by double digits over the last twelve months. Competition from the shadow inventory of lower priced distressed properties (foreclosures and short sales) is diminishin...

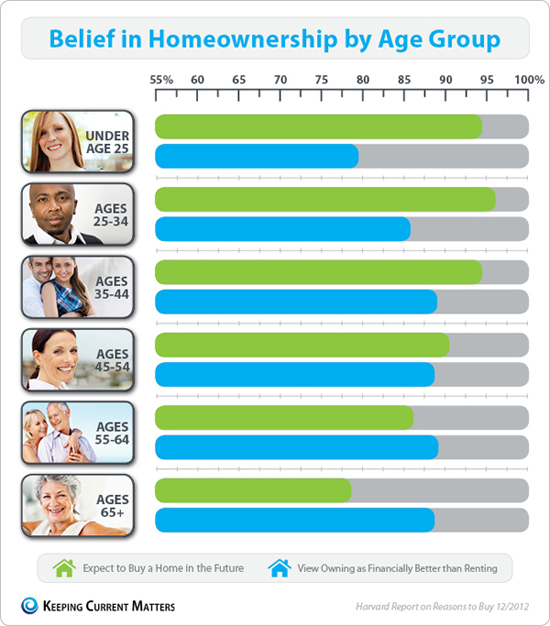

(English) Belief in Homeownership [INFOGRAPHIC]

(English) ...

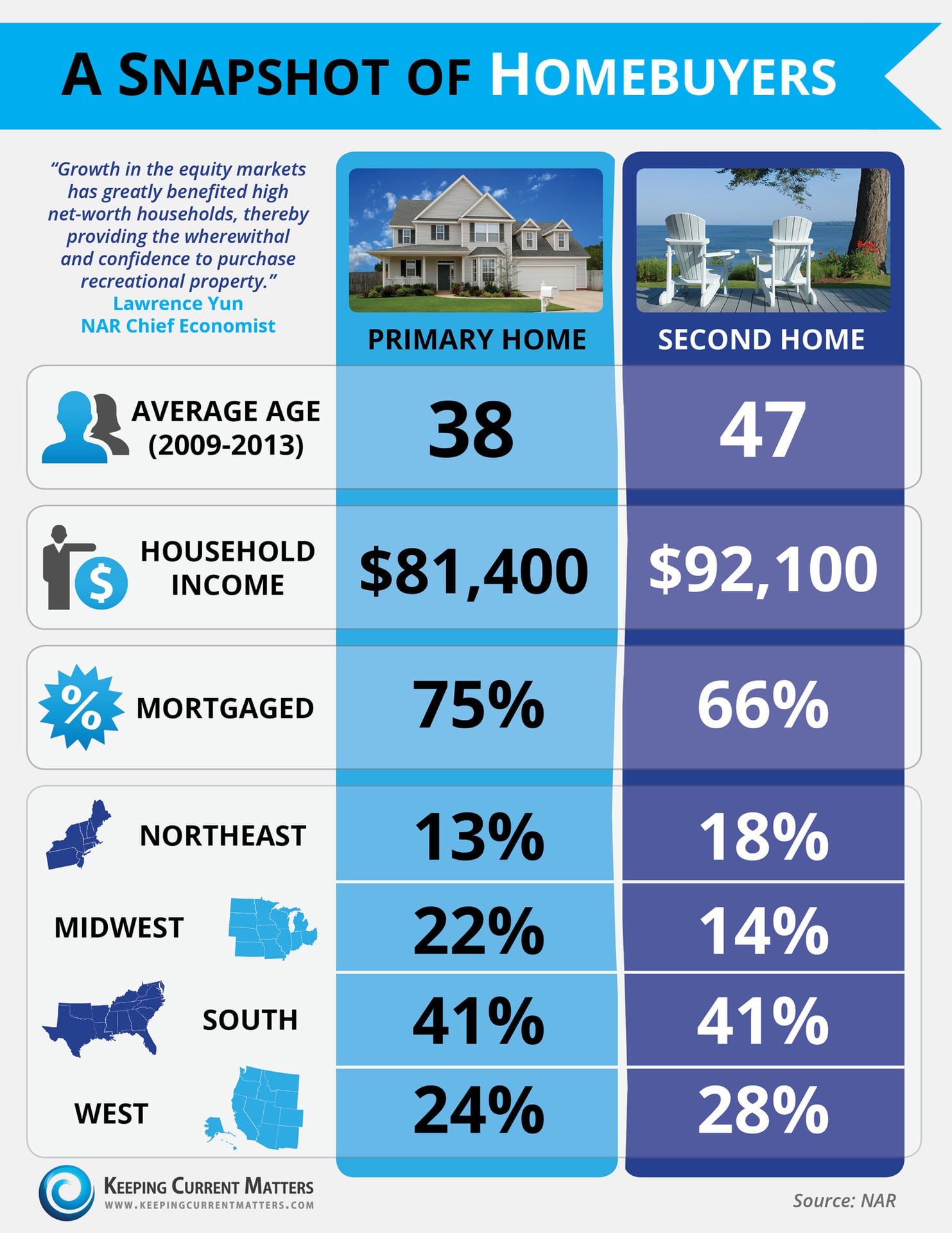

- Vacation-Home sales rose 29.7 percent to 717,000 from 553,000 in 2012

- Sales accounted for 13% of all transactions last year, up from 11% in 2012

- The median price was $168,700, compared with $150,000 in 2012, reflecting a greater number of more expensive recreational property sales in 2013

- 42% of vacation homes purchased in 2013 were distressed homes (in foreclosure or short sale)

Buyer Profile

- The typical vacation-home buyer was 43 years old

- The median household income was $85,600

- Buyers plan to own their recreational property for a median of 6 years

- 33% said they were likely to purchase another vacation home within two years

- 82% of all second-home buyers said it was a good time to buy (compared with 67% of primary residence buyers)

Reasons for Purchasing

Lifestyle factors remain the primary motivation for vacation-home buyers:- 87% want to use the property for vacations or as a family retreat

- 31% plan to use it as a primary residence in the future

- 28% wanted to diversify their investments or saw a good investment opportunity

- 23% plan to rent to others

Location

- 41% of vacation homes purchased last year were in the South

- 28% in the West

- 18% in the Northeast

- 14% in the Midwest

- 46% were within 100 miles

- 34% were more than 500 miles

Financing

- 38% of vacation-home buyers paid cash in 2013

- The median down payment was 30%, up from 27% in 2012

The American desire to own a second home as a vacation home is alive and well!

The American desire to own a second home as a vacation home is alive and well!

The National Association of Realtors analysis of U.S. Census Bureau data shows there are approximately 8 million vacation homes in the U.S. Their 2014 Investment and Vacation Home Buyers Survey shows vacation home sales improved substantially in 2013.

NAR Chief Economist Lawrence Yun said favorable conditions are driving second-home sales:

“Growth in the equity markets has greatly benefited high net-worth households, thereby providing the wherewithal and confidence to purchase recreational property,” he said. “However, vacation-home sales are still about one-third below the peak activity seen in 2006.”

Here are the key findings from the report:

Raw Numbers

- Vacation-Home sales rose 29.7 percent to 717,000 from 553,000 in 2012

- Sales accounted for 13% of all transactions last year, up from 11% in 2012

- The median price was $168,700, compared with $150,000 in 2012, reflecting a greater number of more expensive recreational property sales in 2013

- 42% of vacation homes purchased in 2013 were distressed homes (in foreclosure or short sale)

Buyer Profile

- The typical vacation-home buyer was 43 years old

- The median household income was $85,600

- Buyers plan to own their recreational property for a median of 6 years

- 33% said they were likely to purchase another vacation home within two years

- 82% of all second-home buyers said it was a good time to buy (compared with 67% of primary residence buyers)

Reasons for Purchasing

Lifestyle factors remain the primary motivation for vacation-home buyers:- 87% want to use the property for vacations or as a family retreat

- 31% plan to use it as a primary residence in the future

- 28% wanted to diversify their investments or saw a good investment opportunity

- 23% plan to rent to others

Location

- 41% of vacation homes purchased last year were in the South

- 28% in the West

- 18% in the Northeast

- 14% in the Midwest

- 46% were within 100 miles

- 34% were more than 500 miles

Financing

- 38% of vacation-home buyers paid cash in 2013

- The median down payment was 30%, up from 27% in 2012

(English) Vacation Home Property Sales Surge

(English) The American desire to own a second home as a vacation home is alive and well!

The National Association of Realtors analysis of U.S. Census Bureau data shows there are approximately 8 million vacation homes in the U.S. Their 2014 Investmen...

- The average American family has a net worth of $77,300

- Of that net worth, 61.4% ($47,500) of it is in home equity

- A homeowner’s net worth is over thirty times greater than that of a renter

- The average homeowner has a net worth of $174,500 while the average net worth of a renter is $5,100

Bottom Line

The Fed study found that homeownership is still a great way for a family to build wealth in America.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => Para los compradores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)  Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A study by the Federal Reserve formally answered this question.

Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A study by the Federal Reserve formally answered this question.

Some of the findings revealed in their report:

- The average American family has a net worth of $77,300

- Of that net worth, 61.4% ($47,500) of it is in home equity

- A homeowner’s net worth is over thirty times greater than that of a renter

- The average homeowner has a net worth of $174,500 while the average net worth of a renter is $5,100

Bottom Line

The Fed study found that homeownership is still a great way for a family to build wealth in America.

[created_at] => 2014-04-09T07:00:54Z

[description] => (English) Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A stu...

[expired_at] =>

[featured_image] => https:///

[id] => 16

[published_at] => 2014-04-09T07:00:54Z

[related] => Array

(

)

[slug] => homeownerships-impact-on-net-worth-2

[status] => published

[tags] => Array

(

)

[title] => (English) Homeownership’s Impact on Net Worth

[updated_at] => 2014-06-12T20:55:44Z

[url] => /es/2014/04/09/homeownerships-impact-on-net-worth-2/

)

(English) Homeownership’s Impact on Net Worth

(English) Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A stu...

(English) 3 Reasons to Sell Your Home this Spring

(English) Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. H...

(English) A Home’s Cost vs. Price Explained

(English) We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first time or repeat buyer, you must not...

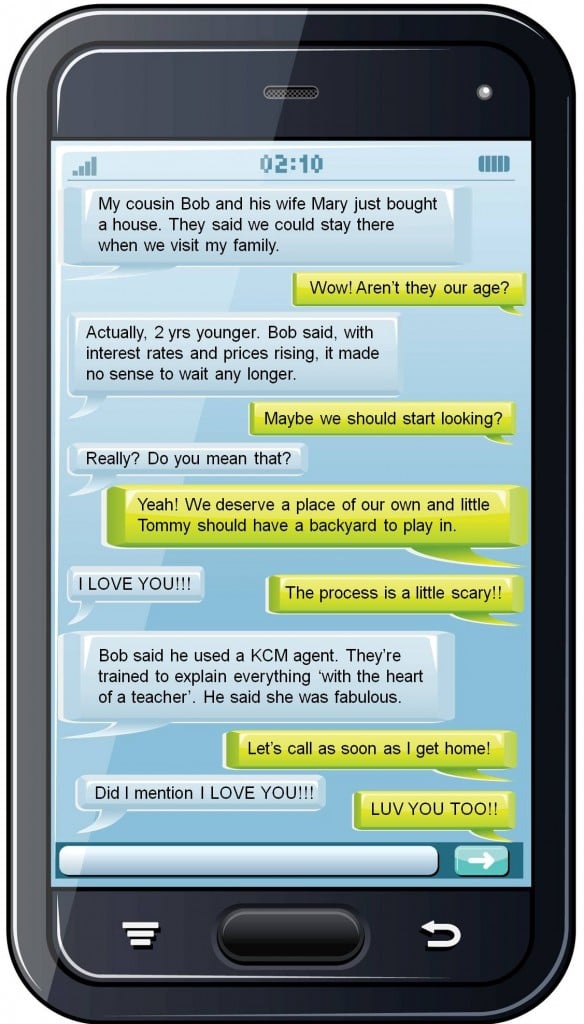

(English) Millennials: Texting About Buying A Home [INFOGRAPHIC]

(English) ...

(English) Millennials & Income

(English) Today, Justin DeCesare returns as our guest blogger. Justin is the CEO of Middleton & Associates Real Estate in La Jolla, CA. - The KCM Crew

Millennials have become an important topic of discussion for media outlets and blogs throug...

- In 2003, 34% were Spanish dominant, 44% English dominant, 22% bilingual

- In 2013, 31% were Spanish dominant, 31% English dominant, 38% bilingual

Where are they looking for homes?

This report revealed “62% of the Millennials prefer to live in the type of mixed-use communities found in urban centers where they live in close proximity to a mix of shopping, restaurants and offices. This is the first time since the 1920s where the growth in U.S. cities outpaces growth outside of the cities. And, 40 percent say they would like to live in an urban area in the future. The “American Dream” is transitioning from the white picket fence in the suburbs to the historic brownstone stoop in the heart of the city” and the markets with a major concentration of Millennials reflect this desire: Top 10 markets for Millennials (by %):- Austin, TX (16%)

- Salt Lake City, UT (15%)

- San Diego, CA (15%)

- Los Angeles, CA (14%)

- Denver, CO (14%)

- Washington, DC (14%)

- Houston, TX (14%)

- Las Vegas, NV (14%)

- San Francisco, CA (14%)

- Dallas-Ft. Worth, TX (14%)

Nielsen recently released their report “Millennials – Breaking the Myths” and today I want to focus on the information reported about Hispanic Millennials.

Of the 77 million Millennials, 19% are Hispanic. This group (age 18-36) is the most racially and ethnically diverse than any previous generation. According to this report, Nielsen expects the Hispanic population to grow by 167% by 2050.

Millennials are 14% first generation, and 12% second generation Americans, keeping strong ties to their home country, culture and language. For example:

1. 63% of the Millennials feel it is their responsibility to care for an elderly parent, according to Nielsen: “this is partially tied to the ethnic diversity of the generation. Typically ‘Hispanic and Asian Americans’ have cultural expectations that elderly family members will be cared for by the younger generations.”

This can help you to understand why when a Hispanic Millennial is looking for a home, they are requesting that extra bedroom.

2. 65% of Hispanic Millennials are U.S. Born and are more bilingual than other generations

Nielsen recently released their report “Millennials – Breaking the Myths” and today I want to focus on the information reported about Hispanic Millennials.

Of the 77 million Millennials, 19% are Hispanic. This group (age 18-36) is the most racially and ethnically diverse than any previous generation. According to this report, Nielsen expects the Hispanic population to grow by 167% by 2050.

Millennials are 14% first generation, and 12% second generation Americans, keeping strong ties to their home country, culture and language. For example:

1. 63% of the Millennials feel it is their responsibility to care for an elderly parent, according to Nielsen: “this is partially tied to the ethnic diversity of the generation. Typically ‘Hispanic and Asian Americans’ have cultural expectations that elderly family members will be cared for by the younger generations.”

This can help you to understand why when a Hispanic Millennial is looking for a home, they are requesting that extra bedroom.

2. 65% of Hispanic Millennials are U.S. Born and are more bilingual than other generations

- In 2003, 34% were Spanish dominant, 44% English dominant, 22% bilingual

- In 2013, 31% were Spanish dominant, 31% English dominant, 38% bilingual

Where are they looking for homes?

This report revealed “62% of the Millennials prefer to live in the type of mixed-use communities found in urban centers where they live in close proximity to a mix of shopping, restaurants and offices. This is the first time since the 1920s where the growth in U.S. cities outpaces growth outside of the cities. And, 40 percent say they would like to live in an urban area in the future. The “American Dream” is transitioning from the white picket fence in the suburbs to the historic brownstone stoop in the heart of the city” and the markets with a major concentration of Millennials reflect this desire: Top 10 markets for Millennials (by %):- Austin, TX (16%)

- Salt Lake City, UT (15%)

- San Diego, CA (15%)

- Los Angeles, CA (14%)

- Denver, CO (14%)

- Washington, DC (14%)

- Houston, TX (14%)

- Las Vegas, NV (14%)

- San Francisco, CA (14%)

- Dallas-Ft. Worth, TX (14%)

(English) Hispanic Millennials & Housing

(English) Nielsen recently released their report “Millennials – Breaking the Myths” and today I want to focus on the information reported about Hispanic Millennials.

Of the 77 million Millennials, 19% are Hispanic. This group (age 18-36) is the mo...

I have been a subscriber to the Wall Street Journal (WSJ) for as long as I can remember. In my opinion, it is the single greatest source of financial information and insights available. I don’t always agree with their analysis but I always respect their position.

However, in an article this past weekend,

I have been a subscriber to the Wall Street Journal (WSJ) for as long as I can remember. In my opinion, it is the single greatest source of financial information and insights available. I don’t always agree with their analysis but I always respect their position.

However, in an article this past weekend,  Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are three of those reasons.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are three of those reasons. Someone said to me recently, “Sixty-five is the new forty-five.” We chuckled, but the more I thought about it, the more I found myself in full agreement.

With more and more people working beyond traditional retirement age and the advances in modern medicine, the lines between middle and late adulthood are becoming a bit blurred.

Someone said to me recently, “Sixty-five is the new forty-five.” We chuckled, but the more I thought about it, the more I found myself in full agreement.

With more and more people working beyond traditional retirement age and the advances in modern medicine, the lines between middle and late adulthood are becoming a bit blurred.

In a

In a  In a recent

In a recent  The Gallup organization just released their

The Gallup organization just released their

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => Para los compradores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => Para los compradores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)

If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when it comes to purchasing real estate. That is actually far from reality.

After all 12,575 houses sold yesterday, 12,575 will sell today and 12,575 will sell tomorrow. 12,575!

That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. According to the report, annualized sales now stand at 4.59 million. Divide that number by 365 (days in a year) and we can see that, on average, over 12,500 homes sell every day.

If you are considering whether or not to put your house up for sale, don't let the headlines scare you. There are purchasers in the market and they are buying - to the tune of 12,575 homes a day.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => Para los vendedores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)

If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when it comes to purchasing real estate. That is actually far from reality.

After all 12,575 houses sold yesterday, 12,575 will sell today and 12,575 will sell tomorrow. 12,575!

That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. According to the report, annualized sales now stand at 4.59 million. Divide that number by 365 (days in a year) and we can see that, on average, over 12,500 homes sell every day.

If you are considering whether or not to put your house up for sale, don't let the headlines scare you. There are purchasers in the market and they are buying - to the tune of 12,575 homes a day.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => Para los vendedores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)  There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with our parents rent free, you are paying a mortgage - either your mortgage or your landlord’s.

As a

There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with our parents rent free, you are paying a mortgage - either your mortgage or your landlord’s.

As a

Just like May flowers, every spring the housing market blossoms as buyers come out ready to purchase their dream house. This spring, we believe we are going to see the strongest purchasing market we have seen in a decade.

Why are we so bullish on the housing market this spring?

Here are a few reasons:

Just like May flowers, every spring the housing market blossoms as buyers come out ready to purchase their dream house. This spring, we believe we are going to see the strongest purchasing market we have seen in a decade.

Why are we so bullish on the housing market this spring?

Here are a few reasons:

We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family is ready, willing and able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy.

We are not the only ones that think owning has massive benefits or that now is a sensational time to plunge into owning your own home. Here are a few others:

We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family is ready, willing and able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy.

We are not the only ones that think owning has massive benefits or that now is a sensational time to plunge into owning your own home. Here are a few others:

The sales of vacation homes

The sales of vacation homes

The housing market is recovering nicely. Prices have increased nationally by double digits over the last twelve months. Competition from the shadow inventory of lower priced distressed properties (foreclosures and short sales) is diminishing rapidly. Now may be the perfect time to sell your home and move to the dream house or beautiful location your family has always talked about.

The one suggestion we would definitely offer: DON’T OVERPRICE IT!!

Even though prices have increased by more than 10% over the last year, the acceleration of appreciation has slowed dramatically over the last few months. As an example, in their April

The housing market is recovering nicely. Prices have increased nationally by double digits over the last twelve months. Competition from the shadow inventory of lower priced distressed properties (foreclosures and short sales) is diminishing rapidly. Now may be the perfect time to sell your home and move to the dream house or beautiful location your family has always talked about.

The one suggestion we would definitely offer: DON’T OVERPRICE IT!!

Even though prices have increased by more than 10% over the last year, the acceleration of appreciation has slowed dramatically over the last few months. As an example, in their April

We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first time or repeat buyer, you must not be concerned about price but instead about the ‘long term cost’ of the home. Let us explain.

Recently, we

We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first time or repeat buyer, you must not be concerned about price but instead about the ‘long term cost’ of the home. Let us explain.

Recently, we

Millennials have become an important topic of discussion for media outlets and blogs throughout the Country. While some argue that my generation is blossoming later than our predecessors, optimists such as myself believe that with our rebounding economy will help Millennials finally arrive in the economic arena that allows them the growth potential generations before us were afforded.

While I truly believe Millennials are positioned to become an important force in the new economy, the widening economic policy that minimizes retirement accounts and creates underemployment of Millennials threatens what is now America’s largest demographic.

Millennials have become an important topic of discussion for media outlets and blogs throughout the Country. While some argue that my generation is blossoming later than our predecessors, optimists such as myself believe that with our rebounding economy will help Millennials finally arrive in the economic arena that allows them the growth potential generations before us were afforded.

While I truly believe Millennials are positioned to become an important force in the new economy, the widening economic policy that minimizes retirement accounts and creates underemployment of Millennials threatens what is now America’s largest demographic.