stdClass Object

(

[agents_bottom_line] => (English)  We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago.

There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any time in history.

We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago.

There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any time in history.

- The government has set new guidelines that now demand that the bank prove beyond any doubt that you are indeed capable of affording the mortgage. During the run-up in the housing market, many people ‘qualified’ for mortgages that they could never pay back. This led to millions of families losing their home. The government wants to make sure this can’t happen again

- The banks don’t want to be in the real estate business. Over the last seven years, banks were forced to take on the responsibility of liquidating millions of foreclosures and also negotiating another million plus short sales. Just like the government, they don’t want more foreclosures. For that reason, they need to double (maybe even triple) check everything on the application.

However, there is some good news in the situation. The housing crash that mandated that banks be extremely strict on paperwork requirements also allowed you to get a mortgage interest rate probably below 5%.

The friends and family who bought homes ten or twenty ago experienced a simpler mortgage application process but also paid a higher interest rate (the average 30 year fixed rate mortgage was 8.12% in the 1990’s and 6.29% in the 2000’s). If you went to the bank and offered to pay 7% instead of <5%, they would probably bend over backwards to make the process much easier.

Bottom Line

Instead of concentrating on the additional paperwork required, let’s be thankful that we are able to buy a home at historically low rates.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => Para los compradores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)  We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago.

There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any time in history.

We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago.

There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any time in history.

- The government has set new guidelines that now demand that the bank prove beyond any doubt that you are indeed capable of affording the mortgage. During the run-up in the housing market, many people ‘qualified’ for mortgages that they could never pay back. This led to millions of families losing their home. The government wants to make sure this can’t happen again

- The banks don’t want to be in the real estate business. Over the last seven years, banks were forced to take on the responsibility of liquidating millions of foreclosures and also negotiating another million plus short sales. Just like the government, they don’t want more foreclosures. For that reason, they need to double (maybe even triple) check everything on the application.

However, there is some good news in the situation. The housing crash that mandated that banks be extremely strict on paperwork requirements also allowed you to get a mortgage interest rate probably below 5%.

The friends and family who bought homes ten or twenty ago experienced a simpler mortgage application process but also paid a higher interest rate (the average 30 year fixed rate mortgage was 8.12% in the 1990’s and 6.29% in the 2000’s). If you went to the bank and offered to pay 7% instead of <5%, they would probably bend over backwards to make the process much easier.

Bottom Line

Instead of concentrating on the additional paperwork required, let’s be thankful that we are able to buy a home at historically low rates.

[created_at] => 2014-06-17T06:00:51Z

[description] => (English)

We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate ea...

[expired_at] =>

[featured_image] => https:///

[id] => 65

[published_at] => 2014-06-17T10:00:51Z

[related] => Array

(

)

[slug] => getting-a-mortgage-why-so-much-paperwork

[status] => published

[tags] => Array

(

)

[title] => (English) Getting a Mortgage: Why SO MUCH Paperwork?

[updated_at] => 2014-06-17T20:08:43Z

[url] => /es/2014/06/17/getting-a-mortgage-why-so-much-paperwork/

)

(English) Getting a Mortgage: Why SO MUCH Paperwork?

(English)

We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate ea...

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Last year Nielsen and the Association of Hispanic Advertising Agencies (AHAA) identified Upscale Latinos as the most influential segment since the Baby Boomers. Upscale Latinos are becoming a powerful population segment and have grown by more than two million since 2010.

“Recognizing the diversity within the Hispanic population in the U.S., Nielsen and AHAA embarked this year on a second study to further understand the behavior of upscale Latino households, what drives them toward upscale-luxury purchases and what drivers and detractors they share—or don’t share—with non-Hispanic upscale households.” Here are some important points that they found:

Last year Nielsen and the Association of Hispanic Advertising Agencies (AHAA) identified Upscale Latinos as the most influential segment since the Baby Boomers. Upscale Latinos are becoming a powerful population segment and have grown by more than two million since 2010.

“Recognizing the diversity within the Hispanic population in the U.S., Nielsen and AHAA embarked this year on a second study to further understand the behavior of upscale Latino households, what drives them toward upscale-luxury purchases and what drivers and detractors they share—or don’t share—with non-Hispanic upscale households.” Here are some important points that they found:

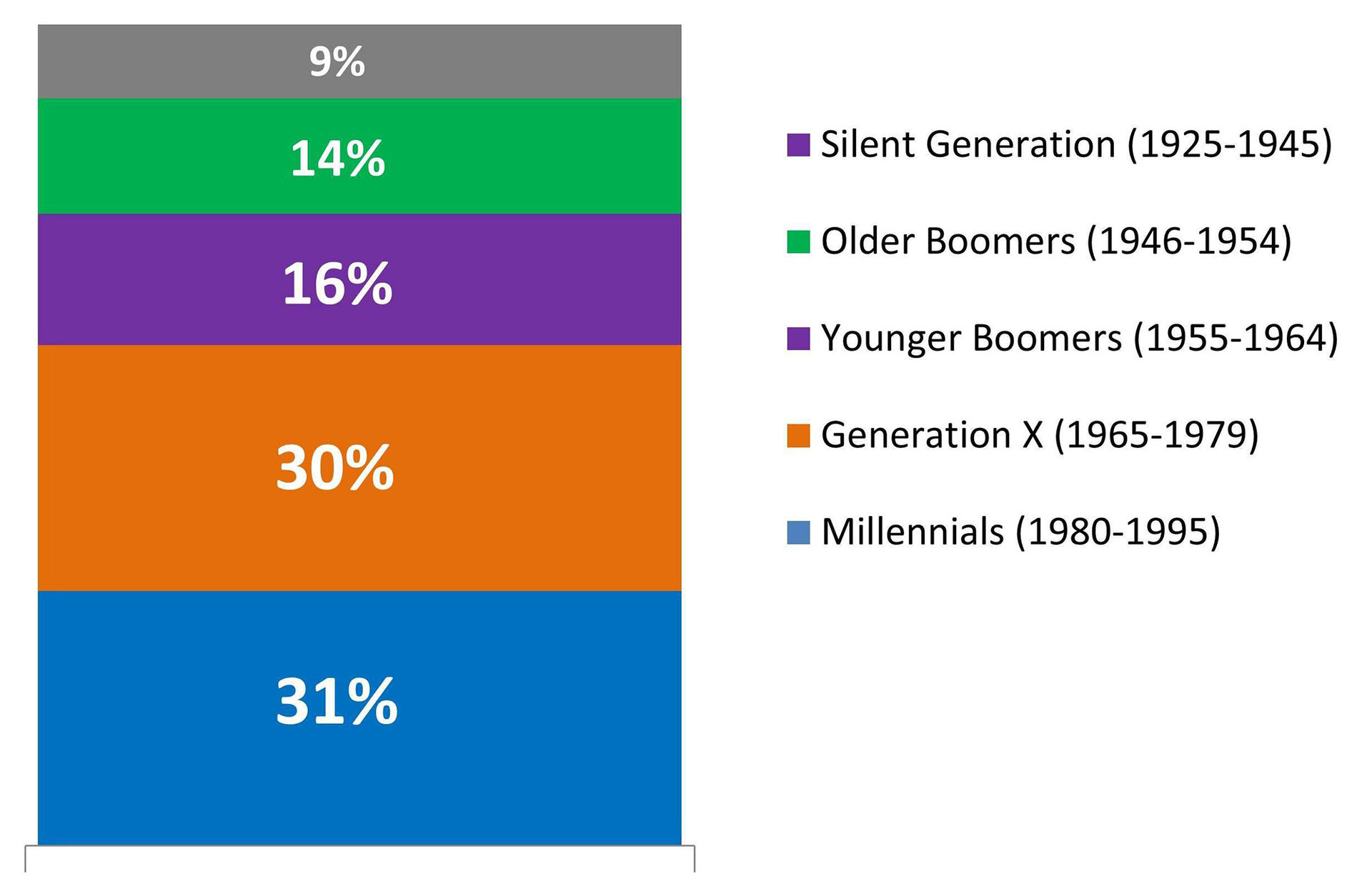

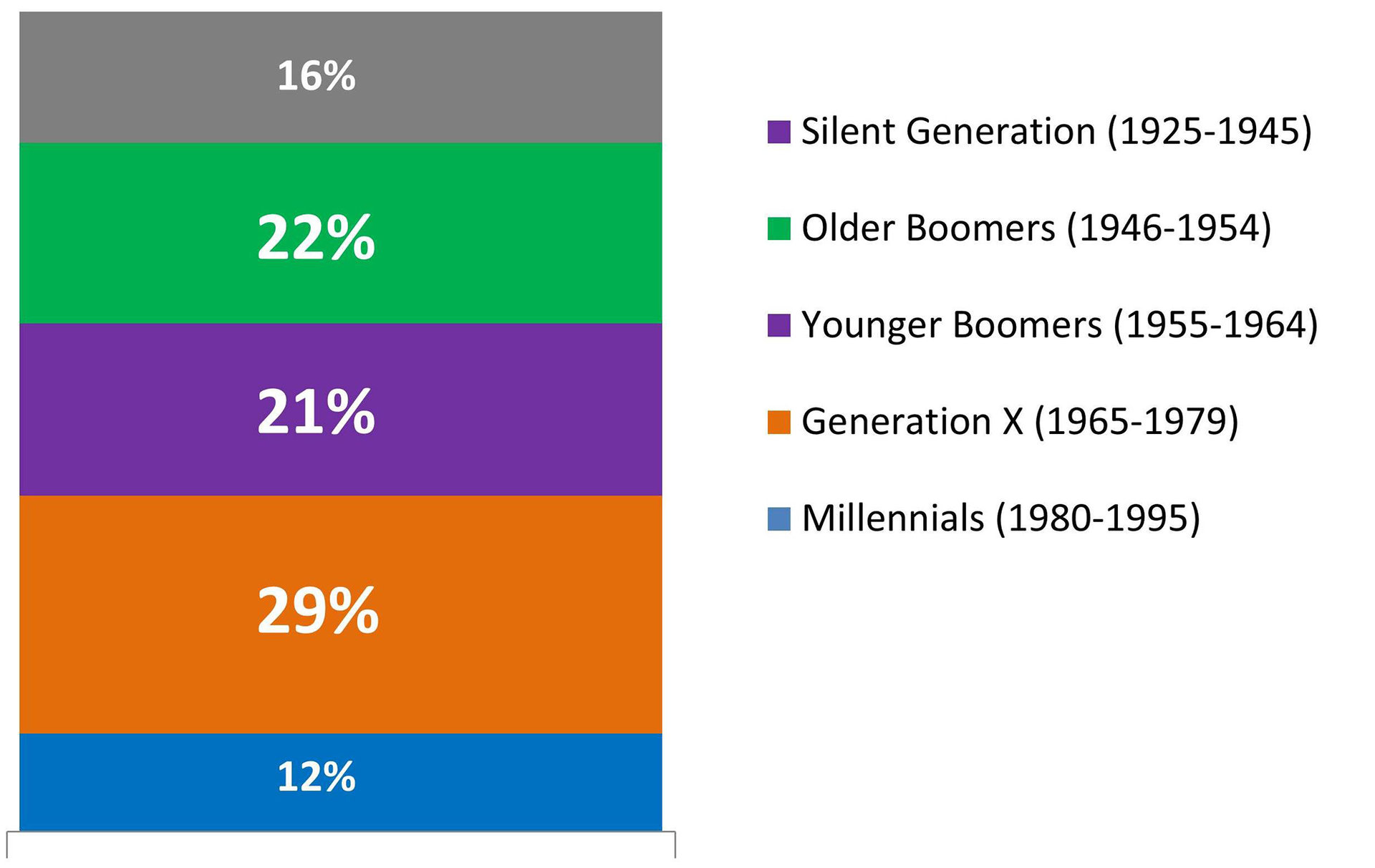

A recent study by the National Association of Realtors,

A recent study by the National Association of Realtors,

There has been a lot written about how buying a home is less expensive than renting one in most parts of the country. Rents are skyrocketing and homes are still at great prices. These two situations are also causing some sellers to consider renting their home instead of selling it. After all, a homeowner can get great rental income now and perhaps wait until house values increase even further before selling.

This logic makes sense in some cases. There is a strong belief that residential real estate is a great investment right now. However, if you have no desire to actually become an educated investor in this sector, you may be headed for more trouble than you were looking for.

Before renting your home, you should answer the following questions to make sure this is the right course of action for you and your family.

There has been a lot written about how buying a home is less expensive than renting one in most parts of the country. Rents are skyrocketing and homes are still at great prices. These two situations are also causing some sellers to consider renting their home instead of selling it. After all, a homeowner can get great rental income now and perhaps wait until house values increase even further before selling.

This logic makes sense in some cases. There is a strong belief that residential real estate is a great investment right now. However, if you have no desire to actually become an educated investor in this sector, you may be headed for more trouble than you were looking for.

Before renting your home, you should answer the following questions to make sure this is the right course of action for you and your family.

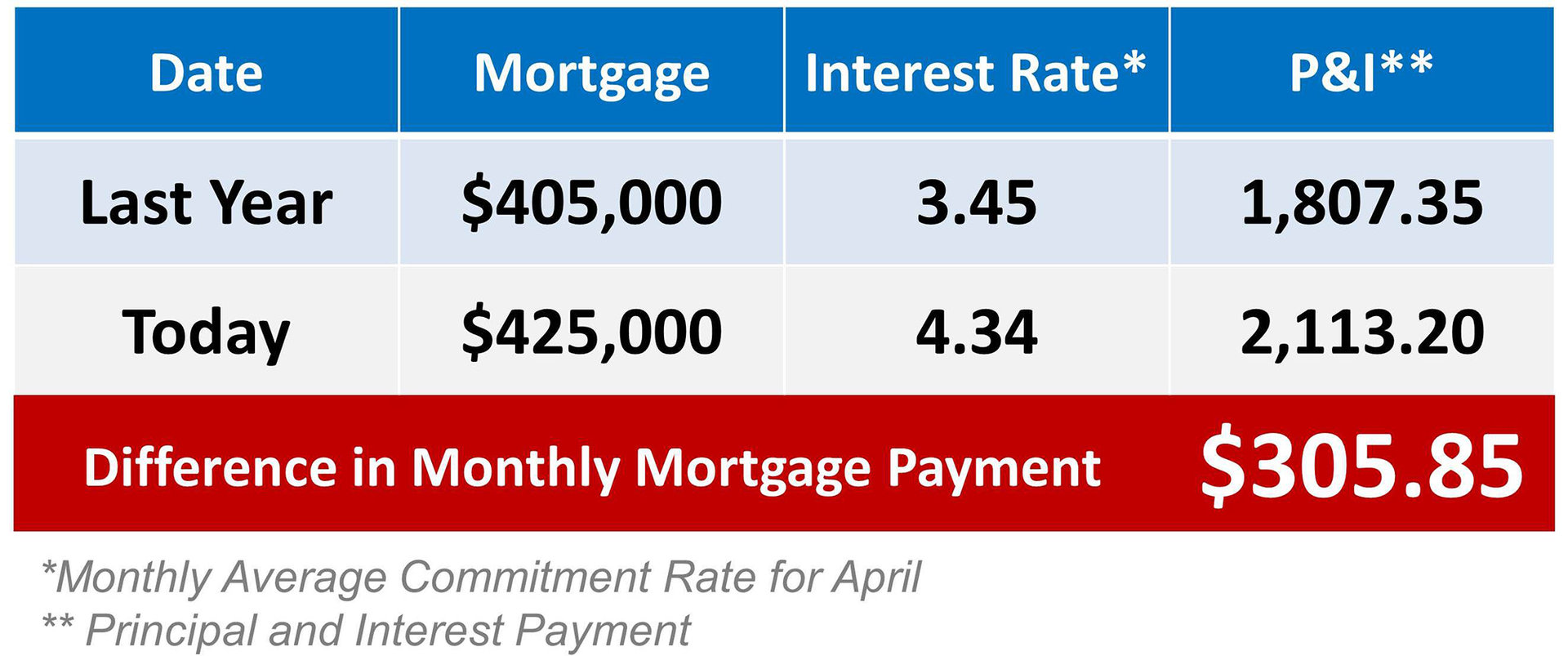

Here are four great reasons to consider buying a home today, instead of waiting.

Here are four great reasons to consider buying a home today, instead of waiting.

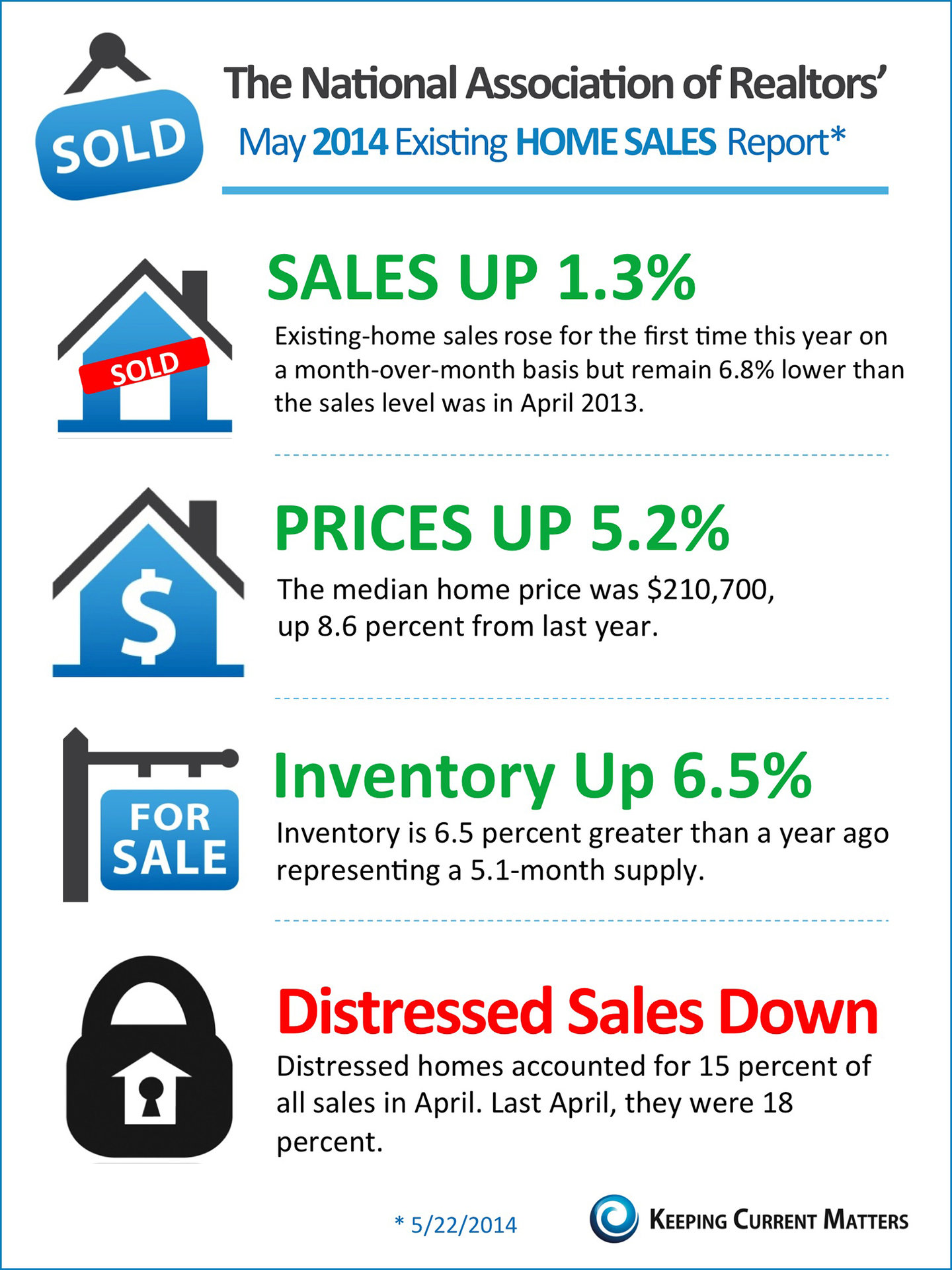

Some housing experts are concerned that the housing recovery seems to be stalling. Some are blaming the one percent increase in mortgage interest rates since the first quarter of last year. Others are pointing at an economy that is improving but only at a snail’s pace. Still, others are questioning whether homeownership is even considered by some to still be part of the American Dream.

However, there is great evidence that the true reason home sales aren’t stronger is because we lack inventory in the vast majority of markets across the country.

Here are a few reasons why we believe this to be true:

Some housing experts are concerned that the housing recovery seems to be stalling. Some are blaming the one percent increase in mortgage interest rates since the first quarter of last year. Others are pointing at an economy that is improving but only at a snail’s pace. Still, others are questioning whether homeownership is even considered by some to still be part of the American Dream.

However, there is great evidence that the true reason home sales aren’t stronger is because we lack inventory in the vast majority of markets across the country.

Here are a few reasons why we believe this to be true:

American consumers’ perception of the residential real estate market was revealed in a recent

American consumers’ perception of the residential real estate market was revealed in a recent

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? Can buyers qualify for a mortgage? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are five of those reasons.

It's probably only natural for real estate agents to assume that most boomers or retirees bent on moving to a new city to enjoy their golden years will be on the trail to Florida, Arizona, or some other state blessed with warmth and plenty of sunshine. And those states are probably the ones best situated to offer plenty of age-in-place benefits, right?

Nope.

When a boomer or senior who's open-minded about where they wish to move and retire searches Google for the best cities to age in place or best cities to retire, they finds some spots that are a bit out of the norm, but quite intriguing nonetheless.

Places like Sioux Falls, SD; Provo, UT; Iowa City, IA; Bismarck, ND; Columbia, MO; Omaha, NE; Madison, WI; and Boston, MA top the list.

As adults 55+ begin to contemplate their future and plan for a possible move, they are hearing more and more about the importance of preparing to age-in-place. They already know they hope to live in their own home, independently, for as long as possible. And the cities listed above – plus many other non-traditional retirement options – are receiving plenty of attention as go-to spots for their aging-in-place benefits in the form of quality healthcare, accessible transportation, government initiatives in building the city as senior-friendly, and a number of other indexes.

The Milken Institute, a non-partisan think tank, compiled a list in 2012 of the 259 Best Cities to Age Successfully. Another ranking is due later this summer of 2014. It divided the rankings into "Large Metros" and 'Small Metros," with Provo, Utah topping the Large City list and Sioux Falls the Small City rankings.

Others in the Top 10 of Large Cities to Age Successfully include Pittsburgh, Toledo, Des Moines, Salt Lake City, and Washington D.C.

Others in the Top 10 of Small Cities to Age Successfully include Rochester, MN, Ann Arbor, MI, Missoula, MT, Durham-Chapel Hill, NC, and Gainesville, FL.

See the entire list here and learn more about the Milken Institute's approach to promoting aging-in-place awareness:

It's probably only natural for real estate agents to assume that most boomers or retirees bent on moving to a new city to enjoy their golden years will be on the trail to Florida, Arizona, or some other state blessed with warmth and plenty of sunshine. And those states are probably the ones best situated to offer plenty of age-in-place benefits, right?

Nope.

When a boomer or senior who's open-minded about where they wish to move and retire searches Google for the best cities to age in place or best cities to retire, they finds some spots that are a bit out of the norm, but quite intriguing nonetheless.

Places like Sioux Falls, SD; Provo, UT; Iowa City, IA; Bismarck, ND; Columbia, MO; Omaha, NE; Madison, WI; and Boston, MA top the list.

As adults 55+ begin to contemplate their future and plan for a possible move, they are hearing more and more about the importance of preparing to age-in-place. They already know they hope to live in their own home, independently, for as long as possible. And the cities listed above – plus many other non-traditional retirement options – are receiving plenty of attention as go-to spots for their aging-in-place benefits in the form of quality healthcare, accessible transportation, government initiatives in building the city as senior-friendly, and a number of other indexes.

The Milken Institute, a non-partisan think tank, compiled a list in 2012 of the 259 Best Cities to Age Successfully. Another ranking is due later this summer of 2014. It divided the rankings into "Large Metros" and 'Small Metros," with Provo, Utah topping the Large City list and Sioux Falls the Small City rankings.

Others in the Top 10 of Large Cities to Age Successfully include Pittsburgh, Toledo, Des Moines, Salt Lake City, and Washington D.C.

Others in the Top 10 of Small Cities to Age Successfully include Rochester, MN, Ann Arbor, MI, Missoula, MT, Durham-Chapel Hill, NC, and Gainesville, FL.

See the entire list here and learn more about the Milken Institute's approach to promoting aging-in-place awareness:  Many experts are currently discussing a variety of topics such as real estate as an investment, the movement on mortgage interest rates and reasons to buy now instead of waiting. It is important that we realize that this does not apply solely to the first time home buyer.

The opportunity that exists in real estate today is there for everyone.

However, the family that already owns a home might be thinking that, if they wait, their home could be worth more next year than it is now. And that may cause them to delay moving up to the home of their dreams thinking it makes good financial sense. Actually, the opposite is true. This is the best chance a family has to buy up into the home that makes sense for their family right now.

We must realize that whatever percentage of value we gain on our house will also be gained on our dream home.

Let’s assume your current home is worth $500,000. Your house will be worth $520,000 next year if prices rise by 4% over that time (a number projected by the Home Price Expectation Survey).

However, the $750,000 home you are hoping to move into will also appreciate by about that same 4%. That means next year it will be valued at $780,000. You wouldn’t make $20,000 by waiting. You would actually be losing $10,000 ($30,000 - $20,000).

And, you will pay a lower interest rate on the mortgage than you probably will next year.

Plug in the numbers that apply to your house and the home you are longing to buy and see what the bottom line turns out to be for you.

That is how wealth is built in this country - by purchasing real estate at the right time, at the right price and at the right terms.

Go out and find your family's dream house and buy it! Ten years from now, you will be glad you did!

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => Para los compradores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)

Many experts are currently discussing a variety of topics such as real estate as an investment, the movement on mortgage interest rates and reasons to buy now instead of waiting. It is important that we realize that this does not apply solely to the first time home buyer.

The opportunity that exists in real estate today is there for everyone.

However, the family that already owns a home might be thinking that, if they wait, their home could be worth more next year than it is now. And that may cause them to delay moving up to the home of their dreams thinking it makes good financial sense. Actually, the opposite is true. This is the best chance a family has to buy up into the home that makes sense for their family right now.

We must realize that whatever percentage of value we gain on our house will also be gained on our dream home.

Let’s assume your current home is worth $500,000. Your house will be worth $520,000 next year if prices rise by 4% over that time (a number projected by the Home Price Expectation Survey).

However, the $750,000 home you are hoping to move into will also appreciate by about that same 4%. That means next year it will be valued at $780,000. You wouldn’t make $20,000 by waiting. You would actually be losing $10,000 ($30,000 - $20,000).

And, you will pay a lower interest rate on the mortgage than you probably will next year.

Plug in the numbers that apply to your house and the home you are longing to buy and see what the bottom line turns out to be for you.

That is how wealth is built in this country - by purchasing real estate at the right time, at the right price and at the right terms.

Go out and find your family's dream house and buy it! Ten years from now, you will be glad you did!

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => Para los compradores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)  A recent

A recent

Today, many real estate conversations center on housing prices and where they may be headed. That is why the Home Price Expectation Survey is a great barometer. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey

Today, many real estate conversations center on housing prices and where they may be headed. That is why the Home Price Expectation Survey is a great barometer. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey

Do as I Say… not as I Do

Do as I Say… not as I Do [assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => Para los vendedores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English) There are many advantages a homeowner has when they use a real estate professional to help sell their home. It’s good to know that FannieMae agrees. Here is a quote directly from the

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => Para los vendedores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English) There are many advantages a homeowner has when they use a real estate professional to help sell their home. It’s good to know that FannieMae agrees. Here is a quote directly from the  [created_at] => 2014-05-19T06:00:08Z

[description] => (English) There are many advantages a homeowner has when they use a real estate professional to help sell their home. It’s good to know that FannieMae agrees. Here is a quote directly from the Know Your Options section of their website.

...

[expired_at] =>

[featured_image] => https:///

[id] => 44

[published_at] => 2014-05-19T10:00:08Z

[related] => Array

(

)

[slug] => selling-a-house-fanniemae-suggests-you-use-an-agent

[status] => published

[tags] => Array

(

)

[title] => (English) Selling a House? FannieMae Suggests You Use an Agent

[updated_at] => 2023-03-22T20:33:54Z

[url] => /es/2014/05/19/selling-a-house-fanniemae-suggests-you-use-an-agent/

)

[created_at] => 2014-05-19T06:00:08Z

[description] => (English) There are many advantages a homeowner has when they use a real estate professional to help sell their home. It’s good to know that FannieMae agrees. Here is a quote directly from the Know Your Options section of their website.

...

[expired_at] =>

[featured_image] => https:///

[id] => 44

[published_at] => 2014-05-19T10:00:08Z

[related] => Array

(

)

[slug] => selling-a-house-fanniemae-suggests-you-use-an-agent

[status] => published

[tags] => Array

(

)

[title] => (English) Selling a House? FannieMae Suggests You Use an Agent

[updated_at] => 2023-03-22T20:33:54Z

[url] => /es/2014/05/19/selling-a-house-fanniemae-suggests-you-use-an-agent/

)

The Hispanic community was hit hardest by the housing crash. Now that the market is recovering, many of these families have the opportunity to either buy a home again, or those that lost home value during those years, are seeing equity return allowing them to sell and move to the home that they always wanted.

These buyers are ready, but according to a recent survey done by NAHREP (the National Association of Hispanic Real Estate Professionals) there are barriers that do not allow these buyers to enter the market right now. As real estate professionals is our duty to remove some of these barriers, if possible, and help as many families as we can become homeowners if they are willing ready and able to.

The Hispanic community is becoming a very important part of today’s real estate market, “The number of Hispanic households has grown to 14.7 million in 2013 and today a Hispanic youth turns 18 every minute of every day,” according to the 2013 State of Hispanic Homeownership Report.

4 out of 10 new households in the United States are expected to be Hispanic in 2014, this is a major opportunity for real estate professionals.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 1

[name] => No clasificado

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => uncategorized

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)

The Hispanic community was hit hardest by the housing crash. Now that the market is recovering, many of these families have the opportunity to either buy a home again, or those that lost home value during those years, are seeing equity return allowing them to sell and move to the home that they always wanted.

These buyers are ready, but according to a recent survey done by NAHREP (the National Association of Hispanic Real Estate Professionals) there are barriers that do not allow these buyers to enter the market right now. As real estate professionals is our duty to remove some of these barriers, if possible, and help as many families as we can become homeowners if they are willing ready and able to.

The Hispanic community is becoming a very important part of today’s real estate market, “The number of Hispanic households has grown to 14.7 million in 2013 and today a Hispanic youth turns 18 every minute of every day,” according to the 2013 State of Hispanic Homeownership Report.

4 out of 10 new households in the United States are expected to be Hispanic in 2014, this is a major opportunity for real estate professionals.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 1

[name] => No clasificado

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => uncategorized

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)  Whether you are buying or selling a home, you need an experienced Real Estate Professional to lead you toward your ultimate goal. In this world of instant gratification and Internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but rather have been strengthened in recent months due to

Whether you are buying or selling a home, you need an experienced Real Estate Professional to lead you toward your ultimate goal. In this world of instant gratification and Internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but rather have been strengthened in recent months due to  Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year he released a paper on homeownership -

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year he released a paper on homeownership -  A

A

The price of any item (including residential real estate) is determined by ‘supply and demand’. If many people are looking to buy an item and the supply of that item is limited, the price of that item increases.

According to the National Association of Realtors (NAR), the supply of homes for sale is still

The price of any item (including residential real estate) is determined by ‘supply and demand’. If many people are looking to buy an item and the supply of that item is limited, the price of that item increases.

According to the National Association of Realtors (NAR), the supply of homes for sale is still