stdClass Object

(

[agents_bottom_line] =>  With interest rates still in the low 4%’s, many buyers may be on the fence as to whether to act now and purchase a new home, or wait until next year.

With interest rates still in the low 4%’s, many buyers may be on the fence as to whether to act now and purchase a new home, or wait until next year.

If you look at what the experts are predicting for 2015, it may make the decision for you.

Even an increase of half a percentage point can put a dent in your family’s net worth.

Let’s look at it this way…

The monthly payment (principal & interest only) on a $250,000 home today, with the current 4.1% interest rate would be $1,208.

If we take that same home a year later, the Home Price Expectation Survey projects that prices will rise about 4% making that home cost $10,000 more at $260,000.

If we take Freddie Mac’s rate projection of 4.8%, the monthly mortgage payment climbs to $1,364.

Some buyers might not think that an extra $156 a month is that bad. But over the course of 30-year mortgage you have spent an additional $56,160 by waiting a year.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => For Buyers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los compradores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] =>  With interest rates still in the low 4%’s, many buyers may be on the fence as to whether to act now and purchase a new home, or wait until next year.

With interest rates still in the low 4%’s, many buyers may be on the fence as to whether to act now and purchase a new home, or wait until next year.

If you look at what the experts are predicting for 2015, it may make the decision for you.

Even an increase of half a percentage point can put a dent in your family’s net worth.

Let’s look at it this way…

The monthly payment (principal & interest only) on a $250,000 home today, with the current 4.1% interest rate would be $1,208.

If we take that same home a year later, the Home Price Expectation Survey projects that prices will rise about 4% making that home cost $10,000 more at $260,000.

If we take Freddie Mac’s rate projection of 4.8%, the monthly mortgage payment climbs to $1,364.

Some buyers might not think that an extra $156 a month is that bad. But over the course of 30-year mortgage you have spent an additional $56,160 by waiting a year.

[created_at] => 2014-09-15T06:00:30Z

[description] =>

With interest rates still in the low 4%’s, many buyers may be on the fence as to whether to act now and purchase a new home, or wait until next year.

If you look at what the experts are predicting for 2015, it may make the decision for you.

E...

[expired_at] =>

[featured_image] => https:///

[id] => 129

[published_at] => 2014-09-15T10:00:30Z

[related] => Array

(

)

[slug] => how-interest-rates-impact-family-wealth

[status] => published

[tags] => Array

(

)

[title] => How Interest Rates Impact Family Wealth

[updated_at] => 2014-09-15T13:54:15Z

[url] => /2014/09/15/how-interest-rates-impact-family-wealth/

)

How Interest Rates Impact Family Wealth

With interest rates still in the low 4%’s, many buyers may be on the fence as to whether to act now and purchase a new home, or wait until next year.

If you look at what the experts are predicting for 2015, it may make the decision for you.

E...

We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago.

There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any time in history.

We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago.

There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any time in history.

In Trulia’s 2014

In Trulia’s 2014

Whether you are buying or selling a home, the process can be challenging. That is why you should take on the services of a real estate professional when embarking on a potential home move. However, not all real estate agents are the same. A family must make sure they hire someone who truly understands the current housing market and, not only that, knows how to connect the dots to explain how market conditions may impact your decision.

How can you make sure you have an agent who meets these requirements?

Here are just a few questions every real estate professional should be able to answer for their clients and customers:

Whether you are buying or selling a home, the process can be challenging. That is why you should take on the services of a real estate professional when embarking on a potential home move. However, not all real estate agents are the same. A family must make sure they hire someone who truly understands the current housing market and, not only that, knows how to connect the dots to explain how market conditions may impact your decision.

How can you make sure you have an agent who meets these requirements?

Here are just a few questions every real estate professional should be able to answer for their clients and customers:

People across the country are beginning to think about what their life will look like next year. It happens every fall. We ponder whether we should relocate to a different part of the country to find better year round weather or perhaps move across the state for better job opportunities. Homeowners in this situation must consider whether they should sell their house now or wait. If you are one of these potential sellers, here are five important reasons to do it now versus the dead of winter.

People across the country are beginning to think about what their life will look like next year. It happens every fall. We ponder whether we should relocate to a different part of the country to find better year round weather or perhaps move across the state for better job opportunities. Homeowners in this situation must consider whether they should sell their house now or wait. If you are one of these potential sellers, here are five important reasons to do it now versus the dead of winter.

Many people report on the National Association of Realtors’ (NAR) Existing Home Sales Report which quantifies the number of closed sales of single-family homes, townhomes, condominiums and co-ops. However, there is another report that NAR releases each month that may be even more important - the

Many people report on the National Association of Realtors’ (NAR) Existing Home Sales Report which quantifies the number of closed sales of single-family homes, townhomes, condominiums and co-ops. However, there is another report that NAR releases each month that may be even more important - the  NORTHEAST

NORTHEAST

SOUTH

SOUTH

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 1

[name] => Uncategorized

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => uncategorized

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => No clasificado

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] =>

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 1

[name] => Uncategorized

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => uncategorized

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => No clasificado

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => ![NAR's Existing Home Sales Report [INFOGRAPHIC] | Keeping Current Matters](https://www.keepingcurrentmatters.com/wp-content/uploads/2014/08/Existing-Home-Sales-Report-July.jpg)

There are many hot topics right now and immigration is definitely one of them. Whether we agree or disagree on what is going on at this moment, the

There are many hot topics right now and immigration is definitely one of them. Whether we agree or disagree on what is going on at this moment, the

There are some pundits lamenting the softness of the 2014 housing market. We can’t understand why. Though it is true that the early part of the year disappointed because of a myriad of reasons (ex. weather, lack of inventory, less distressed sales), the recent housing news is extremely encouraging. Let’s give some examples:

There are some pundits lamenting the softness of the 2014 housing market. We can’t understand why. Though it is true that the early part of the year disappointed because of a myriad of reasons (ex. weather, lack of inventory, less distressed sales), the recent housing news is extremely encouraging. Let’s give some examples:

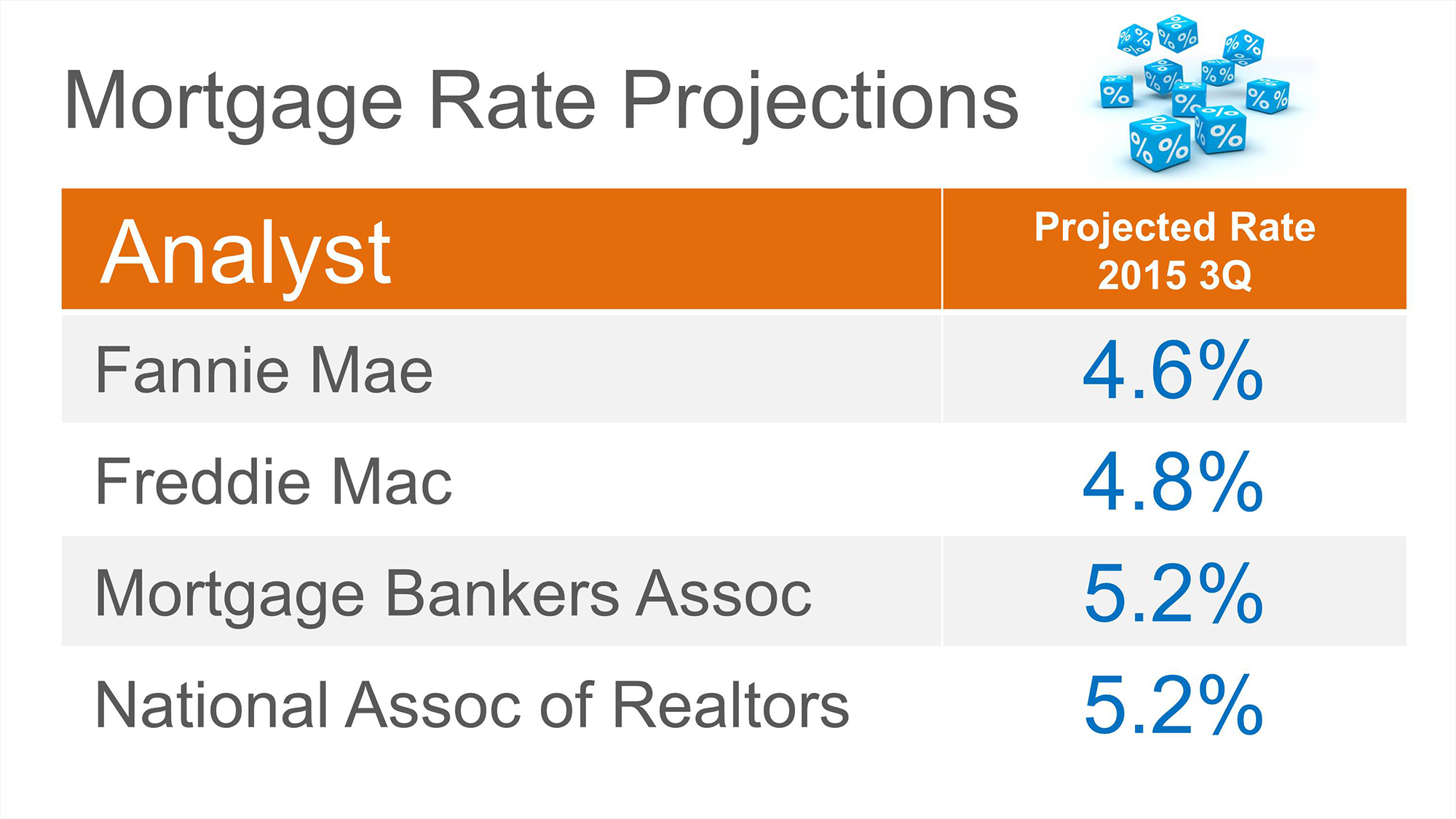

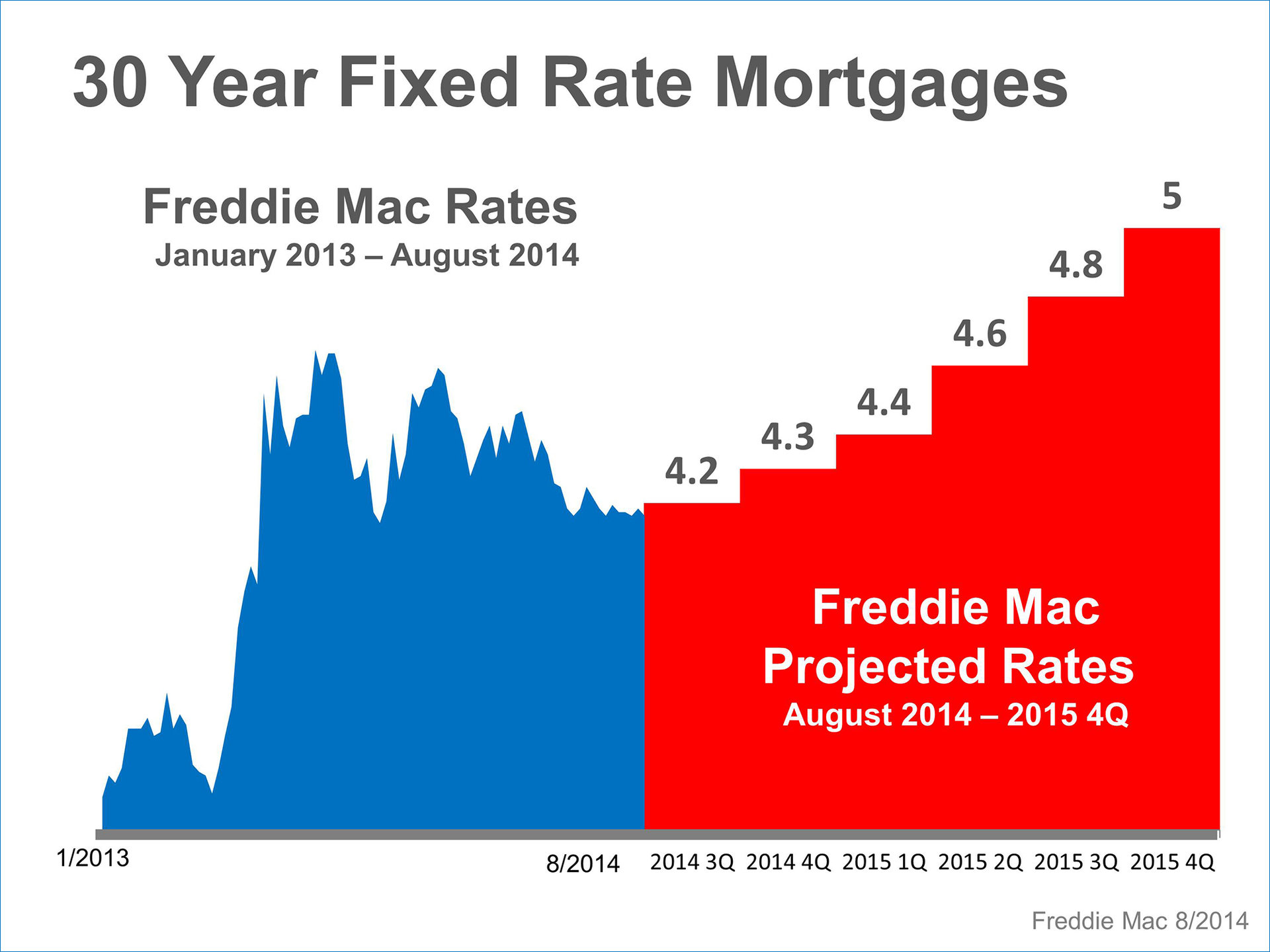

The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate the greater the payment will be. That is why it is important to look at where rates are headed when deciding to buy now or wait until next year.

According to a

The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate the greater the payment will be. That is why it is important to look at where rates are headed when deciding to buy now or wait until next year.

According to a

Kevin Kelly, Chairman of the National Association of Home Builders (NAHB), recently explained that:

Kevin Kelly, Chairman of the National Association of Home Builders (NAHB), recently explained that:

Some homeowners consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons this might not be a good idea for the vast majority of sellers.

Some homeowners consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons this might not be a good idea for the vast majority of sellers.

Whether you are buying or selling a home, it can be quite an adventurous journey. You need an experienced Real Estate Professional to lead you to your ultimate goal. In this world of instant gratification and internet searches, many sellers think that they can For Sale by Owner or FSBO. The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but have rather been strengthened in recent months due to the projections of

Whether you are buying or selling a home, it can be quite an adventurous journey. You need an experienced Real Estate Professional to lead you to your ultimate goal. In this world of instant gratification and internet searches, many sellers think that they can For Sale by Owner or FSBO. The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but have rather been strengthened in recent months due to the projections of  Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year, he released a paper on homeownership -

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year, he released a paper on homeownership -  There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either your mortgage or your landlord’s. As a

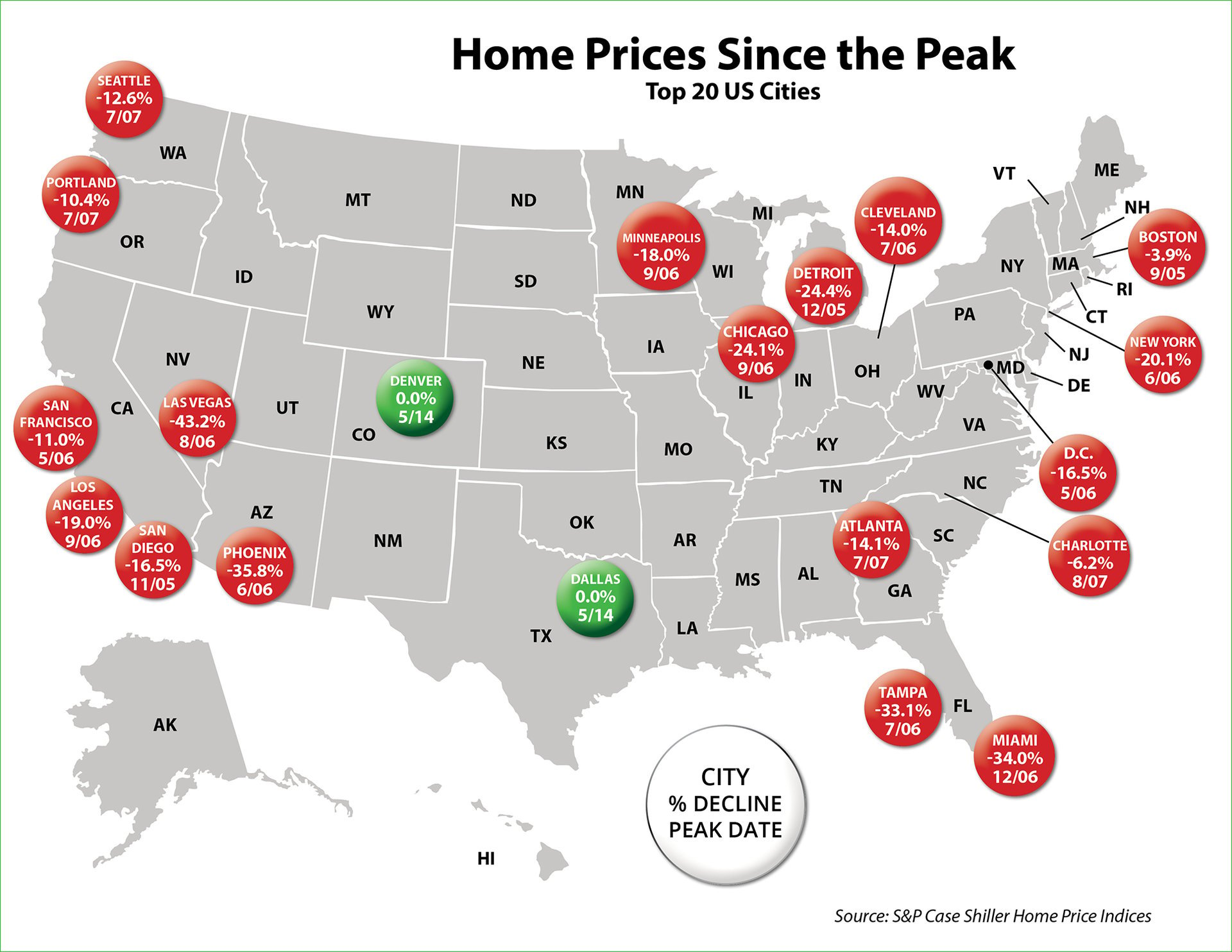

There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either your mortgage or your landlord’s. As a  Many people suffered through the housing crisis. We realize that most of the heartache was the result of a housing and mortgage market gone wild. Many consumers were swept away by the waters of a frenzied real estate market that resulted in a crisis even the experts didn’t see coming.

However, some of the suffering was caused by home buyers and home owners simply making bad decisions. NOT YOU! You didn’t buy that house that stretched your family finances past the point of sustainability. You didn’t take out a home equity loan and buy new water skis. You didn’t do a cash-out refinance for the maximum amount possible.

Instead, you bought a home your family could enjoy – and afford! You waited for interest rates to drop to historic lows and then refinanced your mortgage; not for the sake of taking cash out but instead to lower your monthly payment.

You have equity in your house and a nice, low mortgage payment. You played the housing market perfectly.

Many people suffered through the housing crisis. We realize that most of the heartache was the result of a housing and mortgage market gone wild. Many consumers were swept away by the waters of a frenzied real estate market that resulted in a crisis even the experts didn’t see coming.

However, some of the suffering was caused by home buyers and home owners simply making bad decisions. NOT YOU! You didn’t buy that house that stretched your family finances past the point of sustainability. You didn’t take out a home equity loan and buy new water skis. You didn’t do a cash-out refinance for the maximum amount possible.

Instead, you bought a home your family could enjoy – and afford! You waited for interest rates to drop to historic lows and then refinanced your mortgage; not for the sake of taking cash out but instead to lower your monthly payment.

You have equity in your house and a nice, low mortgage payment. You played the housing market perfectly.

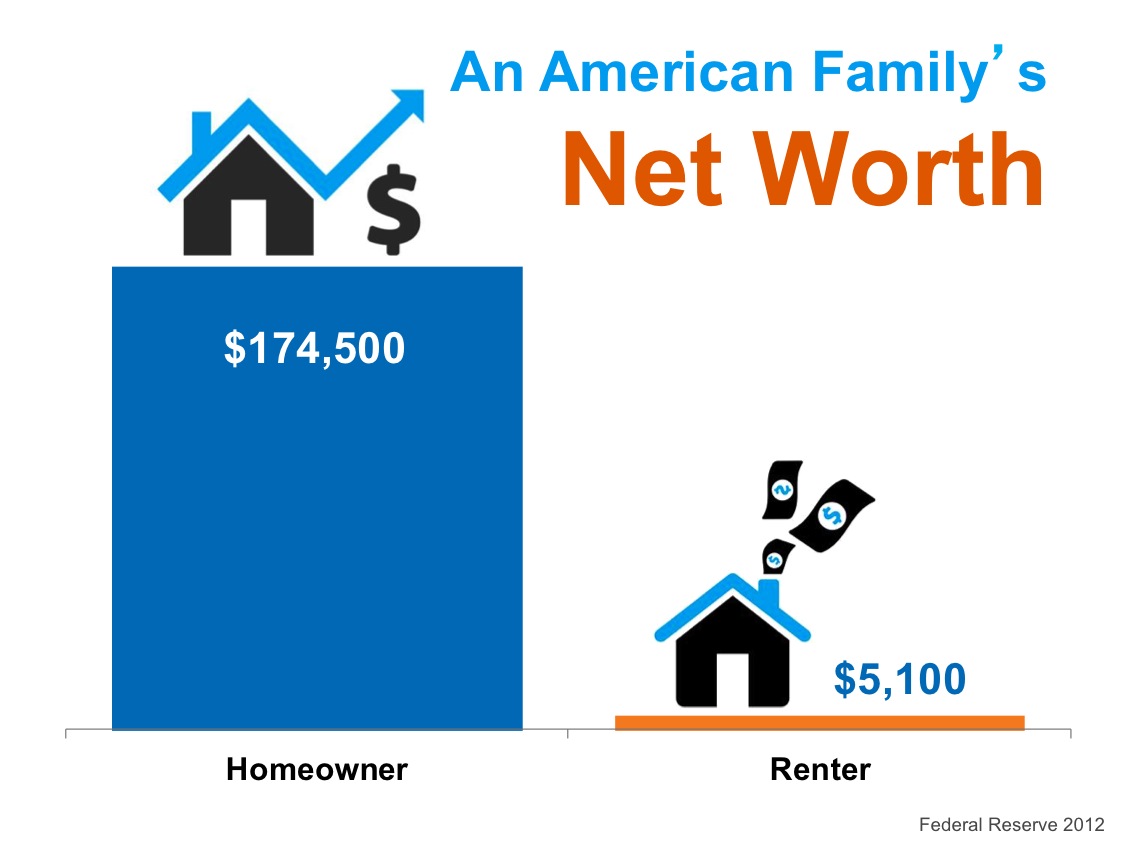

Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A

Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A

Today, many real estate conversations center on housing prices and where they may be headed. That is why the Home Price Expectation Survey is seen to be a reliable source. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey

Today, many real estate conversations center on housing prices and where they may be headed. That is why the Home Price Expectation Survey is seen to be a reliable source. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey