stdClass Object

(

[agents_bottom_line] =>  There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet, maybe it's not priced properly.

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet, maybe it's not priced properly.

After all 13,808 houses sold yesterday, 13,808 will sell today and 13,808 will sell tomorrow.

13,808!

That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. NAR reported that sales are at an annual rate of 5.04 million. Divide that number by 365 (days in a year) and we can see that, on average, over 13,800 homes sell every day.

The report from NAR also revealed that there is currently only a 4.4 months supply of inventory available for sale, (6 months inventory is considered ‘historically normal’).

That means less competition for buyers who are out in the market now, but more houses will hit the market soon with spring right around the corner.

Bottom Line

We realize that you want to get the fair market value for your home. However, if it hasn't sold in today's active real estate market, perhaps you should reconsider your current asking price.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 6

[name] => For Sellers

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => sellers

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Para los vendedores

)

)

[updated_at] => 2019-06-03T18:18:43Z

)

[1] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 38

[name] => Move-Up

[parent] =>

[parent_id] =>

[published_at] => 2024-04-10T16:00:35Z

[slug] => move-up

[status] => public

[translations] => stdClass Object

(

[es] => stdClass Object

(

[name] => Compradores de casa mas grande

)

)

[updated_at] => 2024-04-10T16:00:35Z

)

)

[content_type] => blog

[contents] =>  There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet, maybe it's not priced properly.

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet, maybe it's not priced properly.

After all 13,808 houses sold yesterday, 13,808 will sell today and 13,808 will sell tomorrow.

13,808!

That is the average number of homes that sell each and every day in this country according to the National Association of Realtors’ (NAR) latest Existing Home Sales Report. NAR reported that sales are at an annual rate of 5.04 million. Divide that number by 365 (days in a year) and we can see that, on average, over 13,800 homes sell every day.

The report from NAR also revealed that there is currently only a 4.4 months supply of inventory available for sale, (6 months inventory is considered ‘historically normal’).

That means less competition for buyers who are out in the market now, but more houses will hit the market soon with spring right around the corner.

Bottom Line

We realize that you want to get the fair market value for your home. However, if it hasn't sold in today's active real estate market, perhaps you should reconsider your current asking price.

[created_at] => 2015-01-29T06:00:46Z

[description] =>

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet, maybe it's not priced properly.

A...

[expired_at] =>

[featured_image] => https:///

[id] => 224

[published_at] => 2015-01-29T10:00:46Z

[related] => Array

(

)

[slug] => 13808-houses-sold-yesterday-did-yours

[status] => published

[tags] => Array

(

)

[title] => 13,808 Houses Sold Yesterday! Did Yours?

[updated_at] => 2015-01-28T10:51:25Z

[url] => /2015/01/29/13808-houses-sold-yesterday-did-yours/

)

13,808 Houses Sold Yesterday! Did Yours?

There are some homeowners that have been waiting for months to get a price they hoped for when they originally listed their house for sale. The only thing they might want to consider is... If it hasn't sold yet, maybe it's not priced properly.

A...

You’ve decided to sell your house. You begin to interview potential real estate agents to help you through the process. You need someone you trust enough to:

You’ve decided to sell your house. You begin to interview potential real estate agents to help you through the process. You need someone you trust enough to:

You’ve decided to sell your house. You begin to interview potential real estate agents to help you through the process. You need someone you trust enough to:

You’ve decided to sell your house. You begin to interview potential real estate agents to help you through the process. You need someone you trust enough to:

The headlines agree mortgage interest rates have dropped substantially below initial projections. Many who are considering purchasing a home, or moving up to their dream home, might think that they should wait to buy, because rates may continue to fall.

A recent

The headlines agree mortgage interest rates have dropped substantially below initial projections. Many who are considering purchasing a home, or moving up to their dream home, might think that they should wait to buy, because rates may continue to fall.

A recent  Whether you are buying or selling a home, it can be quite an adventurous journey. You need an experienced Real Estate Professional to lead you to your ultimate goal. In this world of instant gratification and internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but have rather been strengthened due to the projections of

Whether you are buying or selling a home, it can be quite an adventurous journey. You need an experienced Real Estate Professional to lead you to your ultimate goal. In this world of instant gratification and internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but have rather been strengthened due to the projections of  Heading into 2015 many people have their sights set on buying a home. The personal reasons differ for each buyer, with many basic similarities. Eric Belsky, the Managing Director of the Joint Center of Housing Studies at Harvard University expanded on the top 5 financial benefits of homeownership his paper -

Heading into 2015 many people have their sights set on buying a home. The personal reasons differ for each buyer, with many basic similarities. Eric Belsky, the Managing Director of the Joint Center of Housing Studies at Harvard University expanded on the top 5 financial benefits of homeownership his paper -  If you are thinking about purchasing a home right now, you are surely getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in real estate. Let’s look at whether or not now is actually a good time for you to buy a home.

There are three questions you should ask before purchasing in today’s market:

If you are thinking about purchasing a home right now, you are surely getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in real estate. Let’s look at whether or not now is actually a good time for you to buy a home.

There are three questions you should ask before purchasing in today’s market:

There are many people deciding on whether to sign a new lease on a rental property or take the dive into homeownership. Every situation is different. However, with rents, home values and mortgage interest rates projected to rise, buying now might make a lot more sense than waiting until next year.

Here are others who seem to agree:

There are many people deciding on whether to sign a new lease on a rental property or take the dive into homeownership. Every situation is different. However, with rents, home values and mortgage interest rates projected to rise, buying now might make a lot more sense than waiting until next year.

Here are others who seem to agree:

There are many people deciding on whether to sign a new lease on a rental property or take the dive into homeownership. Every situation is different. However, with rents, home values and mortgage interest rates projected to rise, buying now might make a lot more sense than waiting until next year.

Here are others who seem to agree:

There are many people deciding on whether to sign a new lease on a rental property or take the dive into homeownership. Every situation is different. However, with rents, home values and mortgage interest rates projected to rise, buying now might make a lot more sense than waiting until next year.

Here are others who seem to agree:

Every home must be sold TWICE! Once to the buyer, and once to the bank appraiser if a mortgage is involved.

Every home must be sold TWICE! Once to the buyer, and once to the bank appraiser if a mortgage is involved.

![Existing Home Sales Report [INFOGRAPHIC] | Simplifying The Market](http://www.simplifyingthemarket.com/wp-content/uploads/2015/01/Existing-Home-Sales-December-STM.jpg)

![Existing Home Sales Report [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2015/01/Existing-Home-Sales-December-STM.jpg)

At the end of the year, in every region of the country, hundreds of homeowners have a tough decision to make. The ‘listing for sale agreement’ on their house is about to expire and they now must decide to either take their house off the market (OTM), For Sale by Owner (FSBO) or list it again with the same agent or a different agent. Let’s assume you or someone you know is in this situation and take a closer look at each possibility:

At the end of the year, in every region of the country, hundreds of homeowners have a tough decision to make. The ‘listing for sale agreement’ on their house is about to expire and they now must decide to either take their house off the market (OTM), For Sale by Owner (FSBO) or list it again with the same agent or a different agent. Let’s assume you or someone you know is in this situation and take a closer look at each possibility:

At the end of the year, in every region of the country, hundreds of homeowners have a tough decision to make. The ‘listing for sale agreement’ on their house is about to expire and they now must decide to either take their house off the market (OTM), For Sale by Owner (FSBO) or list it again with the same agent or a different agent. Let’s assume you or someone you know is in this situation and take a closer look at each possibility:

At the end of the year, in every region of the country, hundreds of homeowners have a tough decision to make. The ‘listing for sale agreement’ on their house is about to expire and they now must decide to either take their house off the market (OTM), For Sale by Owner (FSBO) or list it again with the same agent or a different agent. Let’s assume you or someone you know is in this situation and take a closer look at each possibility:

According to Freddie Mac’s latest

According to Freddie Mac’s latest

According to Freddie Mac’s latest

According to Freddie Mac’s latest

Last week, we

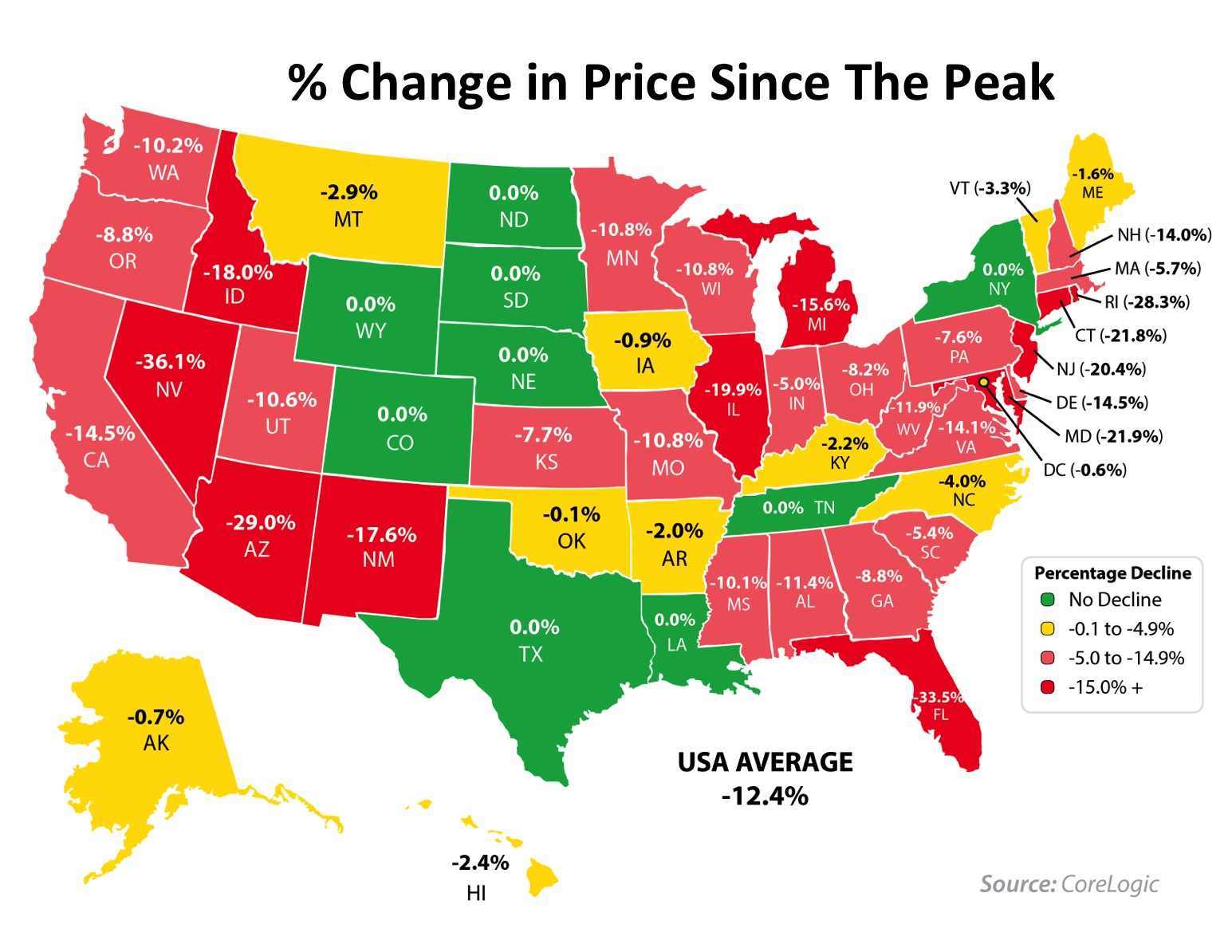

Last week, we  There is no doubt that the housing market has recovered from the meltdown that occurred just a few short years ago. However, in some states home values still have not returned to the prices we saw in 2006 and 2007. Here is a breakdown showing where current prices are in each state as compared to peak prices.

There is no doubt that the housing market has recovered from the meltdown that occurred just a few short years ago. However, in some states home values still have not returned to the prices we saw in 2006 and 2007. Here is a breakdown showing where current prices are in each state as compared to peak prices.

There is no doubt that the housing market has recovered from the meltdown that occurred just a few short years ago. However, in some states home values still have not returned to the prices we saw in 2006 and 2007. Here is a breakdown showing where current prices are in each state as compared to peak prices.

There is no doubt that the housing market has recovered from the meltdown that occurred just a few short years ago. However, in some states home values still have not returned to the prices we saw in 2006 and 2007. Here is a breakdown showing where current prices are in each state as compared to peak prices.

![Millennial Homebuyers & Their Preferences [INFOGRAPHIC] | Simplifying The Market](http://www.simplifyingthemarket.com/wp-content/uploads/2014/12/Millennial-Homebuyers.jpg)

![Millennial Homebuyers & Their Preferences [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2014/12/Millennial-Homebuyers.jpg)

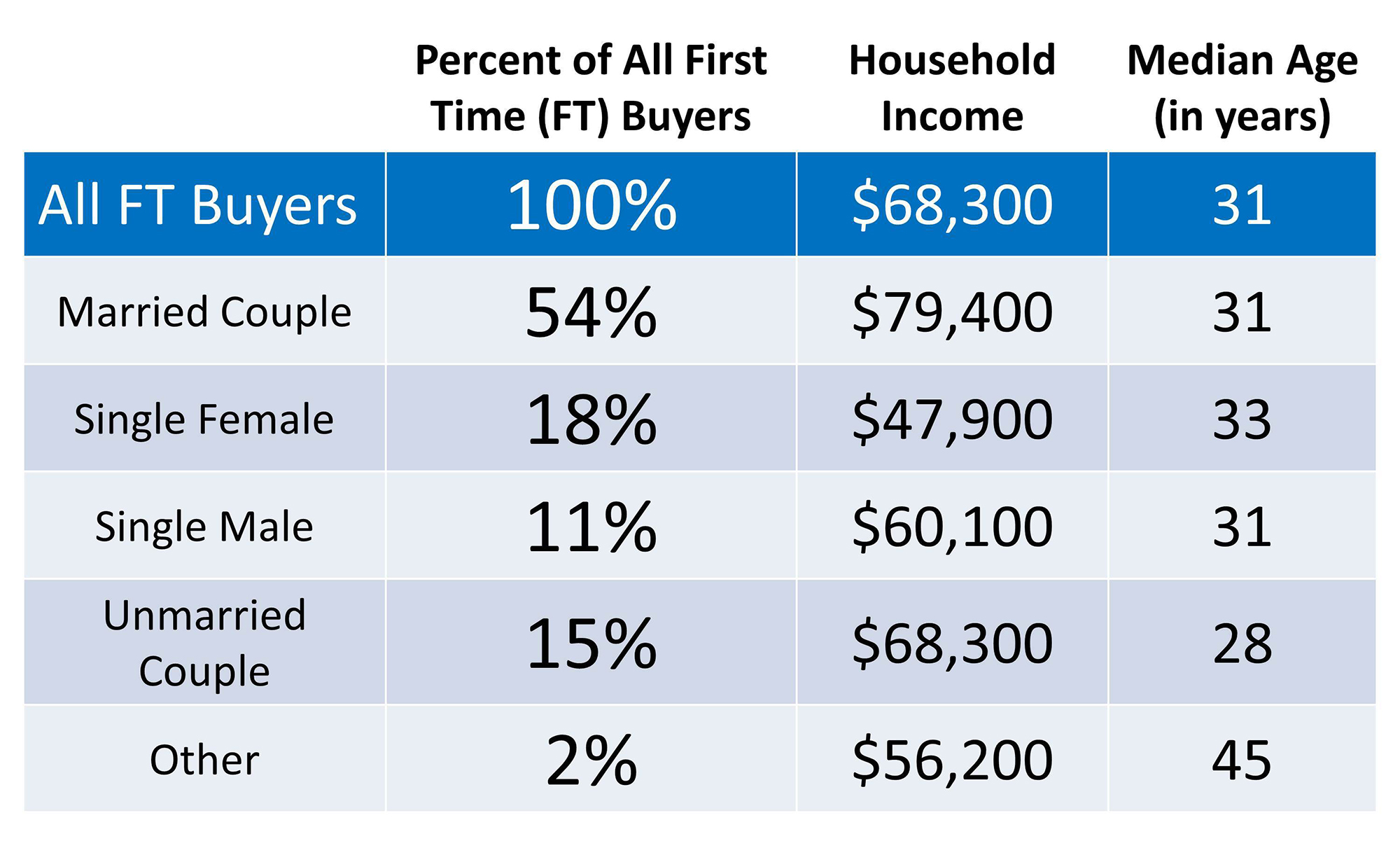

There are many people sitting on the sidelines trying to decide if they should purchase a home or sign a rental lease. Some might wonder if it makes sense to purchase a house before they are married and have a family. Others may think they are too young. And still others might think their current income would never enable them to qualify for a mortgage.

We want to share what the typical first time homebuyer actually looks like based on the National Association of REALTORS most recent

There are many people sitting on the sidelines trying to decide if they should purchase a home or sign a rental lease. Some might wonder if it makes sense to purchase a house before they are married and have a family. Others may think they are too young. And still others might think their current income would never enable them to qualify for a mortgage.

We want to share what the typical first time homebuyer actually looks like based on the National Association of REALTORS most recent

There are many people sitting on the sidelines trying to decide if they should purchase a home or sign a rental lease. Some might wonder if it makes sense to purchase a house before they are married and have a family. Others may think they are too young. And still others might think their current income would never enable them to qualify for a mortgage.

We want to share what the typical first time homebuyer actually looks like based on the National Association of REALTORS most recent

There are many people sitting on the sidelines trying to decide if they should purchase a home or sign a rental lease. Some might wonder if it makes sense to purchase a house before they are married and have a family. Others may think they are too young. And still others might think their current income would never enable them to qualify for a mortgage.

We want to share what the typical first time homebuyer actually looks like based on the National Association of REALTORS most recent

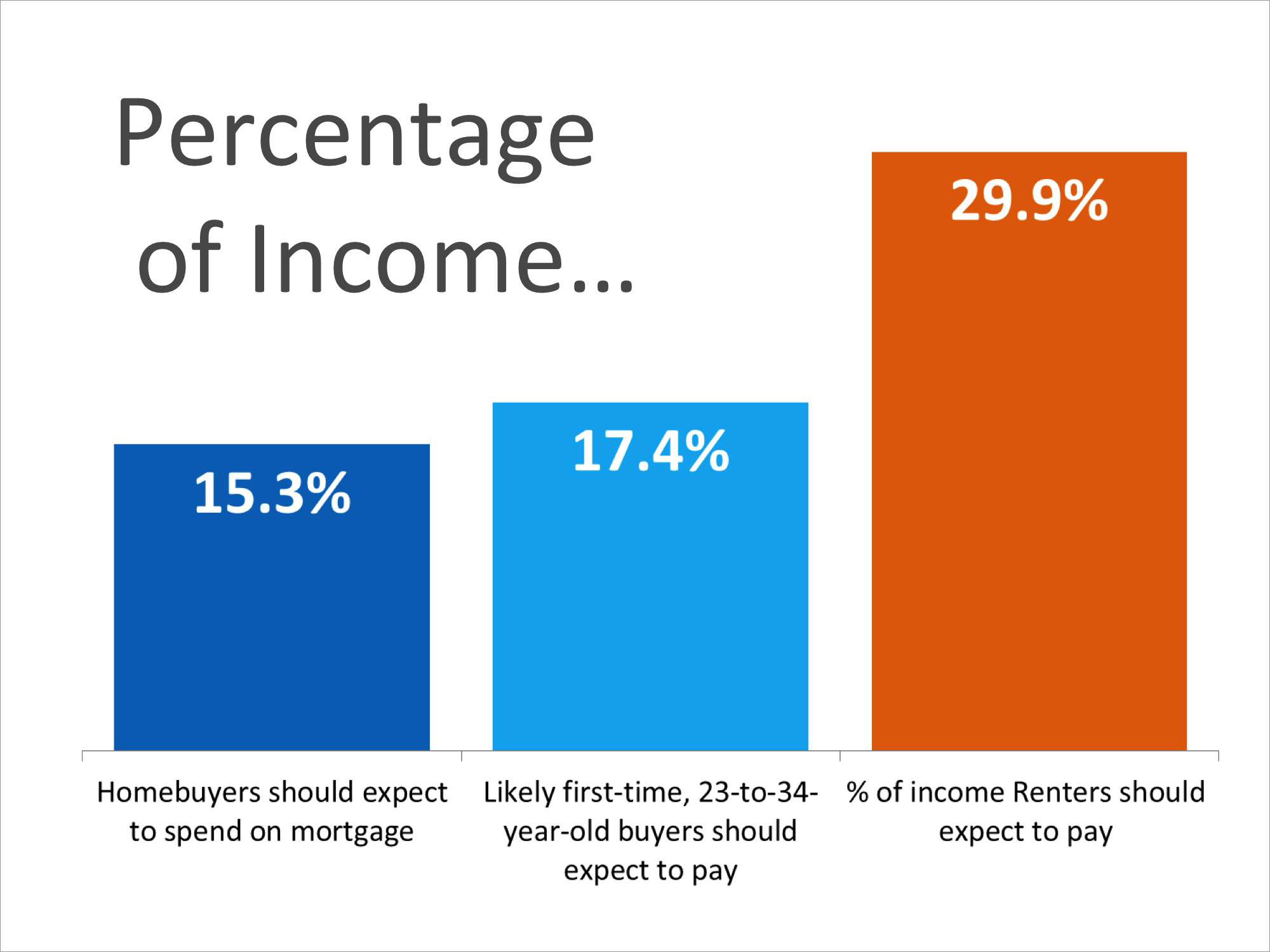

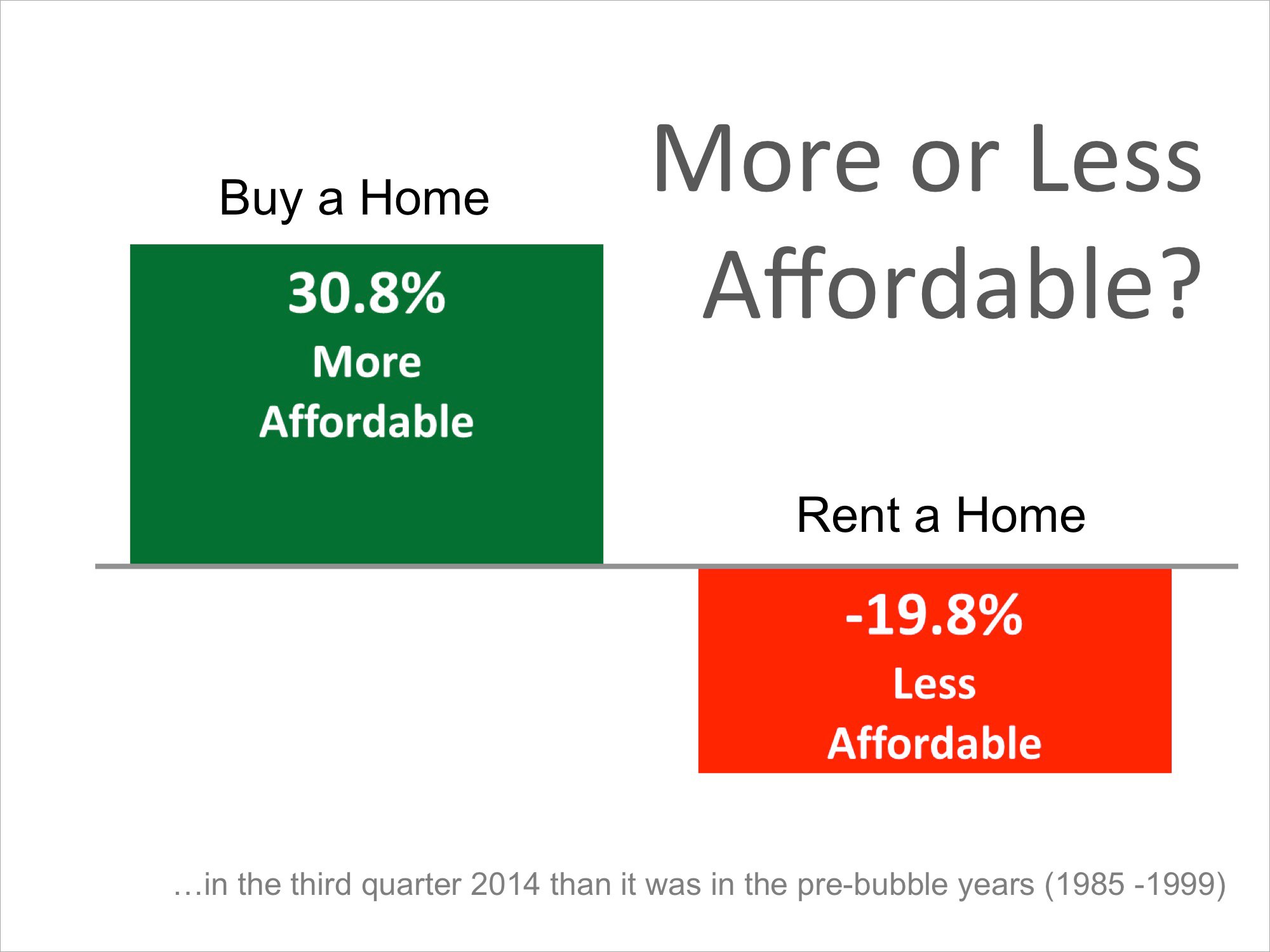

There are many young people debating whether they should renew the lease on their apartment or sign a contract to purchase their first home. Based on a recent study, here are two reasons buying a home might make more sense:

There are many young people debating whether they should renew the lease on their apartment or sign a contract to purchase their first home. Based on a recent study, here are two reasons buying a home might make more sense:

There are many young people debating whether they should renew the lease on their apartment or sign a contract to purchase their first home. Based on a recent study, here are two reasons buying a home might make more sense:

There are many young people debating whether they should renew the lease on their apartment or sign a contract to purchase their first home. Based on a recent study, here are two reasons buying a home might make more sense:

Earlier this month, Zillow

Earlier this month, Zillow  The New York Times recently published an editorial entitled, “

The New York Times recently published an editorial entitled, “![Year-over-Year Price Changes by Price Point [INFOGRAPHIC] | Simplifying The Market](http://www.simplifyingthemarket.com/wp-content/uploads/2014/12/12.12-InfoGraphic.jpg)

![Year-over-Year Price Changes by Price Point [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2014/12/12.12-InfoGraphic.jpg)

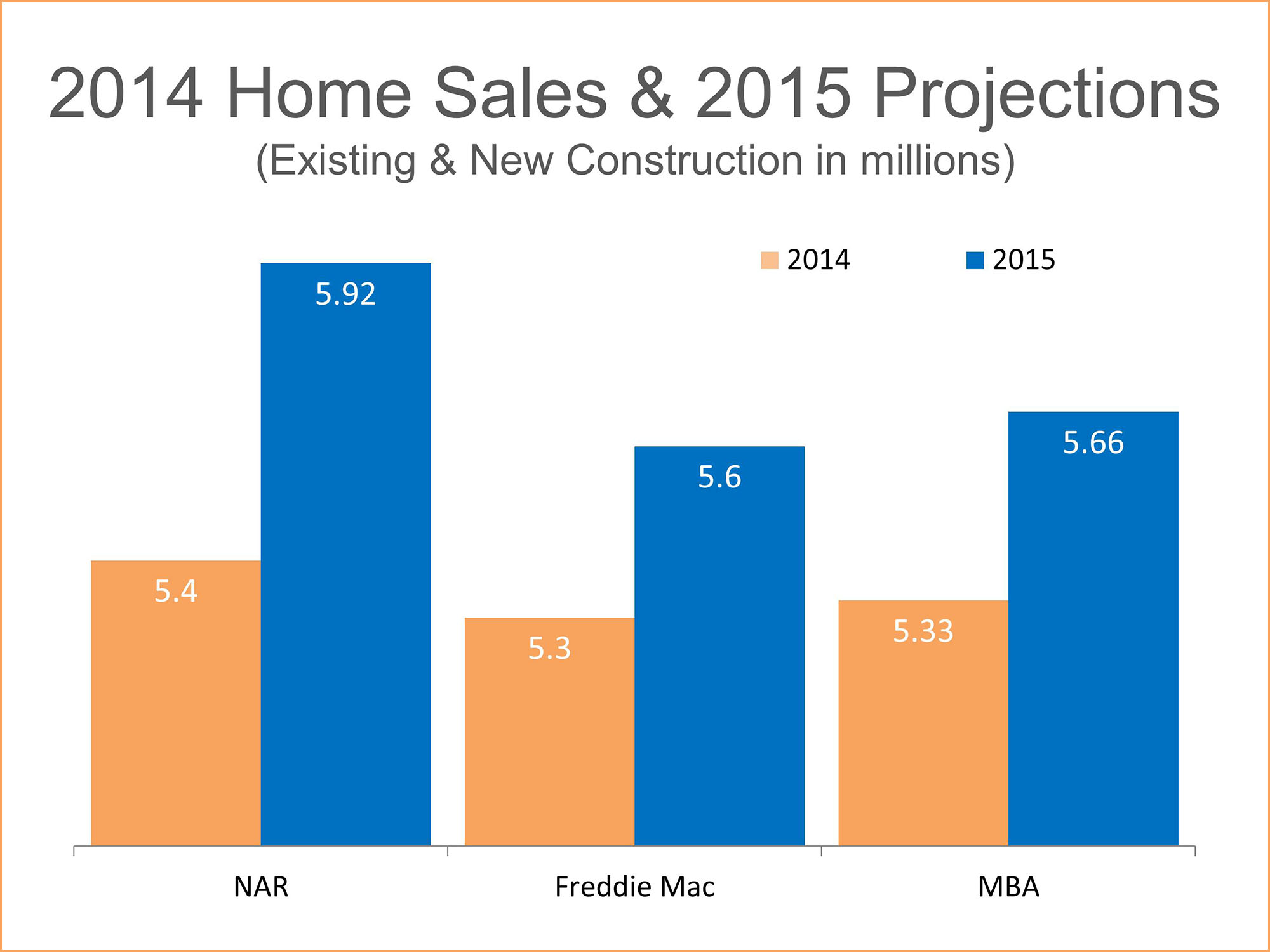

The Mortgage Bankers Association, the National Association of Realtors, Fannie Mae and Freddie Mac are each projecting mortgage interest

The Mortgage Bankers Association, the National Association of Realtors, Fannie Mae and Freddie Mac are each projecting mortgage interest  Yesterday, HousingWire

Yesterday, HousingWire  Yesterday, HousingWire

Yesterday, HousingWire  CNBC’s Diana Olick recently

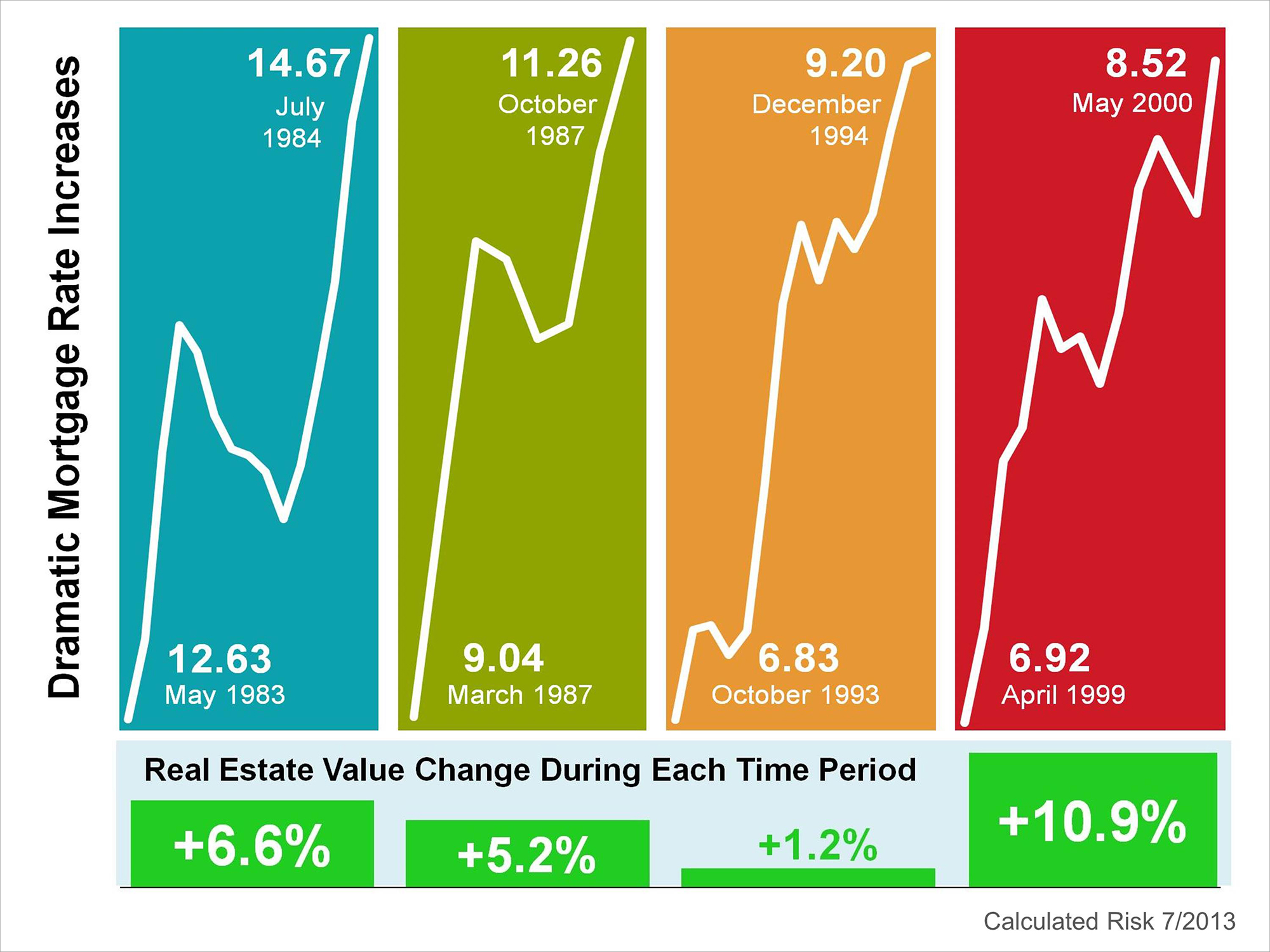

CNBC’s Diana Olick recently  There are some who are calling for a substantial drop in home prices should mortgage interest rates begin to rise rapidly. Intuitively that makes sense. The cost of a home is determined by the price of the home and the price of financing that home. If mortgage interest rates increase, less people will be able to buy. The logic says prices will fall if demand decreases.

However, history shows us that this has not been the case the last four times mortgage interest rates dramatically increased.

There are some who are calling for a substantial drop in home prices should mortgage interest rates begin to rise rapidly. Intuitively that makes sense. The cost of a home is determined by the price of the home and the price of financing that home. If mortgage interest rates increase, less people will be able to buy. The logic says prices will fall if demand decreases.

However, history shows us that this has not been the case the last four times mortgage interest rates dramatically increased.

There are some who are calling for a substantial drop in home prices should mortgage interest rates begin to rise rapidly. Intuitively that makes sense. The cost of a home is determined by the price of the home and the price of financing that home. If mortgage interest rates increase, less people will be able to buy. The logic says prices will fall if demand decreases.

However, history shows us that this has not been the case the last four times mortgage interest rates dramatically increased.

There are some who are calling for a substantial drop in home prices should mortgage interest rates begin to rise rapidly. Intuitively that makes sense. The cost of a home is determined by the price of the home and the price of financing that home. If mortgage interest rates increase, less people will be able to buy. The logic says prices will fall if demand decreases.

However, history shows us that this has not been the case the last four times mortgage interest rates dramatically increased.