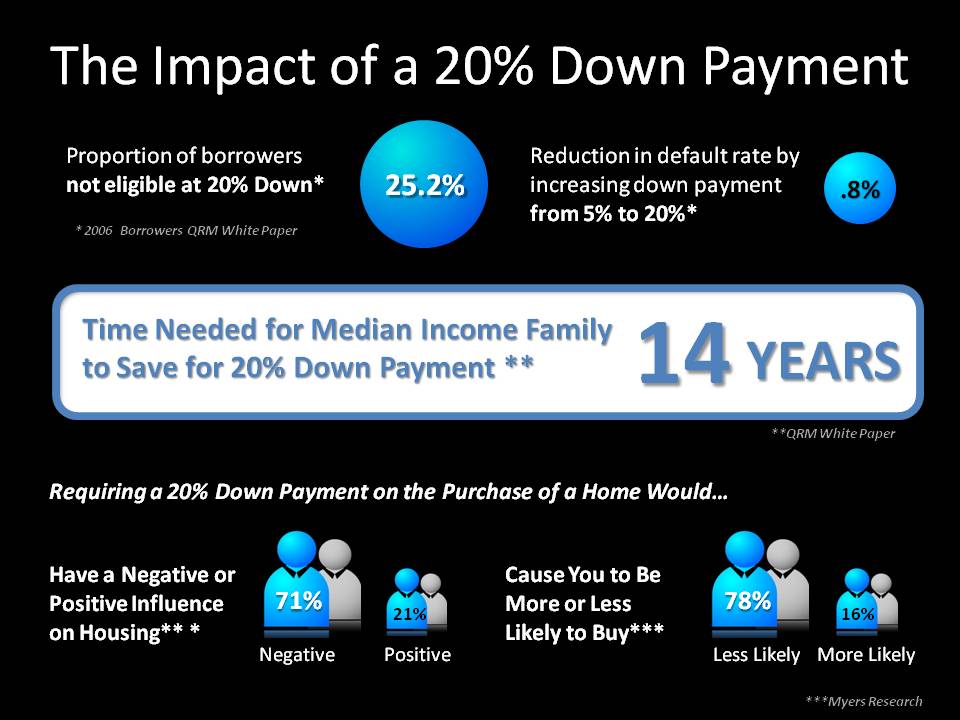

A 14% Home Mortgage Rate?

We have written on the long term impact that the new mortgage guidelines known as ‘Qualified Residential Mortgage’ (QRM) will have on the cost of financing a home. However, it seems that these expenses are already beginning to creep into lending. The QRM guidelines are much more rigid than those used in the last year. Though […]

Infographic

Infographic Monthly Housing Survey InfoGraphic

Monthly Housing Survey InfoGraphic Distressed Property InfoGraphic

Distressed Property InfoGraphic InfoGraphic

InfoGraphic