stdClass Object

(

[agents_bottom_line] =>  Every day we are pleasantly surprised with the research coming forward regarding the Millennial generation. Whether it was the over-exaggeration of the student debt challenge, the misbelief that they are not yet ready to buy or the under estimation of their actual home purchases, evidence is beginning to debunk the myths many have held about this generation and homeownership. Now, one more strongly held belief is being questioned.

Every day we are pleasantly surprised with the research coming forward regarding the Millennial generation. Whether it was the over-exaggeration of the student debt challenge, the misbelief that they are not yet ready to buy or the under estimation of their actual home purchases, evidence is beginning to debunk the myths many have held about this generation and homeownership. Now, one more strongly held belief is being questioned.

Do Millennials Live in their Parents Basements?

It seems not as many as once was reported. Our friends at Calculated Risk (CR) alerted us to a post by Derek Thompson in the Atlantic: The Misguided Freakout About Basement-Dwelling Millennials. The article explains that according to the Census Reports:

“It is important to note that the Current Population Survey counts students living in dormitories as living in their parents' home.”

What?!? If you live in a college dorm, the census counts you as living with your parents. Thompson has some fun with this when he explains:

“When you were adjusting to your freshman roommate, you were ‘living with your parents’. When you snagged that sweet triple with your best friends in grad housing, you were ‘living with your parents’. That one time you launched butt-rattling bottle rockets at the stroke of midnight off your fraternity roof? I hope you didn't make too much noise. After all, you were ‘living with your parents’."

The data is “Criminally Misleading”

According to Thompson, the counting of those living in college dorms as living with their parents is “criminally misleading”. He explains that part of the increase in these numbers is actually attributed to the fact that more people are attending college:

“[T]he share of 25- to 29-year-olds with a bachelor degree has grown by almost 50 percent since the early 1980s. More than 84 percent of today's 27-year-olds spend at least some time in college and now 40 percent have a bachelor's or associate's degree. More young people going to school means more young people living in dorms, which means more young people ‘living with their parents’, according to the weird Census.”

Thompson then goes on to reveal that:

"[T]he share of 18-to-24-year-olds living at home who aren't in college has declined since 1986. But the share of college students living "at home" (i.e.: in dorms, often) has increased.

So the Millennials-living-in-our-parents meme is almost entirely a result of higher college attendance.” (emphasis added)

The Other Side of the Argument

However, Trulia’s chief economist Jed Kolko, doesn’t totally agree. In a post in response to the Thompson article, Kolko explains:

“The Current Population Survey’s (CPS) Annual Social and Economic Supplement (ASEC) counts college students who are living in dorms as living with their parents, and college enrollment has indeed gone up. But it does not follow that basement-dwelling millennials are a myth. The ASEC and other Census data show that after adjusting for college enrollment and for dormitory living, millennials were more likely to live with parents in 2012 and 2013 than at any other time for which a consistent data series is available.”

Bottom Line

There are more Millennials living with their parents than ever before. However, the numbers being quoted by some seem to be exaggerated.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

)

[content_type] => blog

[contents] =>  Every day we are pleasantly surprised with the research coming forward regarding the Millennial generation. Whether it was the over-exaggeration of the student debt challenge, the misbelief that they are not yet ready to buy or the under estimation of their actual home purchases, evidence is beginning to debunk the myths many have held about this generation and homeownership. Now, one more strongly held belief is being questioned.

Every day we are pleasantly surprised with the research coming forward regarding the Millennial generation. Whether it was the over-exaggeration of the student debt challenge, the misbelief that they are not yet ready to buy or the under estimation of their actual home purchases, evidence is beginning to debunk the myths many have held about this generation and homeownership. Now, one more strongly held belief is being questioned.

Do Millennials Live in their Parents Basements?

It seems not as many as once was reported. Our friends at Calculated Risk (CR) alerted us to a post by Derek Thompson in the Atlantic: The Misguided Freakout About Basement-Dwelling Millennials. The article explains that according to the Census Reports:

“It is important to note that the Current Population Survey counts students living in dormitories as living in their parents' home.”

What?!? If you live in a college dorm, the census counts you as living with your parents. Thompson has some fun with this when he explains:

“When you were adjusting to your freshman roommate, you were ‘living with your parents’. When you snagged that sweet triple with your best friends in grad housing, you were ‘living with your parents’. That one time you launched butt-rattling bottle rockets at the stroke of midnight off your fraternity roof? I hope you didn't make too much noise. After all, you were ‘living with your parents’."

The data is “Criminally Misleading”

According to Thompson, the counting of those living in college dorms as living with their parents is “criminally misleading”. He explains that part of the increase in these numbers is actually attributed to the fact that more people are attending college:

“[T]he share of 25- to 29-year-olds with a bachelor degree has grown by almost 50 percent since the early 1980s. More than 84 percent of today's 27-year-olds spend at least some time in college and now 40 percent have a bachelor's or associate's degree. More young people going to school means more young people living in dorms, which means more young people ‘living with their parents’, according to the weird Census.”

Thompson then goes on to reveal that:

"[T]he share of 18-to-24-year-olds living at home who aren't in college has declined since 1986. But the share of college students living "at home" (i.e.: in dorms, often) has increased.

So the Millennials-living-in-our-parents meme is almost entirely a result of higher college attendance.” (emphasis added)

The Other Side of the Argument

However, Trulia’s chief economist Jed Kolko, doesn’t totally agree. In a post in response to the Thompson article, Kolko explains:

“The Current Population Survey’s (CPS) Annual Social and Economic Supplement (ASEC) counts college students who are living in dorms as living with their parents, and college enrollment has indeed gone up. But it does not follow that basement-dwelling millennials are a myth. The ASEC and other Census data show that after adjusting for college enrollment and for dormitory living, millennials were more likely to live with parents in 2012 and 2013 than at any other time for which a consistent data series is available.”

Bottom Line

There are more Millennials living with their parents than ever before. However, the numbers being quoted by some seem to be exaggerated.

[created_at] => 2014-07-17T06:00:51Z

[description] =>

Every day we are pleasantly surprised with the research coming forward regarding the Millennial generation. Whether it was the over-exaggeration of the student debt challenge, the misbelief that they are not yet ready to buy or the under estimati...

[expired_at] =>

[featured_image] => https:///

[id] => 87

[published_at] => 2014-07-17T10:00:51Z

[related] => Array

(

)

[slug] => millennials-how-many-are-actually-living-with-their-parents

[status] => published

[tags] => Array

(

)

[title] => Millennials: How Many are Actually ‘Living with their Parents’

[updated_at] => 2014-07-21T18:31:34Z

[url] => /es/2014/07/17/millennials-how-many-are-actually-living-with-their-parents/

)

Millennials: How Many are Actually ‘Living with their Parents’

Every day we are pleasantly surprised with the research coming forward regarding the Millennial generation. Whether it was the over-exaggeration of the student debt challenge, the misbelief that they are not yet ready to buy or the under estimati...

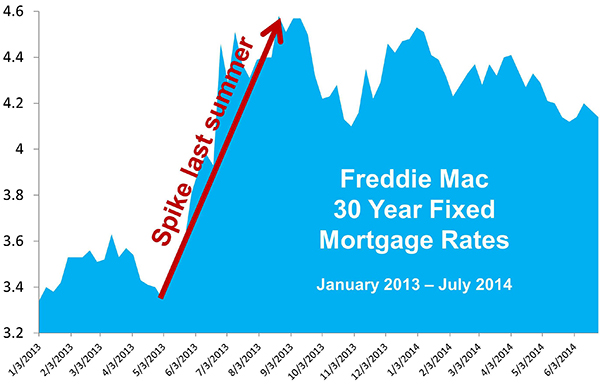

Many readers have asked where interest rates are headed over the next several months. While no one has a crystal ball, we did want to share what some experts are saying on the subject.

Many readers have asked where interest rates are headed over the next several months. While no one has a crystal ball, we did want to share what some experts are saying on the subject.

If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that the threat of rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when it comes to purchasing real estate. That is actually far from reality. After all 13,397 houses sold yesterday, 13,397 will sell today and 13,397 will sell tomorrow.

If you read certain headlines, you might be led to believe that the housing recovery has come to a screeching halt. Naysayers are claiming that the threat of rising mortgage rates and a lack of consumer confidence are keeping Americans on the fence when it comes to purchasing real estate. That is actually far from reality. After all 13,397 houses sold yesterday, 13,397 will sell today and 13,397 will sell tomorrow.

We are pleased to have KCM Founder and Chief Content Creator, Steve Harney, do a personal post today. Enjoy!

That is what a headline announced in a CNNMoney

We are pleased to have KCM Founder and Chief Content Creator, Steve Harney, do a personal post today. Enjoy!

That is what a headline announced in a CNNMoney  For almost a year now, we have been trying to debunk the myth that student debt is keeping the vast majority of Millennials from purchasing a home.

We explained that Millennials have purchased more homes over a recent twelve month period than any other generation as was

For almost a year now, we have been trying to debunk the myth that student debt is keeping the vast majority of Millennials from purchasing a home.

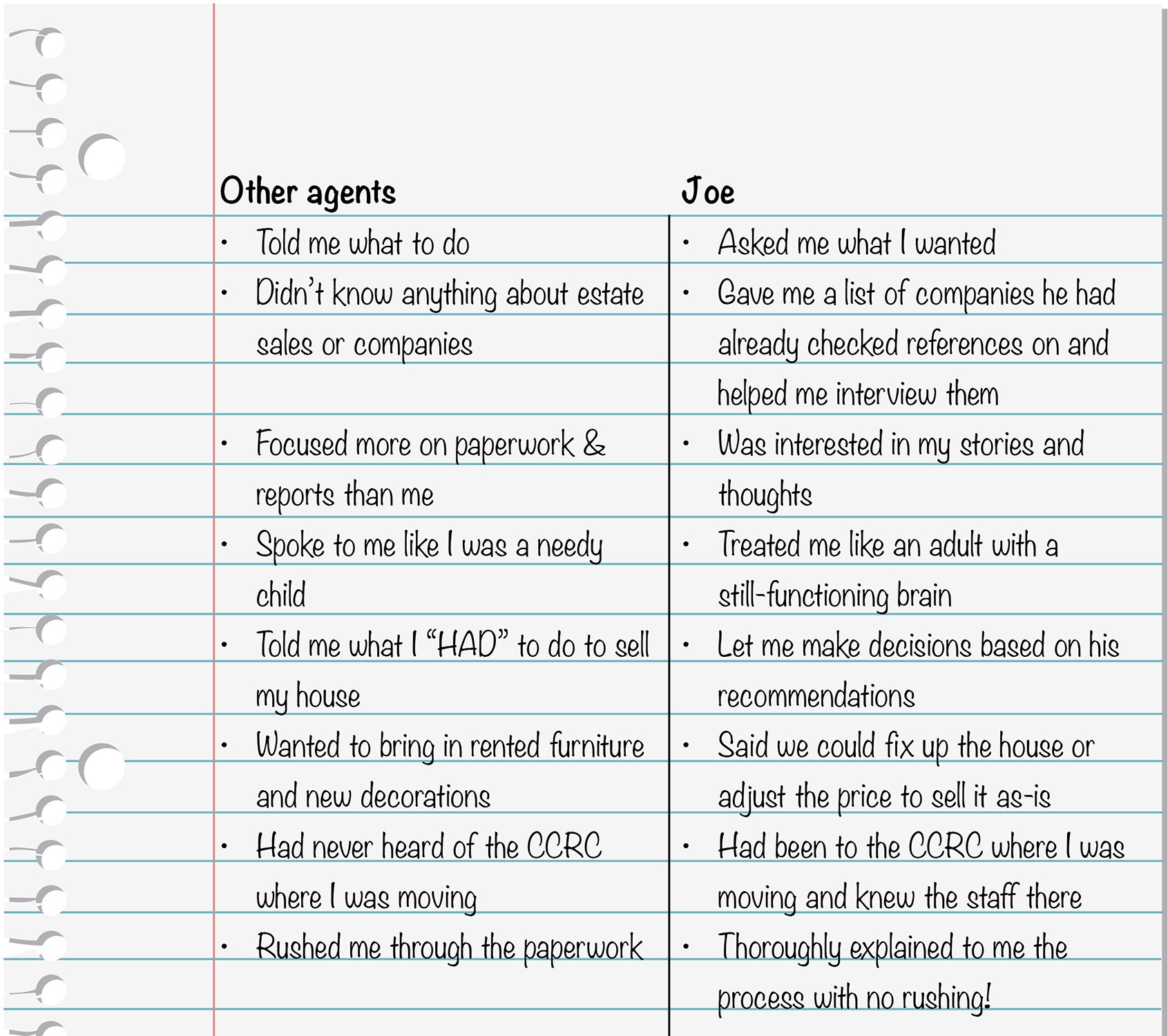

We explained that Millennials have purchased more homes over a recent twelve month period than any other generation as was  Are you thinking of buying a home? Are you dreading having to walk through strangers’ houses? Are you concerned about getting the paperwork correct? Hiring a professional real estate agent can take away most of the challenges of buying. A great agent is always worth more than the commission they charge just like a great doctor or great accountant.

You want to deal with one of the best agents in your marketplace. To do this, you must be able to distinguish the average agent from the great one.

Here are the top 4 demands you need to make of your Real Estate Agent when buying a home:

Are you thinking of buying a home? Are you dreading having to walk through strangers’ houses? Are you concerned about getting the paperwork correct? Hiring a professional real estate agent can take away most of the challenges of buying. A great agent is always worth more than the commission they charge just like a great doctor or great accountant.

You want to deal with one of the best agents in your marketplace. To do this, you must be able to distinguish the average agent from the great one.

Here are the top 4 demands you need to make of your Real Estate Agent when buying a home:

We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago.

There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any time in history.

We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago.

There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any time in history.

Last year Nielsen and the Association of Hispanic Advertising Agencies (AHAA) identified Upscale Latinos as the most influential segment since the Baby Boomers. Upscale Latinos are becoming a powerful population segment and have grown by more than two million since 2010.

“Recognizing the diversity within the Hispanic population in the U.S., Nielsen and AHAA embarked this year on a second study to further understand the behavior of upscale Latino households, what drives them toward upscale-luxury purchases and what drivers and detractors they share—or don’t share—with non-Hispanic upscale households.” Here are some important points that they found:

Last year Nielsen and the Association of Hispanic Advertising Agencies (AHAA) identified Upscale Latinos as the most influential segment since the Baby Boomers. Upscale Latinos are becoming a powerful population segment and have grown by more than two million since 2010.

“Recognizing the diversity within the Hispanic population in the U.S., Nielsen and AHAA embarked this year on a second study to further understand the behavior of upscale Latino households, what drives them toward upscale-luxury purchases and what drivers and detractors they share—or don’t share—with non-Hispanic upscale households.” Here are some important points that they found:

Here are four great reasons to consider buying a home today, instead of waiting.

Here are four great reasons to consider buying a home today, instead of waiting.

It's probably only natural for real estate agents to assume that most boomers or retirees bent on moving to a new city to enjoy their golden years will be on the trail to Florida, Arizona, or some other state blessed with warmth and plenty of sunshine. And those states are probably the ones best situated to offer plenty of age-in-place benefits, right?

Nope.

When a boomer or senior who's open-minded about where they wish to move and retire searches Google for the best cities to age in place or best cities to retire, they finds some spots that are a bit out of the norm, but quite intriguing nonetheless.

Places like Sioux Falls, SD; Provo, UT; Iowa City, IA; Bismarck, ND; Columbia, MO; Omaha, NE; Madison, WI; and Boston, MA top the list.

As adults 55+ begin to contemplate their future and plan for a possible move, they are hearing more and more about the importance of preparing to age-in-place. They already know they hope to live in their own home, independently, for as long as possible. And the cities listed above – plus many other non-traditional retirement options – are receiving plenty of attention as go-to spots for their aging-in-place benefits in the form of quality healthcare, accessible transportation, government initiatives in building the city as senior-friendly, and a number of other indexes.

The Milken Institute, a non-partisan think tank, compiled a list in 2012 of the 259 Best Cities to Age Successfully. Another ranking is due later this summer of 2014. It divided the rankings into "Large Metros" and 'Small Metros," with Provo, Utah topping the Large City list and Sioux Falls the Small City rankings.

Others in the Top 10 of Large Cities to Age Successfully include Pittsburgh, Toledo, Des Moines, Salt Lake City, and Washington D.C.

Others in the Top 10 of Small Cities to Age Successfully include Rochester, MN, Ann Arbor, MI, Missoula, MT, Durham-Chapel Hill, NC, and Gainesville, FL.

See the entire list here and learn more about the Milken Institute's approach to promoting aging-in-place awareness:

It's probably only natural for real estate agents to assume that most boomers or retirees bent on moving to a new city to enjoy their golden years will be on the trail to Florida, Arizona, or some other state blessed with warmth and plenty of sunshine. And those states are probably the ones best situated to offer plenty of age-in-place benefits, right?

Nope.

When a boomer or senior who's open-minded about where they wish to move and retire searches Google for the best cities to age in place or best cities to retire, they finds some spots that are a bit out of the norm, but quite intriguing nonetheless.

Places like Sioux Falls, SD; Provo, UT; Iowa City, IA; Bismarck, ND; Columbia, MO; Omaha, NE; Madison, WI; and Boston, MA top the list.

As adults 55+ begin to contemplate their future and plan for a possible move, they are hearing more and more about the importance of preparing to age-in-place. They already know they hope to live in their own home, independently, for as long as possible. And the cities listed above – plus many other non-traditional retirement options – are receiving plenty of attention as go-to spots for their aging-in-place benefits in the form of quality healthcare, accessible transportation, government initiatives in building the city as senior-friendly, and a number of other indexes.

The Milken Institute, a non-partisan think tank, compiled a list in 2012 of the 259 Best Cities to Age Successfully. Another ranking is due later this summer of 2014. It divided the rankings into "Large Metros" and 'Small Metros," with Provo, Utah topping the Large City list and Sioux Falls the Small City rankings.

Others in the Top 10 of Large Cities to Age Successfully include Pittsburgh, Toledo, Des Moines, Salt Lake City, and Washington D.C.

Others in the Top 10 of Small Cities to Age Successfully include Rochester, MN, Ann Arbor, MI, Missoula, MT, Durham-Chapel Hill, NC, and Gainesville, FL.

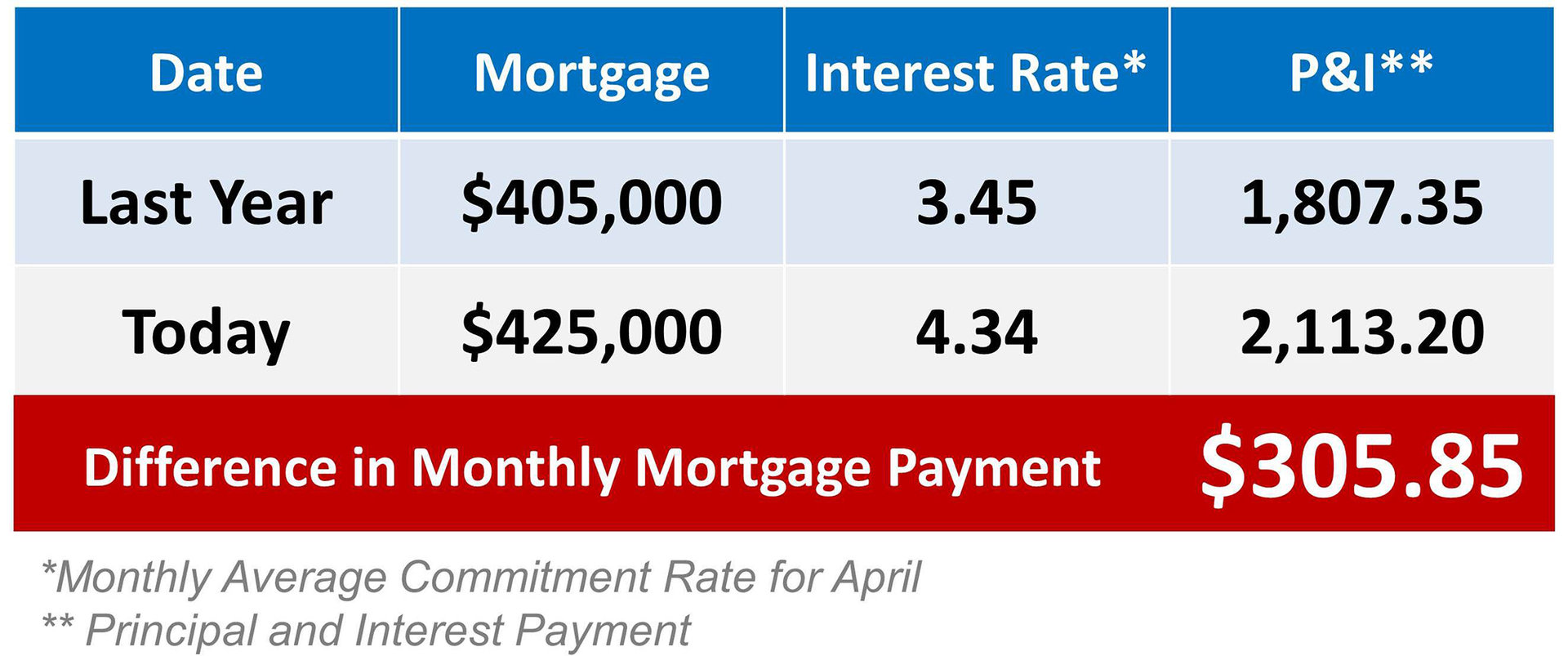

See the entire list here and learn more about the Milken Institute's approach to promoting aging-in-place awareness:  Many experts are currently discussing a variety of topics such as real estate as an investment, the movement on mortgage interest rates and reasons to buy now instead of waiting. It is important that we realize that this does not apply solely to the first time home buyer.

The opportunity that exists in real estate today is there for everyone.

However, the family that already owns a home might be thinking that, if they wait, their home could be worth more next year than it is now. And that may cause them to delay moving up to the home of their dreams thinking it makes good financial sense. Actually, the opposite is true. This is the best chance a family has to buy up into the home that makes sense for their family right now.

We must realize that whatever percentage of value we gain on our house will also be gained on our dream home.

Let’s assume your current home is worth $500,000. Your house will be worth $520,000 next year if prices rise by 4% over that time (a number projected by the Home Price Expectation Survey).

However, the $750,000 home you are hoping to move into will also appreciate by about that same 4%. That means next year it will be valued at $780,000. You wouldn’t make $20,000 by waiting. You would actually be losing $10,000 ($30,000 - $20,000).

And, you will pay a lower interest rate on the mortgage than you probably will next year.

Plug in the numbers that apply to your house and the home you are longing to buy and see what the bottom line turns out to be for you.

That is how wealth is built in this country - by purchasing real estate at the right time, at the right price and at the right terms.

Go out and find your family's dream house and buy it! Ten years from now, you will be glad you did!

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => Para los compradores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)

Many experts are currently discussing a variety of topics such as real estate as an investment, the movement on mortgage interest rates and reasons to buy now instead of waiting. It is important that we realize that this does not apply solely to the first time home buyer.

The opportunity that exists in real estate today is there for everyone.

However, the family that already owns a home might be thinking that, if they wait, their home could be worth more next year than it is now. And that may cause them to delay moving up to the home of their dreams thinking it makes good financial sense. Actually, the opposite is true. This is the best chance a family has to buy up into the home that makes sense for their family right now.

We must realize that whatever percentage of value we gain on our house will also be gained on our dream home.

Let’s assume your current home is worth $500,000. Your house will be worth $520,000 next year if prices rise by 4% over that time (a number projected by the Home Price Expectation Survey).

However, the $750,000 home you are hoping to move into will also appreciate by about that same 4%. That means next year it will be valued at $780,000. You wouldn’t make $20,000 by waiting. You would actually be losing $10,000 ($30,000 - $20,000).

And, you will pay a lower interest rate on the mortgage than you probably will next year.

Plug in the numbers that apply to your house and the home you are longing to buy and see what the bottom line turns out to be for you.

That is how wealth is built in this country - by purchasing real estate at the right time, at the right price and at the right terms.

Go out and find your family's dream house and buy it! Ten years from now, you will be glad you did!

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 5

[name] => Para los compradores

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => buyers

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)  A recent

A recent

Today, many real estate conversations center on housing prices and where they may be headed. That is why the Home Price Expectation Survey is a great barometer. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey

Today, many real estate conversations center on housing prices and where they may be headed. That is why the Home Price Expectation Survey is a great barometer. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey

Do as I Say… not as I Do

Do as I Say… not as I Do The Hispanic community was hit hardest by the housing crash. Now that the market is recovering, many of these families have the opportunity to either buy a home again, or those that lost home value during those years, are seeing equity return allowing them to sell and move to the home that they always wanted.

These buyers are ready, but according to a recent survey done by NAHREP (the National Association of Hispanic Real Estate Professionals) there are barriers that do not allow these buyers to enter the market right now. As real estate professionals is our duty to remove some of these barriers, if possible, and help as many families as we can become homeowners if they are willing ready and able to.

The Hispanic community is becoming a very important part of today’s real estate market, “The number of Hispanic households has grown to 14.7 million in 2013 and today a Hispanic youth turns 18 every minute of every day,” according to the 2013 State of Hispanic Homeownership Report.

4 out of 10 new households in the United States are expected to be Hispanic in 2014, this is a major opportunity for real estate professionals.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 1

[name] => No clasificado

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => uncategorized

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)

The Hispanic community was hit hardest by the housing crash. Now that the market is recovering, many of these families have the opportunity to either buy a home again, or those that lost home value during those years, are seeing equity return allowing them to sell and move to the home that they always wanted.

These buyers are ready, but according to a recent survey done by NAHREP (the National Association of Hispanic Real Estate Professionals) there are barriers that do not allow these buyers to enter the market right now. As real estate professionals is our duty to remove some of these barriers, if possible, and help as many families as we can become homeowners if they are willing ready and able to.

The Hispanic community is becoming a very important part of today’s real estate market, “The number of Hispanic households has grown to 14.7 million in 2013 and today a Hispanic youth turns 18 every minute of every day,” according to the 2013 State of Hispanic Homeownership Report.

4 out of 10 new households in the United States are expected to be Hispanic in 2014, this is a major opportunity for real estate professionals.

[assets] => Array

(

)

[can_share] => no

[categories] => Array

(

[0] => stdClass Object

(

[category_type] => standard

[children] =>

[created_at] => 2019-06-03T18:18:43Z

[id] => 1

[name] => No clasificado

[parent] =>

[parent_id] =>

[published_at] => 2019-06-03T18:18:43Z

[slug] => uncategorized

[status] => public

[translations] => stdClass Object

(

)

[updated_at] => 2019-06-03T18:18:43Z

)

)

[content_type] => blog

[contents] => (English)  Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year he released a paper on homeownership -

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year he released a paper on homeownership -  Growing up it seemed ‘white lies’ were okay while lying was a sin. As children, we sometimes had difficulty understanding where the line was. As we matured, we realized there most definitely was a difference.

Growing up it seemed ‘white lies’ were okay while lying was a sin. As children, we sometimes had difficulty understanding where the line was. As we matured, we realized there most definitely was a difference. I have been a subscriber to the Wall Street Journal (WSJ) for as long as I can remember. In my opinion, it is the single greatest source of financial information and insights available. I don’t always agree with their analysis but I always respect their position.

However, in an article this past weekend,

I have been a subscriber to the Wall Street Journal (WSJ) for as long as I can remember. In my opinion, it is the single greatest source of financial information and insights available. I don’t always agree with their analysis but I always respect their position.

However, in an article this past weekend,  Someone said to me recently, “Sixty-five is the new forty-five.” We chuckled, but the more I thought about it, the more I found myself in full agreement.

With more and more people working beyond traditional retirement age and the advances in modern medicine, the lines between middle and late adulthood are becoming a bit blurred.

Someone said to me recently, “Sixty-five is the new forty-five.” We chuckled, but the more I thought about it, the more I found myself in full agreement.

With more and more people working beyond traditional retirement age and the advances in modern medicine, the lines between middle and late adulthood are becoming a bit blurred.

In a

In a  In a recent

In a recent  This month the National Association of Hispanic Real Estate Professionals (NAHREP) released their annual State of Hispanic Homeownership Report for 2013. A 35 page report designed to highlight “the homeownership growth and household formation rates of Hispanics as well as their educational achievements, entrepreneurial endeavors, labor force profile, and purchasing power in the United States”.

This report is full of great information and you should

This month the National Association of Hispanic Real Estate Professionals (NAHREP) released their annual State of Hispanic Homeownership Report for 2013. A 35 page report designed to highlight “the homeownership growth and household formation rates of Hispanics as well as their educational achievements, entrepreneurial endeavors, labor force profile, and purchasing power in the United States”.

This report is full of great information and you should